Bitcoin mining, once a pursuit for tech enthusiasts with modest hardware has evolved into an industry dominated by large-scale operations with dedicated mining farms. Now many wonder “can you still mine bitcoin in 2024 without a substantial upfront capital investment?”

The answer, while nuanced, leans toward the affirmative, albeit with some significant caveats and considerations.

Bitcoin mining involves solving complex mathematical problems to validate transactions on the Bitcoin network. Successful miners are rewarded with newly minted bitcoin and transaction fees.

This process requires substantial computational power, provided by powerful hardware known as Application-Specific Integrated Circuits (ASICs).

Related: What is Bitcoin Mining? A Comprehensive Guide

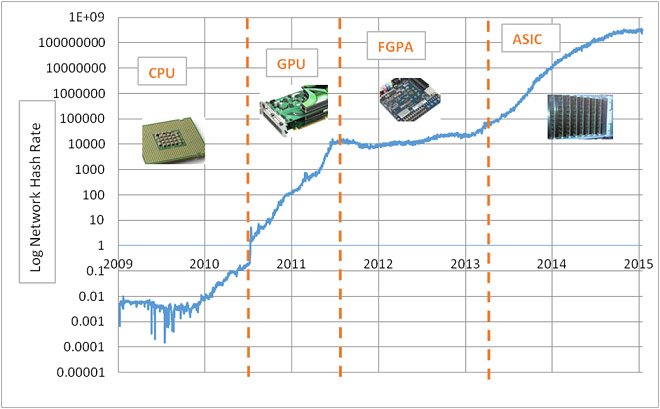

In the early days of Bitcoin, mining was feasible with ordinary CPUs and later, more efficiently, with GPUs (Graphics Processing Units).

However, as more miners joined the network and the difficulty of mining increased, the need for more specialized hardware emerged. Today, ASICs dominate the mining landscape due to their superior efficiency and performance.

Mining farms are large-scale operations equipped with thousands of ASIC miners. These farms benefit from economies of scale, access to cheap electricity, and optimized cooling solutions, making them far more competitive than individual miners.

As a result, solo miners have found it increasingly challenging to compete with these industrial-scale operations.

Can You Still Mine Bitcoin Without A Mining Farm?

For those still interested in solo mining, obtaining the latest and most efficient ASIC miners is crucial.

Models like the Bitmain Antminer S19 Pro or the Whatsminer M30S++ offer high hashrates, which are essential for staying competitive. However, these devices are expensive, often costing several thousand dollars each.

Electricity is a significant operational cost in Bitcoin mining. Mining farms often operate in regions with cheap electricity, such as Iceland or parts of Africa.

For solo miners, it’s essential to consider whether the cost of electricity in their area makes mining financially viable. High electricity costs can quickly erode any potential profits.

Given the challenges of solo mining, many individual miners opt for pool mining. Mining pools allow miners to combine their computational resources to increase their chances of solving a block and earning rewards.

Although the rewards are shared among all participants, joining a mining pool can provide a more stable and predictable income stream compared to solo mining.

The profitability of Bitcoin mining is influenced by several factors, including the price of bitcoin, mining difficulty, hardware efficiency, and electricity costs.

Prospective miners should use profitability calculators, such as Hashrate Index, which consider these variables, to estimate potential earnings and make informed decisions.

There is also lottery mining, which introduces a novel approach allowing individual miners—even those with modest resources—to compete for block rewards.

Instead of distributing rewards proportionally based on computational power, lottery mining enables individuals with lower hashrate to try their luck. When a block is successfully mined, the individual miner receives the entire reward.

This system injects excitement and the potential for significant payouts, even for miners with less powerful hardware, by giving everyone a shot at winning the “lottery.”

For those interested in lottery mining, several platforms offer this service. Popular options include “Slush Pool,” “CK Pool,” and “KanoPool.”

Functional Heat And Bitcoin Mining

“At first glance, the concept of a Bitcoin space heater might seem perplexing. How could Bitcoin and a household appliance possibly be related?

The answer lies in the innovative design that combines the functionality of a heater with the computational power of a Bitcoin mining rig.

– Source: Households Will Run A Bitcoin Heater

To use a Bitcoin heater for solo mining, you would set it up in your home, connect it to a power source and the internet, and configure it with mining software linked to your Bitcoin wallet.

As the device mines Bitcoin, it contributes computational power to the network while the resulting heat is used to warm your home.

This dual-purpose functionality makes the Bitcoin heater an energy-efficient option, particularly in colder climates, as it can offset some of the costs associated with heating.

For those seeking a more consistent income stream, this Bitcoin heater can be connected to mining pools such as Ocean.xyz or Braiins.

By joining a mining pool, users can combine their computational power with that of other miners, increasing the chances of solving a block and receiving more regular payouts.

This approach mitigates the uncertainty of solo mining by distributing rewards more evenly among all participants.

Cryptocloaks provides a comprehensive guide on how to set up and optimize your Bitcoin heater which can be found here.

While the era of solo mining with a home computer is long gone, it is still possible to mine Bitcoin without a dedicated mining farm.

However, it still requires a substantial investment in specialized hardware, access to cheap electricity, and a realistic understanding of the potential profitability.

For many individuals, joining a mining pool or exploring cloud mining options may offer more feasible alternatives. As the Bitcoin network continues to evolve, so too will the landscape of mining, presenting new opportunities and challenges for those who wish to participate.