Following its 2014 collapse due to a massive hack resulting in the loss of approximately 850,000 bitcoin, Mt. Gox’s demise marked one of the biggest crises in Bitcoin’s timeline.

Now, after years of legal proceedings, the long-awaited Mt Gox bitcoin payout is finally making headlines once again.

As the distribution to creditors draws nearer, the Bitcoin community is eager to see how this event might impact the market and whether it signals the closing chapter in this decade-long saga.

The Mt Gox Journey

For nearly a decade, the Mt. Gox saga has been entangled in legal proceedings, investigations, and restitution efforts. Initially headquartered in Japan, Mt. Gox handled over 70% of all global Bitcoin transactions at its peak, making it the world’s largest Bitcoin exchange.

However, the security breach in February 2014, when hackers stole 850,000 BTC, led to the exchange’s collapse. In the aftermath, it was revealed that Mt. Gox’s security vulnerabilities and poor management were contributing factors to its demise.

Fast-forward to 2024, and creditors who lost funds in the Mt. Gox collapse are now closer than ever to receiving their long-overdue compensation. Thanks to the recovery efforts by the exchange’s trustee, approximately 160,000 bitcoin, along with other assets, were eventually retrieved.

Creditors have been waiting for the return of these funds, with final payout deadlines now within sight. The news of impending payouts has revived interest and speculation in the Bitcoin market.

Timeline and Status of Mt Gox Bitcoin Payouts

As of the latest developments in 2024, the Mt. Gox trustee has already distributed approximately 36% of the recovered bitcoin to creditors. The remaining 64%—a significant portion of the 160,000 bitcoin still under management—has yet to be distributed.

Creditors had a deadline of March 2024 to submit payout information, and while delays have occurred, much of the remaining payout is expected to be processed by the end of the year.

The payouts will be processed in both bitcoin and fiat currency options, but the majority of creditors have shown a preference for receiving bitcoin.

This is in part due to bitcoin’s increased value since the 2014 collapse, as well as the long-term optimism held by many creditors who have adopted the “HODL” mindset, choosing to keep their bitcoin despite its volatility in fiat terms.

Related: Mt. Gox Transfers Over $2.8 Billion in Bitcoin From Its Cold Wallets

Creditors’ Sentiments on the Payout

Recent data from Reddit and other online communities reveal interesting insights into creditor sentiments.

According to a July 2024 poll on the Mt. Gox Insolvency subreddit, 56% of creditors who responded plan to hold onto their bitcoin after receiving their payout, indicating strong confidence in bitcoin’s long-term value.

Meanwhile, around 20% of creditors indicated they would sell their entire payout, while others expressed interest in selling smaller portions.

Despite the poll’s small sample size, it provides a glimpse into the potential behavior of creditors once their payouts are completed. While the survey cannot be generalized to represent all creditors, it’s clear that many remain bullish on bitcoin and intend to hold onto their BTC despite the years of waiting.

