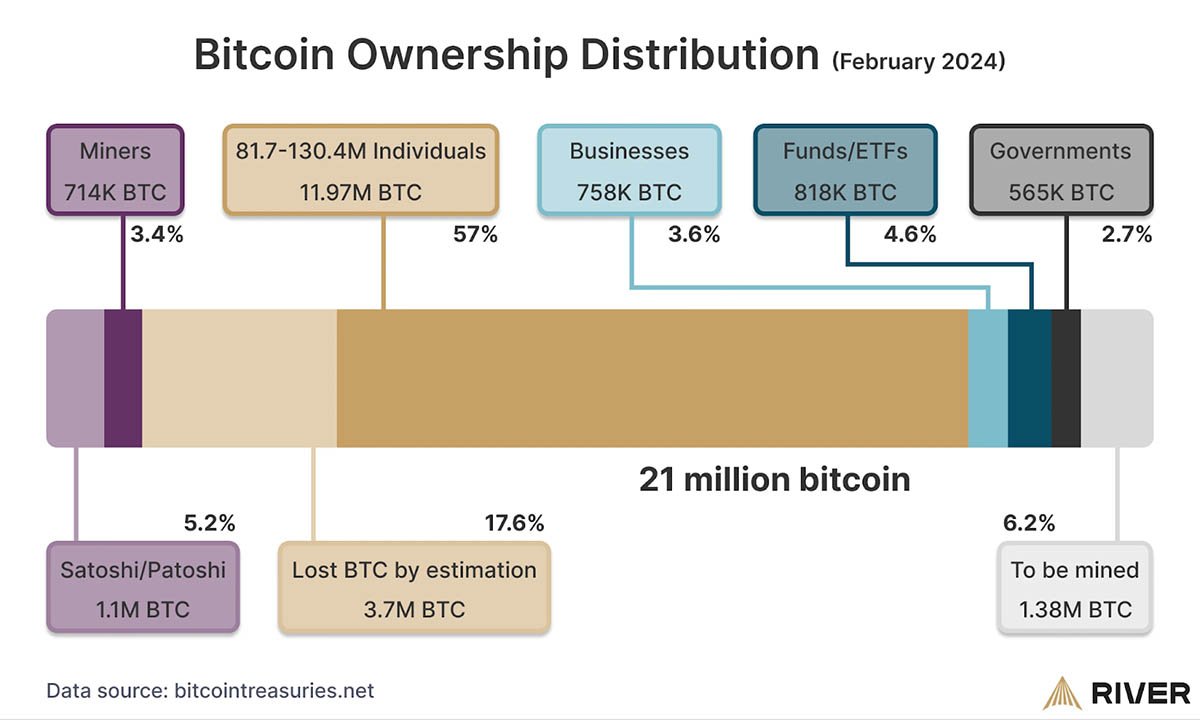

As of 2024, Bitcoin remains a decentralized and widely distributed asset, with ownership spread across a variety of entities and individuals.

However, a small number of significant holders—from early adopters and institutional investors to governments and private companies—control a substantial portion of bitcoin’s supply.

Understanding who owns the most bitcoin and how much they hold provides insight into Bitcoin’s market and its dynamics.

Early Adopters and Bitcoin Whales

Those who recognized Bitcoin’s potential, and invested in or mined it early on, have become some of the wealthiest holders.

These early adopters, often called “whales,” hold significant amounts of bitcoin. While the identities of many of these early adopters remain anonymous, some known figures include:

- Satoshi Nakamoto: The pseudonymous creator of Bitcoin, Satoshi Nakamoto, is believed to hold approximately 1 million bitcoin, making this entity the single largest holder. These bitcoin have never been moved, adding to the mystery and speculation surrounding Nakamoto’s identity.

- The Winklevoss Twins: Cameron and Tyler Winklevoss, founders of the Gemini digital assets exchange, are among the most well-known bitcoin billionaires.

