In the fast-paced world of digital assets, we often focus on digital security—complex passwords, two-factor authentication, and cold storage wallets. But there’s a hidden danger lurking in the physical realm that few consider: the vulnerability of paper backups.

Imagine this scenario: You’ve diligently written down your Bitcoin seed phrase—the key to accessing your digital fortune should your hardware devices ever fail—on a piece of paper and tucked it away for safekeeping.

But in a moment of chaos, your toddler finds it and decides it looks delicious. Suddenly, your “unhackable” Bitcoin wallet becomes inaccessible, not because of sophisticated cybercriminals, but because of an unexpected appetite.

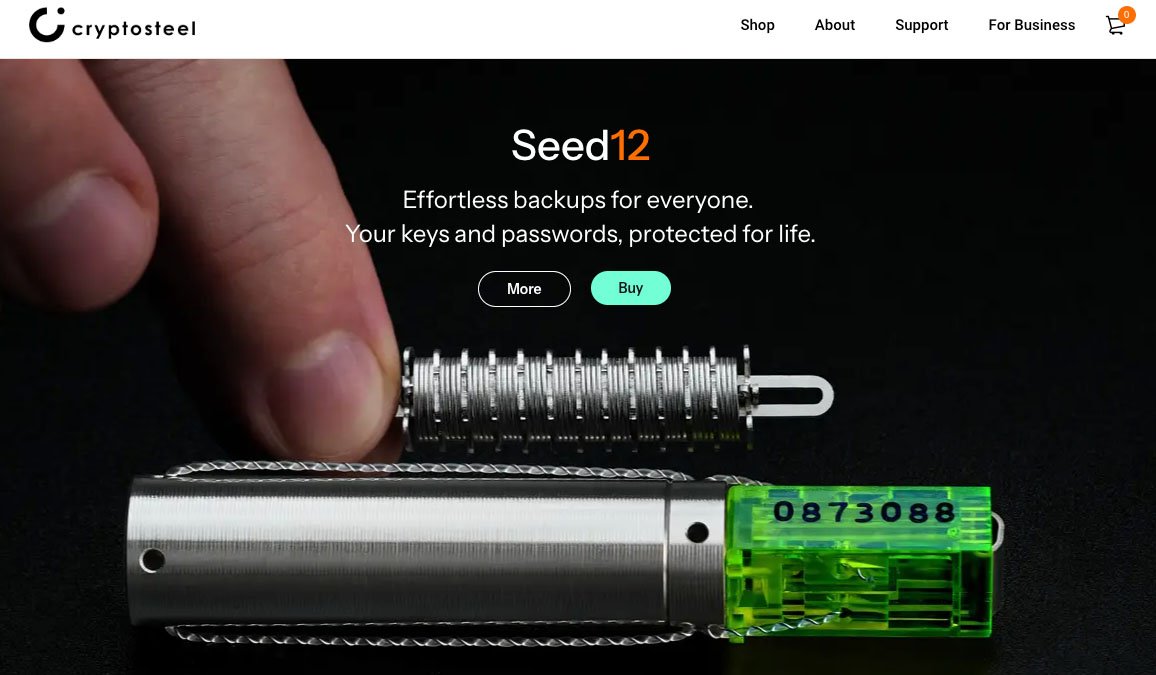

This may sound far-fetched, but it’s exactly what inspired the creation of CryptoSteel, a pioneering solution in physical seed phrase backups.

Over a decade ago, founder Wojtek Stopiński. discovered his children nibbling on paper wallets during a party. This eye-opening incident revealed a glaring weakness in how we secure our digital assets.

Since then, the digital assets space has evolved, with metal backups becoming the gold standard for seed phrase storage.

But not all metal backups are created equal. As the market flooded with imitators, a crucial lesson emerged: when it comes to securing your financial future, no cost is too great.

Cheaper alternatives may promise the same protection at a fraction of the cost, but they often use inferior materials that can melt or degrade under extreme conditions.

In a house fire or natural disaster, that bargain backup could quite literally go up in smoke, taking your bitcoin with it. Without the ability to verify the quality of the materials, you could be putting your entire investment at risk.

Physical security is just one piece of the puzzle. The real challenge lies in making self-custody—the practice of personally managing your Bitcoin keys—accessible and appealing to the masses.

As institutional players like BlackRock enter the Bitcoin space with ETFs, there’s a dangerous narrative emerging that suggests self-custody is an advanced step, something to graduate to after dabbling in more traditional investment vehicles.

This couldn’t be further from the truth.

Self-custody isn’t just about security; it’s about embracing the core ethos of Bitcoin—financial sovereignty. By holding your own keys, you’re not just protecting your assets; you’re participating in a revolutionary system that removes the need for trusted intermediaries.

Relying on third parties introduces systemic risks, as history has repeatedly demonstrated through numerous exchange failures and custodial losses.

