An internet-native, permissionless, global monetary network was never going to mature the way markets expect. There’s no announcement, no bell ringing, no victory lap. You see it in the behavior instead.

Fewer slogans, more invoices, more hiring plans, more people choosing to build real companies on top of a protocol that lets people be their own bank, while the rest of the world keeps trading narratives about price targets, ETFs, and the next macro boogeyman.

Bitvocation’s Annual Bitcoin Job Market Report puts numbers to that behavior. In 2025, the platform tracked 1,801 Bitcoin-related job postings, a 6 percent increase year over year.

Bitvocation tracks Bitcoin hiring by scraping company career pages and other sources, then manually reviewing and deduplicating listings to keep the feed high-signal. The result is a fully detailed report with charts, methodology, and the full breakdown behind the numbers: Annual Report 2025: The State of the Bitcoin Job Market.

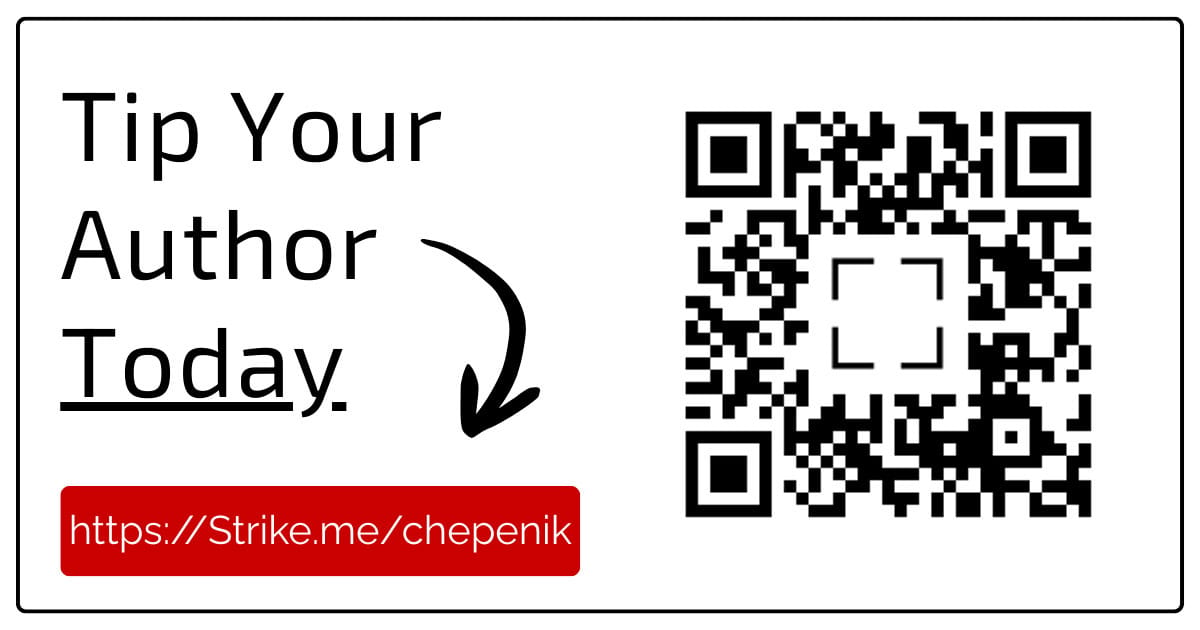

Bitcoin Jobs distribution map

On its own, that number of Bitcoin-related job postings is fine. Not euphoric and not alarming. What matters is what’s underneath it. Who is hiring? What kinds of roles they are hiring for? And what assumptions those companies are now making about Bitcoin as a long-term operating environment rather than a short-term trade.

Bitcoin hiring is starting to look less like a movement recruiting believers and more like an economy allocating labor.

What makes this data useful isn’t just the count. It’s the curation. A surprising amount of Bitvocation’s work isn’t scraping more jobs, but rather deciding which ones belong in the feed at all. The goal is not maximum volume. It is signal.

