The time-honored 60/40 portfolio, distinguished by its allocation of 60% to equities and 40% to bonds, has been a classic investment strategy for generations. It’s a straightforward approach and it has historically been a steady performer across a multitude of economic conditions.

Is 60/40 Portfolio Dead?

Yet, many are wondering is the 60/40 portfolio dead? As we navigate through the evolving terrain of global finance, marked by the rise of digital currencies such as Bitcoin and the looming threat of inflation, the once unassailable efficacy of this investment framework is now under scrutiny.

The hardest part about learning something new is unlearning everything you’ve been taught previously. With Bitcoin and inflation running hot, we may be at a pivotal juncture for the traditional 60/40 portfolio strategy, prompting investors to question its viability.

The Rise of Bitcoin

Bitcoin introduced a new asset class that possesses characteristics distinct from traditional equities and bonds. These digital assets offer a hedge against inflation and a non-correlated alternative to the stock and bond markets.

For those who enjoy listening to Ray Dalio, the former CEO of one of the most successful hedge funds in history, Ray often discusses the importance of diversifying and finding assets that are not correlated. Now, a hardened Bitcoiner might point out that to them, Bitcoin is money, so it’s just like saving cash without the debasement from printing money.

However, another set of people will see Bitcoin as appealing to investors who wish to diversify their portfolios beyond conventional assets. As Bitcoin becomes more mainstream, with increased adoption by both retail and institutional investors, it will continue to draw capital away from traditional equities and bonds, likely diminishing the relevance of the 60/40 split.

