A battle for monetary dominance intensifies between the U.S. Dollar (USD) and Bitcoin. These two forms of money could not be more different.

One is a government-issued fiat currency backed by the force of the state, while the other is a decentralized, digitally native form of money that operates independently of central authorities.

The battle of USD vs Bitcoin in 2024 takes on even greater importance as people, businesses, and nations confront the realities of inflation, financial instability, and the growing demand for a sound alternative to the dollar.

This article will explore the stark contrasts between USD and Bitcoin, and how they’ve performed leading into 2024.

The Dollar’s Decline: A Fiat System on the Edge

The US dollar has long been the world’s reserve currency, but in recent years, its position has come under increasing scrutiny.

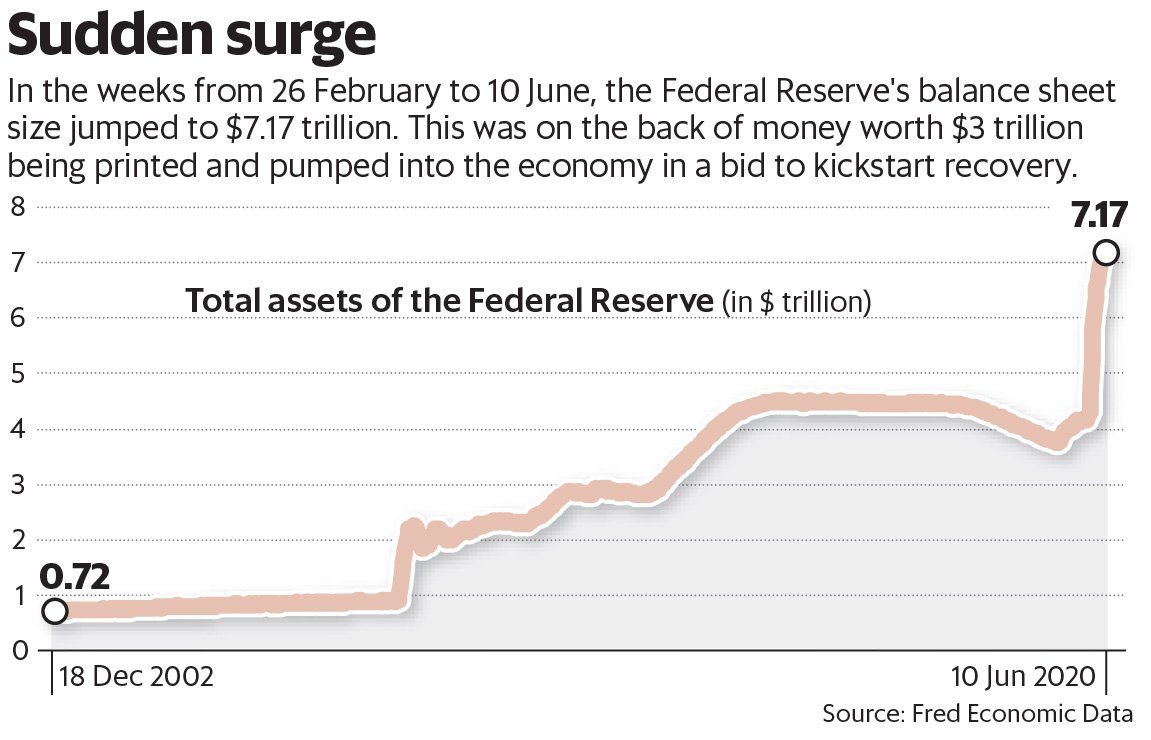

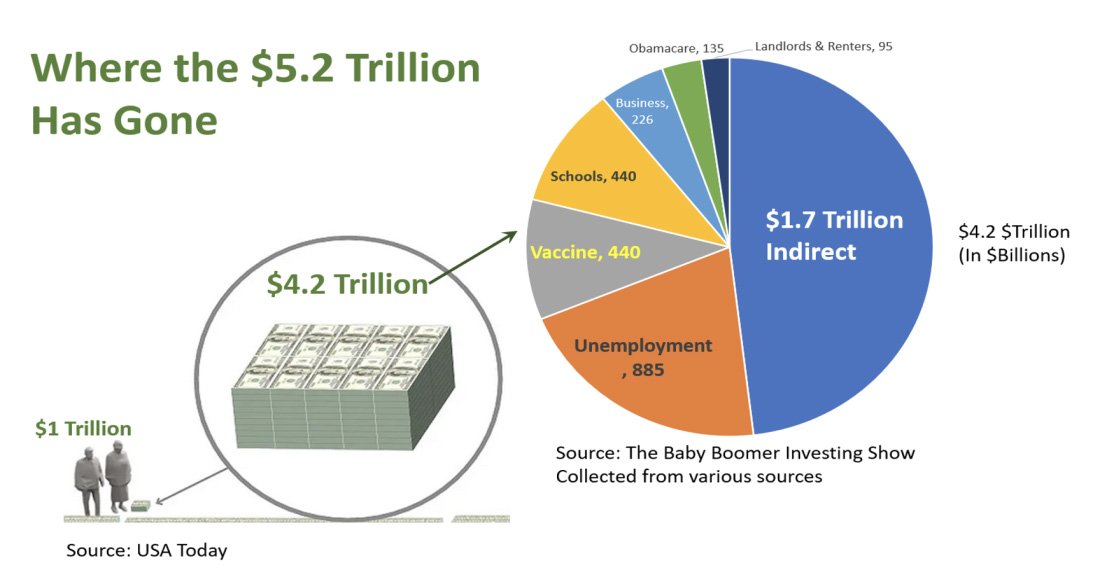

The Federal Reserve’s endless money printing, especially during crises such as the COVID-19 pandemic and subsequent economic turmoil, has eroded trust in the dollar’s long-term stability.

