“The Bitcoin Standard” by Saifedean Ammous is a compelling exploration of the economic and historical principles underpinning Bitcoin, the world’s first decentralized digital currency.

Ammous takes readers on a journey through the history of money, from ancient to modern times, arguing that Bitcoin represents the most sound form of money ever created.

This book is not just about Bitcoin; it is a broader examination of what makes money valuable and how societies have evolved in their use of different monetary systems.

The Concept of Sound Money

At the heart of Ammous’s argument is the concept of sound money. Sound money refers to a monetary system that is stable, reliable, and resistant to manipulation by central authorities.

Historically, gold has been considered the epitome of sound money due to its scarcity, durability, and resistance to counterfeiting. Gold’s value has persisted through millennia, making it the standard against which all other forms of money have been measured.

Ammous argues that fiat money—the modern system where currencies are not backed by any physical commodity but by government decree—lacks the qualities of sound money.

He traces the history of fiat money and its tendency to lose value over time due to inflation and mismanagement by central banks. In contrast, he presents Bitcoin as the modern equivalent of gold, offering a new standard of sound money in the digital age.

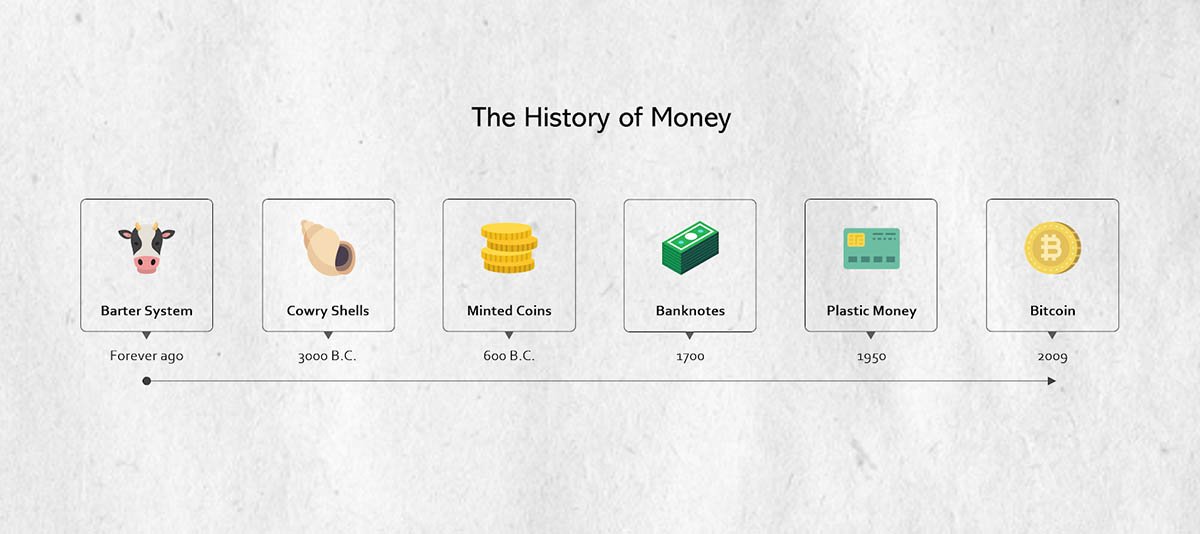

The History of Money

The book begins with an in-depth examination of the history of money, providing context for why Bitcoin matters today. Ammous explores how early societies used barter systems, where goods and services were directly exchanged.

As trade expanded, barter became impractical, leading to the development of commodity money, where items like shells, beads, and eventually precious metals served as mediums of exchange.

Over time, gold and silver emerged as the most widely accepted forms of money due to their inherent qualities. These metals were scarce, divisible, durable, and easily recognizable, making them ideal for trade.

The establishment of a gold standard—where currencies were directly tied to a specific quantity of gold—provided economic stability and facilitated global trade.

However, the 20th century saw the abandonment of the gold standard after World War II.

The Bretton Woods Agreement initially attempted to maintain a link between gold and the U.S. dollar, but this system collapsed in 1971 when the U.S. government ended the dollar’s convertibility into gold.

This move marked the beginning of the modern fiat money era, characterized by central banks’ control over money supply and interest rates.

The Bitcoin Standard

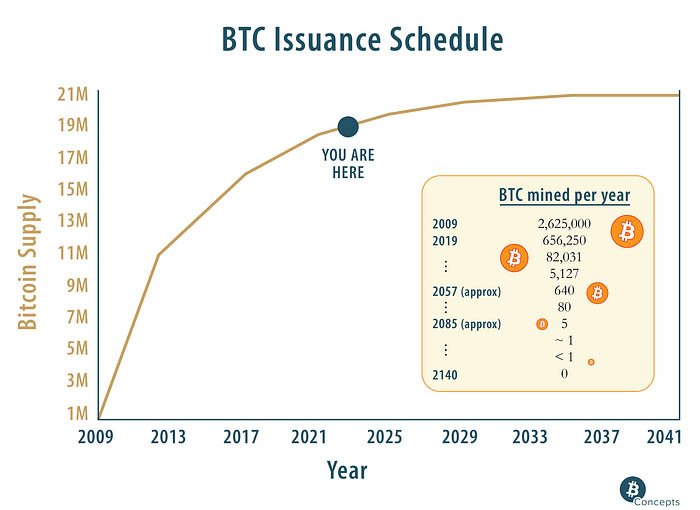

Ammous positions Bitcoin as the digital successor to gold. Like gold, bitcoin is scarce—only 21 million coins will ever exist. This fixed supply contrasts sharply with the infinite supply of fiat currencies, which can be printed at will by central banks.

Bitcoin’s scarcity, combined with its decentralized nature, makes it resistant to inflation and government interference.

The author also highlights Bitcoin’s unique properties as a digital asset. Unlike physical gold, bitcoin can be transferred across the globe in minutes, making it more practical for the modern economy.

Its cryptographic security ensures that ownership and transactions are secure, eliminating the need for trusted third parties like banks.

These qualities make Bitcoin a revolutionary form of money that could potentially replace fiat currencies as the global standard (also called Hyperbitconization).

The Role of Central Banks and Governments

A significant portion of “The Bitcoin Standard” critiques the role of central banks and governments in managing money. Ammous argues that central banks’ ability to print money leads to the devaluation of currencies over time, eroding savings and wealth.

This phenomenon, known as inflation, disproportionately affects the poor and middle class, who are less able to protect their wealth from depreciation.

In contrast, bitcoin’s fixed supply creates a deflationary environment where the value of the currency increases over time as demand grows.

“its mere existence is an insurance policy that will remind governments that the last object the establishment could control, namely, the currency, is no longer their monopoly. This gives us, the crowd, an insurance policy against an Orwellian future.”

– Saifedean Ammous, The Bitcoin Standard

The Future of Bitcoin

Ammous envisions a world where Bitcoin becomes the primary global reserve currency, replacing fiat money and restoring the principles of sound money.

He argues that this transition could lead to a more stable and prosperous world, where governments are less able to manipulate money for political ends.

“The Bitcoin Standard” is a thought-provoking book that challenges conventional economic wisdom and offers a fresh perspective on the future of money.

Saifedean Ammous’s historical analysis and compelling arguments make a strong case for Bitcoin as the soundest form of money in existence.

Whether or not one agrees with all of his conclusions, the book provides valuable insights into the nature of money and the potential role of Bitcoin in the global economy.