Blurring the Lines Between Savings and Investment

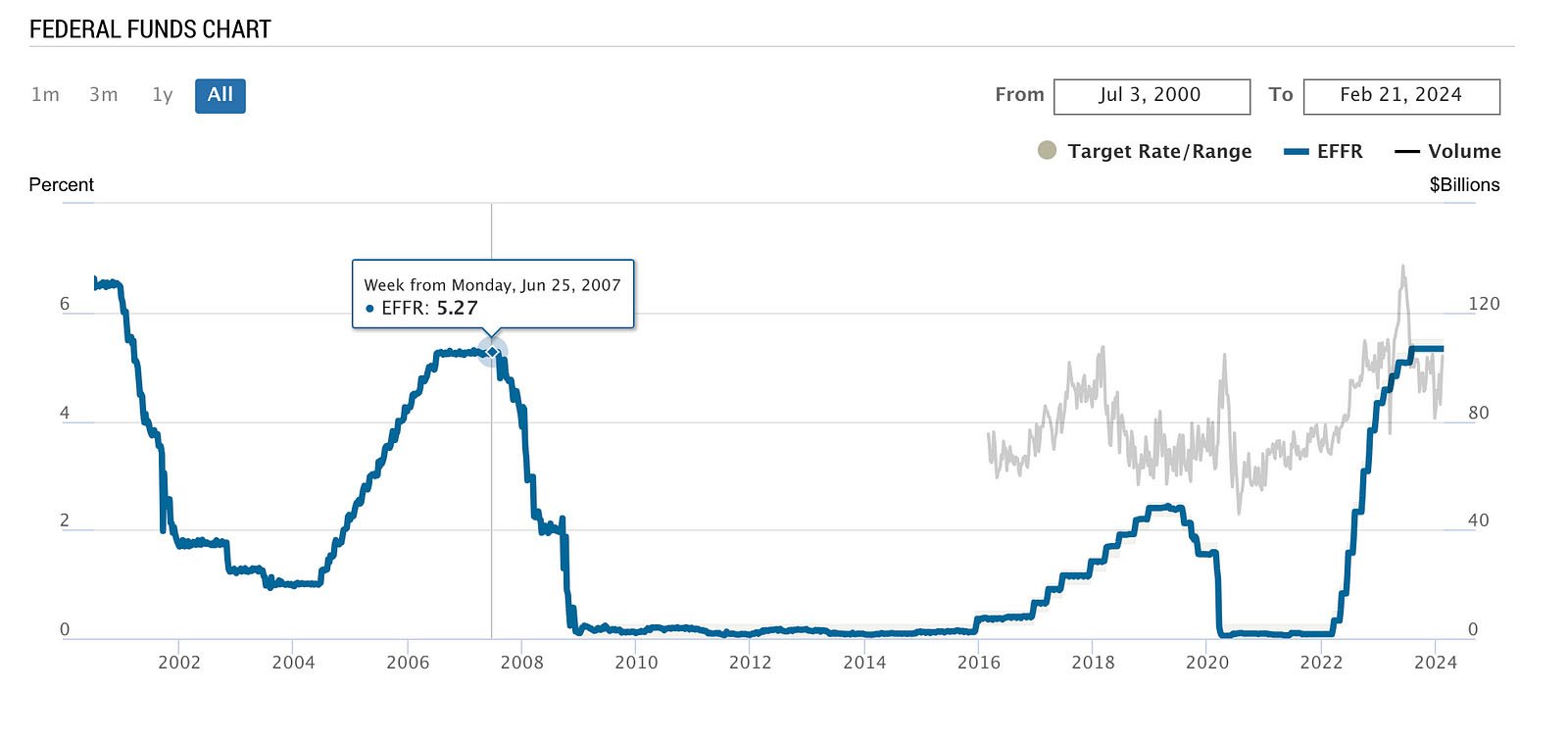

The persistent threat of inflation significantly undermines purchasing power, posing a unique challenge, particularly to the fixed-income components of an investment portfolio. In recent times, global economies have exhibited increasing signs of inflation. This uptick is largely attributed to the extraordinary monetary stimulus measures enacted in response to the COVID-19 pandemic. Consequently, the actual returns on bonds have been squeezed, raising alarm bells for investors.

This situation could grow even more complex if the higher interest rates we’ve been experiencing don’t tame inflation. Such an environment leaves central banks with minimal wiggle room to adjust monetary policy as the fiscal dominance of government spending crowds out the private sector.

Moreover, this dynamic has led to a blurring of the traditional distinctions between saving and investing. Besides the super wealthy who are more concerned with capital preservation rather than capital appreciation, very few people hold a large chunk of cash in their savings. This is because inflation destroys purchasing power.

The conventional wisdom that saving in fixed-income assets like bonds offers a secure, predictable return is also being challenged. Investors are now facing a scenario where the very instruments designed to protect their wealth are failing to keep pace with inflation, effectively eroding the real value of their savings.

Related reading: Bank of Canada Calls for Wage Restraint Amid Rampant Inflation

As a result, most individuals and institutions have completely abandoned the idea that savings and investment are different things. This makes sense. Navigating a financial landscape that has been significantly altered by macroeconomic forces and failed policy responses to global challenges does not make it easy to grow one’s purchasing power.

