In recent years, the financial landscape has seen a significant shift as an increasing number of corporations are integrating bitcoin treasuries.

This trend, driven by a variety of strategic considerations, reflects a broader acceptance of Bitcoin as a valuable asset class and a hedge against economic uncertainties.

Several high-profile companies have publicly disclosed their bitcoin holdings, positioning themselves as pioneers in the financial sector. These corporations, ranging from tech giants to financial services firms, view bitcoin as a strategic reserve asset.

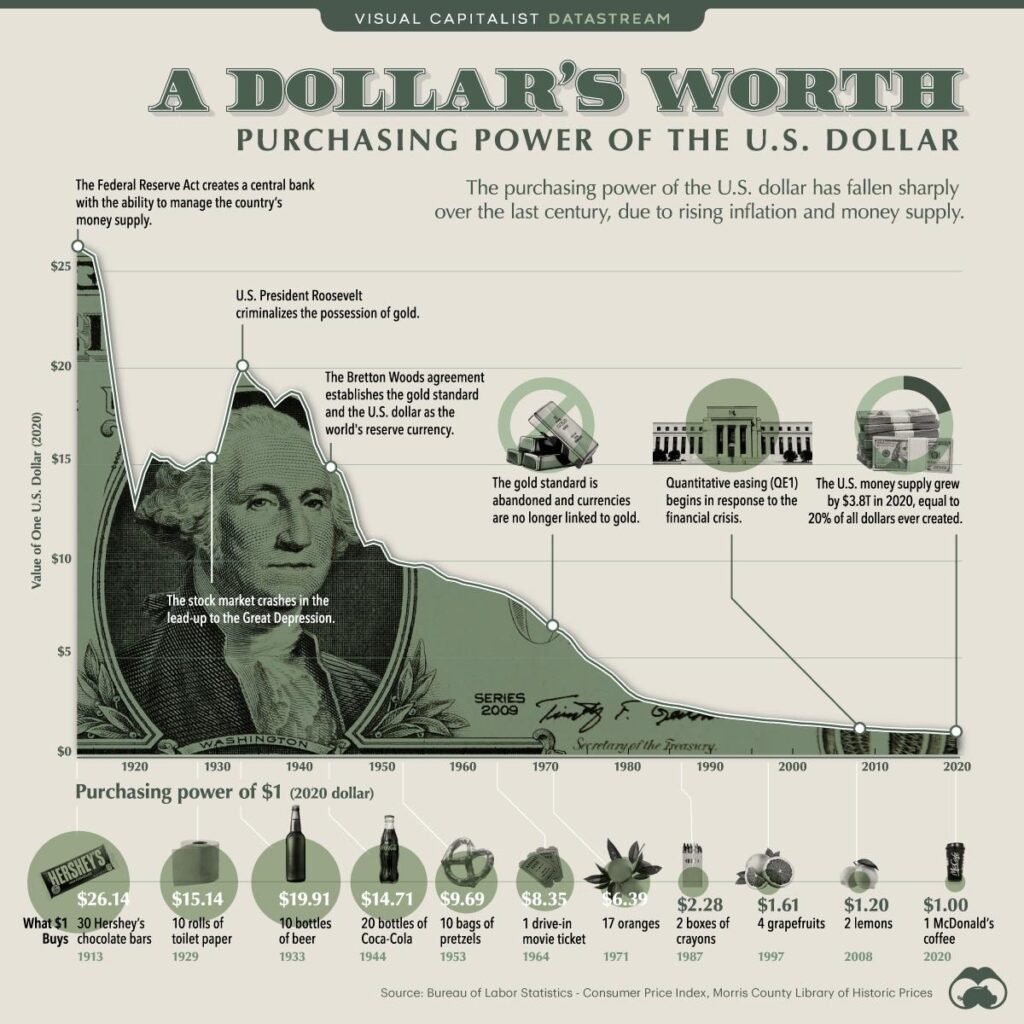

The rationale behind this move often includes concerns about fiat currency devaluation, inflation, and the desire for diversification.

