Bitcoin has attracted not only investors and freedom-minded individuals but also scammers eager to exploit the uninformed or overly trusting.

Despite Bitcoin’s secure and decentralized nature, scams involving the asset remain prevalent, often targeting those unfamiliar with the technology or those seeking quick profits.

In 2024, it’s more important than ever to be aware of common scams.

Related: Everyone’s a Scammer

Bitcoin Scammer List: Common Types in 2024

- Phishing Scams: These scams involve tricking individuals into revealing their private keys, passwords, or other sensitive information.

- Fake Investment Schemes: In 2024, fake investment schemes remain a major issue. These scams often promise high returns with little risk, enticing individuals to invest their Bitcoin into fraudulent platforms or funds.

- Rug Pulls and Exit Scams: A rug pull occurs when developers of a project suddenly withdraw all funds and disappear, leaving investors with nothing.

- Social Media Impersonation: Scammers frequently impersonate well-known figures in the Bitcoin and financial space on social media platforms like X, Instagram, YouTube and Telegram.

- Fake Exchanges and Wallets: Scammers have created fake exchanges and wallet apps that look and function similarly to legitimate ones.

- Ransomware Attacks: Ransomware remains a significant threat in 2024, where scammers lock victims out of their devices or data and demand a ransom paid in bitcoin to regain access.

Latest Bitcoin Scams in 2024

While Sam Bankman-Fried’s downfall from the collapse of FTX captivated global attention due to the sheer scale and impact of the scandal, it’s important to recognize that smaller yet significant bitcoin scams continue to plague the financial landscape.

CryptoFX Ponzi Scheme

This massive $300 million Ponzi scheme targeted over 40,000 predominantly Latino investors across the U.S. and two other countries.

The scheme was operated by CryptoFX LLC, with promises of “risk-free” and “guaranteed” returns from Bitcoin, other digital assets, and foreign exchange investments.

The SEC charged 17 individuals, including the scheme’s principal operators, Mauricio Chavez and Giorgio Benvenuto, who had already been charged in 2022.

Among the charged were individuals from Texas, California, Louisiana, Illinois, and Florida, who allegedly continued to solicit investments even after court orders halted the scheme.

$25M Ponzi Scheme by Saffron and Mazzotta

David Gilbert Saffron, an Australian national, and Vincent Anthony Mazzotta Jr., from California, were charged for running a $25 million Ponzi scheme. They falsely promoted various Bitcoin and other digital assets trading programs and misappropriated the funds for personal luxury expenses.

Both face multiple charges, including conspiracy to commit wire fraud, money laundering, and obstruction of justice, which could result in significant prison time if convicted.

“Saffron and Mazzotta promoted the investment programs under various names including Circle Society, Bitcoin Wealth Management, Omicron Trust, Mind Capital, and Cloud9Capital.”

– Source: Department of Justice

AI Fake Videos

Other common Bitcoin scams involved impersonators of prominent figures like Elon Musk and Michael Saylor. These scammers would host fake live streams on platforms like YouTube and X, claiming to give away bitcoin.

The scheme promised viewers that if they sent a certain amount of bitcoin to a provided address, they would receive double in return. However, once the bitcoin was sent, the scammers disappeared with the funds, leaving victims holding the bag.

These scams were made to look legitimate by using previously recorded footage of Musk or Saylor and AI-generated voices, giving the illusion that they were genuinely participating in the live stream.

Despite ongoing efforts by platforms to detect and remove these scams, they continue to deceive unsuspecting users.

