When it comes to MicroStrategy bitcoin purchases, Michael Saylor, CEO of MicroStrategy, plays a game slightly different from your average cypherpunk anarchist. It’s like comparing a Golden Delicious apple to a blood orange – both are fruits with seeds, but different origins and flavors.

MicroStrategy Bitcoin Purchases – A Long List

The list of MicroStrategy bitcoin purchases is anything but short. The company has been constantly acquiring bitcoin since 2020. Reportedly, the firm currently owns 189,150 BTC valued at over $8 billion.

| Date | BTC Purchased | Amount | Total Bitcoin | Total Dollars |

| 8/11/20 | 21,454 | $250M | 21,454 | $250M |

| 9/14/20 | 16,796 | $175M | 38,250 | $425M |

| 12/4/20 | 2,574 | $50M | 40,824 | $475M |

| 12/21/20 | 29,646 | $650M | 70,470 | $1.125B |

| 1/22/21 | 314 | $10M | 70,784 | $1.135B |

| 2/2/21 | 295 | $10M | 71,079 | $1.145B |

| 2/24/21 | 19,452 | $1.026B | 90,531 | $2.171B |

| 3/1/21 | 328 | $15M | 90,859 | $2.186B |

| 3/5/21 | 205 | $10M | 91,064 | $2.196B |

| 3/12/21 | 262 | $15M | 91,326 | $2.211B |

| 4/5/21 | 253 | $15M | 91,579 | $2.226B |

| 5/13/21 | 271 | $15M | 91,850 | $2.241B |

| 5/18/21 | 229 | $10M | 92,079 | $2.251B |

| 6/21/21 | 13,005 | $249M | 105,085 | $2.740B |

| 9/13/21 | 8,957 | $419M | 114,042 | $3.159B |

| 11/28/21 | 7,002 | $414M | 121,044 | $3.573B |

| 11/29/21 – 12/8/2021 | 1,434 | $82.4M | 122,478 | $3.655B |

| 12/30/2021 | 1,914 | $94.2M | 124,391 | $3.750B |

| 1/1/2022 – 1/31/2022 | 660 | $25M | 125,051 | $3.775B |

| 2/15/2022 – 4/5/2022 | 4,167 | $190M | 129,218 | $3.965B |

| 6/28/2022 | 480 | $10M | 129,699 | $3.975B |

| 9/20/2022 | 301 | $6M | 130,000 | $3.981B |

| 11/01/2021 – 12/21/2022 | 2,395 | $42.8M | 132,395 | $4.024B |

| 12/22/2022 | -704 | $11.8M | 131,690 | $4.012B |

| 12/24/2022 | 810 | $13.65M | 132,500 | $4.027B |

| 03/27/2023 | 6,455 | $150.00M | 138,955 | $4.140B |

| 04/05/2023 | 1,045 | $29.30M | 140,000 | $4.170B |

| 04/29/2023 – 6/27/2023 | 12,333 | $347M | 152,333 | $4.517B |

| 07/01/2023 – 7/31/2023 | 467 | $14.4M | 152,800 | $4.53B |

| 09/24/2023 | 5,445 | $147.3M | 158,245 | $4.68B |

| 11/01/2023 | 155 | $5.3M | 158,400 | $4.69B |

| 11/30/2023 | 16,130 | $593.3M | 174,530 | $5.28B |

| 12/27/2023 | 14,620 | $615.7M | 189,150 | $5.90B |

Trust No One

“Murder your heroes—then they can’t break your heart when they fail to live up to their billing.”

– Nassim Nicholas Taleb

There is no denying that Saylor has orange-pilled a large number of people, especially those with a lot of wealth. This is a good thing in the sense that it will lead to more people investing in bitcoin, which causes the USD number most people value bitcoin in to go up.

It is damn impressive to watch what MicroStrategy is doing. Unlike your cousin who thought Dogecoin was a retirement plan, MicroStrategy made a bet on Bitcoin that paid off, big time! As of January 17, 2024, they are sitting on a dragon’s hoard of Bitcoin, valued at a jaw-dropping $8.07 billion. That’s not just walking-around money; that’s “buy your own island” money.

Microstrategy stock was the de-facto way for trad-fi to get exposure to bitcoin before all the ETFs launched. Anyone who says Michael Saylor has been a net negative for the Bitcoin ecosystem is likely delusional or likes losing. It was inevitable for trad-fi to get involved in bitcoin.