Trillions of dollars were created out of thin air to prop up a teetering system, which inevitably led to one outcome: inflation and currency devaluation.

Related: US National Debt Hits $35 Trillion | Could Bitcoin Be the Solution?

While the official inflation numbers in the United States reportedly hover around a manageable figure, real-world inflation—what consumers experience in housing, energy, and food prices—is much higher.

In 2024, inflation remains one of the primary concerns for many people.

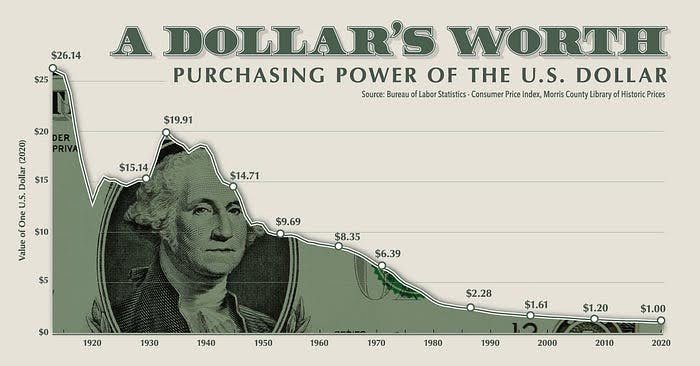

The dollar’s purchasing power continues to decrease, and this has driven a growing number of people to question the sustainability of a currency that can be devalued by the whims of central banks and government fiscal policies.

The U.S. government, saddled with over $35 trillion in national debt, shows no signs of reigning in its spending.

The problem with fiat money is simple: It is centrally controlled and can be manipulated for political purposes. Every time the Federal Reserve prints more dollars, it’s effectively a hidden tax on savings.