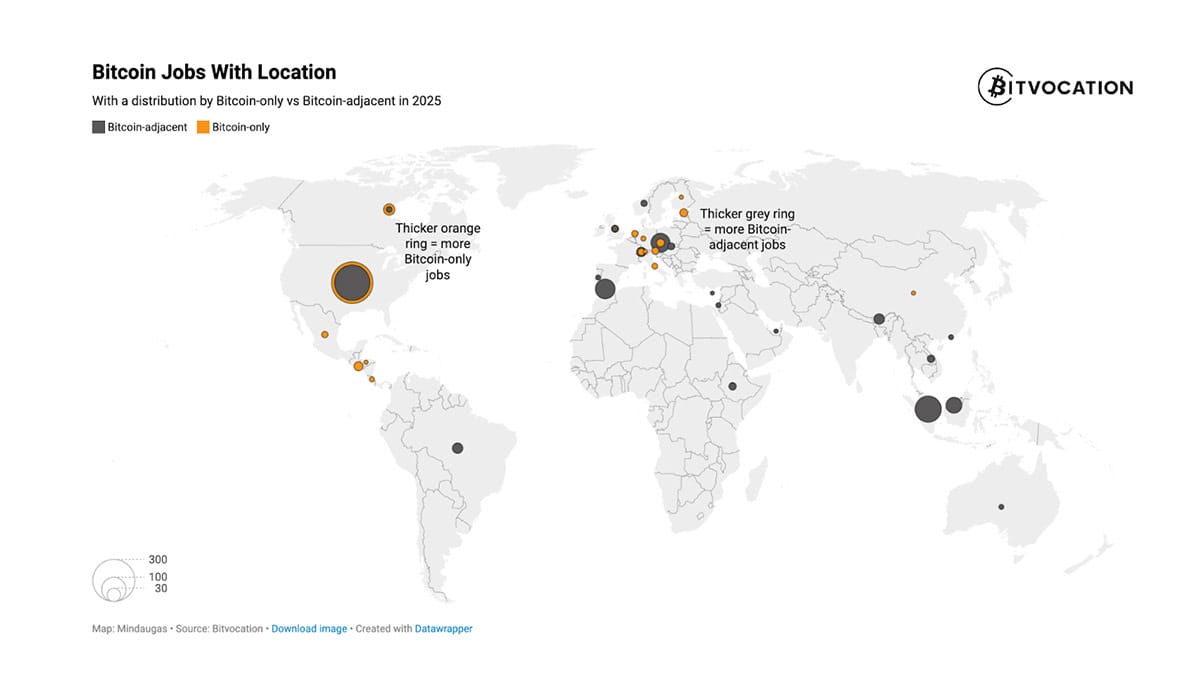

Bitcoin Jobs distribution preference in 2025

Start with the most obvious signal, once you define what “Bitcoin-only” actually means. Bitcoin-only roles now account for 47 percent of all postings, up from 42 percent last year, an increase of 134 Bitcoin-only jobs. Bitcoin-adjacent companies still hold a narrow majority at 53 percent, but the direction of travel is clear. The center of gravity is moving toward firms that have made a clean decision.

One protocol, one asset, no hedging. For Bitvocation, Bitcoin-only companies are defined by three criteria:

Core products that focus exclusively on Bitcoin

A publicly stated commitment to Bitcoin

Active contribution to the Bitcoin ecosystem.

The point isn’t ideological purity. It is a filter that prevents smaller, high-conviction teams from being buried by larger firms that can flood a job feed overnight.

That distinction matters because Bitcoin-only companies behave differently. They raise capital differently, they plan differently, they hire differently. Optionality feels smart in bull markets. Conviction is what survives drawdowns, regulatory pressure, and long stretches where the narrative simply doesn’t care about you.

