Ironically, politics and Bitcoin go hand in hand, even though Bitcoin was created to take money out of the hands of the state. May 2024 saw massive political shifts overnight, with both parties flipping from hostile or indifferent to pandering and encouraging of the overall digital asset ecosystem.

Bitcoiners should use this shift to emphasize the importance of self-custody for bitcoin and why it will become ever more crucial in uncertain times.

Much like a soldier clinging to their weapon on the battlefield, having control over one’s private keys is essential for maintaining financial sovereignty and security.

Just as a disarmed soldier is rendered defenseless, relinquishing control of your private keys leaves you vulnerable to hostile forces seeking to deprive you of your wealth and freedom.

This newfound political support in Washington D.C provides an opportunity to advocate for policies that protect self-custody and educate the broader public on its importance.

By securing the right to self-custody, we can ensure that individuals retain control over their financial futures, free from the whims of changing political landscapes.

Mao famously stated, “Political power grows out of the barrel of a gun,” highlighting the coercive nature of state power. In contrast, Bitcoin represents a decentralized form of power that relies on cryptographic security and consensus mechanisms, rather than physical force.

Related: Bitcoin Is An Unstoppable Non-Violent Resistance Movement

Historical examples show the resilience of decentralized systems. Just as criminal organizations have thrived by adapting to state controls, Bitcoin’s decentralized nature makes it resilient against centralized power.

At the forefront of this movement is Satoshi Action Fund, a non-profit organization dedicated to advocating for Bitcoin and Bitcoin mining within the United States.

Its mission involves working with lawmakers, regulators, and the public to promote Bitcoin adoption and protect the rights of individuals to mine, hold, and transact with Bitcoin.

In a recent interview, Dennis Porter, CEO at Satoshi Action Fund, emphasized the importance of self-custody and property rights in the context of Bitcoin. He stated:

“If you care about property rights […] you’re going to want to protect self-custody. If you care about the ability for people to have access to their own digital financial tools and not have to be forced to go through a third party, you’re going to like that policy.”

The concept of “fire and movement” in warfare can be adapted to the digital realm. In military terms, “fire and movement” involves one group of soldiers providing covering fire while another group advances to a better position, ensuring continuous protection and progress.

Similarly, Bitcoin’s mobility and security enable individuals to maintain control over their assets regardless of political conditions.

Creating multiple wallets, using different setups, and employing various security protocols are akin to having multiple vehicles and routes in a crisis, enhancing financial security.

For example, keeping smaller amounts in hot wallets for everyday use, using multi-signature wallets for larger holdings, and storing a significant portion in a single sig cold wallet for a rainy day are solid ways to help protect one’s private keys.

The “fire” in this analogy is the effort to push politicians to pass laws that protect the right to self-custody.

The “movement” is the proactive step of already having self-custody measures in place. This way, even if political efforts fail, bitcoin holders are prepared to maintain their financial sovereignty.

Porter also highlighted the broader appeal of self-custody beyond just Bitcoin enthusiasts. He mentioned:

“The vast majority of the language in that bill is in alignment with where most Americans are on how they view technology and how they view being able to have access to their own finances.”

Even gold is not relegated to that sort of demise. As Porter explained, “Most people don’t hold physical gold. They’ll hold an ETF. Maybe they’ll store it with a custodian, but you’re still allowed to, if you want to, hold it in your own home, like in your garage or in a safe; that is your right and so we wanted to make sure to encourage states to protect that right.”

Learning from real-world examples of resilience and adaptability, Bitcoin users can apply similar principles to secure their digital assets.

The reality is that in the future, 8 billion people likely won’t have a UTXO, but having the right to the self-custody of bitcoin is what will help keep people and organizations honest.

Gold failed because it’s centralized, and when nation-states tried to redeem their dollars for gold, they were effectively “rug pulled” by Richard Nixon in 1971.

If self-custody is outlawed, Bitcoin might still prevail, but it will be a painful process, leading to more zero-sum Keynesian economic policies that tend to result in negative outcomes for everyone except those benefiting from the Cantillon effect.

