Fifteen years ago, a revolutionary idea was introduced to the world through a document titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

Published under the pseudonym Satoshi Nakamoto in January 2009, this document laid the groundwork for what would become the first successful decentralized digital currency: Bitcoin.

Every year, Bitcoin enthusiasts celebrate this date as a beacon of hope that emerged after the dark days of 2008 financial crisis. This article reflects on Bitcoin’s journey, its impact on the financial landscape, and its future potential.

The Genesis Block and Early Years

Bitcoin’s inception can be traced back to January 3, 2009, when Satoshi Nakamoto mined the first block of the Bitcoin blockchain, known as the Genesis Block.

Embedded in this block was a cryptic message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This message not only served as a timestamp but also highlighted the motivation behind Bitcoin’s creation: a response to the financial crisis of 2008 and a desire to create a system free from centralized control.

In the early years, Bitcoin was mostly a curiosity for cryptography enthusiasts and libertarians. Its value was negligible, and it was often exchanged for goods and services in informal transactions.

The first known commercial transaction using Bitcoin occurred on May 22, 2010, when a programmer named Laszlo Hanyecz paid 10,000 BTC for two pizzas, an event now celebrated annually as Bitcoin Pizza Day.

Rise to Prominence

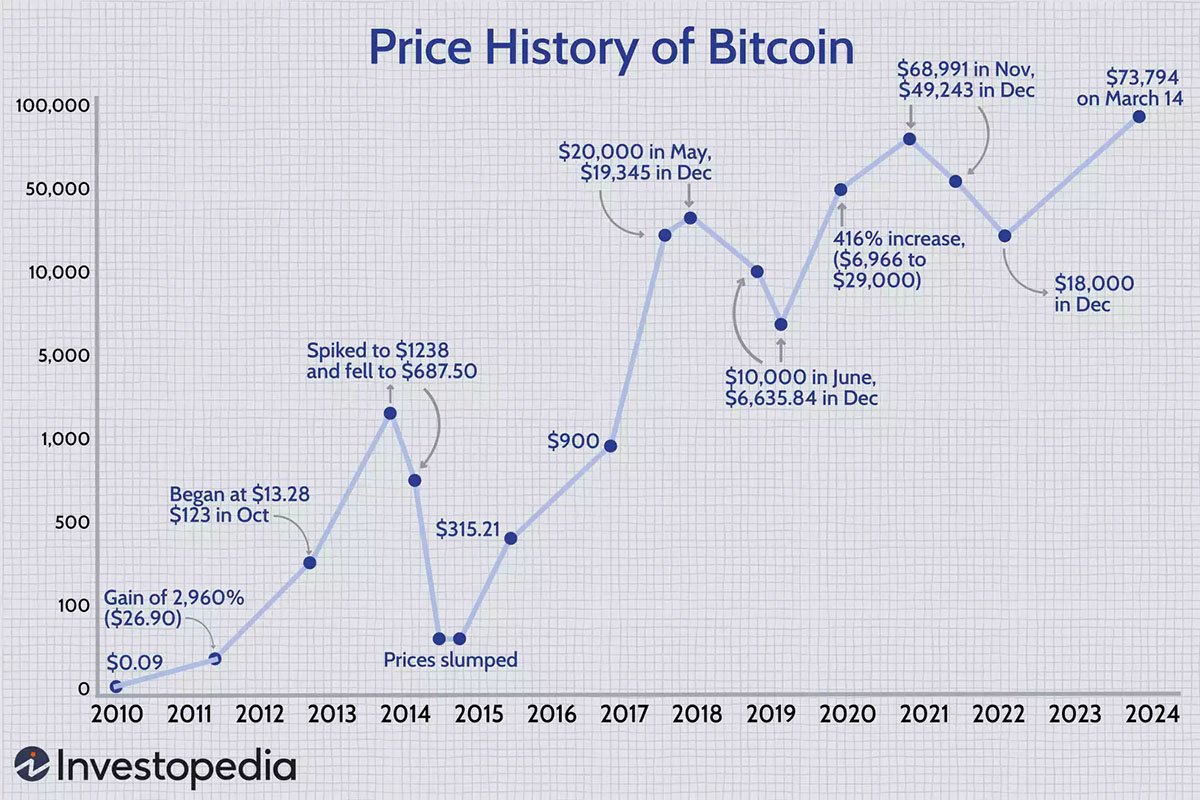

Bitcoin’s rise to prominence began in earnest in 2013 when its value surged from $13 at the beginning of the year to over $1,100 by December. This meteoric rise brought Bitcoin into the mainstream consciousness, attracting investors, technologists, and even governments.

The creation of bitcoin exchanges, such as Mt. Gox facilitated easier trading, although the collapse of Mt. Gox in 2014 highlighted the risks associated with the nascent technology and centralized exchanges.

Despite these setbacks, Bitcoin continued to grow. The implementation of the Lightning Network in 2018 aimed to address scalability issues, making transactions faster and cheaper.

Related: Potentials and Challenges of Lightning Network Adoption

Additionally, the growing acceptance of Bitcoin by major companies, such as Microsoft and Overstock, as well as financial institutions like Fidelity, underscored its increasing legitimacy.