To be fair, established firms like BlackRock and Fidelity offering Bitcoin ETFs are more trustworthy than infamous cases like FTX or Celsius, but it is crucial to understand the trade-offs: ETFs may offer simplicity for those solely interested in price speculation (“number go up”).

Related: Bitcoin ETFs Provide Convenient Price Exposure, But At What Cost?

However, entrusting your bitcoin to these entities sacrifices the permissionless and censorship-resistant aspects of the technology.

The future of Bitcoin’s security lies not just in better technology, but in better education and more intuitive tools.

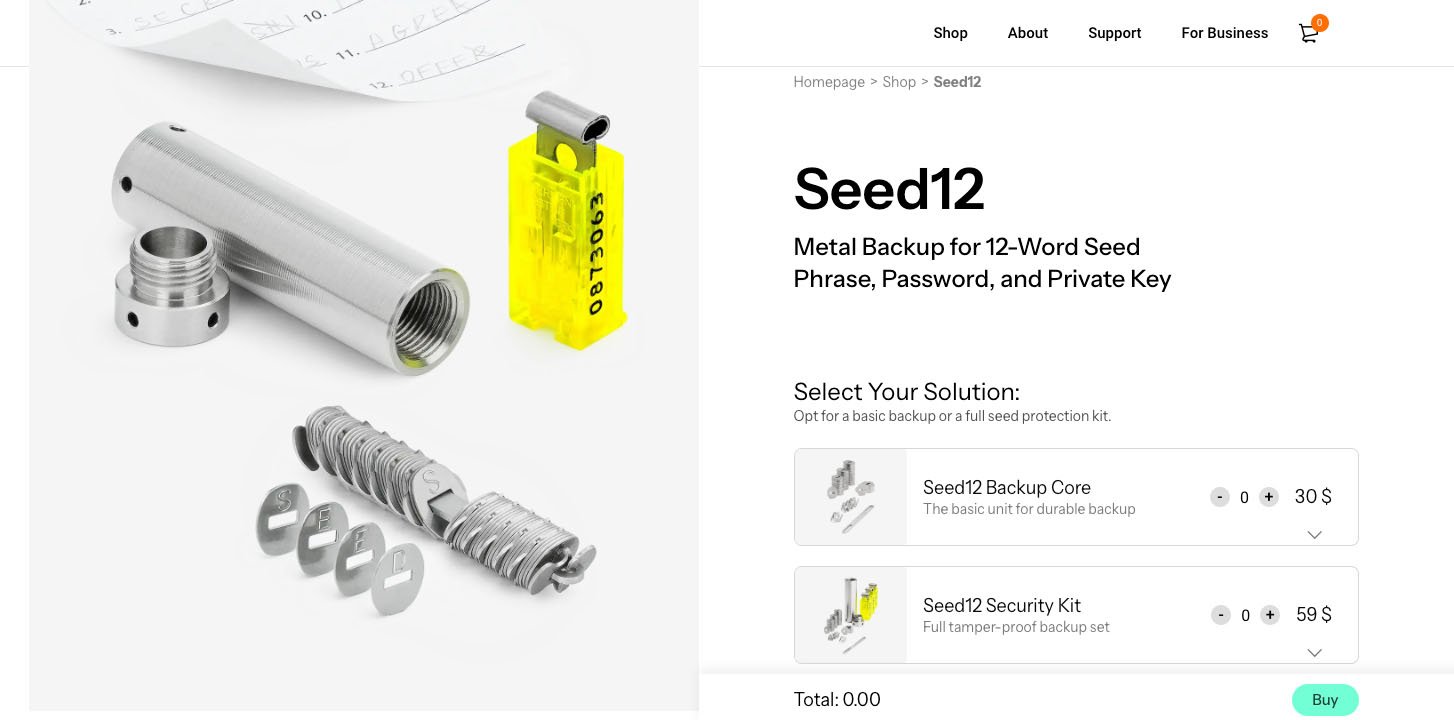

Innovations like CryptoSteel’s newest product, the CryptoSteel Capsule Seed12, are paving the way for a world where self-custody is the norm, not the exception.

In a recent conversation with BitcoinNews, Thibaud—a key member of the CryptoSteel team, shared an exciting vision for the future of seed phrase protection. He stated:

“Picture this, maybe in the future; you’d have a seed which is the backup for your Nostr, which is the backup for your bitcoin, which is the backup for your password manager, which is the backup for many other things. And that is what Seed12 could ultimately protect.”

As we stand on the brink of widespread Bitcoin adoption, we must remember that true financial freedom comes with responsibility.

It’s not enough to buy bitcoin; we must learn to properly secure it from the start. The next generation of Bitcoin users shouldn’t have to choose between convenience and security. With the right tools and knowledge, they can have both.

So before you celebrate your latest bitcoin investment, ask yourself: Is your backup plan child-proof, fireproof, and future-proof? Your financial sovereignty may depend on it.