Key Takeaways

The CFTC launched a 35-member committee to modernize digital asset market rules.

Industry leaders from digital assets, traditional finance, and venture capital will advise on DeFi, AI, and tokenization.

The move comes amid debate over U.S. digital asset legislation and oversight between the CFTC and SEC.

Innovation Advisory Committee: Reshaping Future Rules

The U.S. Commodity Futures Trading Commission (CFTC) has created a new advisory group made up of top leaders from the digital assets industry and traditional finance. The goal is to help the agency write clearer and more modern rules as technology changes financial markets.

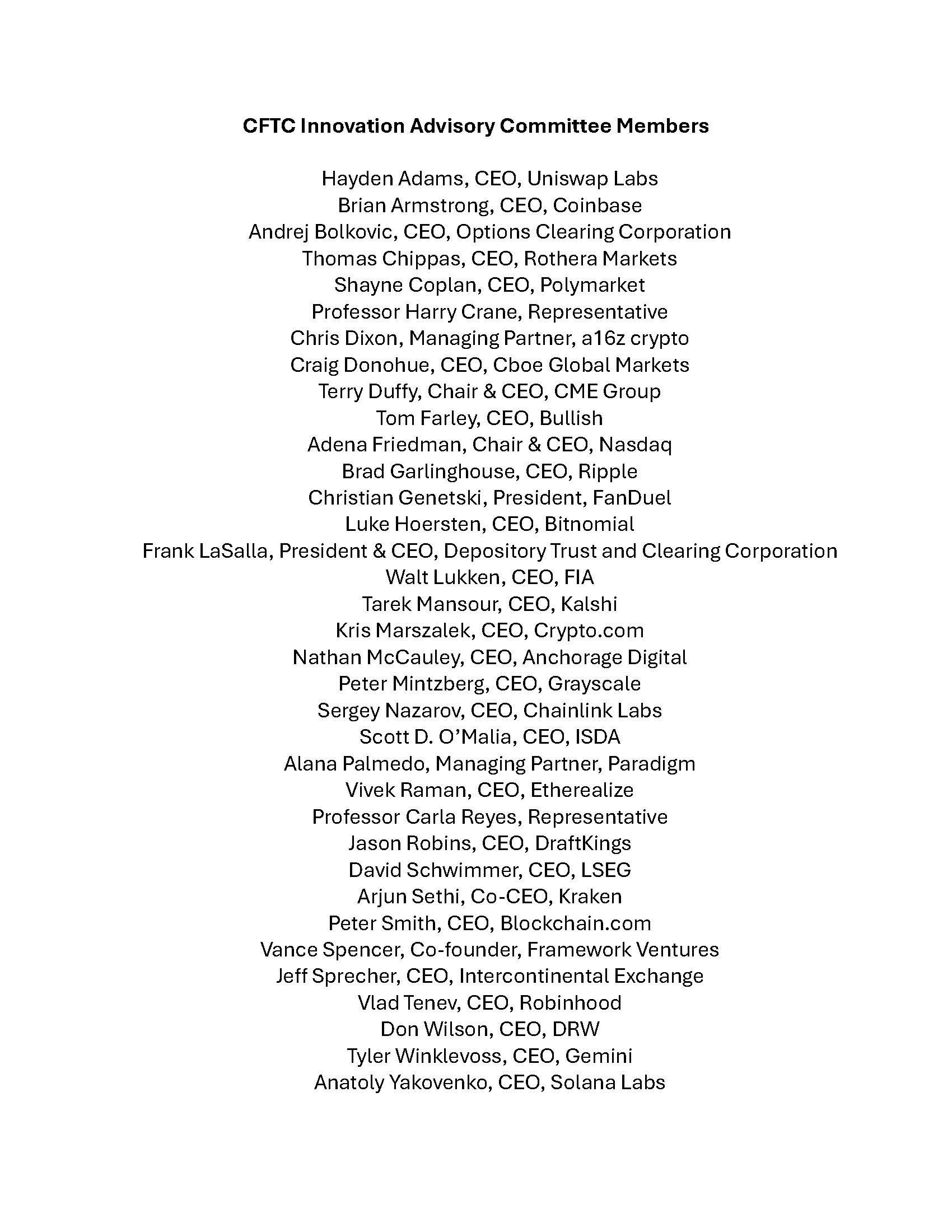

The new group is called the Innovation Advisory Committee. It has 35 members and will give advice on issues like blockchain, digital assets, prediction markets, and artificial intelligence.

CFTC Chair Michael S. Selig described the launch as “an important and energizing moment” for the agency. He said the committee will help the CFTC “future-proof its markets” and make sure its decisions “reflect market realities” today.

Many of the most well-known leaders in the digital assets market are now part of the committee. These include Brian Armstrong of Coinbase, Brad Garlinghouse of Ripple, and Vlad Tenev of Robinhood.

Other members include Tyler Winklevoss from Gemini, Kris Marszalek from Crypto.com, and Arjun Sethi from Kraken.

Members of the Innovation Advisory Committee — Mike Selig on X

Leaders from blockchain and decentralized finance projects are also included. Hayden Adams of Uniswap Labs, Sergey Nazarov of Chainlink Labs, and Anatoly Yakovenko of Solana Labs are all part of the panel.

Prediction market platforms are represented as well. Shayne Coplan of Polymarket and Tarek Mansour of Kalshi have seats on the committee. This shows the CFTC is paying attention to event-based contracts and new types of trading platforms.

The committee is not only focused on digital assets. Major traditional finance companies also have a voice.

Executives from Nasdaq, CME Group, Cboe Global Markets, Intercontinental Exchange, and the Depository Trust & Clearing Corporation are also members of the panel.

Some venture capital leaders are also included. Chris Dixon, Vance Spencer, and Alana Palmedo are part of the group, giving investors a voice in the discussion.

Selig said the wide mix of members is important. He explained:

“By bringing together participants from every corner of the marketplace, the IAC will be a major asset for the Commission as we work to modernize our rules and regulations for the innovations of today and tomorrow.”

The Innovation Advisory Committee replaces the CFTC’s older Technology Advisory Committee. The new group has a broader mission. It will look at how new technologies and business models are changing both digital assets and traditional markets.

The panel will study digital assets market structure, decentralized finance, tokenization, artificial intelligence in trading, and risk management standards. It will also examine how digital asset companies fit within current laws.

The committee’s creation comes as lawmakers debate new digital asset legislation in Washington, including the proposed CLARITY Act. The bill aims to clearly define which digital assets fall under the CFTC and which are overseen by the Securities and Exchange Commission (SEC).

While there is general agreement about dividing oversight between the two agencies, there is still disagreement about how stablecoins should be treated. Some lawmakers and industry leaders are debating whether companies should be allowed to offer yield on dollar-pegged tokens.

Armstrong recently withdrew his support for the bill. He said it had “too many issues,” including rules that could limit tokenized products, restrict decentralized finance, and reduce stablecoin rewards. He also warned that certain changes could risk “stifling innovation” by making the CFTC “subservient to the SEC.”

Many in the digital assets industry see the new committee as a sign that the CFTC is becoming more open to innovation.