Key Takeaways

Oklahoma bill would let workers and vendors opt into Bitcoin payments without replacing the U.S. dollar.

Employees could split pay, choose pricing timing, and use self-custody or custodial wallets.

Proposal eases licensing rules for digital-asset-only firms and sets a 2026 start with tax guidance in 2027.

Oklahoma Lawmakers Weigh Optional Bitcoin Payments

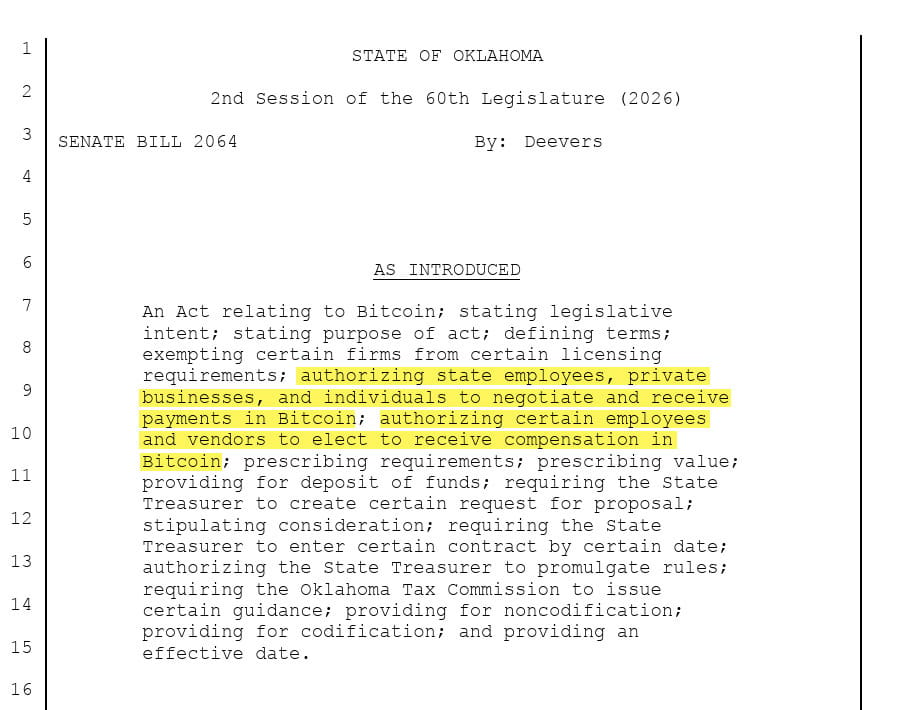

Oklahoma lawmakers are looking at a new bill that could allow Bitcoin to be used for some state payments. The Senate Bill 2064, or SB 2064, was introduced during the 2026 legislative session by State Senator Dusty Deevers. If passed, it would let state employees, vendors, businesses, and residents choose to receive payments in bitcoin.

The bill does not make bitcoin official money in Oklahoma, and the U.S. dollar would still be the main currency. Instead, the bill treats Bitcoin as a financial tool that people can choose to use.

The bill allows state employees and businesses transacting with the state to use Bitcoin

The proposal clearly says it follows U.S. law and does not break the Constitution, which limits what states can call legal tender. According to the bill, Bitcoin would be used only if both sides agree.

It is described as a “financial instrument and medium of exchange” that works within existing legal rules. This means no one would be forced to use Bitcoin, it would always be optional.

One of the main parts of SB 2064 focuses on state workers. If the bill becomes law, state employees could choose how they want to be paid. They could receive their salary in U.S. dollars, in bitcoin, or split between the two.

Employees would also be able to decide how the bitcoin amount is calculated. The value could be set using bitcoin’s market price at the start of a pay period or at the moment the payment is made.

Workers could change their payment choice at the beginning of every pay period. The bill also gives workers control over where their bitcoin goes. Payments could be sent to a self-hosted wallet owned by the employee or to a third-party custodial account.

Vendors that do business with the state would also have the option to accept bitcoin. Companies could choose Bitcoin payment on a transaction-by-transaction basis. This means they could decide separately for each contract or purchase order.

Unless both sides agree otherwise in writing, the bitcoin value would be based on the market price at the time of payment. This keeps the system flexible for both the state and its vendors. The bill goes beyond state payroll and contracts.

It also allows private businesses and residents in Oklahoma to negotiate and receive payments in bitcoin. This would support the use of Bitcoin in everyday transactions across the state. Supporters say this could help the scarce digital currency become more accepted in professional and business settings.

SB 2064 also includes changes for businesses that only work with digital assets. Companies that deal only in bitcoin or other digital assets, and do not exchange them for U.S. dollars, would not need a money transmitter license in Oklahoma.

This part of the bill is meant to reduce regulatory pressure on Bitcoin-focused companies and make Oklahoma more attractive to digital asset businesses. The Oklahoma State Treasurer would play a major role in putting the program into action.

The Treasurer would need to select a digital asset company to handle bitcoin payments for the state. When choosing a provider, the Treasurer must look at things like fees, transaction speed, cybersecurity, custody options, and state licensing. All contracts with the chosen provider must be completed by January 1, 2027. The Treasurer would also be allowed to create rules to manage the program.

If SB 2064 is passed, it would go into effect on November 1, 2026. By January 1, 2027, the Oklahoma Tax Commission would be required to release guidance on how bitcoin payments should be taxed. This is important because taxes on digital assets have often been unclear.