If you made it through this week’s apocalyptic dump without panic selling your Bitcoin, you earned some stripes. The crash was brutal, but the rebound has been just as striking, with Bitcoin reclaiming 18% in only a few days.

Other top stories from the week include:

An exchange accidentally sent more than 600K BTC to clients.

ETF holders proved they have diamond hands.

Cramer hints at inside knowledge regarding the Strategic Bitcoin Reserve.

Latest News

Adoption

A $1M Bitcoin payment settled over Lightning in 0.47 seconds between SD Markets and Kraken, proving Lightning is already operating at institutional scale.

Strategy is launching a coordinated Bitcoin security initiative with the global cyber, crypto, and Bitcoin security community to proactively address potential quantum computing threats to Bitcoin.

Gloria Zhao has stepped down as a Bitcoin Core maintainer after more than five years of contributions, during which she merged 290 commits.

Regulation

The CLARITY Act’s odds of passing jump to 69% as Chuck Schumer pushes to cut a deal following Fairshake’s unveiling of a $193M midterm war chest, though key Democratic red lines remain.

SEC Chair Paul Atkins says it’s time to allow Bitcoin in 401(k)s via professionally managed funds, citing Trump’s 2025 order and ongoing efforts to clarify digital asset rules.

Gemini is cutting 25% of staff and winding down operations across the UK, Europe, and Australia. UK accounts are now withdrawal-only as the country’s hopes of becoming a “crypto hub” begin to fade.

Markets

A Bithumb promotional error sent 2,000 BTC to users instead of the planned $1.50, briefly crashing local prices before trading was halted; most funds were recovered and no hack occurred.

Binance purchases 6,230 BTC ($434M) this week as part of a plan to convert $1B in stablecoins into Bitcoin for its SAFU fund, which protects users during extreme market events.

IBIT, BlackRock’s Bitcoin ETF, traded a record $10B in a single day during a 13% drawdown yet still pulled in +$231M for the week, a reminder that Bitcoin ETFs can absorb chaos even amid volatility.

Treasury

Strategy CEO Phong Le tells CNBC that Bitcoin would need to fall to $8,000 and stay there for five to six years before threatening the company’s ability to service its convertible debt.

World LibertyFi, the Trump family’s stablecoin company, sold $11.7M in wrapped Bitcoin to avoid liquidation on its Aave USDC loan as the Bitcoin market crash to $60K.

Smarter Web, the UK’s largest Bitcoin treasury company with 2,674 BTC, has joined the London Stock Exchange after uplisting from the Aquis Exchange.

Mining

Bitcoin network difficulty fell over 11%, the steepest drop since China’s 2021 ban and the 10th largest negative adjustment on record, as US cold weather and market stress drove hashpower offline.

Tether releases MiningOS, an open-source, modular operating system for Bitcoin miners designed to be scalable and extensible from the ground up.

BitRiver, Russia’s largest Bitcoin mining company, faces a deepening financial crisis as insolvency proceedings were opened against its holding group, and its founder was placed under house arrest.

Politics

Epstein files email cites an alleged FSB report claiming former IMF chief Dominique Strauss-Kahn uncovered evidence that US gold reserves at Fort Knox were missing or unaccounted for.

Scott Bessent tells Congress the U.S. weaponized the dollar against Iran, triggering a currency collapse that sent inflation soaring and pushed local Bitcoin prices to record highs of 100B IRR.

Jim Cramer claims President Donald Trump bought Bitcoin for a US strategic reserve during this week’s market crash, citing rumors of purchases near $60K.

The Perfect Time to Buy?

Bitcoin sentiment may be at an all time low, but historical probabilities suggest this to be a highly favorable buying opportunity.

But where to get the cash from? Well, that’s where Arch comes in…

Arch Lending offer their clients the ability to stack Bitcoin using their existing Bitcoin holdings (they also have the lowest rates in the game 😉).

And at current Bitcoin prices, the Loan to Value (LTV) of a new BTC loan would be substantially less risky than just a few weeks ago.

So if you’re thinking about doubling down on your Bitcoin exposure, check them out today 👇

Bam’s 2 Sats

One Of The Toughest Weeks

Bitcoin just recorded its first-ever daily drop of more than $10,000. Not even the record $19.5B liquidation day on October 10 came close. The move suggests a large forced liquidation, though concrete details remain unknown. Speculation points to overexposure by crypto hedge funds to IBIT, but confirmation will likely only come with future institutional filings.

For now, let’s focus on what actually happened.

The drawdown began in mid-January, when Bitcoin briefly showed strength by trading up to $98K. From there, prices trended steadily lower without any meaningful relief rallies. Last weekend, Bitcoin broke below the $80Ks, and the selling continued.

By Wednesday, Bitcoin was pushing into the low $70Ks, and Thursday delivered the largest red daily candle in its history. Notably, that move was followed by a sharp rebound that nearly produced a legendary $10K “god candle,” but ultimately fell just short.