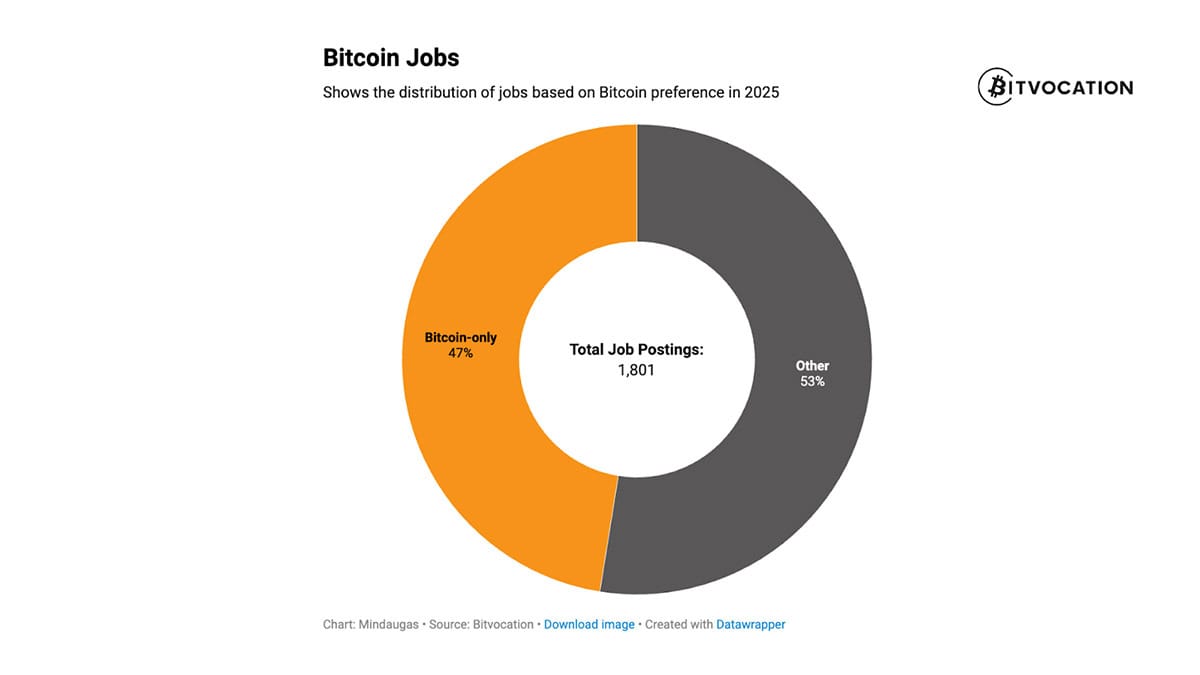

The strongest signal shows up at the top of the distribution. The top Bitcoin-only companies increased their job postings by roughly 156 percent in 2025. These include companies like Riot Platforms, Lightspark, Braiins, Zebedee, Strike, River, Fold, Blockstream, Unchained, and Swan Bitcoin.

These aren’t marketing experiments or speculative side projects tucked inside larger fintechs. They’re infrastructure businesses, financial rails, mining operations, and core service providers.

In other words, the companies doing the least narrative hopping are doing the most hiring. Conviction, it turns out, compounds.

Bitcoin companies with the most job postings

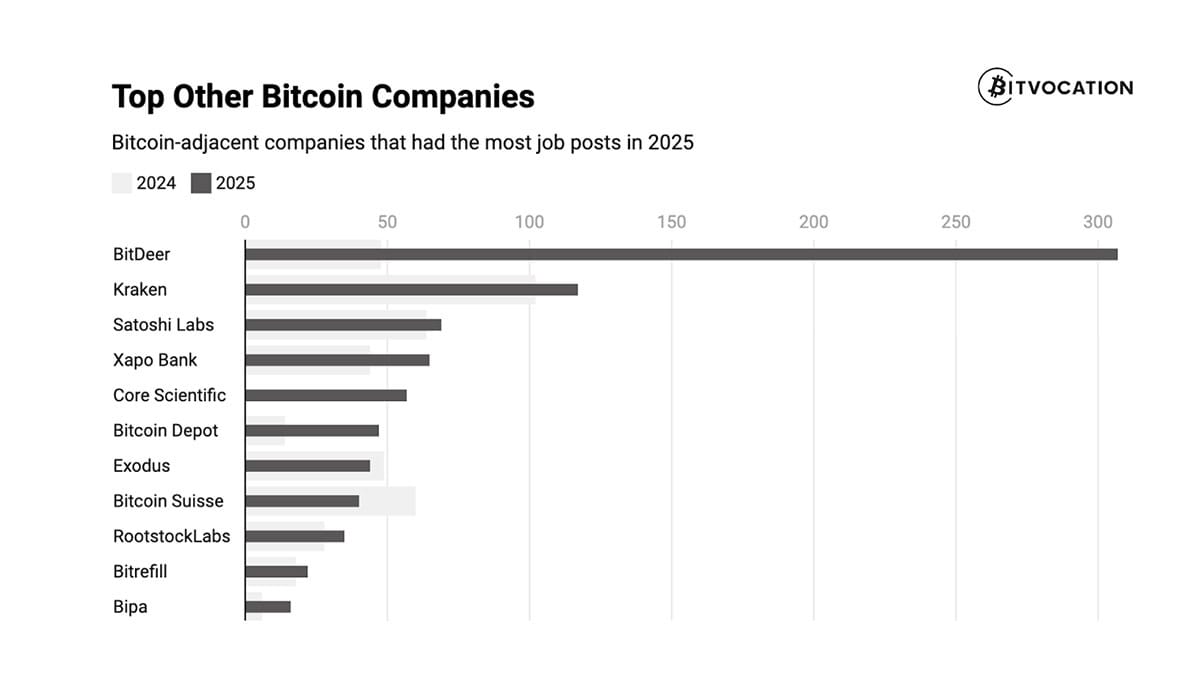

Non-Bitcoin focused digital asset companies with most job postings

There’s a tradeoff embedded in this approach. Bitcoin-adjacent companies dramatically increase raw job volume. Larger firms post more frequently. If the goal were impressions, optimizing for volume would be easy.

But volume creates noise. A single company can dominate the feed for an entire day, while smaller Bitcoin-only startups disappear entirely. Bitvocation has chosen relevance over reach, even when that choice reduces headline numbers.

Another chart dismantles one of Bitcoin’s longest-running misconceptions: that you need to be a developer to have a meaningful career in the ecosystem.

