The first question many Bitcoin newcomers ask when first approaching the ecosystem is “Should I buy bitcoin now?”

When to buy Bitcoin is akin to asking when to plant a tree. The optimal time to do so was many years ago, and the second-best time is now. Let’s break down why now is as good a time as any to buy bitcoin.

Bitcoin, the must trusted blockchain, has consistently proven itself as a long term store of value and a hedge against the inherent flaws of fiat money systems.

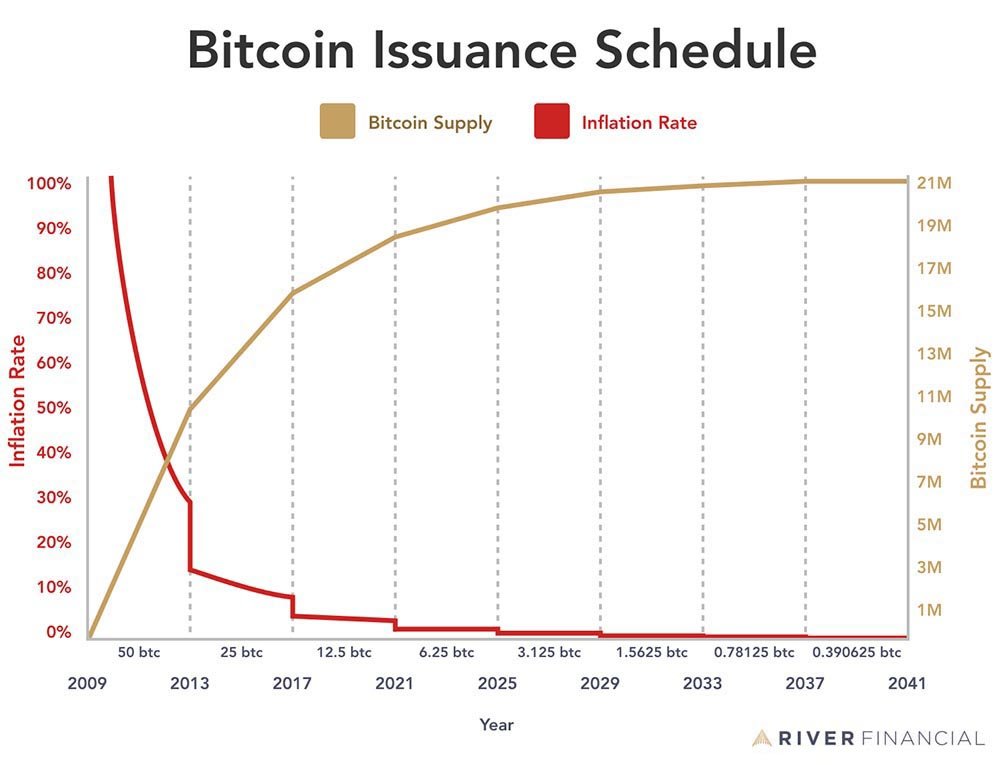

Bitcoin operates on a peer-to-peer network, immune to central bank policies and government interference. Its supply is capped at 21 million coins, making it inherently deflationary – it stands in stark contrast to fiat currencies, which are subject to relentless printing and devaluation.

This scarcity alone positions Bitcoin as “digital gold,” but with advantages that physical gold simply cannot offer, such as ease of transfer and verifiable authenticity.

Bitcoin’s price history is marked by its high degree of volatility, but within this volatility lies a consistent upward price trajectory. Since its inception in 2009, bitcoin has gone from being worth pennies to trading for the tens of thousands of dollars.

This growth is not just a speculative bubble; increasing adoption, technological advancements, and growing recognition of Bitcoin as a legitimate asset class is driving it.

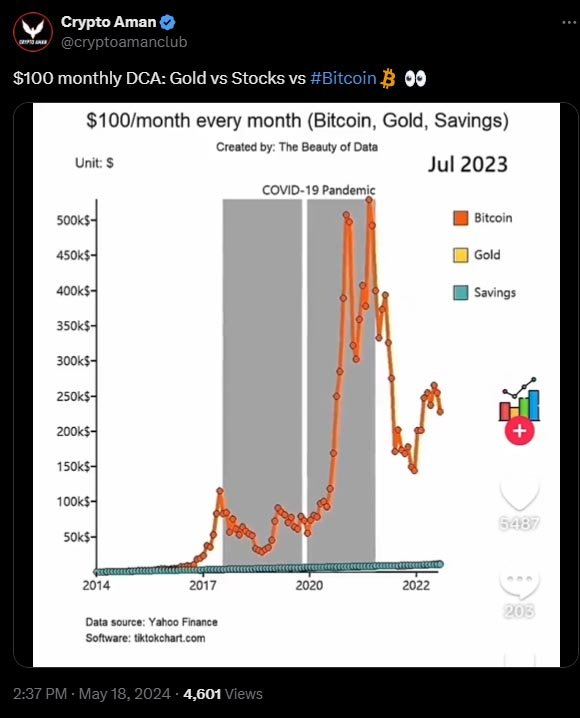

One of the most crucial pieces of investment wisdom is that “time in the market beats timing the market.” Trying to predict bitcoin’s short-term price movements is a fool’s errand.

