Recently, the German government liquidated a significant portion of its seized bitcoin holdings, capturing the attention of bitcoin traders, investors and Bitcoiners alike.

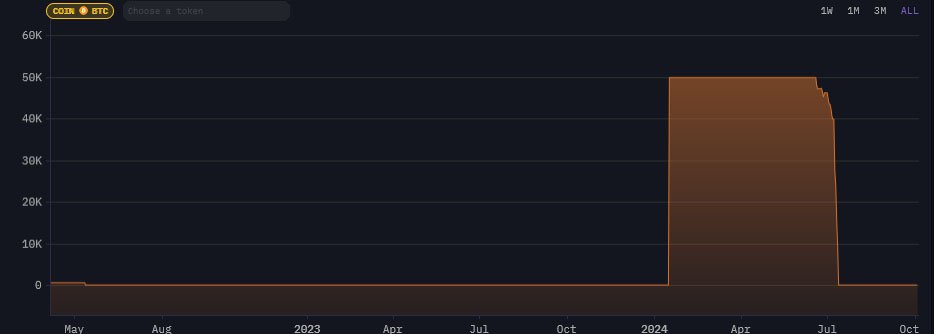

This large cache of bitcoin, originally tied to a 2023 seizure connected to the now-defunct piracy website Movie2K.to, has led to concerns over market volatility as the German government’s bitcoin stash was released onto exchanges.

Origins of the Seized Bitcoin

The German government acquired nearly 50,000 bitcoin as part of a criminal investigation into the Movie2K.to case.

The piracy platform had reportedly generated massive revenues through illicit activities, much of which was later seized by German authorities in the form of bitcoin. Since then, the German Federal Criminal Police Office (BKA) has taken charge of these assets.

In 2024, the government began selling off portions of this bitcoin reserve.

While some observers speculated that the government might hold onto the bitcoin as a long-term asset, German authorities have chosen to gradually liquidate these funds, transferring them to various exchanges and selling them on the open market.