By staying vigilant, informed, and proactive, we can ensure that digital assets create a better world, not a fiat 2.0 where bureaucrats gain even more control. One of the things that makes America, like Bitcoin, so special is our decentralized framework of governance.

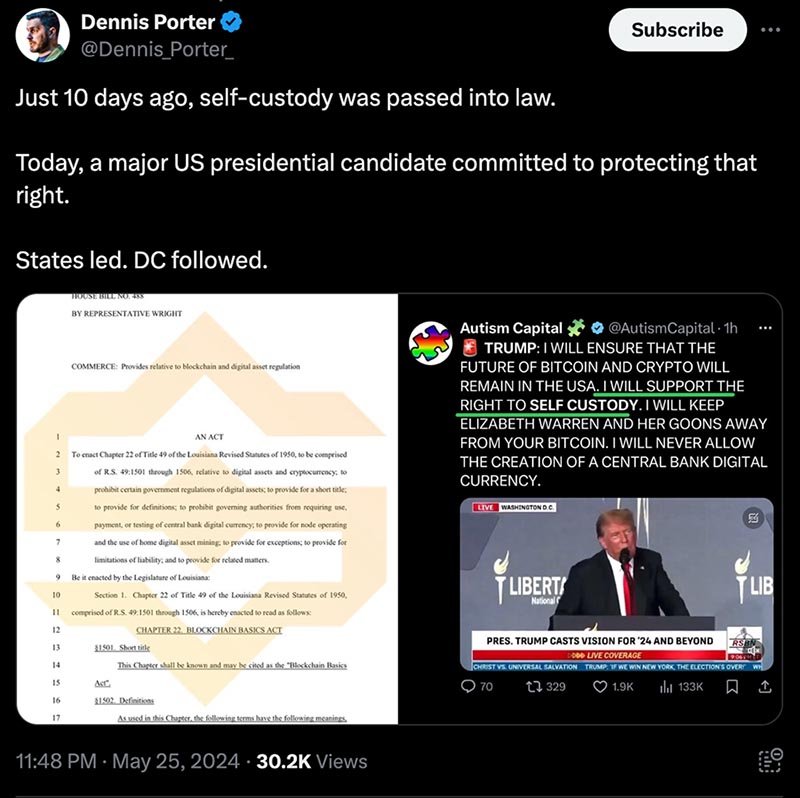

Porter emphasized the role of state-level activity in driving national policy changes, stating, “We’ve seen so much activity at the state level to drive things in the right direction. Study after study shows that when the states move in the right direction, so does the federal government.”

This underscores the importance of local advocacy in shaping broader policy outcomes.

Moreover, Porter highlighted Bitcoin’s potential to unify people across political divides, saying, “Bitcoin is more unifying and I think we’ll have long term impacts on bringing people together. I don’t think we’re ever going to stop battling each other and debating each other.”

He added, “But I do believe we’ve gone to this extreme level right now and it’s very tense globally. I do believe that Bitcoin will be a solution to that. Not the silver bullet, but it’ll help drive us back to the middle and start having conversations again. I mean, we’re having conversations across the political aisle.”

The right to self-custody of Bitcoin should not be taken for granted. Bitcoin is permissionless, but it would be great if Bitcoiners can avoid being labeled a criminal for practicing financial sovereignty.

Just as political resilience requires strategic thinking and adaptability, so does safeguarding one’s financial independence. Bitcoin is superior in many ways, and there is immense value in conveying this to politicians.

As Porter aptly put it, “There are so many reasons why Bitcoin is a value add…Everything from grid balancing to financial inclusion, to creating a system where we all are collectively adding value and benefiting from that value versus a fiat system where, you know, one side is printing money and giving it to their friends.”

Bitcoin might be the way humans separate money from the state, but it’s also deeply political. It is encouraging to see what Dennis Porter is doing with Satoshi Action Fund to drive positive change in the world.

Bitcoiners should continue to get politically involved so that society can engage in more infinite positive-sum games rather than zero-sum ones. By promoting the right to self-custody and highlighting the benefits of Bitcoin, we can ensure a future where financial sovereignty is protected and valued.