In a world plagued by economic uncertainty, rampant inflation, and increasingly centralized control over financial systems, a new asset class called Bitcoin has risen to power.

Many, tired of the current economic conditions, have turned to Bitcoin, but still the question “Is Bitcoin a good investment?” can be heard.

Bitcoin, often referred to as “digital gold,” offers a unique opportunity for individuals to secure their wealth, preserve purchasing power, and potentially achieve financial sovereignty in ways that traditional assets simply cannot.

But to answer the question properly, we need to dive into what makes Bitcoin fundamentally different from any other investment and why it could be the most important asset of the 21st century.

Understanding the Foundation: What is Bitcoin?

Before assessing Bitcoin as an investment, it’s crucial to understand what it is.

Bitcoin is the first decentralized digital currency that operates on a peer-to-peer network without the need for a central authority, like a bank or government. This decentralized nature is made possible by timechain (blockchain) technology, a public ledger that records all transactions across the network.

Related: Decentralization Is The Innovation

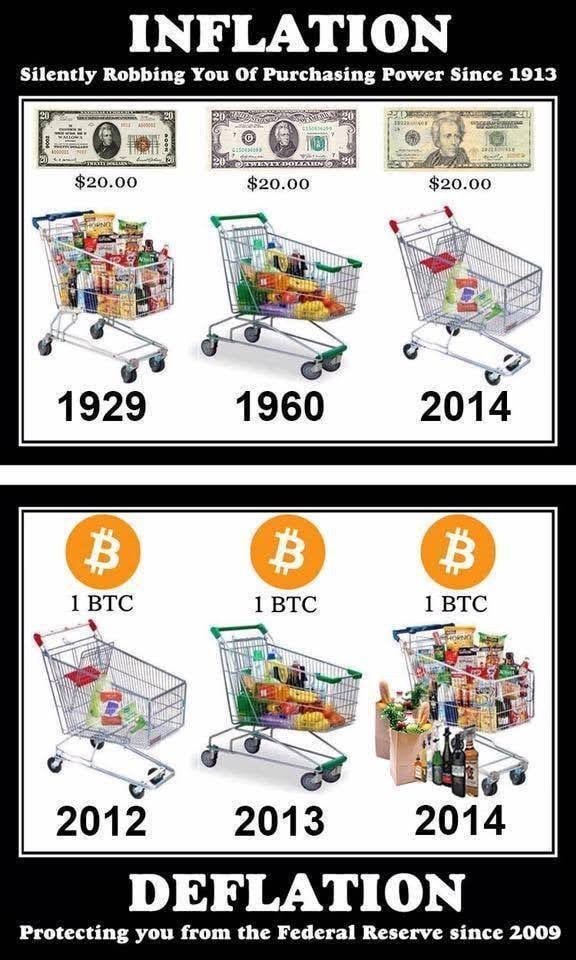

Created in 2009 by the pseudonymous figure Satoshi Nakamoto, Bitcoin was designed to offer a deflationary alternative to fiat currencies, which are subject to inflationary pressures due to government manipulation and money printing.

Bitcoin’s supply is capped at 21 million coins, making it a scarce asset in an age where central banks are printing money at unprecedented rates.

This scarcity, coupled with its decentralized and censorship-resistant nature, forms the bedrock of Bitcoin’s investment thesis.

The Case for Bitcoin as a Store of Value

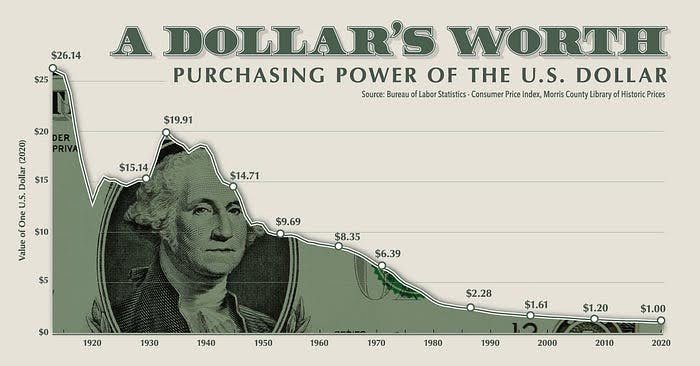

Bitcoin’s most compelling use case is as a store of value—a form of money that preserves its purchasing power over time. Unlike fiat currencies, which can be devalued through inflation, bitcoin’s fixed supply ensures that it cannot be diluted.

This is akin to gold, which has historically served as a hedge against currency devaluation. However, Bitcoin offers several advantages over gold, making it a more suited store of value for the digital age.

- Portability: Bitcoin can be sent across the globe in a matter of minutes, regardless of borders.

- Divisibility: Each bitcoin is divisible into 100 million satoshis, allowing for precise transactions in any amount.

- Verifiability: Bitcoin’s blockchain allows anyone to verify the authenticity and ownership of coins without the need for a trusted third party.

- Scarcity: While gold’s total supply is not entirely known and discoveries can increase its availability, bitcoin’s supply is known and finite.