Related: German Government’s Huge Bitcoin Sell-Off: Over 16,000 BTC Moved

German Government Bitcoin Sales: Market Impact

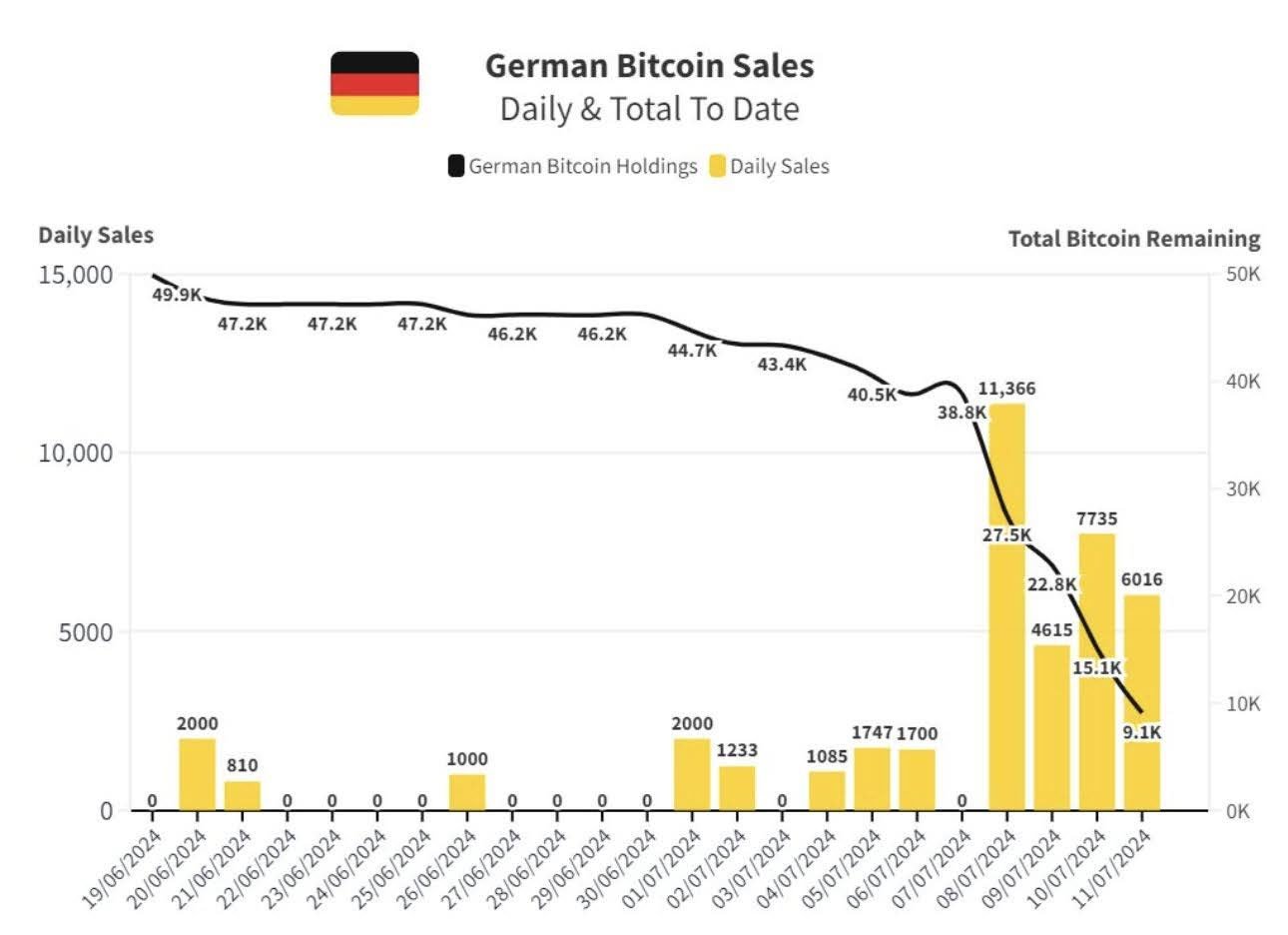

The sales ramped up significantly during the summer of 2024. In June, the government sold approximately 1,000 BTC worth $52 million, followed by another 3,000 BTC later that month, which brought in around $172 million.

This trend continued, with more than 2,700 BTC sold in early July. These sales have been part of a larger strategy, with the government opting to move tens of thousands of bitcoin to exchanges like Kraken, Bitstamp, and Coinbase.

Later In July 2024, this trend continued with over 16,000 BTC moved to exchanges, valued at nearly $895 million, in a single 24-hour period. This triggered a brief 3.5% dip in bitcoin’s price, followed by a quick rebound as the market easily absorbed the selling pressure.

Analysts noted that while these sales contribute to short-term price volatility, the overall market impact was somewhat limited given the size and liquidity of the asset.

In the end, the German government, which released tens of thousands of bitcoin in multiple stages, did a final transfer of 3,846 BTC to “Flow Traders and 139Po.” Arkham identified these recipients as “likely institutional deposits or part of an OTC service.”

Why did Germany Sell Its Bitcoin?

The decision by German authorities to sell off seized bitcoin has been met with mixed reactions. Some market observers argue that the government could have held onto the bitcoin, keeping it as a strategic reserve asset, and potentially see it appreciate in value significantly over time.

Others point out that the government may simply be aiming to liquidate bitcoin to return funds to victims of the crime or to reinvest in state resources.

Germany’s approach differs from other governments, such as El Salvador, which has chosen to hold and even accumulate bitcoin as part of a national financial strategy.

In contrast, Germany appears to view bitcoin more as a liquid asset, to be sold when needed, rather than a long-term store of value. The funds from these sales likely supported the country’s budget or specific projects related to law enforcement actions and concerns.

While the bitcoin market has grown in size and liquidity, the sale of large chunks of bitcoin by governments, particularly in a short period, can create downward pressure on prices.

The term “overhang supply” has been used to describe this phenomenon, where large amounts of bitcoin waiting to be sold can act as a drag on market sentiment.

“ [German government’s move] isn’t a particularly anti-crypto move. It’s not an investment for them. It’s like, if they impound a car or something from people, then at some point they need to get rid of it.”

– Jan Sell, managing director of Coinbase Germany

Future Implications

As the German government continued to sell off its bitcoin reserves, the market experienced occasional short-term volatility.

Bitcoin’s long-term potential, driven by factors such as institutional adoption and technological advancements, will far outweigh the short-term impact of liquidations from seized assets.

Ultimately, while the German government’s decision to sell its bitcoin added a layer of unpredictability to the market, underscoring the growing role that governments and institutions play in shaping the dynamics of bitcoin’s value.

Conclusion

Germany’s liquidation of its seized bitcoin holdings has been a noteworthy event in the market, contributing to some short-term price swings but without a dramatic long-term impact.

As governments increasingly interact with bitcoin—whether through confiscations, regulations, or even holdings—these events highlight the evolving relationship between traditional state institutions and the decentralized nature of Bitcoin.

Despite the sales, bitcoin has demonstrated its ability to withstand such pressures and remains a robust and resilient asset.