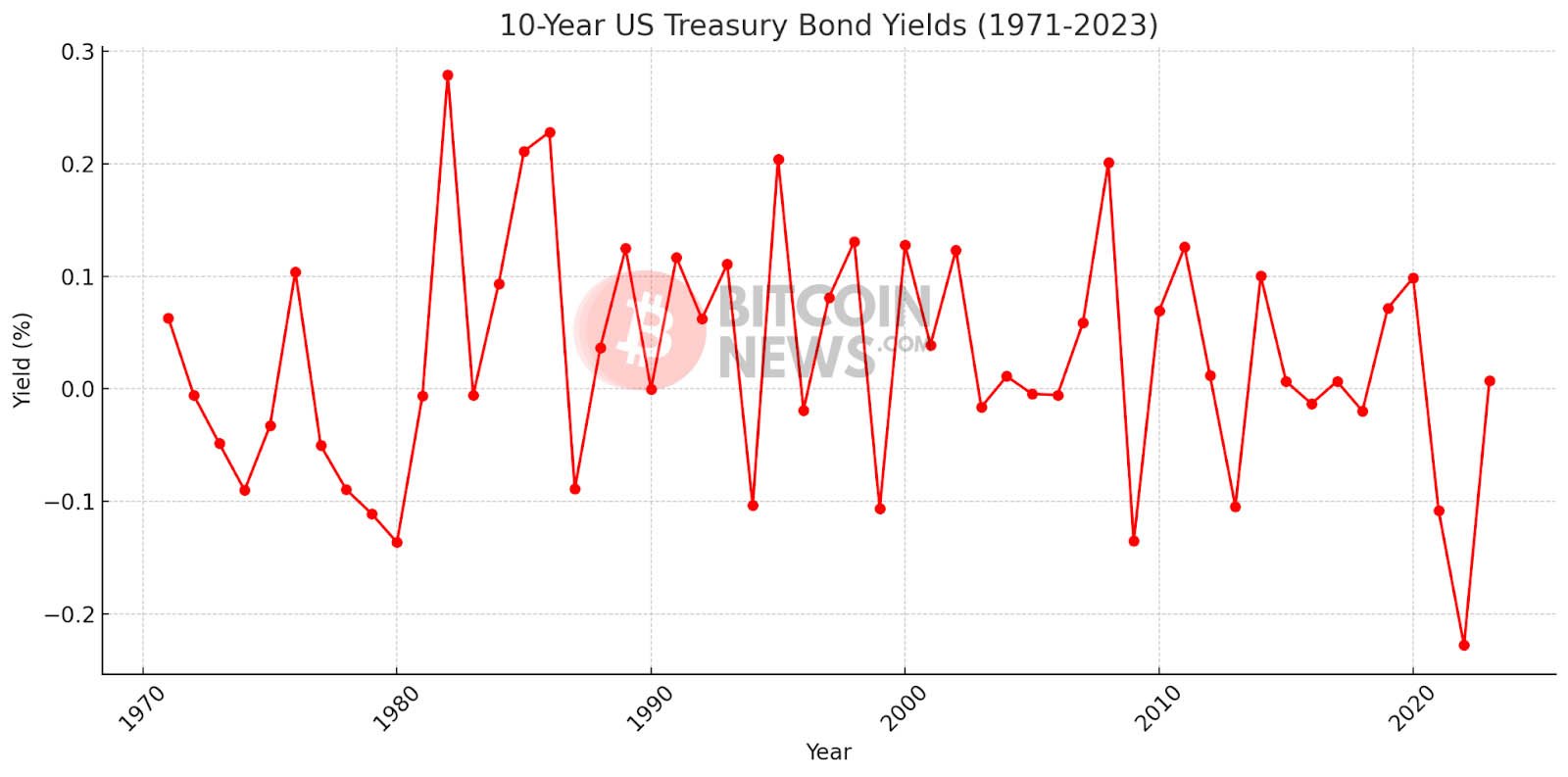

For many companies, the decision to hold bitcoin is part of a broader strategy to diversify their treasury assets. Traditional reserve assets, such as cash and government bonds, have faced diminishing returns, prompting companies to seek alternative stores of value.

Bitcoin, with its fixed supply and decentralized nature, offers a unique proposition. By holding bitcoin, companies can mitigate risks associated with traditional financial markets and safeguard their wealth against macroeconomic instability.

One of the primary motivations for incorporating bitcoin into corporate treasuries is its potential as an inflation hedge. With central banks around the world implementing expansive monetary policies, concerns about future inflation have intensified.

Bitcoin, often referred to as “digital gold,” is perceived by some as a superior hedge against inflation due to its scarcity and deflationary characteristics.

Unlike fiat currencies, which can be printed in unlimited quantities, bitcoin’s supply is capped at 21 million, making it an attractive option for preserving value over the long term.

