Bitcoin volatility, the extreme price swings that critics view as a major drawback preventing it from being a viable currency or store of value, is actually a feature inherent to this revolutionary decentralized digital money, not a bug.

Free markets can be messy. While double-digit percentage moves in bitcoin’s value on a daily or weekly basis can undoubtedly be unsettling, this volatility is a small price to pay for having a truly permissionless, scarce, and decentralized form of money that stands as a superior long-term store of value compared to endlessly inflated fiat currencies.

Measuring Bitcoin’s True Value

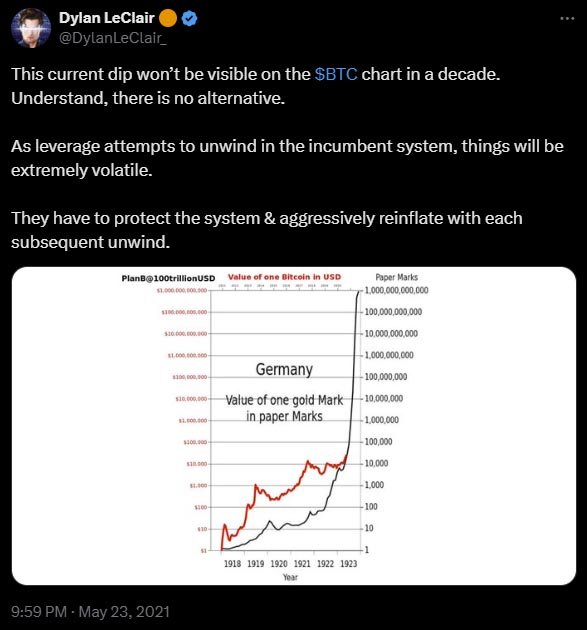

Bitcoin’s worth, when measured in fiat currencies like dollars, is akin to gauging a house’s size with a constantly changing tape measure.

It’s an imperfect and flawed way to judge Bitcoin’s true value. While some fiat currencies like the U.S. dollar are more stable than others like the Argentine peso or Venezuelan bolivar, they all share the critical flaw of being constantly inflated and debased by unchecked money printing by central banks.

One could not build a lasting house if their tape measure changed lengths with every use. While a house built with a less flawed tape measure might endure longer, it will still eventually crumble.

Since there will only ever be 21 million bitcoin in existence by design, it is engineered to perpetually gain value in fiat currency terms. One bitcoin today will always be one bitcoin out of 21 million, an immutable and scarce digital asset engineered to appreciate in value rather than depreciate. This is unlike fiat money, explicitly designed to erode purchasing power over time.

Bitcoin Volatility: Free Market Price Discovery

The volatility witnessed in bitcoin’s fiat exchange rate is simply the free market’s reflection of pricing this revolutionary asset without the heavy hand of central planners and governments dictating its value.

Just as a $100 daily bitcoin move meant doubling its dollar “price” in the early days, $1,000 or more price swings have become par for the course given its engineered scarcity and the unbounded upside of a truly global digital money and store of value.

It would not surprise Bitcoiners to see $10,000 price swings in a day become the norm when bitcoin is worth 10 times as much.

This volatility is the market’s price discovery mechanism at work, finding fair value on unstoppable, decentralized global rails.

Just as there are no “circuit breakers” to artificially constrain bitcoin’s upside, there are also no Central Bank interventions to soften downside moves. Booms and busts are equally crucial for vetting an asset of this magnitude. It’s a much more honest and fair system than one which pauses trading for 15 minutes when the price drops 7% too quickly.

Monetary Revolution

While jarring at times, this volatility is the unavoidable cost of obtaining a monetary revolution outside the control of corrupt nation-states and central planners who have long debased fiat currencies to tax citizens in every possible way, including through inflation—often called “stealth tax”. Bitcoin’s monetary policy is coded and immutable, not subject to constantly shifting edicts.

As bitcoin gains wider adoption as a hedge against currency devaluation and wealth erosion worldwide, its purchasing power should grow commensurately with its fixed supply and increasing global liquidity. Volatility will persist in the interim as the world’s liquid markets grapple with pricing the first truly scarce digital asset for the first time in history.

Conclusion

In a world grappling with rampant currency debasement, financial privacy erosion, and governmental overreach, Bitcoin offers a compelling solution as a truly decentralized, scarce, and permissionless form of money.

While its volatility can be unsettling at times, this is an inevitable byproduct of free market price discovery for a revolutionary asset class operating outside the controls of central planners.

The short-term volatility is a small price to pay for achieving long-term monetary freedom and a robust store of value resistant to inflation and manipulation. As Bitcoin gains wider global adoption, its purchasing power should grow in tandem with its fixed supply and increasing liquidity.

Those able to withstand the interim volatility may be well-positioned to preserve and grow their wealth over time.

Ultimately, Bitcoin represents a monetary revolution, ushering in a future of uncensorable, corruption-proof digital money on an antifragile decentralized network. In a world where financial privacy and property rights face escalating threats, the value proposition of an immutable, permissionless system like Bitcoin becomes ever more compelling despite the volatility.

For those seeking true monetary sovereignty, the transient volatility is a worthwhile tradeoff.