The smarter strategy is to understand bitcoin’s long-term value proposition and accumulate it consistently over time.

This method, known as dollar-cost averaging (DCA), involves buying a fixed amount of bitcoin at regular intervals, regardless of the price. This strategy reduces the impact of volatility and mitigates the risk of making a significant purchase at a market peak.

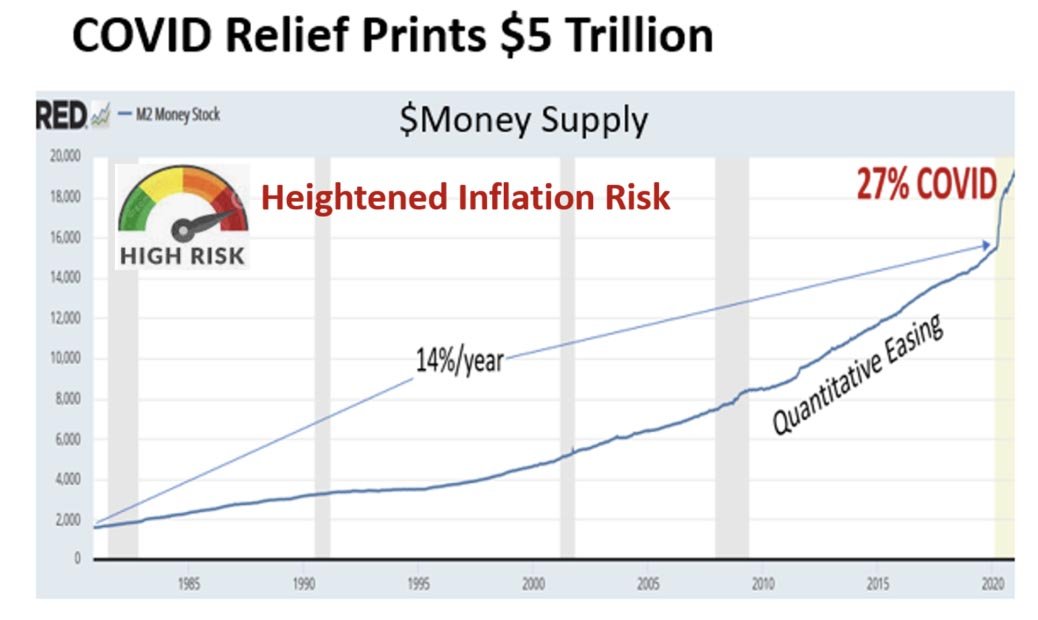

Current global economic conditions further underscore the urgency of owning bitcoin. Central banks around the world are engaged in unprecedented money printing, leading to inflation and a devaluation of fiat currencies.

The COVID-19 pandemic has only accelerated these trends, as governments scramble to prop up struggling economies. In this environment, Bitcoin’s fixed supply and decentralized nature make it an increasingly attractive alternative to traditional fiat money and even other asset classes.

The narrative around Bitcoin has shifted dramatically in recent years, with institutional investors and corporations entering the space.

Companies like MicroStrategy, Tesla, and Square have added bitcoin to their balance sheets, while investment funds and ETFs offer bitcoin exposure to a broader range of investors.

This institutional adoption not only legitimizes Bitcoin but also provides a strong foundation for future price appreciation.

Bitcoin’s underlying technology continues to evolve, making the network more secure, efficient, and scalable.

Developments such as the Lightning Network, and various scaling solutions enhance Bitcoin’s usability and pave the way for broader adoption. As the technology improves, so does the utility and value of bitcoin.

The ultimate vision for Bitcoin is hyperbitcoinization – a scenario where bitcoin becomes the dominant global currency, replacing fiat money.

While this may seem far-fetched, consider the trajectory of technological and monetary evolution. Just as the internet transformed information exchange, Bitcoin has the potential to transform value exchange on a global scale.

Investing in Bitcoin now is essentially a bet on this future, a future where financial sovereignty, privacy, and a fair monetary system prevail.

“You can’t stop things like Bitcoin. It will be everywhere and the world will have to readjust.”

– John McAfee

So, let’s get back to the question at hand: “Should I buy bitcoin?” The answer is a resounding yes. Waiting for the “perfect” time is an exercise in futility.

Bitcoin’s unique characteristics, combined with the current economic landscape, make it an essential addition to any forward-thinking portfolio.

Embrace the volatility, understand the fundamentals, and adopt a long-term perspective. By doing so, you not only secure your financial future but also contribute to the broader movement towards a more equitable and decentralized monetary system.