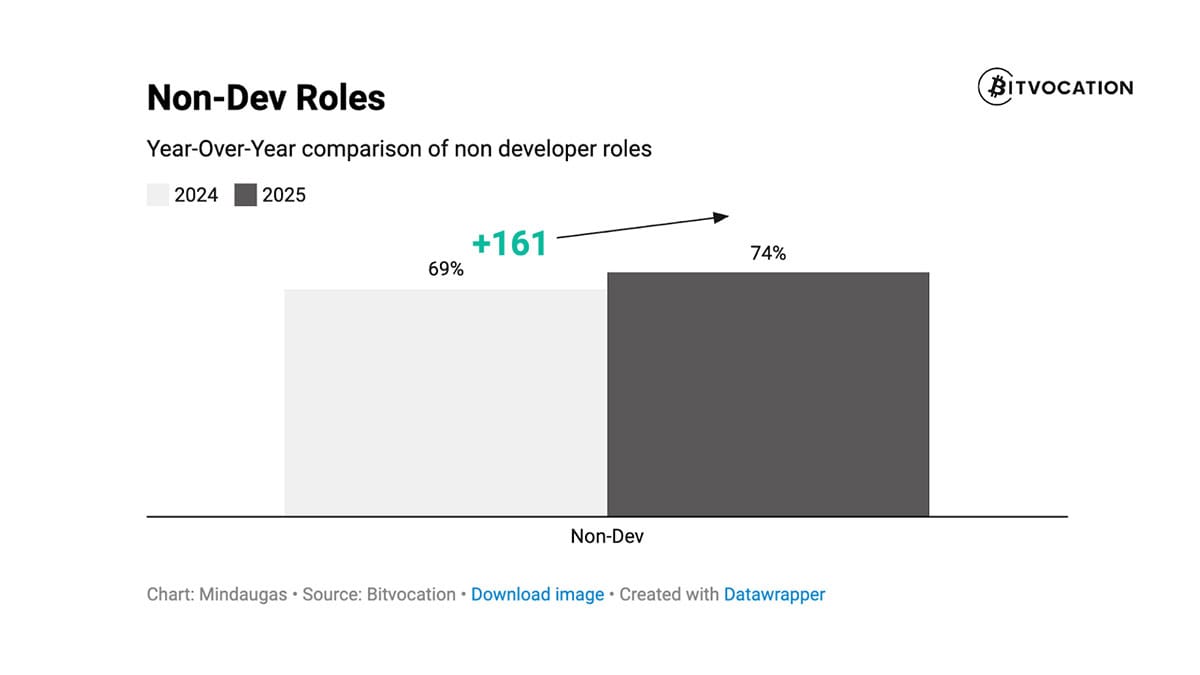

YoY comparison of non-dev roles in the Bitcoin ecosystem

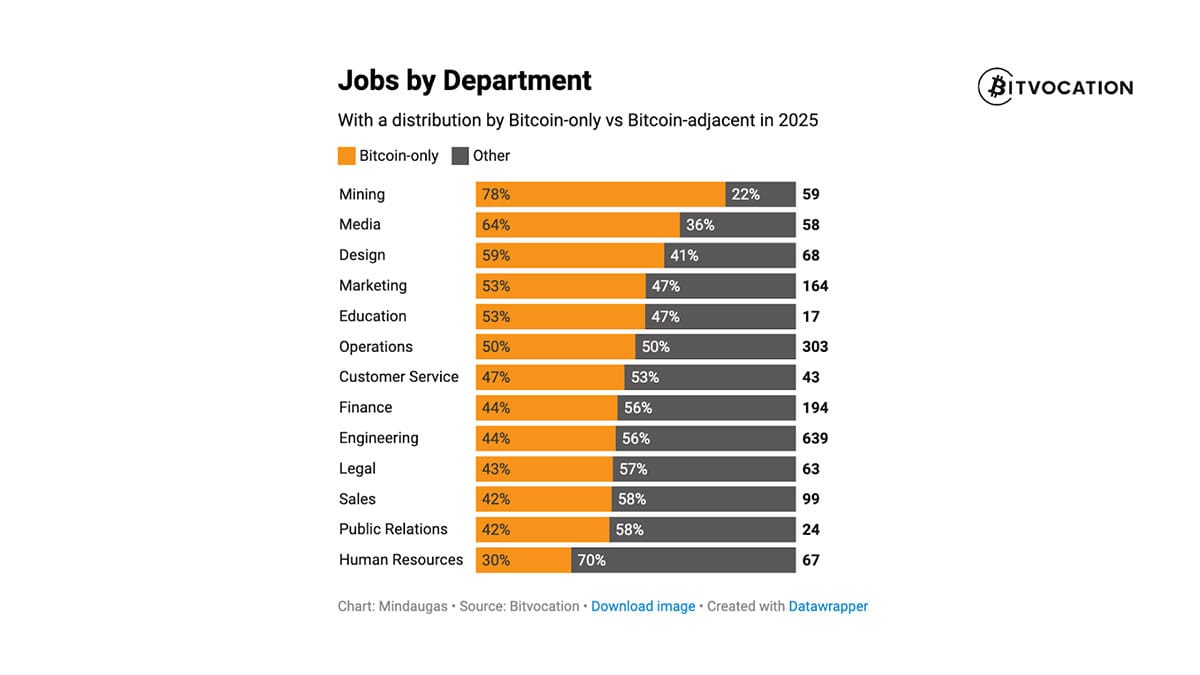

In 2025, non-developer roles made up 74 percent of all Bitcoin job postings, up from 69 percent the year prior, an increase of 161 non-dev roles in a single year. Operations alone accounted for more than 300 postings.