Potential Impact on the Bitcoin Market

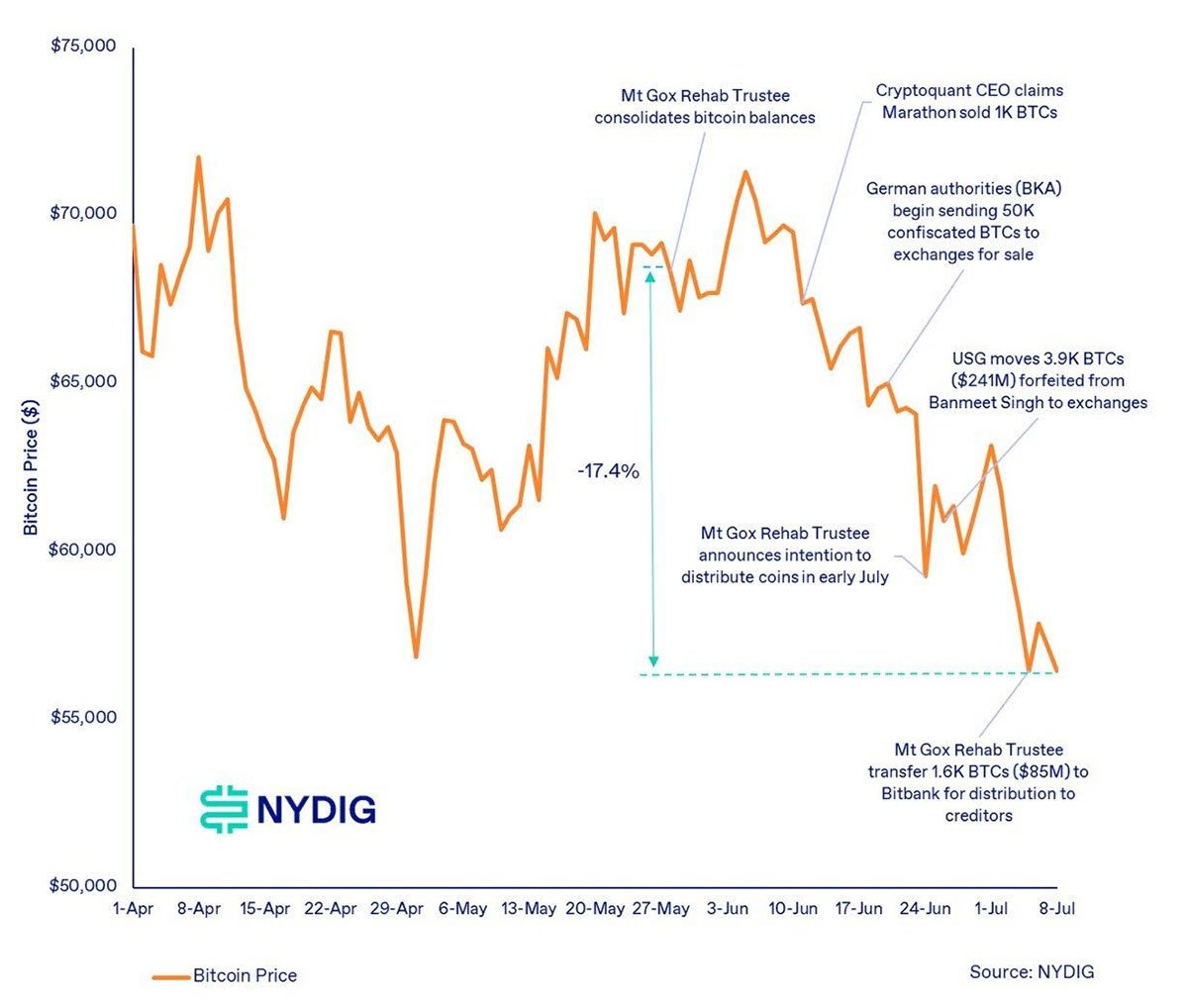

The question of how the Mt. Gox bitcoin payout will impact the market has been widely debated among analysts. With 160,000 bitcoin entering circulation, there is potential for market disruption if large amounts are sold all at once.

Some fear that a sell-off could place temporary downward pressure on bitcoin’s price, especially considering the billions of dollars in value tied to these payouts.

However, several factors suggest that the market may absorb these payouts with limited impact.

First, a significant percentage of creditors are likely to hold their bitcoin, limiting the amount that hits the market. Additionally, bitcoin’s market has matured considerably since 2014, with increased institutional involvement, deeper liquidity, and greater overall stability.

This evolution in market structure could help mitigate any major sell-offs.

Moreover, according to reports, around $3 billion worth of bitcoin has already been distributed, and the market has remained relatively stable despite these transactions.

The remaining balance, which sits at approximately $5.8 billion, is still pending, but given the gradual pace of the payout process, this could prevent a sudden influx of bitcoin into the market.

Broader Market Context

While the Mt. Gox bitcoin payout represents a significant volume of bitcoin being returned to circulation, it’s important to remember that the bitcoin market in 2024 is vastly different from what it was in 2014.

Bitcoin’s market cap is now over $1 trillion, and the network has seen substantial institutional adoption. Firms like BlackRock and Fidelity have launched Bitcoin-related financial products, and Bitcoin ETFs are becoming more common.

This increased demand for bitcoin may help counteract any negative price impacts stemming from the Mt. Gox payout.

Additionally, Bitcoin’s increasing integration into the financial system, combined with developments like the Lightning Network and Bitcoin’s role as a potential hedge against inflation, has solidified its standing as a long-term store of value.

These factors could encourage creditors to hold onto their bitcoin rather than sell.

Final Thoughts

The Mt. Gox bitcoin payout represents the final chapter in a saga that has spanned nearly a decade. For creditors, it offers a sense of closure, while for the bitcoin market, it raises important questions about short-term volatility and long-term resilience.

Regardless of how the market reacts in the immediate aftermath, Bitcoin’s ability to weather crises like the Mt. Gox collapse is a testament to the strength of its decentralized nature.

While the exact impact of the payout on bitcoin’s price remains uncertain, the completion of this process marks an important milestone in Bitcoin’s journey. It’s a reminder that, despite setbacks, the Bitcoin network continues to grow, evolve, and prove its staying power in the face of adversity.