One of the Constitution’s defining features is its clear assignment of monetary authority to the federal government rather than the states. Yet today, monetary control rests largely with an institution, the Federal Reserve, that is neither federal nor backed by actual reserves.

The following post by rand0 highlights a crucial reality: monetary power has drifted significantly away from the original intent of America’s Founding Fathers.

While the Constitution explicitly grants Congress the authority to coin money, this critical responsibility now resides predominantly in the hands of an unelected body we call “The Fed”.

In the Federalist Papers, Alexander Hamilton and James Madison strongly advocated for centralized monetary policy to ensure stability and unity among the states.

Hamilton, in particular, argued passionately that Congress must retain clear authority over money to effectively regulate the economy.

Although Hamilton supported the creation of a national bank, even he envisioned an institution fully subordinate to congressional oversight, not an independent, privately influenced cartel.

However, the establishment of the Federal Reserve in 1913 marked a profound departure from this original intent.

By outsourcing monetary policy to a private, centralized institution, Congress abdicated a core constitutional responsibility, and in doing so, shifted the balance of power fundamentally away from democratic accountability.

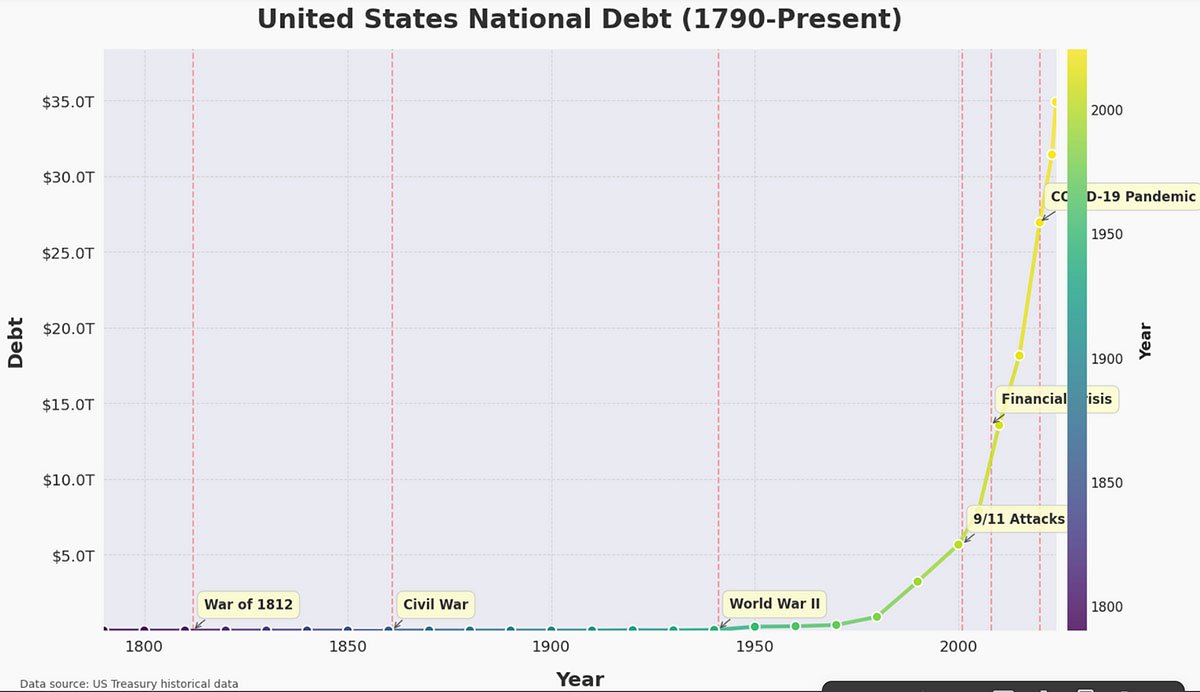

The transfer of power to a fiat currency system has had far-reaching and profound consequences. Rather than enjoying a stable monetary foundation, Americans have faced decades of persistent inflation, disruptive boom-and-bust cycles, and an ever-growing national debt.

With the Federal Reserve able to print money at will, ordinary citizens are left watching helplessly as relentless inflation erodes the value of their savings.

While states lack the authority to create currency, the Fed exercises this power freely, often diminishing citizens’ purchasing power to sustain a financial system that disproportionately benefits rent-seekers at the expense of those who create real value.

Far from providing the stability it promised, the Federal Reserve’s policies have repeatedly triggered economic crises.

From amplifying the Great Depression with misguided interventions to fueling the speculative bubbles that culminated in the 2008 financial crisis, centralized monetary control has consistently driven volatility.

By enabling endless money creation and maintaining artificially low interest rates, the Fed fosters a dangerous addiction to debt.

This much debt incentivizes unchecked government borrowing, as congressional oversight remains toothless, normalizing reckless deficit spending. The result is trillions in unsustainable debt, burdening future generations.