Marketing, finance, design, education, customer support, compliance, and mining operations all saw real demand. Engineering remains the single largest department by volume, but it no longer defines the entire opportunity set.

This doesn’t mean Bitcoin companies are getting softer. It means they’re getting more complete. As the ecosystem matures, the constraint shifts.

Early on, the bottleneck was software development, now it’s translation; Turning Bitcoin’s technical reality into products people can actually use, narratives people can understand, operations that don’t fall apart under stress, and trust that scales without breaking.

Bitcoin jobs by department

If you’ve ever been a non-dev in a dev-heavy Bitcoin world, you know the feeling. Everyone else is talking about commits and code while you are making sure customers don’t rage quit, invoices get paid, and the lights stay on.

It’s not glamorous. It’s also where companies quietly live or die. Turns out, you don’t need to write code to work in Bitcoin, but you do need to be useful.

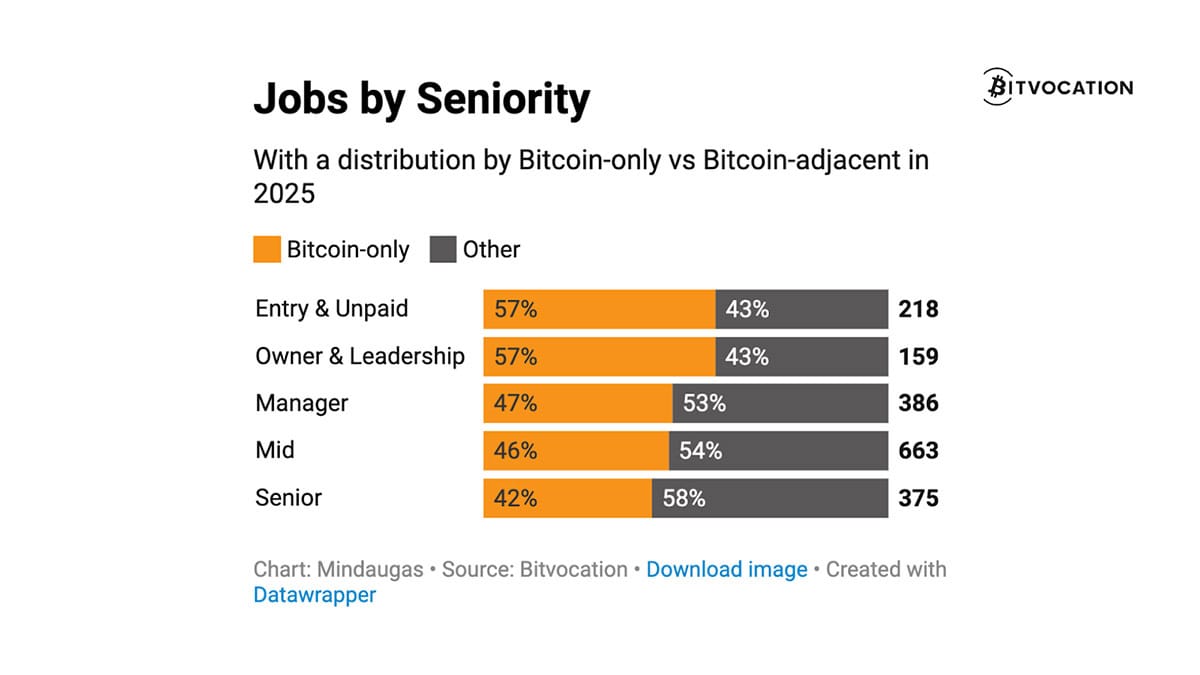

Bitcoin jobs by seniority

The seniority breakdown reinforces this reality. Bitcoin-only companies skew toward the extremes. More entry-level or unpaid roles. More owner and leadership roles. Fewer comfortable middle manager positions where someone can coast unnoticed for years telling others what to do.

That isn’t accidental. It’s capital discipline in action because many Bitcoin-only firms are founder-led, lean, and operating under tighter constraints than their Bitcoin-adjacent peers. They can’t afford organizational fluff. Every hire has to move the needle or it doesn’t happen at all.

