While governments and financial institutions trade in esoteric acronyms like BTFP (Bank Term Funding Program), a different kind of code has taken hold among a defiant breed of investors. BTFD, or “Buy The F***ing Dip,” is the battle cry for those who view turbulence not as a threat, but as an opportunity to fortify their positions. This rebellious mentality once confined to fringe online enclaves has now permeated mainstream discourse, reflecting a bold new era in capital markets.

Central to the BTFD philosophy is the disruptive potential of Bitcoin — hailed by adherents as humanity’s greatest technological achievement in preserving value. By consistently accumulating the digital asset during downturns, hodlers stake their claim in a revolutionary financial paradigm that transcends fiat norms. Each dip is hungrily devoured in anticipation of Bitcoin’s cyclical surges, with the ultimate prize being a decisive, wealth-transferring windfall from those blinded by traditional thinking.

Related reading: Michael Saylor to Continue Purchasing BTC ‘Forever’

It’s Time You Fired That Financial Advisor

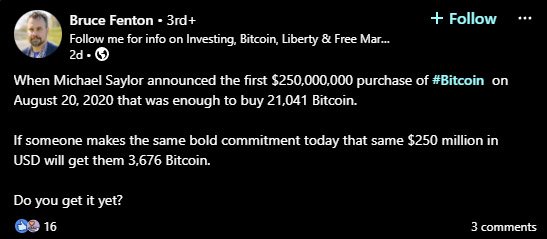

Sometimes it is hard as a Bitcoiner to not snicker at the traditional investment industry packed with funds charging hefty management fees to eke out pedestrian returns of 5–10% annually for their clients, if they’re lucky. Compare that to Bitcoin’s historical performance — even after the annus horribilis of 2022, long-term holders have enjoyed average yearly returns well north of 100%.

And here’s the kicker — there are no middlemen, no financiers taking a cut. Those who self-custody their bitcoin optimize the revolutionary promise of this decentralized digital money by avoiding ceding custody and associated fees to third parties. Simply buy, hold, and let the free market dynamics of bitcoin’s coded scarcity go to work growing your finances on an inevitable trajectory that leaves traditional investment vehicles gasping for air. The BTFD way is a frontal assault on the bloated, rent-seeking management and custodial practices that have bilked investors for decades.

BTFD! The Future Belongs to the Contrarians

In a world where central banks and governments desperately cling to the crumbling financial order, embracing Bitcoin is an act of rebellion against the establishment’s desperate attempts to resuscitate a dying system. The coming decade will separate the wheat from the chaff, as those who bought the dips in sound money like bitcoin will reap generational wealth, while those who trusted in fiat promissory notes backed by nothing but eroding credibility will be left holding the bag.

