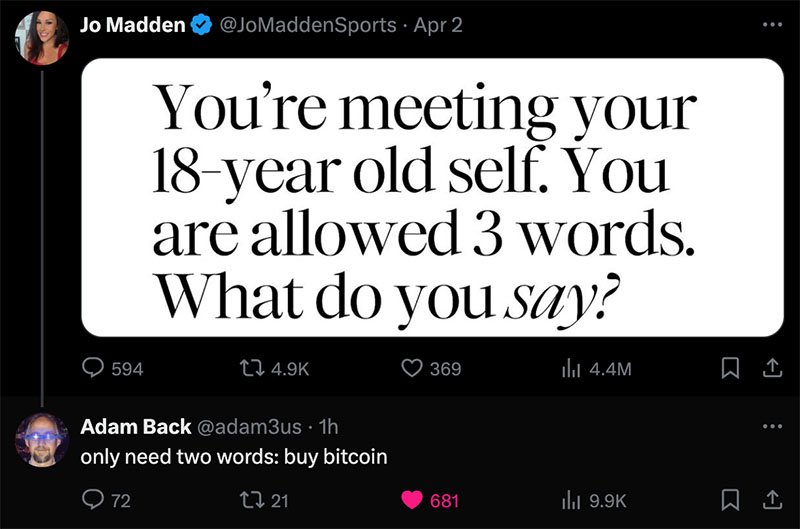

I’ve never met a Bitcoiner who doesn’t wish they had been able to stack sats at a cheaper price. Even the OGs like Adam Back, who got cited in the Bitcoin whitepaper, can acknowledge they wish they had bought Bitcoin earlier.

Yet, within this nostalgic yearning lies practical wisdom. Experienced Bitcoiners understand that the USD price of Bitcoin should be viewed more as a guiding beacon than a source of anxiety. The key is to focus on steadily increasing one’s “stack” of sats over time. Simply buying on red days without overextending one’s financial resources is a great way to build wealth for the future.

This mindset of saving in good money reflects a deeper understanding of Bitcoin’s true value proposition. It’s not about hitting the perfect price point, but about consistently accumulating a store of digital wealth that will appreciate in the long run. By maintaining this disciplined approach, Bitcoiners can avoid the emotional rollercoaster of chasing short-term price fluctuations and instead position themselves for long-term financial success.

What Good Means In The Context Of Money

It’s important to distinguish between the use of “good” in a normative, moral sense versus an engineering or functional sense. Feeding the hungry or building a free clinic would be considered “good” acts from an ethical standpoint. But the word “good” can also be used to describe the ability of a tool or technology to perform its intended purpose. A pen, for instance, can be considered “good” if it can reliably write on paper — this is not a moral judgment, but rather an assessment of its engineering quality.

The same principle applies to money. Money that is “good” at fulfilling the core functions of money — including maintaining value over time and space — is the money that will endure and thrive. This is not a subjective, moralistic assessment, but an observation of the objective consequences of people’s choices in the marketplace.

Bitcoiners recognize that fiat currencies like the US dollar inherently fail this test, as they are engineered by government central banks to gradually lose purchasing power over time through inflation. This allows the state to effectively pick the pockets of savers, redirecting capital towards its own profligate spending.

In stark contrast, Bitcoin has been designed from the ground up to be “good” money — with a fixed, predictable supply schedule that prevents dilution, a decentralized network that is resistant to political interference, and a verifiable record of stability that has withstood over a decade of real-world testing. This is the polar opposite of the “bubble boy” banks who compete in a walled garden. These fundamental attributes should remain unchanged regardless of bitcoin’s US dollar exchange rate at any given moment.

So while the USD price of Bitcoin is certainly important — as it reflects the market’s growing recognition of its superiority over fiat — it is ultimately a distraction from the core reasons why Bitcoin qualifies as “good” money. As long as Bitcoin maintains its engineered principles of scarcity, decentralization and stability (1 bitcoin = 1 bitcoin out of 21 million), its price in ever-debasing fiat should continue rising over time. This is not mere speculation, but the natural consequence of sound money outcompeting unsound money.

Missing the Forest for the Trees

While Bitcoin is far from a perfect, flawless monetary system, it possesses core attributes that make it a uniquely compelling form of money when compared to the fiat alternatives. Those who get caught up in the short-term USD price fluctuations are missing the forest for the trees.

Yes, bitcoin remains volatile in USD terms, and the Bitcoin community still has work to do in order to scale the network to support billions of users. But these are engineering challenges that innovative builders are actively working to solve. In contrast, the fundamental design flaws of fiat currencies — their engineered debasement through central bank policy — are inherent and intractable.

Bitcoin, like a promising NFL rookie, is eager to grow and outshine the old guard of worn-out, unreliable fiat monies — the vets resting on their laurels. While the fintech world has produced some sleek, user-friendly “Ferrari” front-ends, the clunky, outdated “horse and buggy” backend of the legacy financial system remains. Bitcoin, on the other hand, offers a ground-up reconstruction of sound money principles — one based on verifiable scarcity, decentralized resilience, and a track record of stability.

Conclusion: Stack Sats

The wise choice, then, is to tune out the distracting noise of short-term USD price movements and focus solely on consistently accumulating more sats over time. This disciplined stacking approach positions Bitcoiners to preserve their purchasing power and wealth in the face of the inevitable decline of government-controlled currencies. It’s not about hitting the perfect entry point, but about embracing Bitcoin’s superior qualities as money — qualities that will only become more apparent as this new system continues to evolve and outcompete the old.