Bitcoin: The Antithesis of Fiat Money

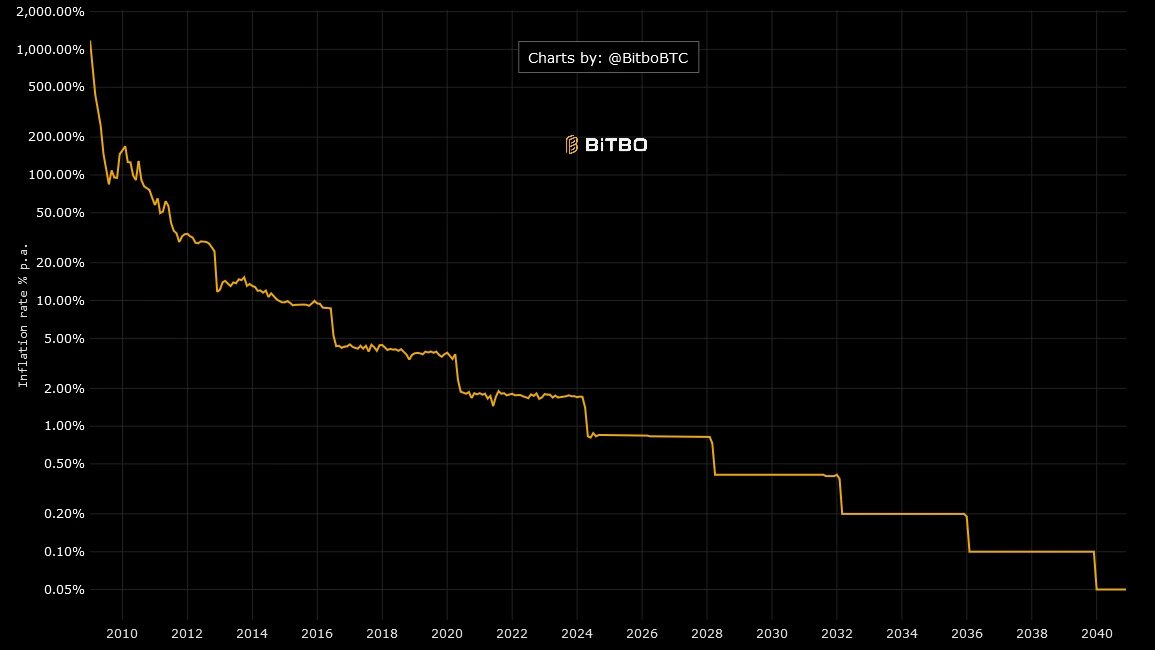

Bitcoin, unlike the USD, operates on a fixed supply of 21 million bitcoin, making it inherently deflationary. This scarcity is a foundational pillar of its value proposition.

Where the dollar can be printed at will, bitcoin’s supply is algorithmically fixed, creating a hard cap that ensures no more coins can ever be created. This contrasts starkly with fiat systems that are prone to inflation and government overreach.

One of Bitcoin’s most powerful attributes is its decentralization. No central authority, government, or institution controls Bitcoin. Instead, it operates on a peer-to-peer network governed by open-source code, cryptography, and decentralized consensus.

In 2024, Bitcoin continues to grow as both an investment vehicle and a means of transferring wealth outside the traditional banking system.

Major institutions, corporations, and even nation-states have begun to adopt Bitcoin, not just as a hedge against currency devaluation but as a way to diversify away from the unstable fiat system.

Related: El Salvador’s 2024 Bitcoin Holdings | An Overview

Store of Value: Bitcoin’s Superior Performance

The role of money as a store of value is crucial, and this is where Bitcoin outshines the USD.

In the decade leading up to 2024, Bitcoin has consistently delivered annualized returns far higher than any fiat currency, including USD. Bitcoin’s supply cap and its predictable issuance schedule through mining have made it an increasingly attractive option for long-term savers and investors.

While the value of bitcoin in fiat terms can be volatile in the short run, its long-term trajectory is clear: it’s an asset that appreciates as demand grows and supply remains fixed.

By contrast, USD’s purchasing power has been in a long-term decline since the creation of the Federal Reserve in 1913, and the pace of that decline has only accelerated in recent years.

Medium of Exchange: Bitcoin as a Global Standard

In terms of utility as a medium of exchange, Bitcoin is also making strides. 2024 has seen an increasing number of businesses, both online and physical, accepting bitcoin for goods and services.

Payment processors such as Strike, CashApp, and BTCPay Server are making it easier for individuals and businesses to use Bitcoin without the need to convert it back into fiat.

Unlike USD, which is tightly controlled by central banks and subject to international sanctions, Bitcoin is permissionless. Anyone, anywhere, can use it, which has made it a valuable tool for financial inclusion, particularly in the developing countries.

Unit of Account: Bitcoin’s Role in Hyperbitcoinization

While USD is still the dominant unit of account, Bitcoin is beginning to challenge that position. Hyperbitcoinization—the hypothetical moment when Bitcoin becomes the world’s primary currency—may still be in its early stages, but its seeds are being planted.

In countries where inflation and currency devaluation have rendered local currencies nearly worthless, bitcoin is already functioning as the de facto unit of account for many people.

As more people, businesses, and even nations adopt Bitcoin, it’s becoming increasingly plausible that the world will move toward a Bitcoin standard.

The key reason is simple: Bitcoin represents sound money, while the dollar is subject to the whims of central banks and government policies.

USD vs Bitcoin in 2024

In 2024, the contest between USD and Bitcoin is more than a competition between two currencies—it’s a battle of two fundamentally different systems.

USD represents the failing fiat experiment, where money is created by decree and manipulated to serve political ends. Bitcoin, by contrast, is the embodiment of sound money, offering scarcity, decentralization, and protection against currency devaluation.

As the world moves further into an era of economic uncertainty, Bitcoin stands as a beacon of hope for those seeking to escape the inflationary pressures and instability of the fiat system.

While the dollar may still dominate today, Bitcoin’s rise in 2024 suggests that the future belongs to sound, decentralized, and incorruptible money.