Key Takeaways

Extreme winter weather and low prices forced many miners offline, triggering a major difficulty cut.

Block times slowed as ~200 EH/s of hashrate vanished, especially from U.S.-based miners.

Mining profits hit record lows, pushing operations below breakeven levels.

Miners Feel the Strain as Network Difficulty Adjusts

Over the weekend, Bitcoin’s mining difficulty dropped by 11.16%, the largest decline since China banned Bitcoin mining in 2021. This change shows how much pressure miners are currently facing from bad weather, falling bitcoin prices, and weak mining profits.

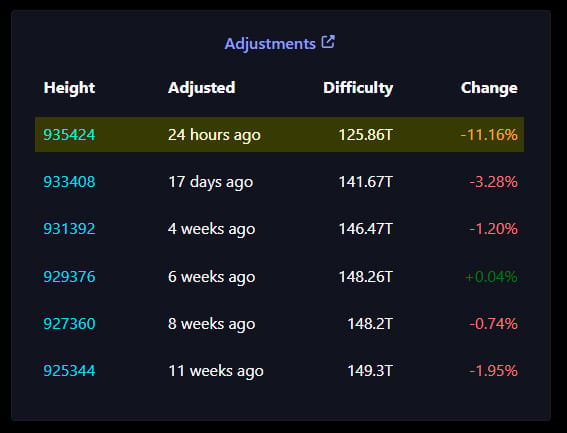

Bitcoin mining difficulty has been going down in the last 3 epochs

Mining difficulty is a system Bitcoin uses to control how hard it is to create new blocks. The network adjusts this number every 2,016 blocks so that blocks are produced roughly every 10 minutes. When fewer miners are active, difficulty falls to keep the network running smoothly.

The latest adjustment happened at block height 935,424, when difficulty dropped from 141.67 trillion to 125.86 trillion. According to analysts, this was one of the largest difficulty cuts in Bitcoin’s history and ranks as the 10th biggest drop ever.

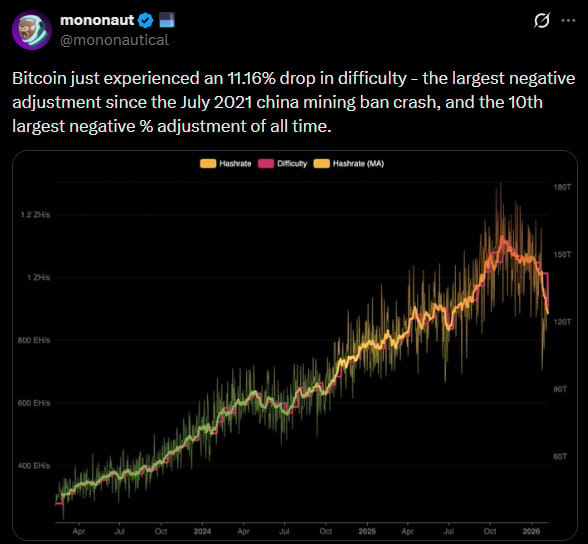

Mononaut on X

The last time Bitcoin saw a drop this large was in 2021, when China forced miners to shut down operations across the country. That decision caused a mass exit of miners, often called the “great mining migration.”

Bitcoin hashrate chart

At that time, China controlled most of the world’s bitcoin mining power. When miners suddenly went offline, Bitcoin’s hashrate fell by nearly 50%. Since then, large difficulty drops have been rare, making this weekend’s decline especially important.

A major reason for the difficulty drop was Winter Storm Fern, which hit the United States in late January. The storm brought extreme cold and damaged power systems across many states.

To protect local power grids, many U.S.-based miners were forced to shut down or reduce operations. This caused a sharp drop in the total computing power securing the Bitcoin network.

The storm knocked about 200 exahashes per second offline. Foundry USA, the largest bitcoin mining pool in the world, briefly lost about 60% of its hashrate during the storm.

