Throughout history, money has evolved through three essential stages: first establishing itself as a store of value, then facilitating exchange as a medium of transaction, and finally, the most challenging step — gaining widespread acceptance as a standard unit of account.

Traditional forms of money traversed this path first over millennia with gold (for 5000 years) and then over centuries with fiat currencies. Now, a new form of money is speed-running the path, trying to accomplish it in decades.

In the wake of the 2008 financial crisis Bitcoin emerged with an audacious proposition to expedite this progression. Its meteoric ascent has sparked fervent discourse around its capacity to redefine the fundamental essence of money and catalyze a paradigm shift in how we perceive and utilize society’s most important tool.

A Cypherpunk’s Digital Gold

Beneath the cypherpunk patina, what truly powers Bitcoin’s rise is a more fundamental human drive: greed. The insatiable desire for a reliable store of value that can preserve and grow one’s wealth is a primal urge that transcends ideologies. Bitcoin’s real genius lies in tapping into this most basic of market forces, harnessing human avarice as the rocket fuel propelling its ascent.

So while the libertarian leanings give Bitcoin a veneer of cool counterculture, at its core, it’s an astute exploitation of one of humanity’s oldest vices — greed. A digital siren call for the material desires that have motivated people across ages, shaping economies and societies in the process. Love it or hate it, Bitcoin has tapped into an eternally renewable resource, an individual’s motive to profit.

From Niche to Normal

Bitcoin is gradually emerging as a medium of exchange. It is no longer just for tech enthusiasts or futuristic investors. From online marketplaces to local cafes, Bitcoin is carving out its niche, allowing for direct peer-to-peer transactions. It’s like the internet in the early ’90s: a bit unfamiliar and clunky, but increasingly indispensable.

It’s also getting way better at astonishingly faster speeds. Human beings can use protocols like Nostr and Bitcoin to send payments to random nyms with the power of public/private key encryption. They don’t need to know anything about the other person besides their public keys in order to send value.

Unit of Account: Bitcoin’s Uphill Battle

As for becoming a universal unit of account, Bitcoin is facing a steep climb. Price stability and widespread acceptance are crucial hurdles. It’s like trying to convince everyone at a multigenerational family reunion to agree on the playlist; it takes time and a bit of negotiation.

