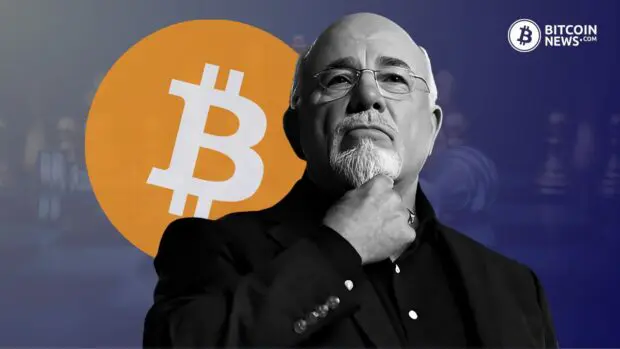

Renowned personal finance guru Dave Ramsey, known as “America’s trusted voice on money,” recently shared his views on Bitcoin, echoing sentiments expressed by Berkshire Hathaway CEO Warren Buffett. In an episode of The Dave Ramsey Show, Ramsey cautioned against considering Bitcoin as a prudent investment, highlighting its speculative nature. Analyzing Ramsey’s perspective might bring to light the reasons underlying his alignments with Buffett’s skepticism.

Dave Ramsey’s Skepticism on Bitcoin

Ramsey’s skepticism towards Bitcoin stems from its volatile nature and speculative value. He emphasizes that Bitcoin’s trillion-dollar market capitalization doesn’t alter its fundamentally speculative character. According to Ramsey:

“But it’s still thin air. Ask people like Warren Buffett who says if he doubled the amount he had put in Bitcoin, he would still have zero, because that’s the amount he’s put in Bitcoin. I’m going with Warren on this one.”

Comparing Bitcoin to Traditional Investments

Ramsey draws parallels between Bitcoin and traditional investments like stocks and commodities. He emphasizes that unlike traditional investments with tangible value, Bitcoin is akin to “thin air.” Ramsey compares Bitcoin’s value to commodities like gold and paper currency, stating:

“The only reason gold has value is two people agree to that value and they fought over it — that’s the only reason, the same reason that green paper has value: two people agree to that value and they fought over it. That’s what gives something value. So commodities are exactly the same way as currencies, Bitcoin … someday it may level out and become a thing, but, Jason, it’s not there … I wouldn’t wish bitcoin investments on somebody I really dislike. “

Related reading: Robert Kiyosaki Explains Why He Prefers Bitcoin Over Gold

Bitcoin as Currency

Contrary to some views treating Bitcoin as a single stock, Ramsey categorizes it as a currency. He highlights that currencies derive their value from people’s trust and willingness to transact with them. However, Ramsey notes the lack of faith in Bitcoin compared to established currencies, cautioning against investing in assets with insufficient track records.

He added:

“No, bitcoin is a currency. Currencies have no value except for their track record that indicates that two people are willing to fight over them.”

During his show, when Michael from Dayton, Ohio, asked about exploring digital asset investments, Ramsey replied: “Bitcoin’s hot. Crypto’s hot. A lot of people are making a lot of money on it right now.”

The Importance of Track Record

Ramsey stresses the significance of a long track record of faith in investment decisions. He emphasizes, “I do not invest in things where people have not established a long track record of faith, and even then, on a currency, I don’t invest in a currency. I would utilize it.” This criterion leads him to dismiss Bitcoin as an investment choice, asserting, “I wouldn’t wish bitcoin investments on somebody I really dislike.”

Ramsey frequently references Warren Buffett’s skepticism towards Bitcoin to reinforce his stance. Buffett famously labeled Bitcoin as “rat poison squared” during Berkshire Hathaway’s annual shareholder meeting. Ramsey aligns with Buffett’s perspective, stating, “I’m going with Warren on this one.”

Ramsey Solutions’ Stance

Ramsey’s cautionary stance on Bitcoin investments is reflected in the recommendations of Ramsey Solutions. While not entirely dismissing the future potential of bitcoin, Ramsey Solutions advises its readership to steer clear of digital assets like Bitcoin. Ramsey emphasizes a more steady and conservative approach to wealth accumulation.

Ramsey Solutions doesn’t completely reject digital assets but advises caution, urging readers to avoid them with a simple “just say no” approach.

Conclusion

Dave Ramsey’s alignment with Warren Buffett’s skepticism on Bitcoin underscores the speculative nature of the digital asset. Ramsey’s cautionary stance highlights the importance of faith and track record in investment decisions. Ramsey seems to have a resolute stance on bitcoin, which might stem from stubbornness and unfamiliarity with Bitcoin in general. Investors who heed Ramsey’s advice to prioritize assets with established track records and “inherent value”, will need to study bitcoin, economics and history more.

In summary, Ramsey’s perspective invites investors to exercise caution and diligence when considering alternative assets like bitcoin. Steering clear of this revolutionary technology and reinvention of what human race considers “money”, does not stop it from advancing. Those who are afraid to join, might regret their decision later in the future.