Happy Monday Bitcoiners, it's Bam here with another Bitcoin update!

Each week, our team at Bitcoin News saves you time by curating the most impactful events into a concise, easy-to-read update.

Notable events this week include:

Phoenix Wallet makes a glorious return to the US.

BlackRock branches out beyond Coinbase for Bitcoin custody.

Bitcoin hashrate breaks the zetahash barrier.

Let’s dive in! ⚡

LATEST NEWS 📰

🙌 ADOPTION

Lomond School in Scotland now accepts tuition payments in Bitcoin and has introduced an Austrian Economics curriculum developed by Saifedean Ammous.

RoboSats releases version 0.7.6, adding a Nostr-based coordinator rating system, streamlined trade messaging, and updated dispute contact requirements.

Lightspark unveils a test wallet enabling real-time, 24/7 currency transfers over Bitcoin as easily as sending a text.

⚖️ LEGAL

The DOJ issues major guidance clarifying that developers of tools like mixers and wallets aren’t liable for user crimes, ending regulatory overreach by prosecution.

The SEC approves Galaxy Digital’s Nasdaq listing as an AI and digital asset investment firm, with plans to relocate its headquarters from the Cayman Islands to Delaware by mid-May.

📈 MARKETS

BitGo and Voltage partner to offer secure, instant Lightning Network transactions for institutions, reducing fees and eliminating settlement delays for Bitcoin payments.

BlackRock expands Bitcoin custody beyond Coinbase, appointing Anchorage Digital to safeguard part of its $45B iShares Bitcoin Trust as part of its risk management strategy.

Union Savings Bank, a community bank with approximately $3 billion in assets, has disclosed its first exposure to Bitcoin.

⛏️ MINING

Bitcoin’s hashrate hits 1 Zettahash per second for the first time, showing network strength even as price declines.

Cango increased its Bitcoin production to 530.1 BTC in March, up 12% from the previous month. Its total holdings reached 2,474.8 BTC by the end of March, up from 1,944.7 BTC in February.

Trump’s 145% China tariffs exempt phones, laptops, chips, and Bitcoin miners under HS code 8471. A major win for US miners, who faced crippling price hikes on new rigs.

🗳️ POLITICS

Senator Tommy Tuberville introduces the Financial Freedom Act of 2025, seeking to give all Americans the right to invest their retirement savings in Bitcoin.

China and Russia are now settling some energy trades in Bitcoin as tensions escalate amid the U.S. trade war.