Staying Safe in 2024

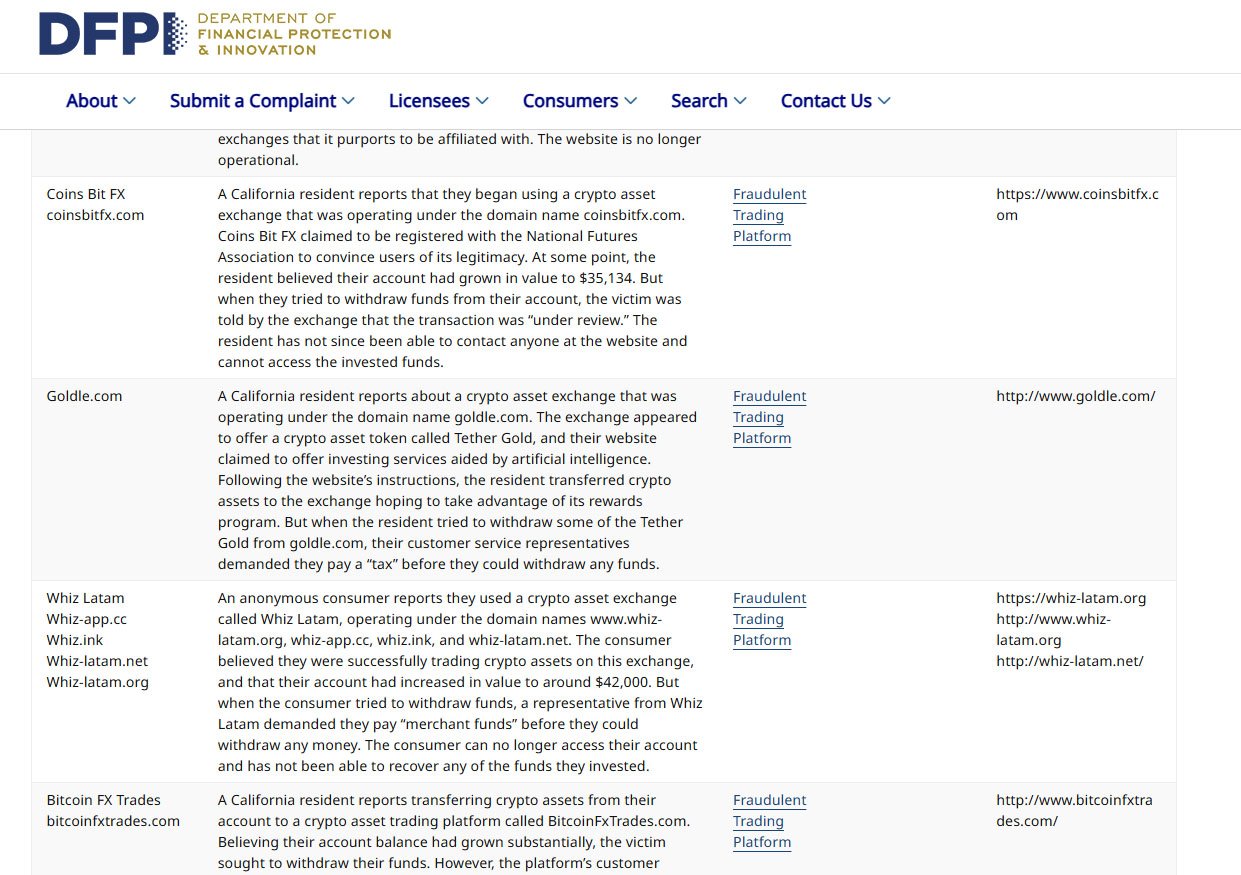

The California Department of Financial Protection and Innovation (DFPI), is a valuable resource for anyone in the Bitcoin space.

This tool helps users identify and avoid common scams by providing a regularly updated list of known fraudulent schemes, tips on recognizing red flags, and guidance on how to report suspicious activities.

Other things to keep in mind:

- Educate Yourself: Stay informed about the latest scams and tactics used by fraudsters. Knowledge is your first line of defense.

- Verify, Then Trust: Always verify the legitimacy of any platform, service, or individual before engaging with them. Use trusted sources and community feedback to assess credibility.

- Use Bitcoin Only Secure Platforms: Stick to well-known, secure exchanges (like Swan Bitcoin or River Financial), wallets, and platforms. Be wary of new or unverified options, especially if they offer deals that seem too good to be true.

- Be Skeptical: If something sounds too good to be true, it probably is. Scammers prey on greed and urgency, so take the time to assess any investment opportunity carefully.

A popular Bitcoin adage, “Not your keys, not your coins”, underscores the importance of personal control in the digital world. While Bitcoin offers immense potential, it also attracts individuals looking to exploit its users.