Bitcoin has always given everyday people a chance to invest directly in a revolutionary technology, often outpacing TradFi returns and allowing individuals to front-run institutional players.

Still, while anyone could buy and hold the underlying asset, the opportunity to invest in the promising young companies building on Bitcoin’s foundations has largely been out of reach unless one qualified as an accredited investor. Timestamp aims to change this.

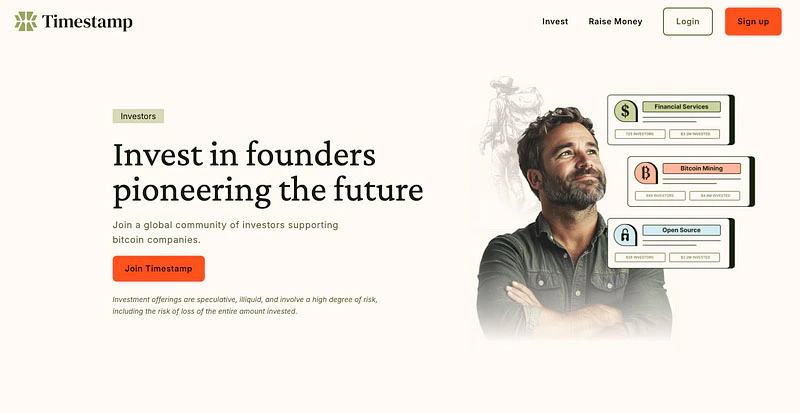

Timestamp, a U.S.-regulated, SEC-registered, and FINRA-member crowdfunding platform, is changing this dynamic by welcoming not just accredited investors, but also non-accredited and international investors into the fold.

According to its founder, Arman Meguerian, a former medical doctor and neuroscientist who transitioned from academia to the Bitcoin world, Timestamp’s goal is to create a more inclusive, community-driven approach to funding Bitcoin-focused and open-source companies.

Prior to launching Timestamp, Arman spent considerable time immersing himself in the Bitcoin ecosystem, engaging with open-source developers, miners, and entrepreneurs building on the technology.

He witnessed firsthand the abundance of talent and brilliant ideas, yet also saw that capital remained concentrated in relatively few hands. Arman said in an exclusive interview with BitcoinNews:

“I realized there were so many incredible people building on Bitcoin. It’s just shocking how many people are out there trying to create something, yet the pipeline to fund these visions is extremely narrow.”

For Arman, the solution involved embracing a more accessible fundraising model. Timestamp underwent a rigorous, time-consuming process to gain SEC and FINRA approval. The effort was worth it.

“We wanted to make sure anyone, whether accredited or not, could invest,” he explained. “If you’re a U.S. or international investor, you now have an opportunity that simply didn’t exist before. We wanted to remove those barriers so that people could directly invest in the future of Bitcoin.”

Founders on Timestamp can set their own terms — whether they opt for SAFEs, convertible notes, priced rounds, or revenue-sharing agreements. “Crowdfunding puts power back into the hands of the founders,” said Arman.

“They’re not forced into unfavorable terms or cornered into shifting their mission just to please a handful of investors. Instead, they can raise capital in a way that’s aligned with their vision, while tapping into a global base of supporters who believe in what they’re building.”

For investors, the platform aims to provide a user-friendly, transparent experience. Everything from signing up and reviewing opportunities, to making an investment and finalizing documents is handled through Timestamp’s platform.

Arman emphasized that simplicity is paramount:

“We’re building a process that’s straightforward for anyone — regardless of their technical background. Reducing complexity is crucial, especially when appealing to a wide audience who may be new to both Bitcoin and private investments.”

Though some might assume Timestamp is designed to bypass venture capitalists altogether, Arman views VCs as complementary partners. “It’s not about cutting VCs out,” he said.

“They’re great at what they do, capital allocation, spotting potential. But now founders have an additional avenue. They can still bring on VCs, and at the same time, offer investment opportunities to everyday Bitcoiners who want to be a part of something bigger.”

Beyond just facilitating investments, Timestamp hopes to foster a stronger community around each startup. “If you have hundreds or thousands of smaller investors who genuinely care about your mission, that’s a powerful network,” said Arman.

“They’ll help spread the word, provide feedback, and support the company long term. That’s the heart of what we’re building — turning investors into active participants in the Bitcoin ecosystem’s growth.”

As Timestamp continues to onboard new companies, the range of opportunities is expected to broaden. Whether it’s infrastructure around the Lightning Network, innovative mining solutions, or next-generation financial tools, the community will guide which projects gain traction.

“It’s an organic process,” Arman highlighted. “We’re giving builders the tools to fund their visions and giving the community the chance to choose which projects deserve their capital. It’s all about aligning incentives and letting innovation flourish.”

The launch of Timestamp signals a shift in how Bitcoin businesses are funded, moving away from exclusive, insider-only deals toward a more open, community-driven model.

By removing traditional barriers while still complying with regulatory standards, Timestamp ensures that individuals who believe in Bitcoin’s future can play an active role in shaping the companies that will bring Bitcoin to even more people.