As bitcoin keeps climbing and attracting attention during its current bull market, Jamie Dimon, the CEO of JPMorgan Chase, reignites the debate surrounding Bitcoin with fresh remarks. This time he branded the leading digital asset as a “public decentralized Ponzi scheme.”

Dimon’s comments, echoing his long-standing skepticism towards Bitcoin, stem from his belief that the scarce digital currency lacks intrinsic value and cannot function as a viable currency. During an interview with Bloomberg, he stated:

“If you mean crypto like Bitcoin, I’ve always said it’s a fraud. If they think of it as a currency, there’s no hope for it. It’s a Ponzi scheme, it’s public decentralized.”

Jamie Dimon And Division in Perceptions of Bitcoin

This isn’t the first time Dimon has voiced such sentiments; he previously garnered attention in 2017 for labeling Bitcoin as a “fraud” that he predicted would eventually “blow up.” Moreover, during a US Senate Banking hearing earlier in January, Dimon even went as far as suggesting that he would “close down” the digital asset industry if given the authority.

Despite his criticism, Dimon acknowledges the potential of blockchain technology, particularly its application in smart contracts, which he believes holds value in areas like supply chain management, financial transactions, and property ownership.

Dimon’s stance underscores the ongoing division in perceptions of Bitcoin. While digital asset enthusiasts praise its decentralized nature, potential as an inflation hedge, and transformative role in finance, opponents highlight concerns about extreme volatility and past instances of fraud and exploitation.

This shows that Dimon remains steadfast in his skepticism, regardless of bitcoin’s stellar 5x performance in the recent months during its current bull market.

Timing of Bitcoin’s Bull Peak

Meanwhile, the bitcoin community is showing a resilient approach to such criticisms, awaiting the potential impacts of the 4th Bitcoin halving on BTC prices.

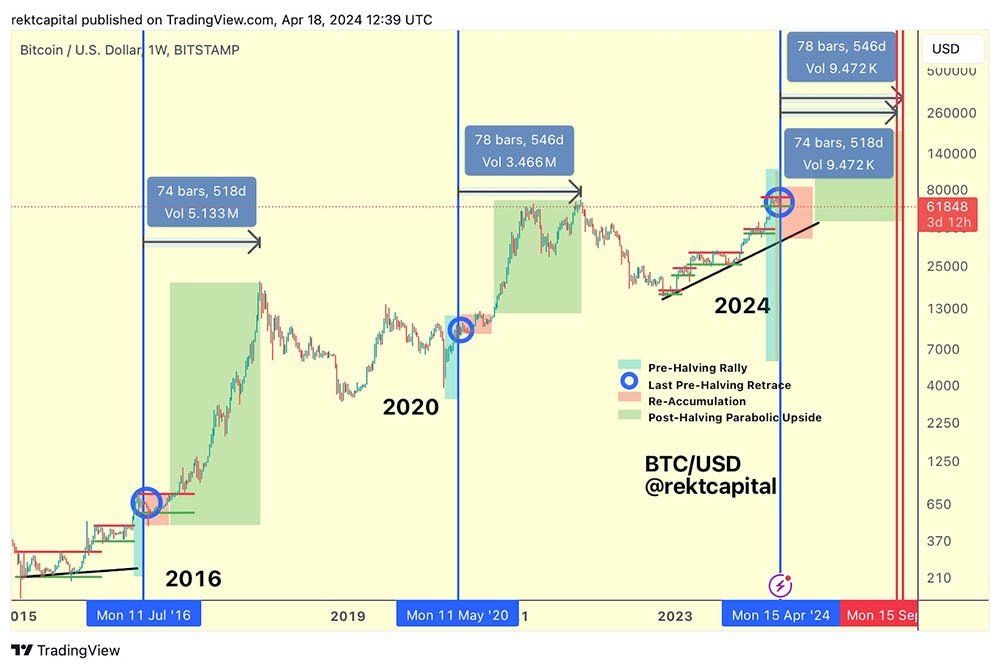

Renowned analyst Rekt Capital recently took to Twitter to share insights into the potential timing of Bitcoin’s peak in the current bull market. Drawing from historical data, Rekt Capital outlined two perspectives on when Bitcoin could reach its peak, considering both the traditional cycle length and the impact of recent acceleration in the market.

Traditionally, bitcoin has peaked in its bull market phase approximately 518-546 days after the halving event, which typically occurs every four years. Based on this historical pattern, Rekt Capital suggests that the next bull market peak could occur around mid-September to mid-October 2025.

An Alternative Approach

Rekt Capital also notes that Bitcoin’s current cycle has shown signs of acceleration compared to historical norms. Bitcoin reached new all-time highs around 260 days ahead of schedule. Despite this fast-paced growth, the digital asset has experienced a pre-halving retrace in the past month, slowing down the cycle by around 30 days.

Considering the impact of this deceleration, Rekt Capital suggests an alternative perspective on predicting the bull market peak. Instead of measuring from the halving event, Rekt Capital proposes measuring from the moment Bitcoin breaks its previous all-time high. In this scenario, the next bull market peak could occur around 266-315 days after surpassing the old all-time high.

Given that bitcoin broke to new all-time highs in March 2024, according to Rekt Capital, this accelerated perspective implies a potential bull market peak in December 2024 or February 2025.