Institutional Adoption and Legal Recognition

The last few years have been marked by significant institutional adoption and legal recognition. Companies like Tesla and Block (formerly Square) have added bitcoin to their balance sheets, and the first Bitcoin ETF was approved in Canada in 2021.

This institutional interest has contributed to Bitcoin’s perception as a store of value, often likened to digital gold.

Moreover, some countries have taken steps to integrate Bitcoin into their economies. El Salvador became the first country to adopt bitcoin as legal tender in September 2021, a bold experiment that has drawn global attention.

While this move has been met with both praise and criticism, it marks a significant milestone in Bitcoin’s journey toward mainstream acceptance.

The Challenges Ahead

Despite its success, Bitcoin faces several challenges.

Scalability remains an issue, with the network occasionally struggling to handle high transaction volumes. Efforts are underway to address these issues, with innovations like the aforementioned Lightning Network and a growing interest in sustainable mining practices.

Regulatory scrutiny is another major challenge.

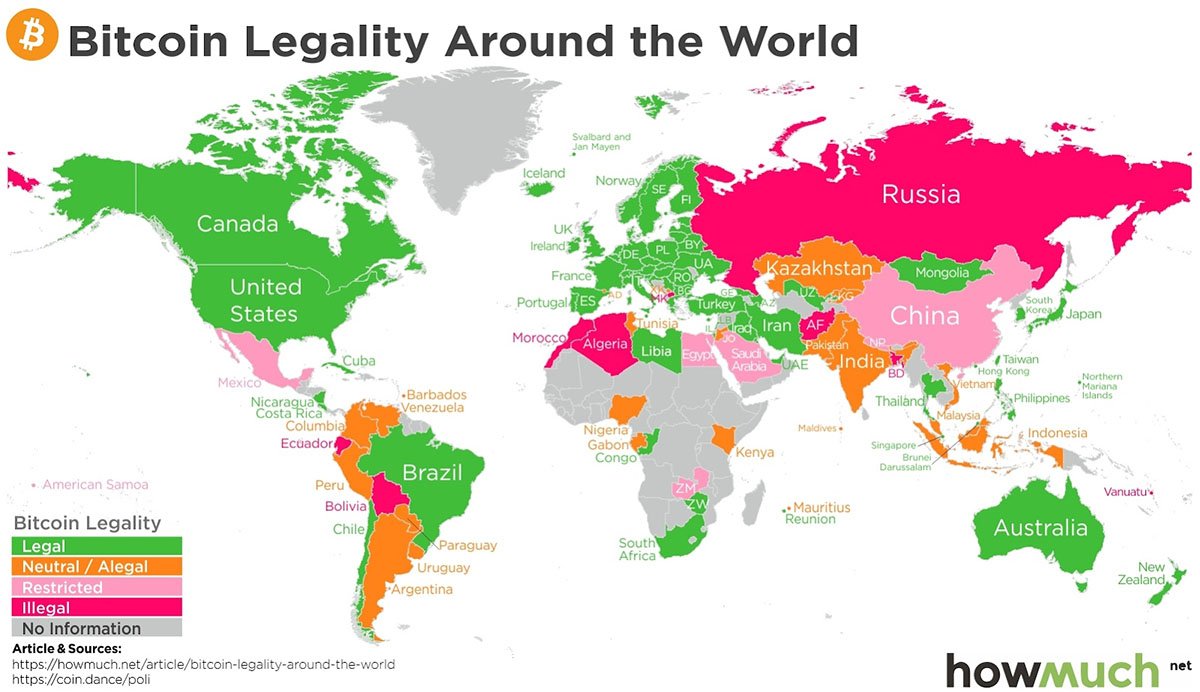

Governments around the world are grappling with how to regulate Bitcoin. While some, like El Salvador, have embraced it, others have imposed strict regulations or outright bans. The evolving regulatory landscape will play a crucial role in shaping Bitcoin’s future.

Looking Forward

In its 16th year of existence, Bitcoin’s future appears both promising and uncertain. The ongoing development and maintenance of the Bitcoin protocol, combined with increasing institutional interest and potential regulatory clarity, could pave the way for broader adoption.

However, challenges related to scalability, environmental impact, and regulatory acceptance must be addressed.

Bitcoin’s underlying technology, blockchain, continues to reinforce its position as the ultimate store of value and a reliable medium of exchange.

The principles established by Bitcoin are driving the development of secure, decentralized financial systems that operate without the need for trusted third parties.

This broader ecosystem of Bitcoin-centric innovation underscores its lasting impact on the world of finance and the potential for creating a more equitable and free monetary system.

Conclusion

Fifteen years after its creation, Bitcoin stands as a testament to the power of decentralized technology and the vision of its mysterious creator, Satoshi Nakamoto.

What began as an experiment in digital currency has grown into a global phenomenon, challenging traditional financial systems and inspiring a new generation of technological innovation.

Nevertheless, it is essential to acknowledge both its achievements and the challenges it faces.

Whether Bitcoin will ultimately fulfill its promise as a global currency or remain a niche store of value is yet to be seen. However, its impact on the financial world is undeniable, and its journey over the past decade and a half has been nothing short of remarkable.