Bitcoin is volatile and that means you are likely to hear the term “paper hands” thrown around. It is a derisive label given to investors who lack the fortitude to withstand market fluctuations. These individuals, gripped by fear and emotion, hastily sell their bitcoin holdings during dips, effectively crystallizing their losses. This knee-jerk reaction stems from a fragile mindset which often leads to premature exits from potentially profitable positions.

The “Paper Hands” Syndrome

The “paper hands” syndrome is antithetical to the principles of disciplined investing and long-term wealth creation. Bitcoin, like any other asset class, is subject to cyclical movements, with periods of exuberance followed by corrections. Those who succumb to paper hands fail to grasp the inherent volatility of the Bitcoin space and allow transient price swings to dictate their investment decisions.

The Virtue of Diamond Hands in Bitcoin Investing

In contrast, “diamond hands” characterizes Bitcoin investors who possess the resilience and conviction to maintain their holdings through market fluctuations. These individuals trust their long-term analysis and strategy, steering clear of impulsive decisions driven by fear or greed. Their unwavering resolve, akin to the strength and durability of diamonds, enables them to weather the storm and capitalize on market recoveries.

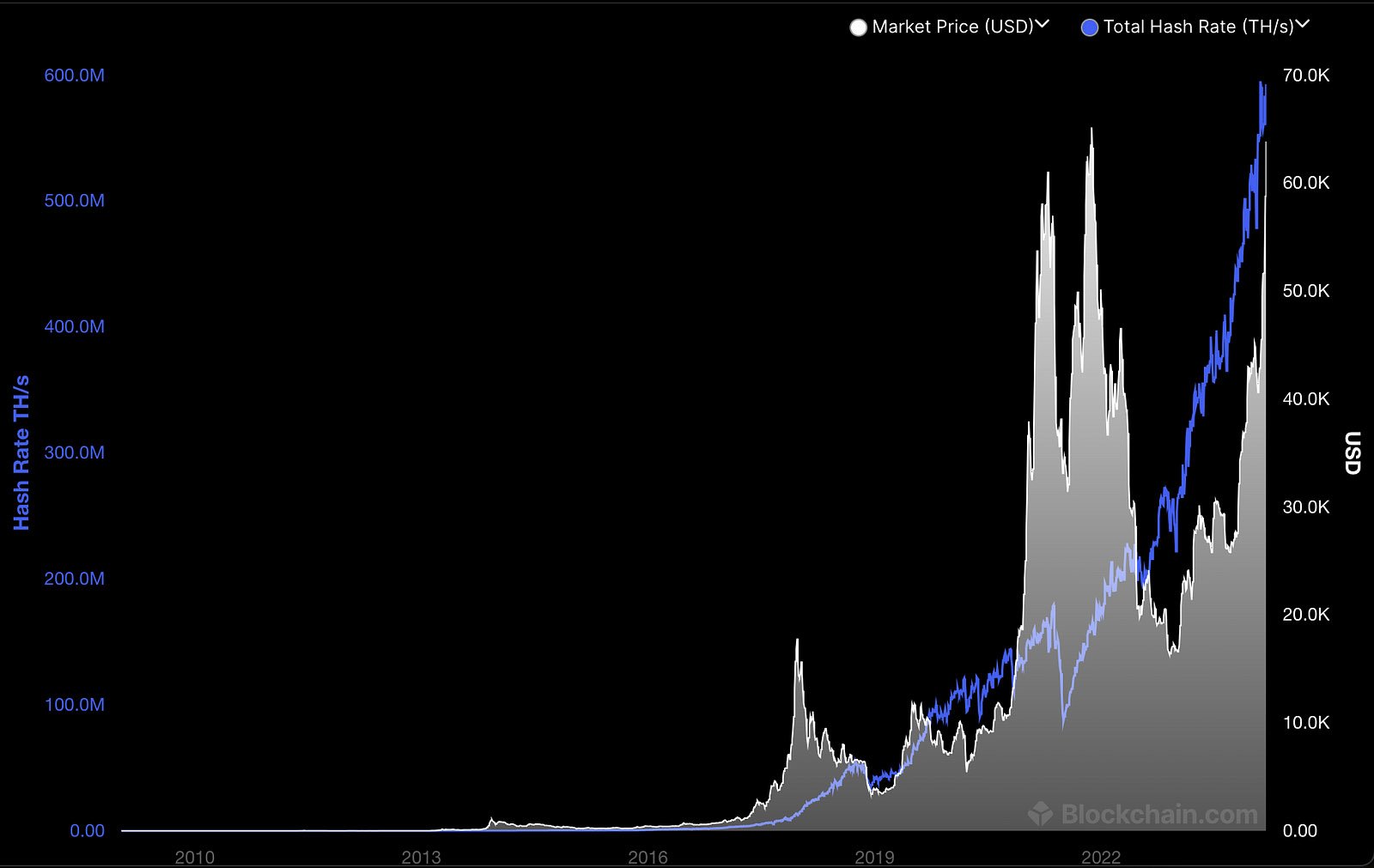

The disdain for paper hands in the Bitcoin community stems from the self-defeating nature of panic selling, which undermines the ability to capitalize on substantial market recoveries. Bitcoin’s price trajectory is notoriously turbulent, with significant retractions often preceding new highs. In many ways, the contempt arises from a place of empathy and hard-earned wisdom. Those who have endured the painful lessons of panic selling and realized losses feel a responsibility to guide newcomers away from that same pitfall.

Their countless hours of research and analysis made them realize the folly of succumbing to paper hands during downturns. Pain is an unforgiving yet potent teacher, and these seasoned investors, having braved market storms, aim to impart their wisdom. It might seem toxic to a bystander lurking on Bitcoin Twitter, but for many, their goal is to spare others the anguish of premature exits and unrealized gains — a fate they have experienced themselves and wish to prevent for their newcomer friends who get into Bitcoin.

Building Generational Wealth