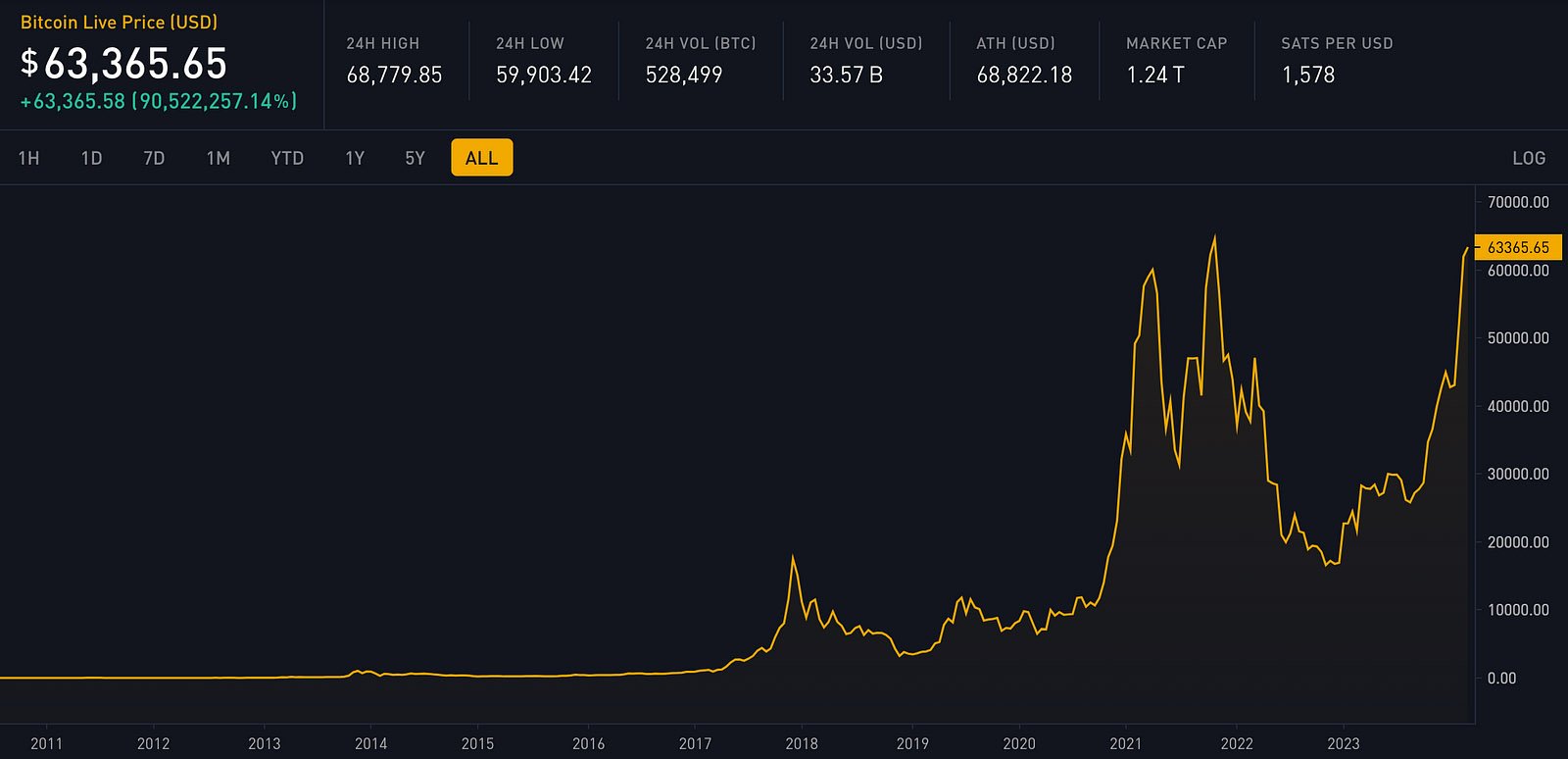

It is amazing that people will look at this chart and still parrot Bitcoin is going to zero in 2024. Said people are in for a rude awakening if they don’t update their mental models.

The BTFD philosophy encapsulates an ethos of self-sovereignty, individualism, and rejection of authority in favor of a decentralized, trustless, and immutable monetary network. It is the antidote to the top-down control fetishism that has impoverished societies and enriched bureaucrats and middlemen leeches for many centuries.

In this battle for the future of money, those who stoically accumulated bitcoin through the volatility will be crowned the victors of the 21st century’s paradigm shift in how value is stored and transmitted globally. Fitting considering the 21 million bitcoin hard cap. BTFD is more than an acronym — it’s a war cry for a better, freer, and more prosperous world.

Conclusion

Going down the Bitcoin rabbit hole is about more than just chasing profits — it’s a paradigm shift in how we think about money itself. Too long have we been conditioned to obsess over the ever-inflating U.S. dollar price of bitcoin, when in truth, it is the dollar that is being debased by endless money printing. The Bitcoin Standard encourages us to start using bitcoin itself as a unit of account, to break free from the perpetual devaluation of fiat currencies.

On this new monetary playing field, the question is not “what is bitcoin worth in dollars today?” but rather “what is the purchasing power of my bitcoin stack compared to last year?” Viewed through this lens, hodlers operating on a bitcoin standard “diet” will find their monetary energy increasing over time as more of the world adopts the hardest money ever created. So let the no-coiners fret over short-term price fluctuations — the BTFD contrarians are too busy stacking generational wealth in the only true safe haven in an age of unprecedented money debasement.