If you’re early in your career, this can be a gift. You get responsibility faster. Exposure earlier. A front-row seat to how decisions actually get made. If you’re senior, the tradeoff is different. You’re expected to own outcomes, not manage processes or sit between layers. The middle still exists, but it’s narrower, and it demands range.

Bitcoin companies don’t hire org charts. They hire leverage.

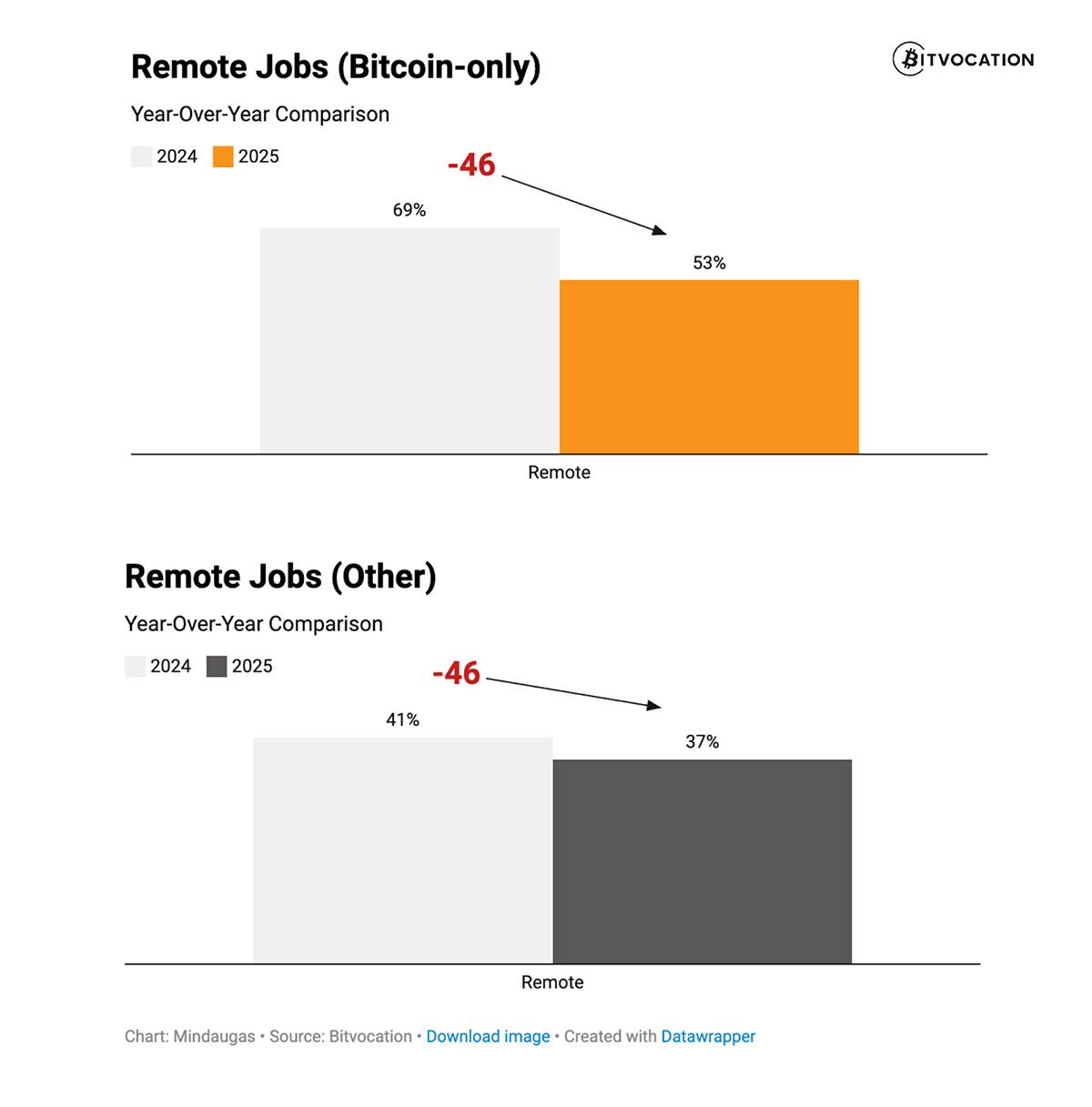

Remote jobs YoY comparison

Remote work trends tell a similar story of tightening assumptions. Total remote roles declined about 10 percent year over year, from 901 to 809 postings. Bitcoin-only companies still favor remote work more than Bitcoin-adjacent firms, but even there the shift is visible. More hybrid roles. More location-specific hiring.

Some of this is structural. Mining sites don’t run on Zoom. Energy infrastructure is physical. Compliance teams deal with real regulators in real jurisdictions. Some of it is cultural. Bitcoin work is high-trust work. Small teams, fast iteration, tight feedback loops.