They reportedly own around 70,000 bitcoin, accumulated through early investments and their belief in Bitcoin’s potential as a hedge against currency devaluation. - Tim Draper: The venture capitalist Tim Draper is another prominent bitcoin whale. Draper famously purchased nearly 30,000 bitcoin at a U.S. government auction of assets seized from the Silk Road marketplace.

His holdings have grown substantially in value, solidifying his status as a major bitcoin holder. - Michael Saylor: Michael Saylor, the prominent advocate for Bitcoin and executive chairman of MicroStrategy, personally owns around 17,000 bitcoin.

While his holdings are modest compared to his company’s substantial bitcoin reserves, this ownership underscores his strong belief in Bitcoin’s potential as a long-term store of value.

Institutional Investors and Public Companies

Over the past few years, the involvement of institutional investors and public companies in Bitcoin has significantly increased. These entities have accumulated large amounts of bitcoin, further legitimizing it as an asset class and driving its adoption.

- MicroStrategy: Led by Executive Chairman Michael Saylor, MicroStrategy is one of the most notable public companies with substantial bitcoin holdings.

As of 2024, MicroStrategy holds over 226,000 bitcoin, having steadily increased its position through multiple purchases. Saylor’s advocacy for bitcoin as a treasury reserve asset has inspired other companies to consider similar strategies. - BlackRock’s Bitcoin ETF (IBIT): BlackRock holds 350,000 bitcoin, making it one of the largest institutional holdings in the Bitcoin space. This significant amount highlights the growing acceptance and integration of Bitcoin within traditional financial markets.

Governments and State-Owned Entities

While private entities and individuals hold the majority of bitcoin, some governments and state-owned entities have begun to accumulate bitcoin as part of their financial strategies or in response to economic sanctions.

- El Salvador: El Salvador made history in 2021 by becoming the first country to adopt bitcoin as legal tender. Since then, the government has steadily increased its bitcoin holdings.

By 2024, El Salvador’s bitcoin reserve is estimated to be around 5,800 bitcoin. The country continues to promote Bitcoin adoption and mining as part of its national strategy. - US (Department of Justice): The U.S. Department of Justice seized approximately 50,676 bitcoin from James Zhong’s home, originally stolen from the Silk Road marketplace in 2012.

The total amount of bitcoin seized, including additional amounts voluntarily surrendered by Zhong, adds up to approximately 51,351 bitcoin.

Bitcoin Held in Exchanges

A substantial amount of bitcoin is held in digital wallets managed by digital assets exchanges. These exchanges act as custodians for millions of users who store their bitcoin on these platforms. As of 2024, the largest exchanges holding bitcoin include:

- Binance: Binance is one of the world’s largest exchanges by trading volume. The exchange is estimated to hold over 609,000 bitcoin in its cold storage wallets, serving millions of users globally.

- Bitfinex: Bitfinex holds approximately 204,338 bitcoin in its reserves, making it one of the largest holders of bitcoin among exchanges globally.

This figure has been made public as part of the exchange’s broader commitment to transparency. It has made its wallet holdings publicly accessible through its GitHub repository.

Bitfinex’s approach to transparency also includes implementing a proof of reserves system to verify these holdings periodically.

Who Owns the Most Bitcoin? Looking Ahead

Institutional adoption is expected to grow, with more companies and governments potentially adding bitcoin to their balance sheets. Additionally, the ongoing accumulation of bitcoin by early adopters, miners, and new investors will continue to shape the distribution of bitcoin ownership.

In conclusion, the ownership of bitcoin in 2024 is characterized by a mix of early adopters, institutional investors, governments, and exchanges.

These entities, whether anonymous individuals or large organizations, play a crucial role in the Bitcoin market.

As Bitcoin continues to gain acceptance and adoption worldwide, understanding who holds the most bitcoin provides valuable insights into its influence, stability, and potential future trajectory.