The ban on Airbnb short-term rentals in New York sparks a debate on balancing housing regulation with economic innovation. Robert Kiyosaki real estate crash predictions influenced by Airbnb, adds depth to the discussion. While his insights offer hope to some, their accuracy remains uncertain.

Robert Kiyosaki Real Estate Crash: Airbnb’s Regulatory Landscape

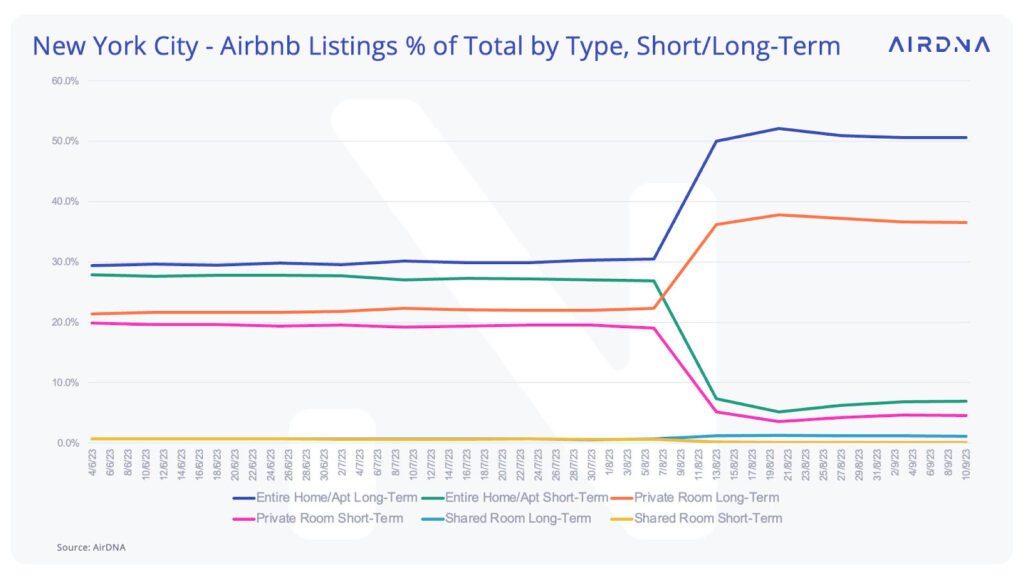

The ban on short-term rentals by Airbnb in New York has sparked considerable debate and controversy within the housing and hospitality sectors. Enacted to address concerns about the impact of short-term rentals on local communities, particularly in densely populated urban areas like New York City, the ban aims to regulate the proliferation of Airbnb listings that detract from the availability of long-term housing options for residents.

The ban reflects broader tensions between the sharing economy, housing affordability, and neighborhood stability. Finding a balance between regulating short-term rentals to protect communities and supporting innovation and economic opportunity remains a challenge for policymakers grappling with the evolving dynamics of the housing market and the rise of platforms like Airbnb.

Kiyosaki’s recent insights have ignited widespread discussion, capturing attention with his prediction of a potential real estate crash triggered by factors related to Airbnb. Simultaneously, he offers a glimmer of hope to aspiring homeowners amidst these forecasts. Yahoo Finance elaborates on these thought-provoking perspectives.

“So, Kiyosaki believes this Airbnb exodus foreshadows a larger real estate pullback. That could mean trouble for overleveraged homeowners or real estate investors late to the party. Property prices already exceed pre-2008 crash highs in many areas. Rising interest rates add pressure in 2023.

However, Kiyosaki says every market crash brings investment bargains, too. He expects the next real estate decline to enable buyers to scoop up properties on the cheap. Investors who acquire rental units or flip houses at deep discounts can profit during the eventual rebound.”

–Yahoo Finance

How Accurate Are Kiyosaki’s Predictions?

Robert Kiyosaki, renowned for his bestselling book “Rich Dad Poor Dad,” has offered predictions spanning financial markets, real estate, and economic trends. He frequently warns of impending market crashes, accurately predicting the 2008 financial crisis and urging investors to brace for potential economic downturns. Kiyosaki advocates for investing in gold, silver and bitcoin as hedges against inflation and economic uncertainty, consistently recommending them as essential components of diversified portfolios.

As a real estate investor, Kiyosaki provides insights into the real estate market, emphasizing the importance of income-producing properties and identifying regions with favorable investment conditions. Additionally, he expresses bullish views Bitcoin, viewing it as potential alternative to fiat currencies and advising investors to allocate a portion of their portfolios as a hedge against currency devaluation.

While Robert Kiyosaki’s predictions have garnered attention and followers, it’s worth noting that not all of his forecasts have been accurate. Critics argue that Kiyosaki’s warnings of impending market crashes and economic downturns can be overly alarmist and lack specificity. Despite his accurate prediction of the 2008 financial crisis, subsequent forecasts of similar magnitude have not materialized to the same extent, leading some to question the reliability of his prognostications.

Furthermore, Kiyosaki’s real estate predictions have been subject to scrutiny. While he emphasizes the importance of income-producing properties and identifies regions with favorable investment conditions, the timing and specifics of his recommendations may not always align with market realities.

“Kiyosaki has repeatedly warned investors about a catastrophic stock market crash for at least 13 years now. Yet since his initial warning in April 2011, the S&P 500 has generated an overall total return of 290%.”

– Source

Conclusion

The ban on short-term rentals by Airbnb in New York underscores the complex interplay between the sharing economy, housing affordability, and neighborhood stability. While enacted to address concerns about the impact of short-term rentals on local communities, the ban has sparked significant debate and controversy. Policymakers face the ongoing challenge of finding a delicate balance between regulating short-term rentals to protect communities and supporting innovation and economic opportunity.

Robert Kiyosaki’s recent predictions regarding a potential real estate crash, influenced by factors related to Airbnb, have stirred widespread discussion and reflection. While Kiyosaki’s insights offer valuable perspectives, it’s essential to approach them with critical analysis. Not all of his forecasts have proven accurate, and critics question the specificity and timing of his predictions.