While Congress shares blame with its exorbitant multi-trillion-dollar spending bills, such excess would be impossible without the Fed and Treasury conjuring dollars from thin air, backed by little more than fiat decree.

Supporters of the Federal Reserve often defend its independence, arguing that monetary policy should remain insulated from politics.

While superficially appealing, this position ignores a fundamental democratic principle: the holders of significant power should be directly accountable to the people.

The Fed, insulated from elections and public influence, answers largely to powerful banking interests rather than the voters.

But perhaps the most troubling legacy of Congress’s abdication of monetary authority is the rise of an unchecked class of financial kleptocrats who thrive under fiat money.

Inflation acts as a hidden tax, silently eroding the wealth of ordinary people while transferring resources upward to the financial elites who benefit directly from Fed policies.

Related: Elizabeth Warren’s Bitcoin Critique | Hypocrisy or Misunderstanding?

Of course, wealth creation through genuine value should be celebrated and nurtured, but fiat currency unfortunately enables moral hazard and rent-seeking instead. At the same time, it hampers true value creators by imposing burdensome regulations, tilting the playing field against them.

With all this in mind taking Rep. Thomas Massie’s Federal Reserve Board Abolition Act seriously is the logical next step. By ending the Fed, we can dismantle the engine of inflation and debt monetization, realigning our financial system with the principles of sovereignty and liberty that define America.

As we witness growing support for abolishing the Fed, sparked by Massie’s reintroduction of H.R. 1846 on March 5, 2025, the time is ripe to reclaim our economic independence.

However, ending the Fed is not the only hope on the horizon for fixing our monetary issues.

Bitcoin is a monetary system aligned with the Founders’ vision of honest, sound money. Unlike fiat currency, Bitcoin is decentralized, scarce, permissionless, and resistant to manipulation.

It offers individuals a level of economic sovereignty that the current system cannot. Bitcoin removes the need for intermediaries, empowering people to reclaim more control over their finances, free from the whims of unelected bureaucrats.

If the Founding Fathers were alive today, they might well recognize Bitcoin as a revolutionary force for liberty and individual sovereignty. In Bitcoin, the people regain control of their economic destiny, free from the hidden taxation of inflation and the whims of those who exploit the current fiat system.

The constitutional crisis created by the Federal Reserve demands urgent reflection and decisive action. Congress must reassert its constitutional duty to govern the nation’s money, or risk further erosion of democratic accountability, economic sovereignty, and individual liberty.

Yet, even if Congress continues to abdicate this responsibility, individuals now possess an unprecedented power: the ability to choose Bitcoin.

America stands at a pivotal moment. We must choose between continuing down the path of unchecked monetary control by an unelected body or returning power to the people through decentralized money. In Federalist №10, James Madison warned:

“The influence of factious leaders may kindle a flame within their particular States, but will be unable to spread a general conflagration through the other States.

“A religious sect may degenerate into a political faction in a part of the Confederacy; but the variety of sects dispersed over the entire face of it must secure the national councils against any danger from that source.

“A rage for paper money, for an abolition of debts, for an equal division of property, or for any other improper or wicked project, will be less apt to pervade the whole body of the Union, than a particular member of it.”

America’s Founding Fathers deeply understood the perils posed by centralized power and unchecked paper currency. They meticulously crafted checks and balances to protect future generations from economic ruin and governmental overreach.

Yet, with the establishment of the Federal Reserve in 1913, their vision was compromised. Centralized monetary authority led inevitably to unchecked inflation, insurmountable debt, and the slow erosion of national wealth and individual prosperity.

Today, recognizing the dire consequences of fiat currency’s weaknesses, we have the unique opportunity to reclaim and fulfill the Founders’ original vision.

Ending the Fed is once again part of the zeitgeist, as is the introduction of a Strategic Bitcoin Reserve, a modern innovation aligned with these foundational principles.

While by no means a panacea, this reserve offers a viable path away from the impending collapse of our paper money system imposed by central banks. On March 6th the strategic Bitcoin Reserve became a reality.

History teaches us a harsh truth: pain is the best teacher. No one of sound mind wishes ruin upon their own nation, yet when a financial system is built upon a house of cards, its collapse is not a question of ‘if,’ but ‘when.’

Bitcoin presents humanity with a profound opportunity; not merely to cushion the fall, but to restore economic sovereignty and realign with the principles envisioned by America’s Founding Fathers.

Unlike the U.S. Constitution, which offered liberty primarily to the citizens of our great nation and served as an example for the rest of the world, Bitcoin acts as a constitution in cyberspace, granting property rights to any of the 8 billion people worldwide who choose to embrace it.

Bitcoin is more than just ones and zeros running on a computer. It will restore America, and indeed the entire world, to a sound money standard, reigniting the spirit of liberty for every freedom-loving individual across the globe.