MicroStrategy has been synonymous with aggressive bitcoin accumulation for some time now, becoming one of the most influential institutional holders of the asset.

MicroStrategy’s Bitcoin plan is led by its co-founder and chairman, Michael Saylor, who has consistently championed bitcoin as a hedge against inflation and a superior store of value compared to traditional fiat currencies.

MicroStrategy Bitcoin Holdings: The Latest Addition

MicroStrategy has once again expanded its bitcoin holdings, acquiring an additional 18,300 BTC between August and September for approximately $1.11 billion, according to the company’s SEC filling.

This marks its largest bitcoin purchase since 2021, further solidifying its commitment to a Bitcoin-centric treasury strategy.

On top of that, MicroStrategy also acquired 7,420 BTC for approximately $458.2 million at an average price of $61,750 per bitcoin, as mentioned by Michael Saylor on his X account.

With this additional acquisition, MicroStrategy’s total bitcoin holdings have grown to 252,220 BTC, showcasing the company’s continued confidence in bitcoin as a long-term store of value.

Why Bitcoin?

MicroStrategy’s rationale for its massive bitcoin holdings is multifaceted.

First, the company views bitcoin as an inflation-resistant asset. As inflation and fiat currency devaluation continue to worry investors globally, Saylor believes that Bitcoin offers a durable, long-term store of value.

Compared to gold, which has been traditionally seen as an inflation hedge, bitcoin is viewed by Saylor as an asset with better fundamentals due to its fixed supply of 21 million coins, along with its borderless and censorship-resistant nature.

Additionally, MicroStrategy’s aggressive bitcoin purchases are part of a broader effort to position the company as a key institutional player in the space.

This strategy has elevated MicroStrategy beyond its original business model of enterprise analytics software, turning it into a kind of proxy for institutional bitcoin investment.

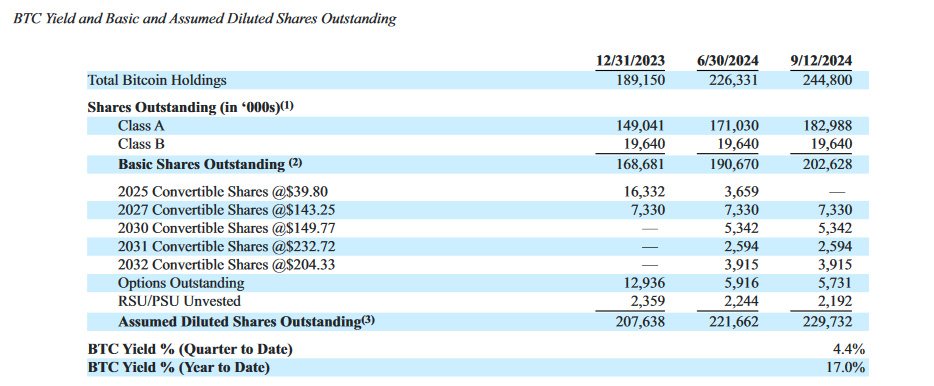

Strategic Returns and Bitcoin Yield

Despite the volatile nature of bitcoin’s price, MicroStrategy’s investment is already delivering returns. According to the company’s most recent filings, it has achieved a 4.4% bitcoin yield for the quarter and an impressive 17.0% year-to-date yield.

While the company has not provided specific details on how these yields were generated, the returns are likely derived from various strategies, such as lending out bitcoin or using it as collateral for loans.

This focus on yield generation demonstrates that MicroStrategy is not merely holding its bitcoin as a static asset; rather, the company is actively leveraging its bitcoin holdings to generate additional income.

This approach could serve as a model for other institutional investors looking to diversify their bitcoin strategies.

