You hear that noise? That’s the frantic typing of the Netherlands’ most productive citizens searching for how to move themselves and their capital before a 36% annual tax on unrealized gains takes effect in 2028.

Fortunately for them, Bitcoin exists as the easiest way to carry significant capital anywhere in the world.

Other top stories from the week include:

Lightning Labs enables autonomous AI agents to operate on the LN.

February’s epic Bitcoin crash gets the anime treatment.

Bitcoin takes a step towards quantum resistance.

Latest News

Adoption

Cash App eliminates fees on BTC buys over $2K and recurring purchases, raises withdrawal limits, aiming to make Bitcoin everyday money. Over 50% of Americans aged 18 to 25 use it monthly.

BIP 360 was merged into Bitcoin’s GitHub repository to address quantum risks, introducing Pay to Merkle Root, a quantum resistant output type that removes Taproot’s vulnerable key path spend.

PysopAnime releases a two minute anime short depicting an epic battle between CZ and Saylor during Bitcoin’s February crash.

Regulation

The Dutch House passes a 36% tax on unrealized capital gains with a move critics warn could trigger capital flight and undermine long term investment strategies, including Bitcoin holdings.

Nic Carter warns BlackRock and other major institutions could “get fed up and fire the devs” if Bitcoin developers fail to take meaningful action addressing the growing quantum computing threat.

Erica Payne, president of Patriotic Millionaires, calls at an IMF and World Bank event for a global asset registry, international limits on excessive wealth, and aggressive taxation to “defend democracy.”

Markets

Lightning Labs releases open source toolkit enabling autonomous AI agents to operate natively on the Bitcoin Lightning Network, allowing instant micropayments without traditional signup barriers.

BlockFills, a Susquehanna-backed crypto lender with $60B in 2025 trading volume, suspends deposits and withdrawals, citing market volatility, reviving memories of 2022’s FTX-driven contagion.

S&P assigns preliminary ratings to Ledn Issuer Trust 2026 1 notes backed by $199M in bitcoin collateralized loans, secured by 4,078 BTC worth about $357M, with additional revolving loans and cash reserves.

Treasury

Binance completes its $1B SAFU conversion from stablecoins to Bitcoin, purchasing a final 4,545 BTC and bringing total holdings to 15,000 BTC, valued at $1.005B at a $67,000 Bitcoin price.

Saylor tells CNBC that Strategy can withstand a Bitcoin price drawdown to $8K and still have sufficient assets to fully cover its debt.

Goldman Sachs, managing roughly $3.5T in assets, discloses $2.36 billion in crypto holdings in its Q4 2025 13F filing, including $1.1 billion in Bitcoin exposure.

Mining

Metalpha, a strategic partner of Bitmain, announces it will allocate up to 20% of its annual net profit to buy Bitcoin, signaling growing corporate treasury adoption beyond miners and exchanges.

Cango sells 4,451 BTC worth $305M to fund a strategic pivot into AI infrastructure, highlighting how mining firms are transitioning toward higher growth compute markets amid shifting industry economics.

Bitdeer Technologies announces its SEALMINER series has reached 65.1 EH/s in total production capacity, reinforcing its expanding footprint in industrial-scale Bitcoin mining infrastructure.

Politics

China instructs banks to sell US Treasuries and limit new purchases amid concerns that US debt may expose them to sharp volatility, signaling a potential shift away from dollar-denominated reserves.

EU moves to ban all cryptocurrency transactions with Russia, proposing a blanket prohibition on Russian crypto platforms to prevent sanctions evasion tied to the Ukraine war.

Brazil reintroduces a bill to create a Strategic Bitcoin Reserve with authorization to acquire up to 1M BTC, joining the growing list of nations exploring sovereign Bitcoin holdings.

Women of Bitcoin Summit

To outsiders, Bitcoin may feel male-dominated, but that’s changing.

Rhino Bitcoin is sponsoring the first Women of Bitcoin Summit, a free global online event designed to make Bitcoin education clear, practical, and approachable.

Live and virtual on March 4th and 5th, 2026.

Whether you’re brand new or already building, this is a space to learn, ask real questions, and connect with other women navigating the future of money.

800+ women are already registered.

Reserve your free spot below👇

Bam’s 2 Sats

The Shakeout

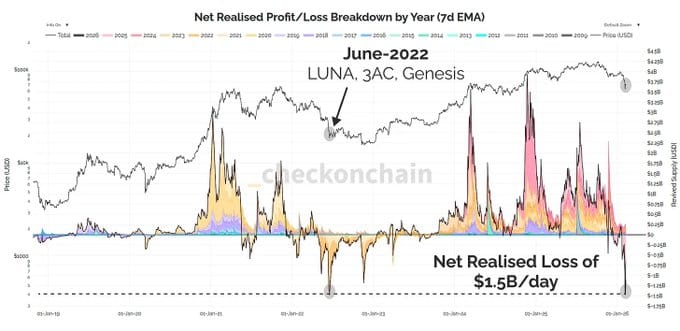

Last week looked like a textbook capitulation event: fast, heavy volume, and losses crystallized from low conviction holders.

According to Checkmate’s latest post and his appearance on What Bitcoin Did, it mirrors June 2022 during the Luna, 3AC, and Genesis meltdown.

A massive transfer from weak hands to strong.

Kip Herriage, Managing Partner at Vertical Research Advisory, agrees.

He says Bitcoin’s lows are in, citing a selling climax in $IBIT, record volume, extreme RSI readings, and a Fear & Greed Index low of 5.

He calls it “extreme oversold” and says VRA is buying.

The Builders

But if you're watching what builders are doing, you get a very different picture.

We're living through an era where the barrier to building Bitcoin freedom tools is collapsing, thanks to AI.

As the agentic boom accelerates, Bitcoiners are steering AI agents toward autonomy and sovereignty.

With minimal guidance, once a bot grasps digital scarcity and operates independently, some begin spawning child agents, provisioning Lightning servers, and buying AI credits via PayPerQ using their own Lightning wallets.

As Matt Corallo says, “It is time for Bitcoiners to step up and build.” The current landscape offers exactly that opportunity.

With AI tools, anyone can start building. The only real limits are imagination and, of course, the cost of API calls.

But none of this would be possible without a permissionless network like Bitcoin.

Two Worlds

The divergence is clear.

One world reacts. The other builds, ships code, stacks sats, and lays the rails for the next decade.

This is what adoption looks like when it stops asking permission. The debates continue, but the merge commits keep moving.

- Bam

Bitcoin Trivia

How much U.S. government debt will mature and need to be refinanced over the next 12 months?

Live on The Daily Stack

With currency debasement accelerating and calls for extreme taxation growing louder, it’s never been more important to understand Bitcoin.

Join host Rob Wallace on @DailyStackHQ live at 11am ET as he breaks down the headlines with Women of Bitcoin Summit ambassadors Sanjna M and Natalie Brunell.