Is Bitcoin a Good Investment? Risk vs. Reward

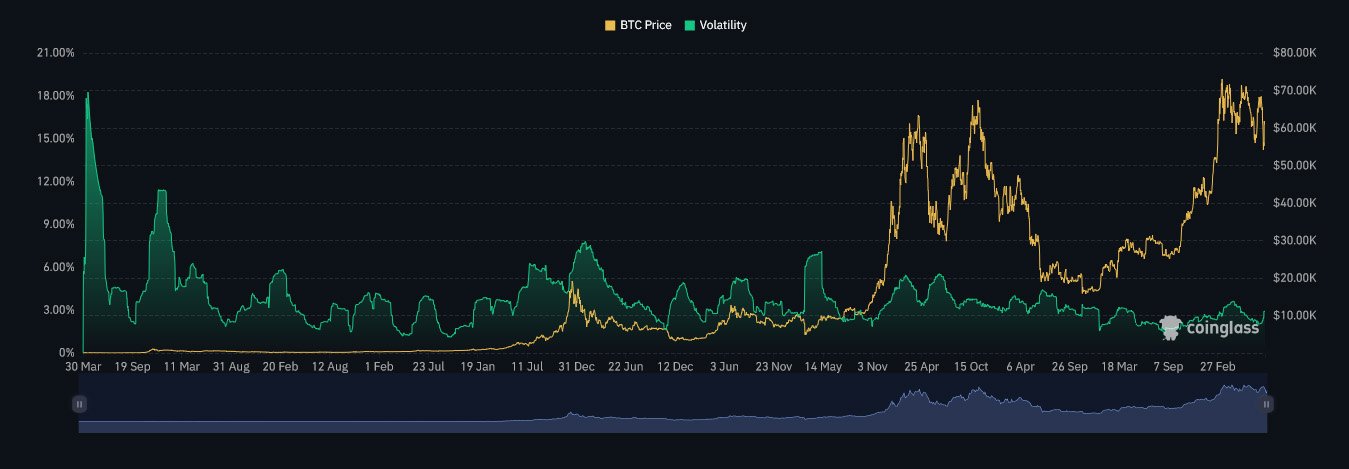

Any discussion of Bitcoin as an investment must acknowledge its volatility in fiat terms. Bitcoin’s price against US dollar can swing wildly over short periods, leading many to describe it as a speculative asset.

Consider the journey of the internet or even gold in its early days; both experienced significant volatility before stabilizing as they gained wider acceptance.

Bitcoin’s volatility can be seen as an opportunity for investors who understand its long-term potential and are willing to tolerate short-term fluctuations.

Over the past decade, bitcoin has outperformed every major asset class, including stocks, bonds, real estate, and gold. While past performance is not indicative of future results, this track record highlights Bitcoin’s potential as a high-growth investment.

“Bitcoin volatility is our protection against fiat games taking over. The volatility adds risk, which prevent the loans from being too easily given, making the borrow and buy trade harder. The volatility also clears out the leverage, which ultimately comes from money printing.”

– Jimmy Song on X

The Path to Hyperbitcoinization

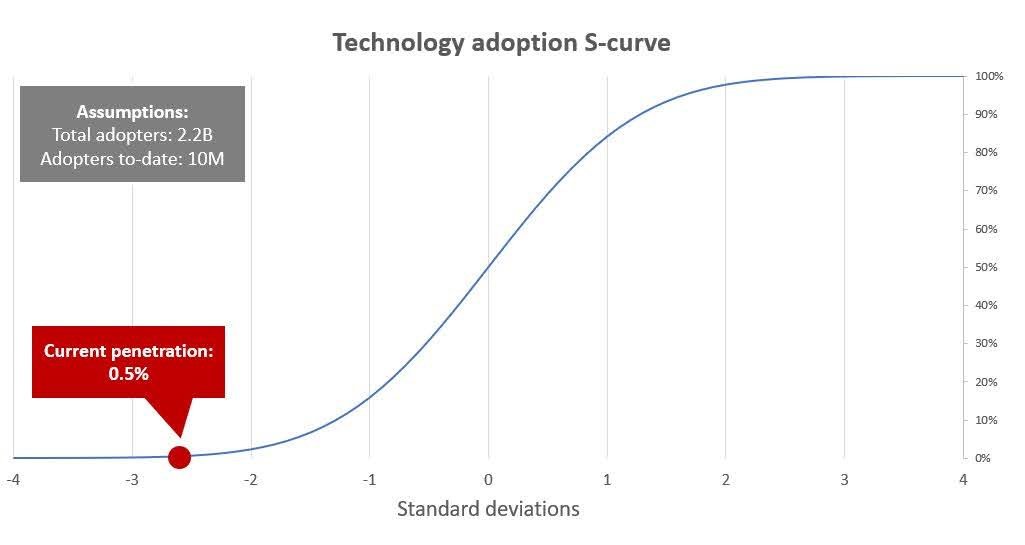

Ultimately, Bitcoin’s potential as an investment hinges on a broader trend known as hyperbitcoinization—the gradual replacement of fiat currencies with bitcoin as the primary medium of exchange and store of value.

As more people lose faith in traditional currencies and financial systems, Bitcoin’s adoption is expected to accelerate, driving demand and, consequently, its price in dollar terms.

Investing in bitcoin today is akin to investing in the early days of the internet.

The full potential of Bitcoin is still being realized, and those who see the writing on the wall now have the opportunity to be part of a paradigm shift in how we understand and use money.

Conclusion

Is Bitcoin a good investment? Suppose you’re looking for an asset that offers scarcity, security, and the potential for significant growth while hedging against the risks inherent in the current financial system.

In that case, the answer is a resounding yes. Bitcoin is not just a good investment; it’s a revolutionary one—an opportunity to participate in the creation of a new global financial standard.

As with any investment, understanding the risks is crucial, but the unique properties of Bitcoin make it an unparalleled addition to any forward-thinking investor’s portfolio.