And, candidly, Bitcoiners tend to like being around other Bitcoiners. Slack works, whiteboards work better. Shared context compounds faster in person. Remote isn’t dead, it is just no longer assumed.

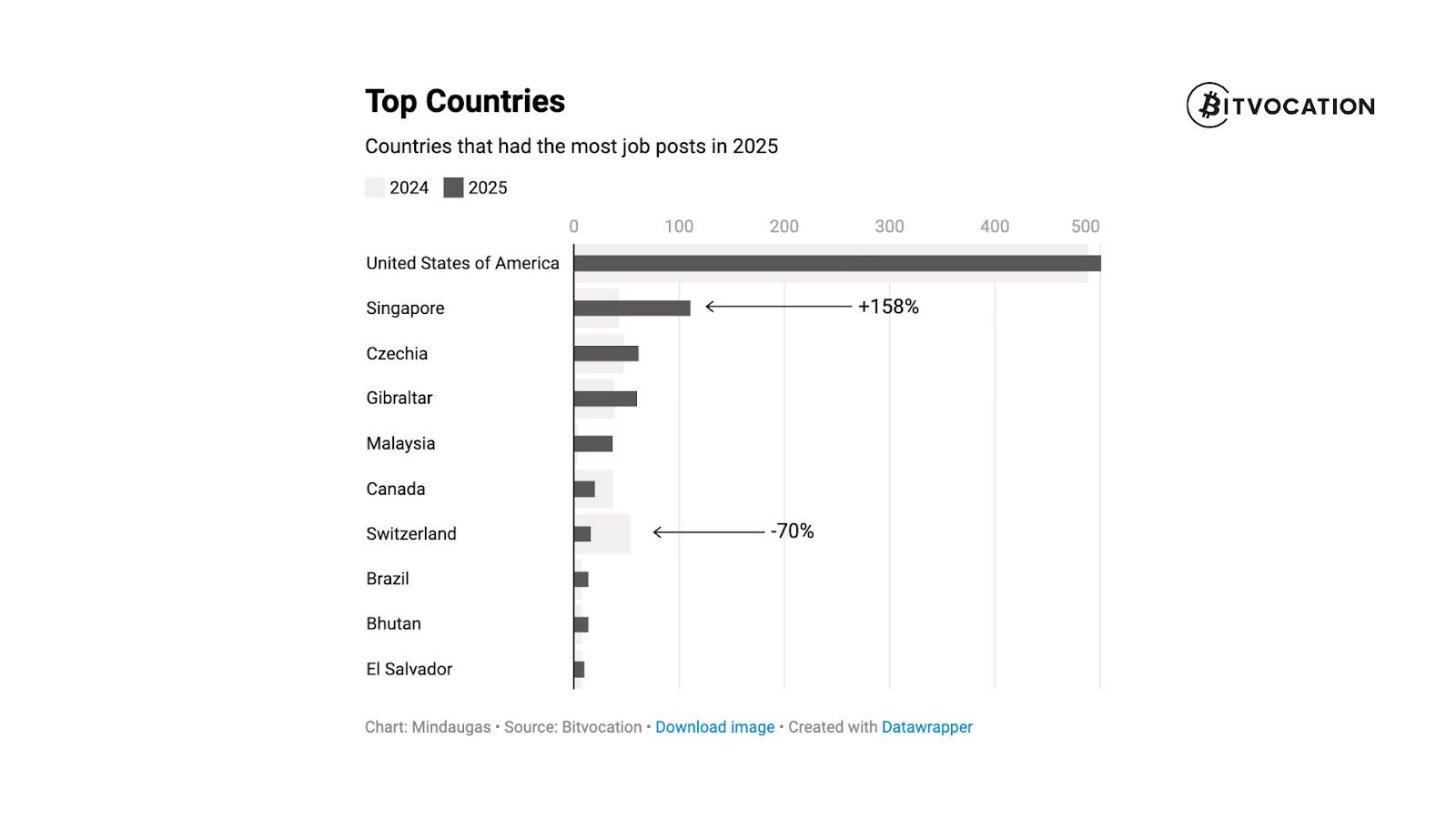

Bitcoin jobs by country

Geographically, the map is tightening rather than flattening. The United States remains the dominant hub for Bitcoin hiring. Singapore saw roughly 158 percent growth in job postings, reinforcing its role as a serious node for Bitcoin and fintech talent. Switzerland saw a sharp decline of about 70 percent, a reminder that regulatory posture and capital flows still matter, even in a global monetary network.

Smaller pockets continue to emerge across Europe, Asia, and parts of the Global South, but the data points toward concentration rather than dispersion. Bitcoin may be global money, but most Bitcoin companies are predominately in the United States.