BAMS 2 SATS 🧢

Whipped by Volatility

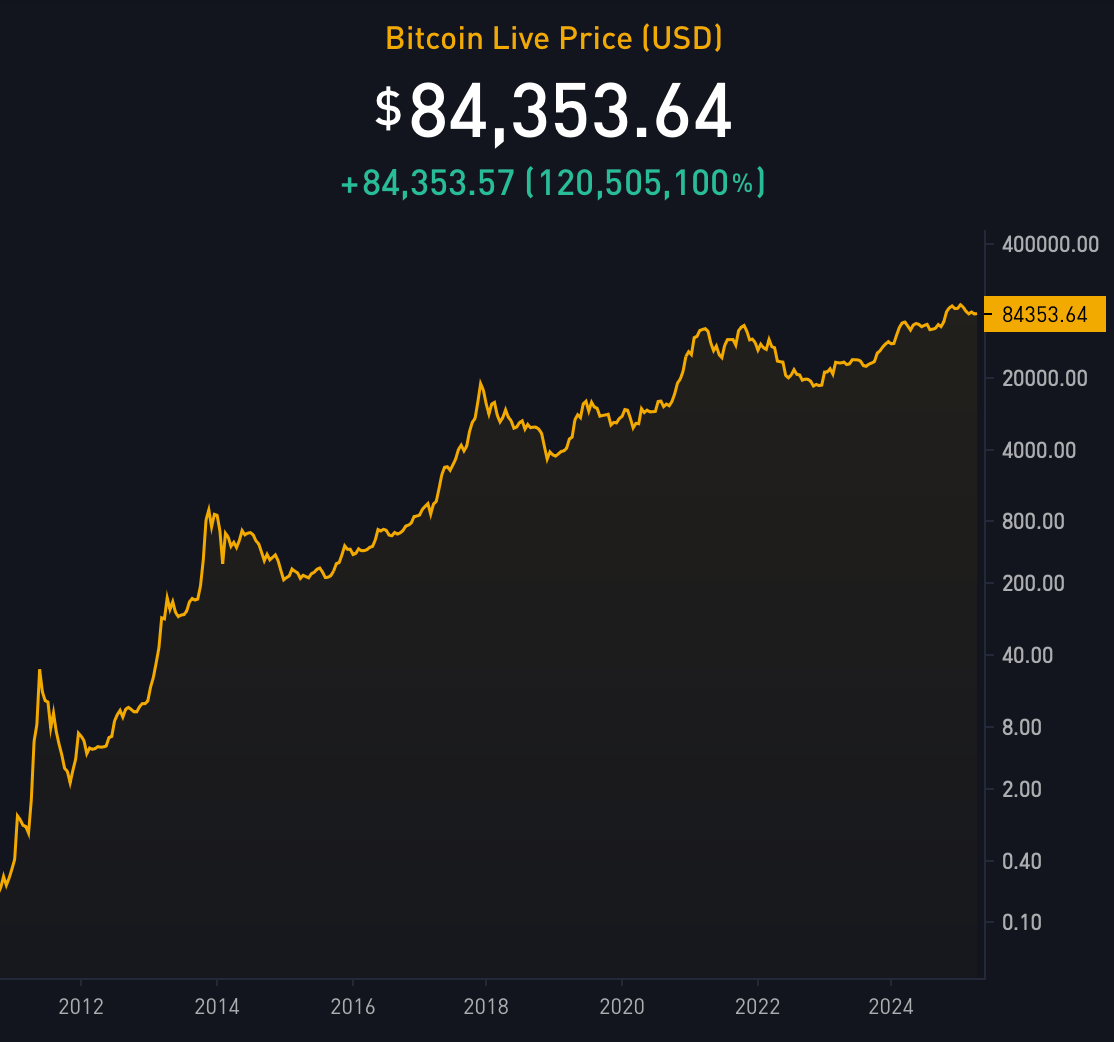

Last week was a wild ride. Bitcoin climbed to the mid-$80Ks before volatility dragged it down near $74K.

Now, doubt is creeping in. Some wonder if this bull run was just a short burst, already fading into another long bear market.

But just as sentiment hits a low, Bitcoin surges back above $84K after the Fed signals it’s ready to step in.

As I write this, I find myself asking, where are we really? Why does morale feel so low across Bitcoin Twitter?

Take a step back: Bitcoin above $80K is incredible. Maybe expectations are off. Maybe too many people treat the four-year cycle like scripture, expecting price to move on a fixed schedule.

Sure, there’s no rule that says we have to hit new highs this year. But it’s also hard to imagine a true bear market from here meaning a 70% drawdown.

Remember — we hit $70K twice before nation-states were buying Bitcoin, before Bitcoin ETFs were the most successful ETF launch in history, and before most institutions showed serious interest.

In 2021, MicroStrategy held around 100,000 BTC when Bitcoin crossed $60K. Today, they hold nearly half a million, and they’re no longer the only ones.

So if you’re feeling bearish, maybe it’s time to step back from the charts for a bit. Take a walk. Reconnect with the big picture. Because Bitcoin isn’t just holding on—it’s gaining ground.

The world has been waiting for a pristine, digital asset to store value. And slowly but surely, Bitcoin is becoming exactly that.

Stay safe and keep on stacking!

Bam

The Bond Market Takes Trump Hostage

In our latest video report, Rob Wallace breaks down how the bond market’s revolt is derailing Trump’s vision for an economic reset.

The question now: can Trump pull it off in a world that’s losing its appetite for U.S. debt?