Interest Rates and the Bond Dilemma

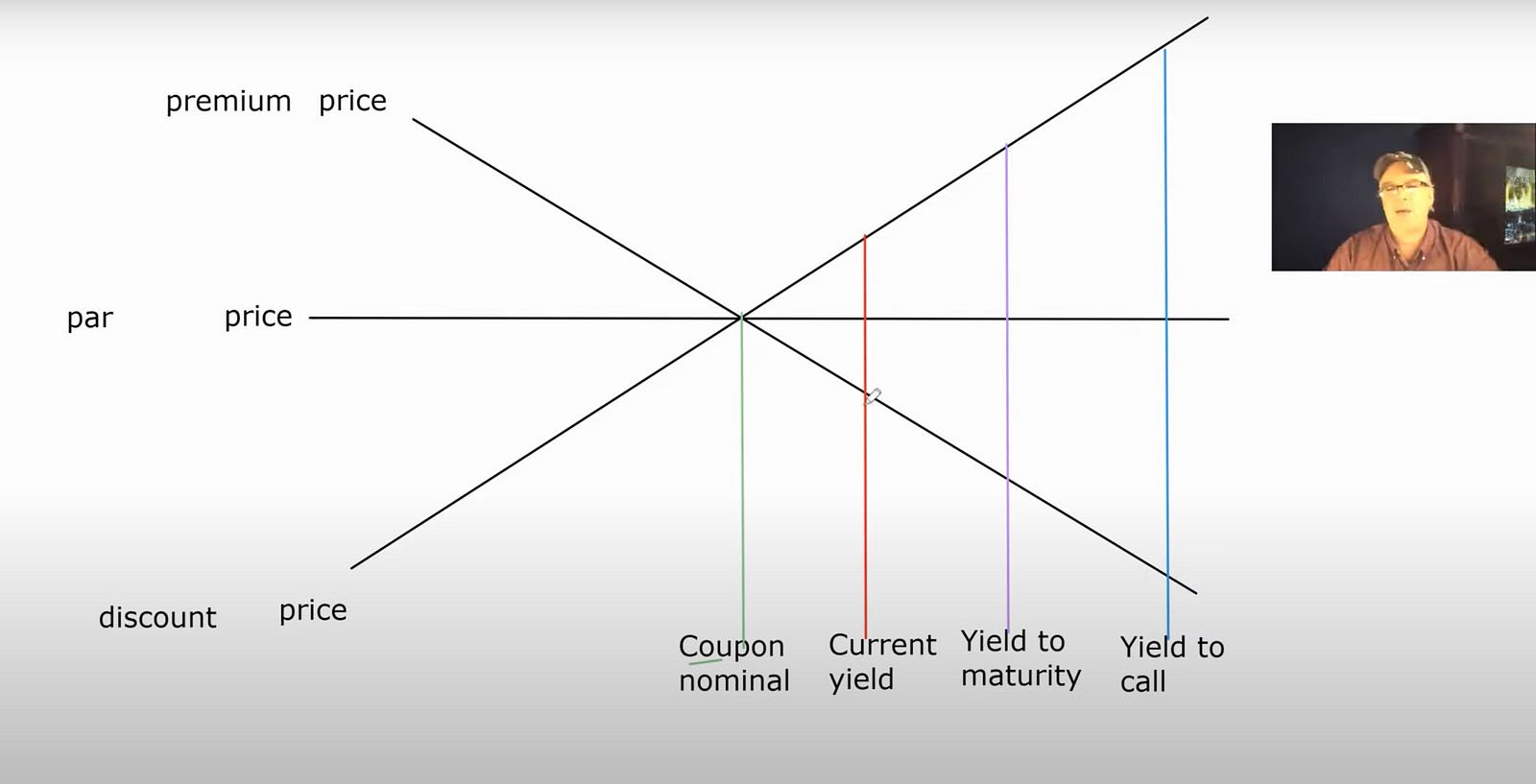

The 40% bond allocation in the 60/40 portfolio has traditionally served as a hedge against the volatility of equities, offering steady income and the potential for price appreciation in times of falling interest rates.

However, after four decades of generally declining interest rates, the potential for continued capital gains from bonds is limited. If interest rates keep rising to combat inflation, the protective buffer offered by bonds diminishes. If they fall inflation will rip, making a bond yield not enticing enough to keep up with inflation. A small group of experts will make a killing, trading the bond seesaw and the rest will likely get rekt.

Conclusion

The financial world is evolving. Christine Lagarde said it best, “If there is an escape, that escape will be used”. Between Bitcoin, the challenges of inflation, and interest rates at record highs since 2008 many investors are looking for that escape hatch from strategies like the 60/40 portfolio.

While this doesn’t mean the immediate demise of such strategies, it does highlight the need for investors to adapt to changing market conditions. Bitcoin emerges as an attractive option for those aiming to safeguard purchasing power without assuming investment risk, offering a clear distinction between saving and investing.