Jim Cramer, the host of CNBC’s “Mad Money” show is a well-known figure in the traditional financial world, renowned for his market insights and often controversial opinions.

Over the years, Cramer has had a dynamic relationship with Bitcoin, oscillating between skepticism and cautious optimism. In recent months, Jim Cramer’s Bitcoin insights and commentaries have been particularly noteworthy, reflecting the broader sentiment and developments in the Bitcoin market.

Cramer’s Evolving Stance on Bitcoin

Jim Cramer’s views on Bitcoin have evolved significantly since he first commented on it. Initially skeptical, Cramer was concerned about bitcoin’s volatility and the regulatory uncertainties surrounding it.

However, as Bitcoin gained mainstream acceptance and institutional interest surged, Cramer began to see its potential as a store of value and a hedge against currency devaluation.

In 2020, Cramer revealed that he had bought bitcoin, likening it to a form of digital gold. He cited the asset’s finite supply, especially in the context of expansive monetary policies by central banks during the COVID-19 pandemic.

This marked a significant shift in his perspective, aligning him with other prominent financial figures who had started to embrace Bitcoin.

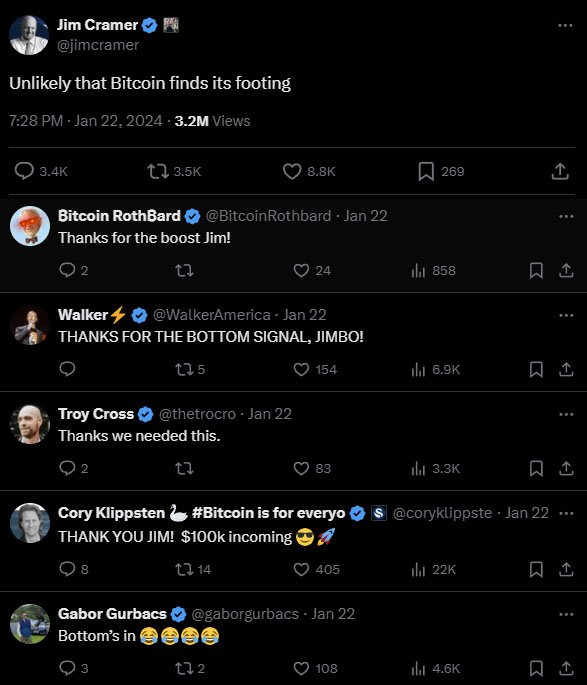

The “Inverse” Jim Cramer Bitcoin News Memes

The term “Inverse Cramer” refers to the phenomenon where the financial market, particularly bitcoin, tends to move in the opposite direction of predictions made by Jim Cramer.

This has led to a humorous yet intriguing observation within the investment community that doing the opposite of what Cramer suggests might be a profitable strategy (which is to be taken as a joke, and not financial advice).

In mid-2023, Cramer predicted a bearish outlook for bitcoin, suggesting it would struggle to maintain its value. Contrary to his prediction, bitcoin experienced a significant rally of around 37% shortly afterward.

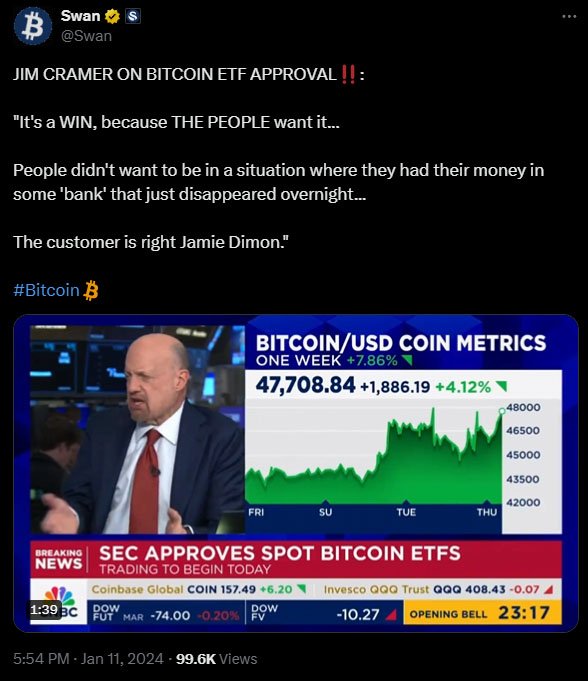

Conversely, when Cramer turns bullish on bitcoin, praising its resilience and technological marvels, bitcoin often sees a subsequent dip. In early January 2024, Cramer lauded bitcoin’s comeback and long-term potential. However, after an initial rise, bitcoin’s value corrected.

The concept of “Inverse Cramer” has permeated investment culture to the point where some traders reportedly base their strategies on doing the opposite of Cramer’s recommendations.

This idea has even sparked humorous discussions about the potential profitability of an “Inverse Cramer” fund, though such strategies should be approached with caution and critical analysis.

Latest Bitcoin News Highlighted by Cramer

- Bitcoin ETF Approvals: One of the major news items that Cramer has discussed was the approval of Bitcoin exchange-traded funds (ETFs) in various markets.

The introduction of Bitcoin ETFs provides a regulated and accessible way for investors to gain exposure to bitcoin without directly holding the asset. This development is seen as a significant step toward mainstream acceptance and could potentially drive further institutional investment.

- El Salvador’s Bitcoin Bond: Another noteworthy topic Cramer has touched upon is El Salvador’s issuance of bitcoin-backed bonds.

This innovative financial instrument aims to raise funds for national projects using Bitcoin, reflecting the country’s continued commitment to integrating Bitcoin into its economy.

Cramer views this as an interesting experiment that could influence other nations’ approach to Bitcoin.

- Corporate Bitcoin Holdings: Cramer has also highlighted the trend of major corporations adding bitcoin to their balance sheets.

Companies like MicroStrategy and Block have made substantial bitcoin purchases, signaling confidence in its long-term value. Cramer believes that this trend could continue, with more companies considering bitcoin as part of their treasury strategy.

Conclusion

Jim Cramer’s recent commentary on Bitcoin encapsulates the broader dynamics of the Bitcoin market. His evolving stance reflects a growing recognition of Bitcoin’s potential as both a store of value and a technological innovation.

The “Inverse Cramer” effect highlights the often unpredictable and contrarian nature of financial markets.

While Jim Cramer’s predictions attract significant attention due to his prominence in financial media, the market’s tendency to move in the opposite direction of his forecasts offers a fascinating study of market psychology and investor behavior.