With fewer miners running, Bitcoin blocks were produced more slowly. Before the adjustment, block times stretched past 11 to 12 minutes, triggering the automatic difficulty cut.

At the same time, bitcoin’s price has been falling.

Bitcoin is down more than 45% from its October peak above $126,000. Prices dropped to as low as $60,000 before recovering slightly to around $70,000.

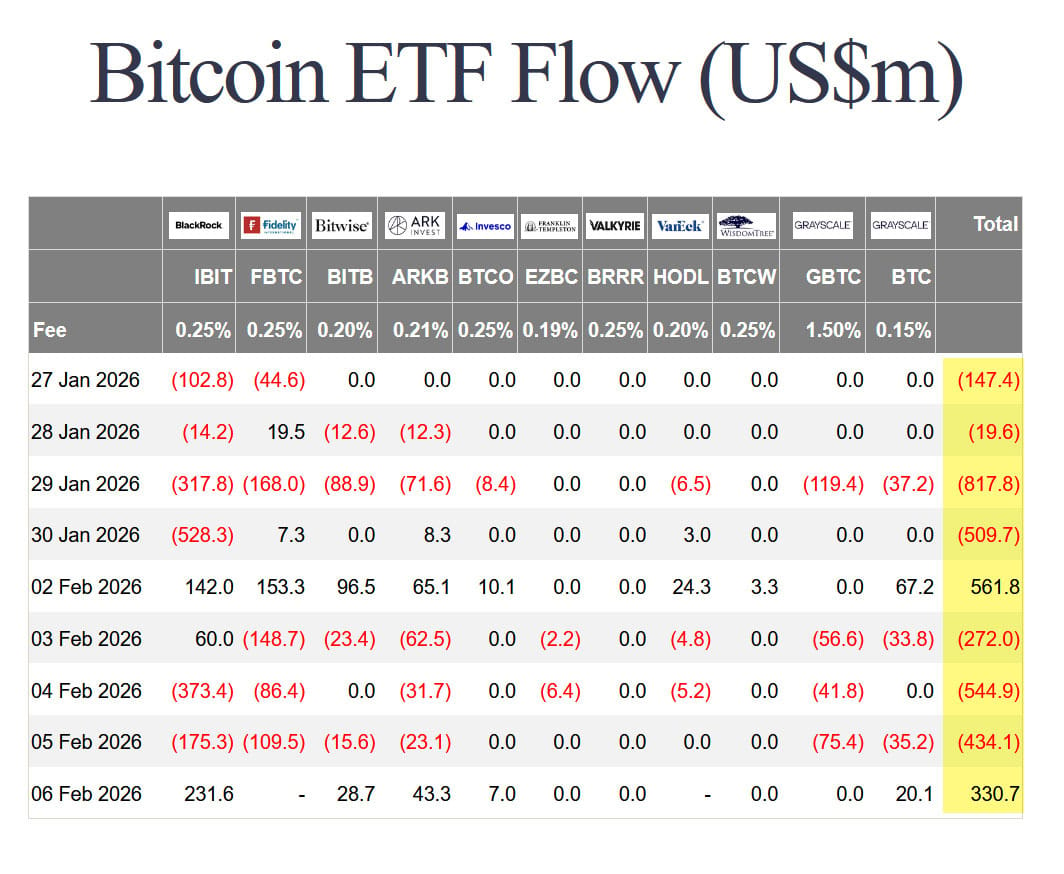

Higher interest rates, ETF outflows, and weaker financial markets have all pushed investors away from riskier assets like bitcoin. As prices fell, mining revenues dropped with them.

All things considered, mining income has suffered badly.

Bitcoin ETFs saw big outflows past few weeks — Farside Investors

A key metric called hashprice, which measures daily mining revenue, fell to record lows in early February. At one point, it dropped to around $28–$33 per petahash per day.

Reports say many miners use $40 per petahash per day as the level needed to stay profitable. Falling below that has forced many operators to shut machines off.