Adopting a Bitcoin standard mindset involves a profound shift in perspective, akin to installing a new operating system for money in one’s mind. When Bitcoin becomes your unit of account, the world rapidly transforms from an inflationary paradigm to a deflationary one — a beautiful phenomenon that unlocks immense wealth-building potential and fosters a mindset of abundance.

Those running on the Bitcoin operating system live in a deflationary world where goods and services become increasingly affordable over time, in stark contrast to the incessant inflationary pressures experienced by those trapped in the fiat system, where everything continually becomes more expensive.

This deflationary outlook is crucial for investors aiming to benefit from Bitcoin’s long-term trajectory. The most significant bitcoin fortunes were amassed by those who wholeheartedly embraced this mindset, holding steadfast through severe price swings and using dips as opportunities to accumulate more sats at discounted prices, with an unwavering belief in Bitcoin’s value proposition.

Seasoned Bitcoiners embrace a contrarian approach, recognizing dips not as threats but as opportunities to increase their Bitcoin holdings at favorable prices. Their unwavering commitment enables them to capitalize on the overreactions of those still trapped in an inflationary, fiat mindset, accumulating more of the digital asset when others are selling. By fully internalizing the deflationary nature of Bitcoin, investors can cultivate a long-term perspective that transcends the emotional turmoil of short-term volatility.

Embrace The New Operating System Of Money

To unlock Bitcoin’s transformative potential and achieve true financial sovereignty, overcoming the paper hands mentality is paramount. This journey requires cultivating an unwavering mindset, one that transcends the fear and emotion that breed paper hands. By developing and adhering to a disciplined investment strategy, fortified with the mental toughness that comes when one puts in the time to form their own opinion, individuals can navigate the volatile Bitcoin landscape with resilience and conviction.

However, true mastery extends beyond mere perseverance; it involves a profound paradigm shift, a complete adoption of Bitcoin’s disruptive ethos as the base layer of your financial decisions. By fully internalizing the deflationary nature of Bitcoin and embracing it as a new operating system for money, humanity can break free from the shackles of fiat’s inflationary thinking and unlock a world of ever-increasing abundance.