Seeing Saylor hold his coins through brutal downturns to now be up over $2 billion in fiat terms is commendable. While traditional finance is full of parasites, there are also some brilliant people in that industry who wish to do good in the world. Things are rarely ever black or white. The infusion of expertise from various financial backgrounds, helps enrich the Bitcoin ecosystem, enhancing its appeal and viability as a legitimate financial instrument.

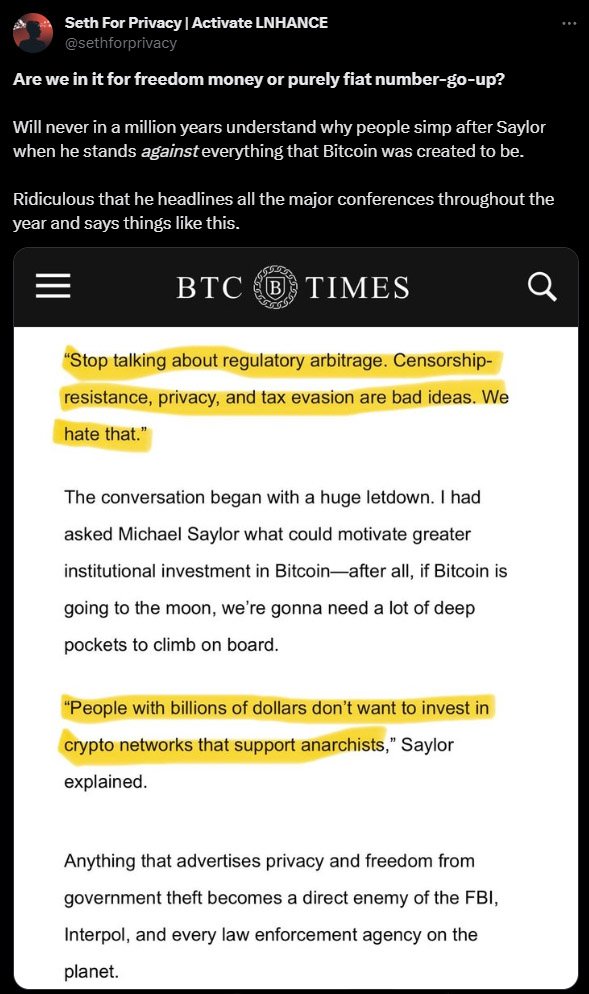

Less Simping, More Building

However, Seth also makes a good point. There is no need to simp for Saylor. His incentives are completely different from the average person who simply wants to control their wealth without a bank. Having a digital asset that is peer-to-peer is why Bitcoin was created. While there’s no denying Saylor’s influence in popularizing Bitcoin among wealthy investors and the general public, it’s important to recognize the varying incentives between different Bitcoiners.

Saylor’s approach to Bitcoin, while educational, does not necessarily advocate for all aspects of Bitcoin’s intended use, such as privacy-focused features like coin mixing. This makes sense. Anyone with 8 billion dollars in one asset is not going to paint a target on their back for law enforcement to come after.

Incentives Matter

In the grand scheme of things, Michael Saylor and MicroStrategy play a significant role in the Bitcoin ecosystem. Their strategies and incentives might differ from those of the cypherpunks, but that has not stopped MicroStrategy from demonstrating an ability to adapt and thrive in the Bitcoin market. Their actions, whether seen as aligning or contrasting with Bitcoin’s original principles, have undoubtedly impacted Bitcoin for the better.

The beauty of Bitcoin is that there are various players, each with their unique strategies and goals. Any one of them can run a node and use the software without the permission of others. Michael Saylor and MicroStrategy remind us that success in this domain often requires smart, sometimes unconventional, moves.

The enemy of my enemy is my friend. Joining forces with unexpected allies can lead to significant benefits, potentially reshaping the financial landscape for the better. Most Bitcoiners value both the privacy aspect of Bitcoin and “the number go up” technology.

The Bitcoin community has diverse motivations that coexist, ranging from financial gain to the pursuit of a more decentralized and private financial system. So stop worrying about those pushing the adoption of Bitcoin and help contribute to the ecosystem in the way you think is most important.

Hal Finney said it best: