For anyone who holds bitcoin, the question “Should I sell my bitcoin now?” will inevitably come up. Given bitcoin’s well-documented volatility and the frequent shifts in global economic landscapes, it’s natural to wonder if the time has come to cash out.

However, the decision to sell bitcoin is not as straightforward as selling a traditional asset, and it comes with deep implications for those who understand its potential.

The Purpose of Bitcoin: Why Did You Buy?

Before considering whether to sell or not, it’s important to ask: Why did you buy bitcoin in the first place?

Most people buy bitcoin for one of three reasons:

- Investment: They believe that bitcoin’s price will continue to rise in the future, providing them with a significant return on their investment.

- Hedge Against Currency Devaluation: With central banks printing money and devaluing fiat currencies, Bitcoin serves as a way to preserve purchasing power over time.

- Belief in a Better Monetary System: Some purchase bitcoin because they see it as the foundation of a new financial system, one that is decentralized, free from manipulation, and designed to replace fiat currencies.

Each of these motivations can influence whether or not selling bitcoin makes sense.

If you’re in it for short-term gains, selling during a price spike might seem tempting. But if you see Bitcoin as a long-term solution to fiat’s failures, selling now may be premature and could be something you deeply regret later on.

Should I Sell My Bitcoin? Timing the Market

One of the primary reasons people consider selling their bitcoin is to take advantage of price movements. When bitcoin experiences a significant price increase, there’s a temptation to sell and lock in profits.

However, timing the market is notoriously difficult, and trying to sell at a peak can be risky.

Bitcoin has historically been a volatile asset, with large price fluctuations in both directions. It’s common to see bitcoin go through cycles where its price shoots up by 100% or more, only to correct by 30% or 40% in the following weeks or months.

Many people who attempt to sell at the top often find themselves selling too early, missing out on future gains. Conversely, others may sell during a correction, only to watch the price recover and rise even higher later on.

The truth is, no one knows exactly when bitcoin’s price will peak.

This uncertainty makes the decision to sell tricky, and for long-term Bitcoin believers, it’s often better to “hodl” than to risk losing out on the massive upside potential that bitcoin still holds.

Bitcoin’s Role in a Broken Fiat System

Many people fail to understand the broader economic forces that make Bitcoin so valuable. Selling bitcoin means returning to the very fiat system that Bitcoin was designed to help you escape from.

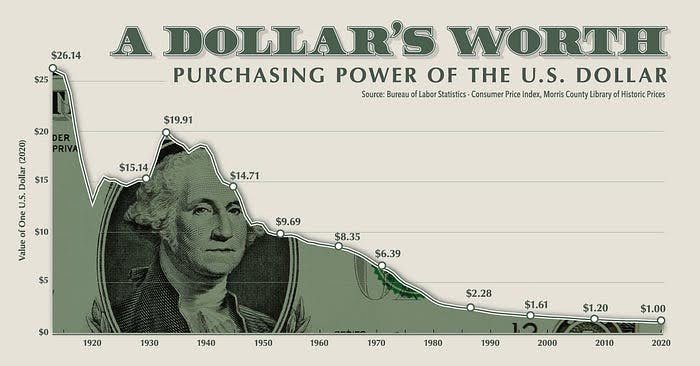

With inflation rising, governments printing money at will, and central banks losing credibility, fiat currencies are in a slow but steady decline.

Bitcoin was created by Satoshi Nakamoto as a hedge against the failures of traditional financial systems, and it represents a fundamentally different approach to money—one that is disinflationary and decentralized.

Related: Satoshi’s Ark and The Fiat’s House Of Cards

By selling bitcoin, you are essentially swapping a superior, sound form of money for an inferior one. Fiat currencies lose purchasing power over time, as central banks inflate the money supply, eroding the value of your savings. Bitcoin, with its capped supply of 21 million coins, is the opposite.

The Long-Term View: Hyperbitcoinization

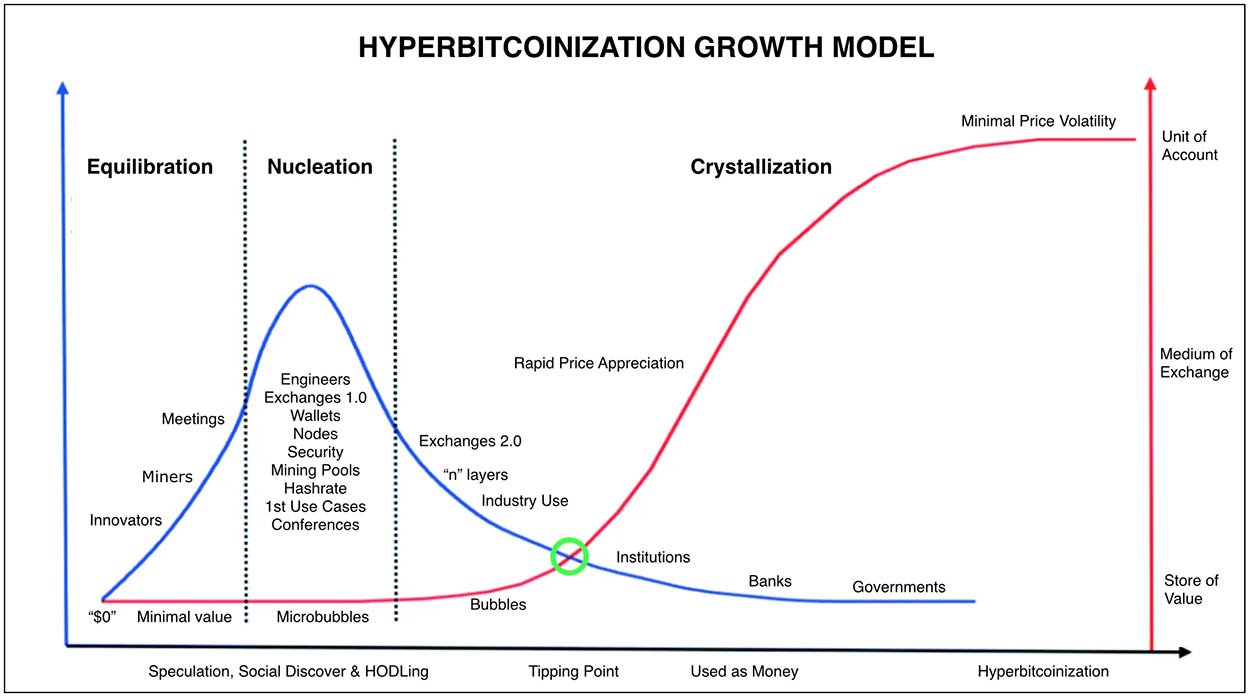

The goal is not merely to profit from bitcoin’s price movements but to hold on until “Hyperbitcoinization”. This refers to the point where Bitcoin becomes the global monetary standard, replacing fiat currencies as the dominant form of money.

While it may seem like a far-off fantasy to some, the steady adoption of Bitcoin by institutions, governments, and individuals suggests that it’s not as improbable as it once seemed.

Hyperbitcoinization would see bitcoin’s purchasing power skyrocket, as demand for bitcoin far exceeds the limited supply. Selling bitcoin before this transformation would be like selling land in Manhattan before the skyscrapers were built.

Tax Implications

Another aspect to consider when deciding whether to sell your bitcoin, is taxes. In most countries, bitcoin is treated as a capital asset, meaning that when you sell it, you may be liable to pay capital gains tax on any profits.

The rate at which you are taxed depends on how long you’ve held the bitcoin and the amount of profit you’ve made. In some cases, taxes can eat up a significant portion of your gains, making the decision to sell less appealing.

Conclusion

The decision to sell bitcoin is deeply personal, but it shouldn’t be made lightly. While there may be short-term gains from selling, the long-term potential of bitcoin far outweighs the fleeting value of fiat currencies.

For those who understand the broken nature of the current financial system, Bitcoin is not just a tool for wealth generation—it’s a solution to a much larger problem. Selling it prematurely could leave you on the wrong side of history.