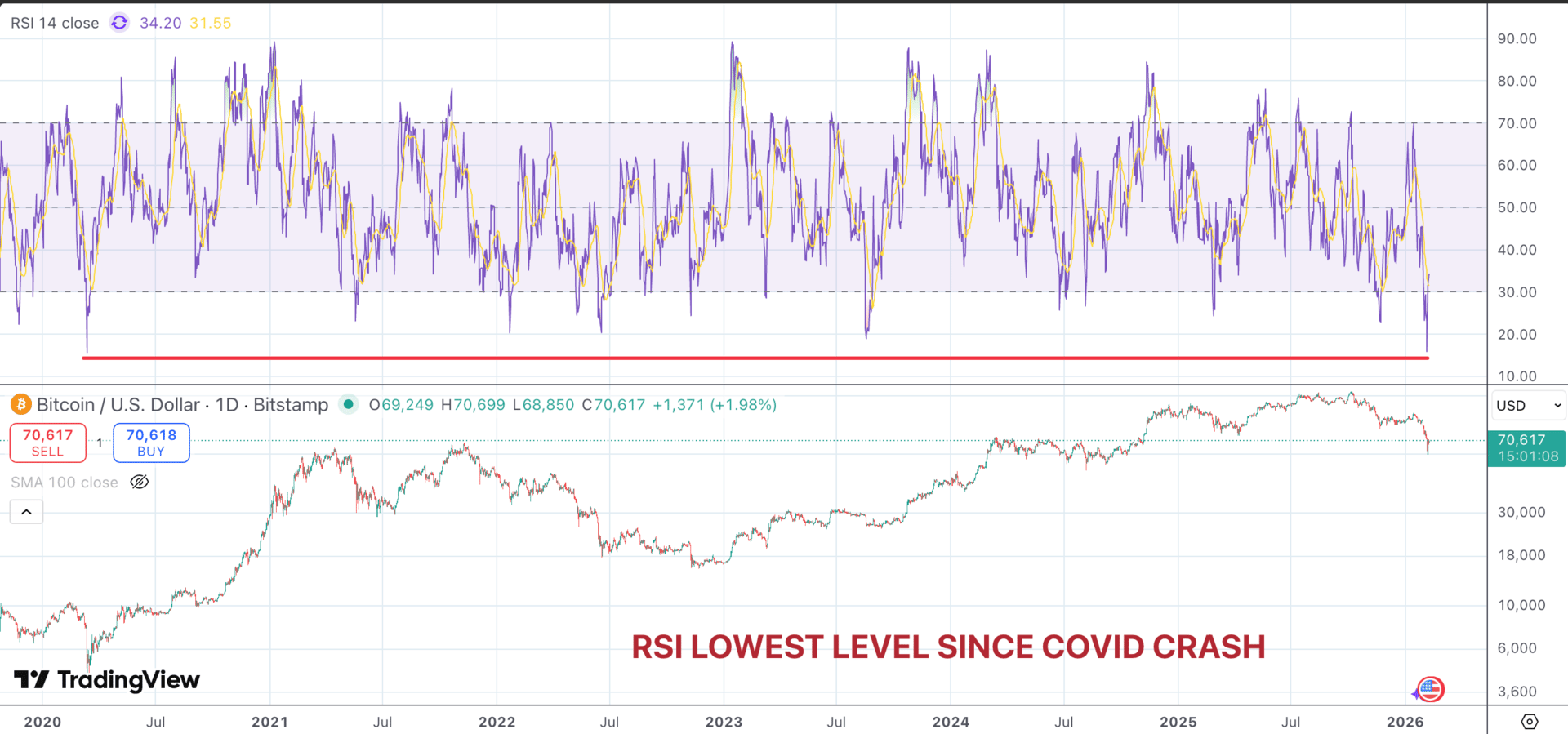

During all of this, Bitcoin’s RSI, one of the most watched momentum indicators, hit levels not seen since the March 2020 Covid crash. Six-year lows. And yet… the market barely flinched.

Shock Absorbers and Strong Hands

What do I mean by “barely flinched”?

Throughout the entire move, Bitcoin ETFs acted like shock absorbers. While price fell more than 50% from the all-time high, ETF holdings declined only about 6.6%. On that brutal Thursday, IBIT, the largest Bitcoin ETF, recorded its highest daily volume ever, with roughly $10B in shares traded.

You would have expected a bloodbath.

The day after the mega crash saw outflows of just over $400M, bringing year-to-date outflows to roughly $2.2B. However, almost unbelievably, ETFs recorded $231M in inflows the following day despite a single-day 13% drawdown.

Forget panic selling. This looks like absorption by large players who see sats on sale.

With institutions holding over 90% of ETF AUM, and accumulation appearing amid some of the worst Bitcoin sentiment in years, this feels less like retail chaos and more like smart money quietly stepping in.

The takeaway? Bitcoin remains highly volatile, even as Wall Street tech and AI stocks begin behaving just as wildly, if not worse. But despite the critics on X, nothing is fundamentally broken, and institutions appear to recognize that.

So be careful out there. Don’t “feed the whales.” These moments are brutal in real time, but they’re also the kind many people have said they’ve been waiting for.

It looks like that day has arrived. Now comes the part where conviction is tested and words turn into action.

Stay safe. And keep on stacking.

- Bam

Bitcoin Trivia

Time to Buy a Private Jet? 🛫

With Bitcoin back above the $70k level, Grant Cardone is now considering buying a new private jet.

Last Friday, @DailyStackHQ team chatted with Grant about real estate, private jets and his real estate bitcoin fund [watch below👇].