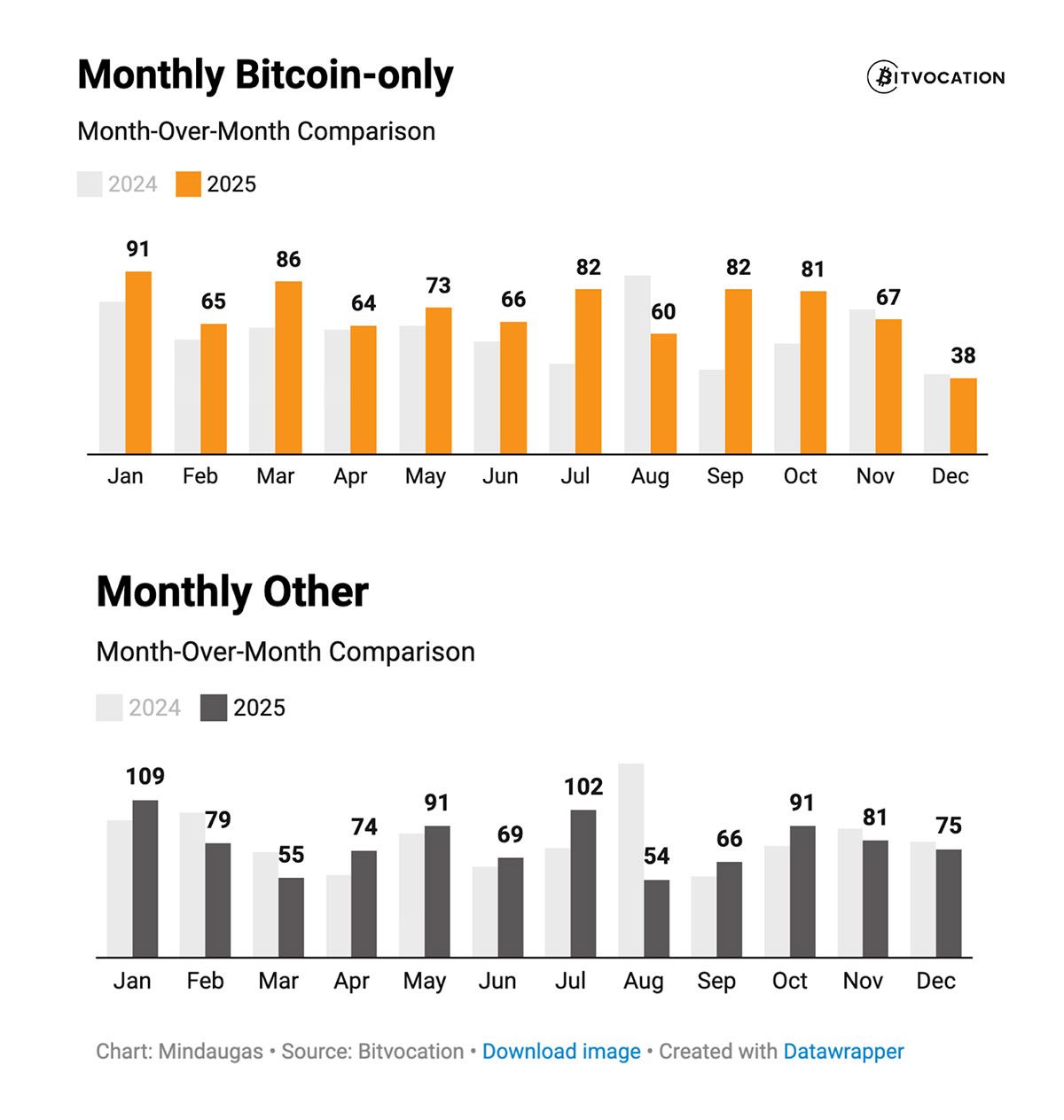

Bitcoin job postings by month

On the employer side, the survey data surfaces a consistent frustration. Hiring isn’t constrained by applicant volume. It’s constrained by signal. Companies struggle to find candidates who combine professional competence with genuine Bitcoin conviction and personal agency. People who can operate without perfect instructions, who follow through, and can wear multiple hats without waiting for permission or a Jira ticket.

On the job seeker side, the experience often feels like a ghost economy. Applications vanish into automated systems. Strong candidates hear nothing back. Effort feels invisible, like shouting into a void populated by ATS bots and unanswered emails. The uncomfortable truth is that job boards are the shallow end of the pool. Necessary, yes. Sufficient, no.

If you want to work in Bitcoin, by all means keep refreshing listings. But don’t stop there. Reach out to hiring managers directly. Follow up thoughtfully. Build something public. Write, contribute, create proof-of-work that exists whether or not someone gives you permission to join their company. Rejection usually isn’t a verdict, it’s just latency.

Bitcoin never promised easy careers. It never promised linear paths or tidy ladders. What it offers instead is something rarer: work that compounds if you stick with it, inside an ecosystem that increasingly rewards conviction over credentials.

And judging by the data, more people are choosing to play that long game.