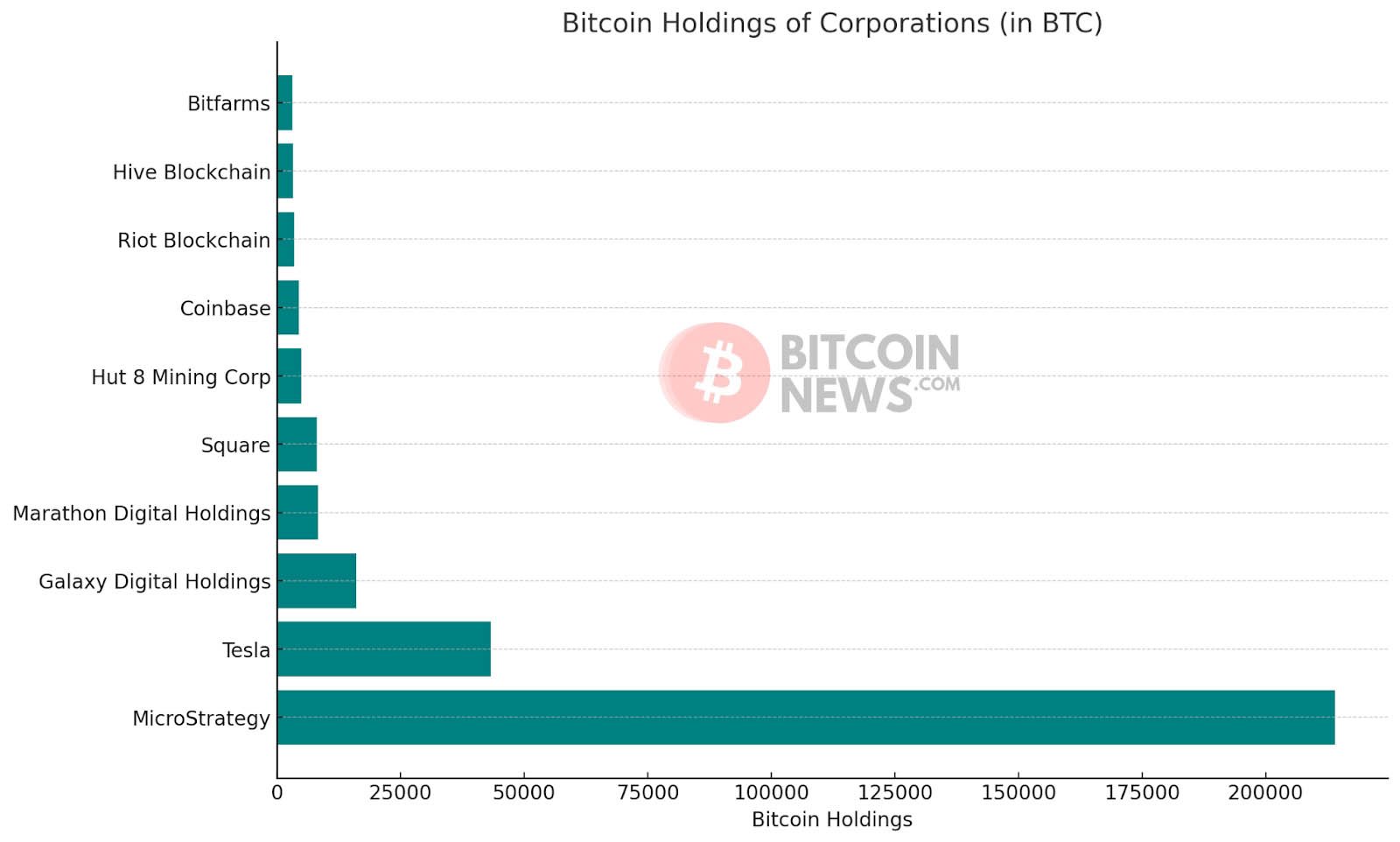

Several companies have emerged as leaders in the adoption of bitcoin treasuries. MicroStrategy, a business intelligence firm, made headlines in 2020 when it announced the purchase of bitcoin as a primary treasury reserve asset.

The company’s CEO, Michael Saylor, has been a vocal advocate for Bitcoin, emphasizing its potential to outperform traditional assets over time.

Following MicroStrategy’s lead, other companies like Tesla and Square have also disclosed substantial bitcoin holdings, further validating the trend.

The financial performance of companies with bitcoin treasuries has been closely watched by investors and market analysts.

In many cases, the appreciation of bitcoin has significantly bolstered the balance sheets of these companies, leading to enhanced shareholder value.

Additionally, the decision to adopt Bitcoin has often been viewed positively by the market, reflecting confidence in the foresight and innovative strategies of corporate leadership.

The future of Bitcoin treasuries looks promising as more companies explore the potential benefits of integrating bitcoin into their financial strategies. As the global economy continues to evolve, the role of Bitcoin as a corporate treasury asset is likely to expand.

Companies that adopt Bitcoin early may gain a competitive edge, positioning themselves as forward-thinking and resilient in the face of economic challenges.

The adoption of Bitcoin treasuries by corporations represents a significant shift in the financial ecosystem.

Driven by the desire for diversification, risk management, and protection against inflation, this trend underscores the growing acceptance of Bitcoin as a valuable asset class.

As more companies recognize the strategic advantages of holding bitcoin, its role in corporate finance is poised to become increasingly prominent.