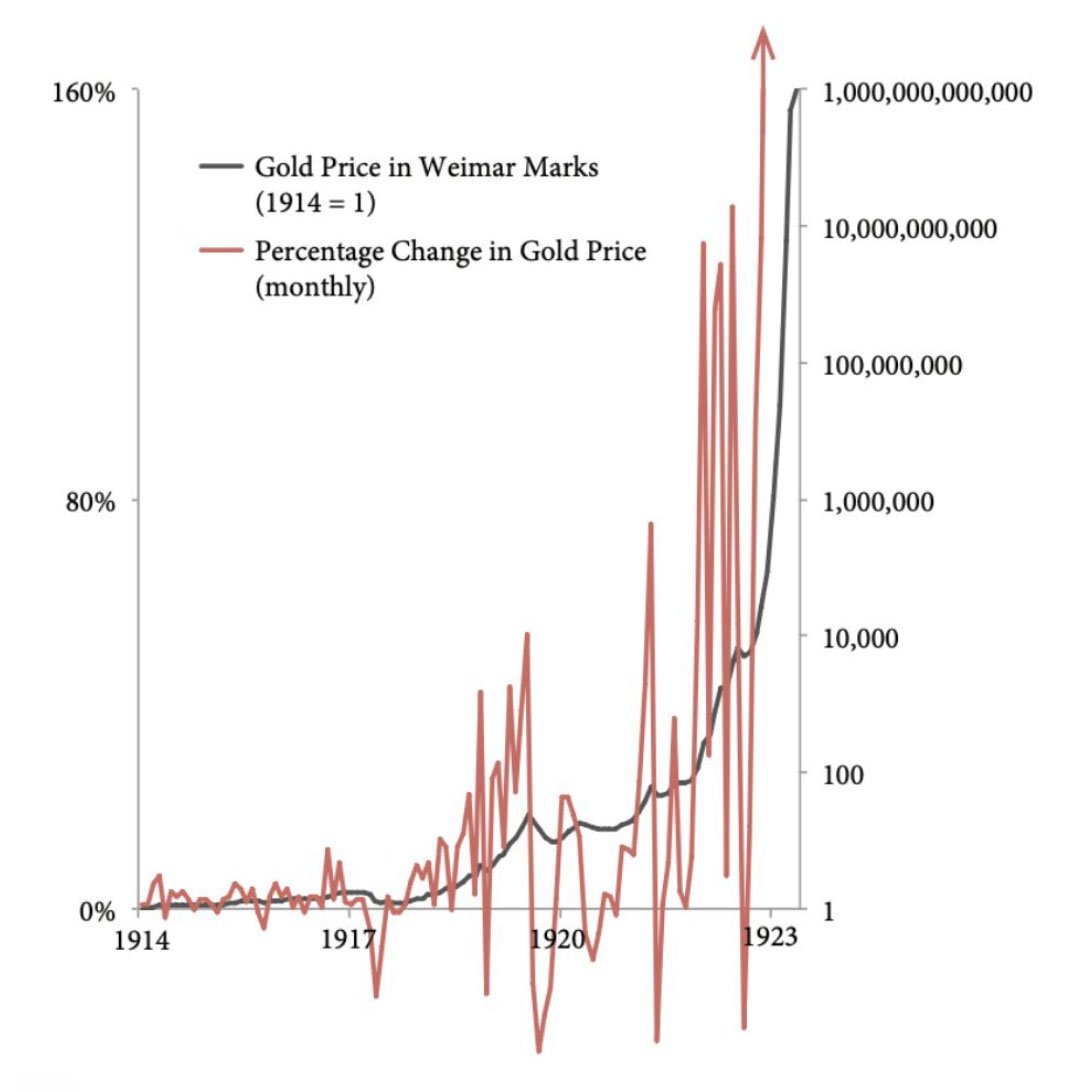

Nonetheless, it seems likely that given sufficient time, Bitcoin’s volatility will subside, and its adoption will continue to grow. Bitcoin may very well erode the monetary premium of other assets that have traditionally been used as stores of value to protect against fiat currency devaluation. One can imagine Bitcoin will find stable footing as gold did in Weimar Germany when people wouldn’t take “paper notes” for real money.

This transition is not without obstacles, as it requires a fundamental shift in the way we perceive and use money, challenging long-held traditions and institutional structures. Ultimately, the success of Bitcoin as a universal unit of account will depend on its ability to inspire confidence and overcome skepticism through continuing to add blocks of transactions roughly every 10 minutes.

Fiat Currency’s Reign and Challenge

Understanding Bitcoin’s emergence and potential means looking at the broader picture. A system where money’s value is based on trust in the government rather than a physical good has not been great. Fiat is built on trust, which at scale is very corruptible. Trust will always be required in our world, but the more that is required means the more that can go wrong.

If Bitcoin does go on to replace fiat and make its holders wealthy it’s important to remember what matters.

Conclusion: Bitcoin Can Become Amazing Money

Bitcoin, from its inception, has been on a mission to fulfill the essential functions of money. While it has made significant inroads as a store of value and medium of exchange, its journey to becoming a universally recognized unit of account is ongoing. The path is fraught with challenges, from volatility that can test the mettle of even the most stoic boomers, to gaining trust and acceptance across generations and geographies.

Bitcoin’s story is one of innovation and persistence, pushing the boundaries of what we consider money. It’s not just about replacing old systems but about offering an alternative for those who seek financial autonomy and resilience against inflation. Learning about Bitcoin is a long journey that might never end for some. Bitcoin represents more than an economic shift; it embodies a choice for individuals and societies to either embrace or contest its value, marking a pivotal chapter in the ongoing narrative of financial evolution during a time when the world digitizes itself.