Market Reactions and Future Implications

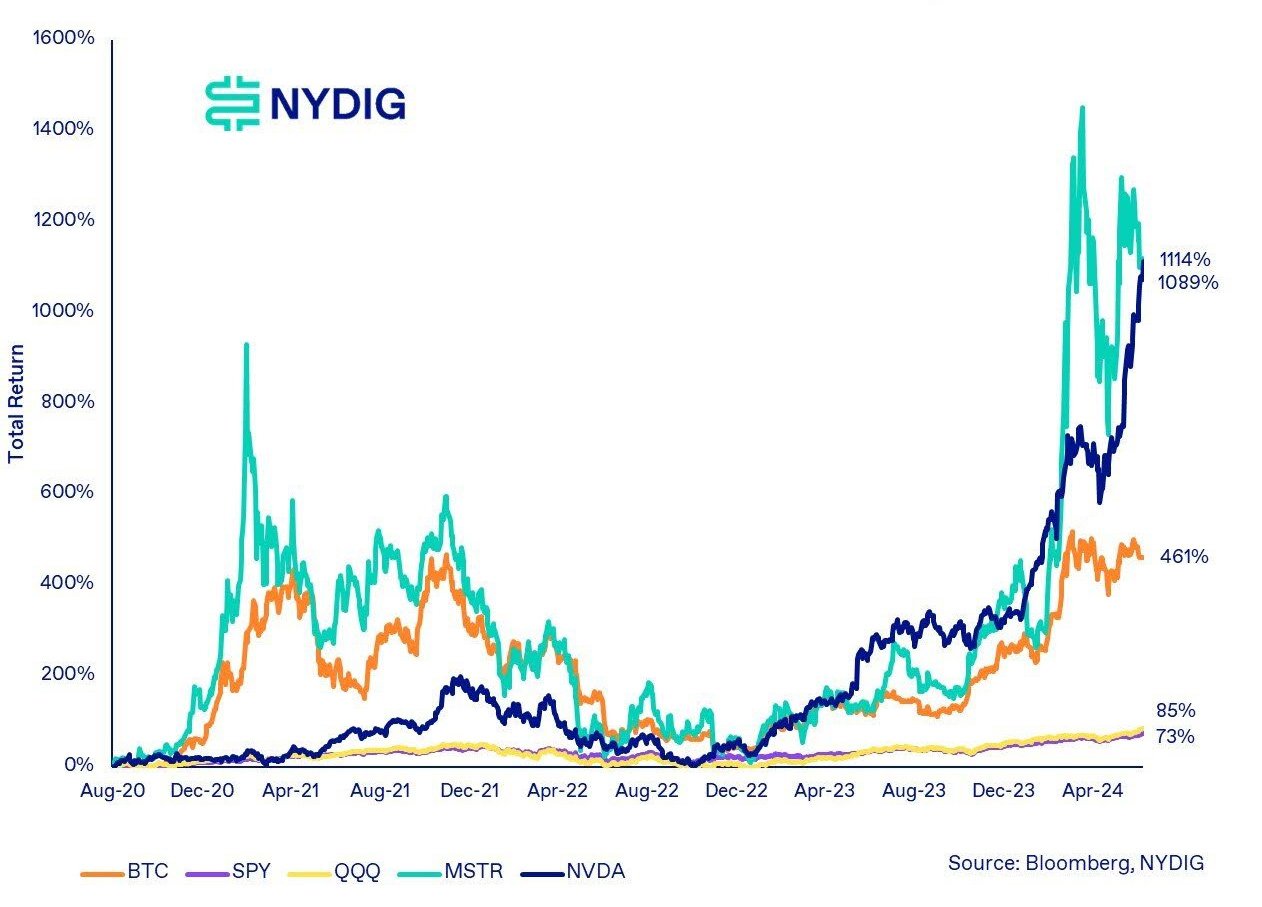

MicroStrategy’s bitcoin accumulation has had a notable impact on its stock price, which has more than doubled in 2024. Interestingly, the stock has outperformed bitcoin itself, reflecting investor confidence in the company’s strategic direction.

While bitcoin has risen approximately 40% this year, MicroStrategy’s stock has gained even more, underscoring the market’s bullish outlook on the company’s Bitcoin-centric strategy.

Looking ahead, MicroStrategy’s continued investment in bitcoin will likely solidify its position as one of the most influential institutional players in the space.

With nearly 1% of the total bitcoin supply under its control, the company has a vested interest in its long-term success. As Bitcoin adoption grows globally, MicroStrategy’s holdings could appreciate significantly, further validating its bold strategy.

Conclusion

MicroStrategy’s ongoing bitcoin acquisitions represent a clear bet on the future of digital money. The latest $1.11 billion purchase highlights the company’s steadfast commitment to bitcoin, even as market volatility continues.

In a world where inflation and economic uncertainty are ever-present, MicroStrategy’s bitcoin strategy serves as a case study of how companies can leverage bitcoin to secure long-term financial stability.

The coming years will reveal whether this bold venture pays off, but for now, MicroStrategy remains at the forefront of institutional bitcoin adoption.