Key Takeaways

Mining hardware prices have plunged to $3–$4 per TH, levels once seen only in distressed sales.

Bitcoin mining profits have dropped below breakeven, forcing miners to shut down or delay expansion.

Weak post-halving revenues and low transaction fees are driving steep discounts and bundled hosting deals.

Deep Discounts Signal Growing Stress

Bitmain, the world’s largest maker of Bitcoin mining machines, is cutting prices across much of its hardware lineup. The move comes as Bitcoin miners face serious financial pressure, with profits falling and operating costs staying high.

To keep sales moving, Bitmain is now offering deep discounts, bundle deals, and even auction-style sales. Reports from The MinerMag and internal price lists show that prices have dropped sharply on both older and newer machines, including the popular Antminer S19 and S21 models.

Miners can now buy equipment for as little as $3 to $4 per terahash (TH). Earlier in 2025, prices this low would have been seen as emergency or “distressed sales.”

In some cases, Bitmain has allowed miners to bid on machines and set their own prices. Certain bundles were auctioned off with buyers effectively able to “name their own price.”

This is unusual for Bitmain and shows how weak demand has become. The main reason for the price cuts is simple: mining profits have collapsed. A key metric called hashprice, which measures how much revenue miners earn per unit of computing power, has fallen to about $35 per petahash per day.

Related Reading: Bitcoin Hashprice Falls to Lowest in a Decade

Most miners need at least $40 per petahash per day just to break even. Falling below that level means many mining operations are losing money. As a result, some miners are turning off machines, while others are delaying expansion plans or looking for cheaper equipment.

The discounts cover a vast number of Bitmain’s major products. Factory price lists show that S19e XP Hydro and 3U S19 XP Hydro machines are being offered at around $3 per TH. Slightly newer S19 XP+ Hydro units are selling for near $4 per TH.

Even Bitmain’s newer machines are being discounted. S21 immersion-cooled miners are being offered at roughly $7 per TH, while S21+ Hydro models are priced closer to $8 per TH before coupons.

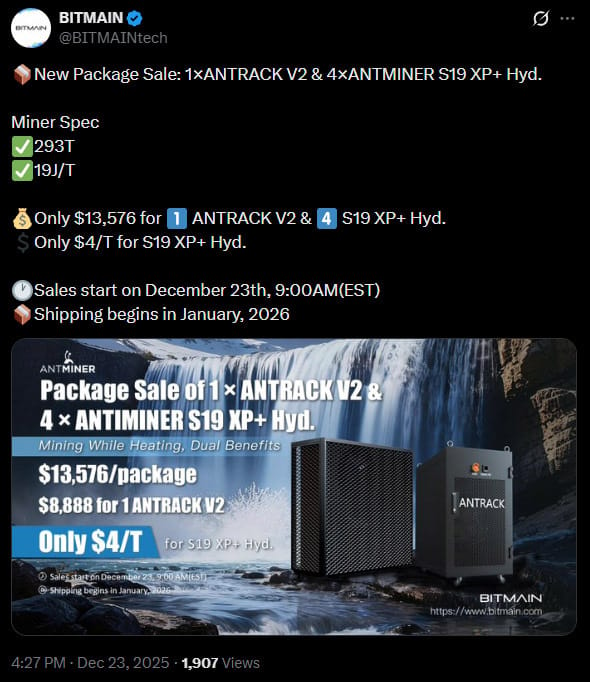

These prices are far below what similar machines were selling for earlier in the year. One December promotion bundled four S19 XP+ Hydro miners with a mining container, putting the price at about $4 per TH. Deliveries for this deal are scheduled for January 2026, showing that Bitmain is willing to lock in low prices ahead of shipment.

@BitmainTECH on X

To make the deals more attractive, Bitmain is also offering hosting services alongside the hardware. These services allow miners to place their machines in facilities run by Bitmain or its partners.

Hosting rates range from about 5.5 to 7 cents per kilowatt-hour in countries such as the United States, Brazil, Kazakhstan, Paraguay, and Ethiopia. By bundling hosting with hardware, Bitmain lowers the upfront work needed for miners to get started.

The wider Bitcoin market has added to miners’ problems.

After the April 2024 halving cut block rewards to 3.125 BTC, miners expected higher bitcoin prices to make up the difference. That did not happen. Bitcoin’s price climbed above $126,000 in October but then fell sharply to around $80,000 in November.

By year-end, bitcoin was still more than 7% lower than at the start of 2025 and nearly 20% below its January high.

Transaction fees have remained low as well. Miners had hoped that when block rewards were cut in half, higher transaction fees would help offset the loss. Instead, the opposite happened: fees declined rather than increased. As a result, recent blocks have consistently provided miners with total fees of less than 0.05 BTC.

Block rewards have shrunk