From politics to TradFi acceptance to merchant adoption, 2025 has been a landmark year for Bitcoin… in nearly every respect except price. After years of supposed suppression, precious metals are now having the Q4 many expected Bitcoin to deliver.

The biggest news events this week include:

A Brazilian orchestra improvising live to the Bitcoin price.

Putin says Trump wants to include Bitcoin mining in Ukrainian peace deal.

CZ’s Trust Wallet gets hacked but says funds are still “safu”.

Latest News

Adoption

Bitcoin Architect releases new website visualizing the entire Bitcoin as tree rings. Each block appears as a transaction ring, and hovering reveals BTC values, making block composition intuitive to explore.

Chaincode Labs launches the 2026 ₿OSS Challenge, a 3 month program helping developers break into Bitcoin open source through guided foundations, partner programming, and real contribution paths.

Culture Ministry of Brazil approves a live orchestra performance for charity that converts real time BTC price action into music, with melodies and tempo shifting dynamically based on market data.

Regulation

Trust Wallet, owned by Binance’s Changpeng Zhao, suffered a Chrome extension hack that stole at least $7 million, with Zhao promising full reimbursement and urging users to update immediately.

IMF praises El Salvador’s robust 4% growth driven by investment and remittances, but remains cautious over Bitcoin risks while seeking transparency as negotiations for the Chivo e-wallet sale advance.

Ghana passes legislation legalizing the use of bitcoin and crypto, marking a significant step toward formal adoption within its financial system.

Markets

Silver hits new ATH of $79. After this week’s parabolic move, Bitcoin has erased all gains versus silver since 2017, pushing the silver-implied Bitcoin power law trend price to roughly $394,000.

JPMorgan is weighing spot and derivatives Bitcoin trading for institutional clients, citing rising demand from hedge funds and asset managers and a more favorable U.S. regulatory environment.

Erebor, co-founded by Palmer Luckey, raises $350M at a $4.35B valuation, targeting tech, crypto, AI, defense, and manufacturing firms with banking and crypto services.

Treasury

Citigroup reiterates a ‘Buy’ rating on Strategy’s STRD Preferred Stock, with an average $241.56 price target implying 209.69% upside from its latest $78 close.

Trump Media acquires an additional 451 bitcoin for 40.3 million dollars, amassing a total of 11,542 BTC in their reserves.

Matador Technologies receives approval from the Ontario Securities Commission to raise CAD $80M to fund its Bitcoin Treasury Strategy.

Mining

Putin says Bitcoin mining has surfaced in talks tied to Donald Trump’s Ukraine peace proposal, with reports a potential U.S. stake in the Zaporozhye Nuclear Power Plant could be used to mine Bitcoin.

Bitcoin mining difficulty recorded a net increase of 35 percent in 2025, reflecting sustained hashrate growth and intensifying competition across the network.

MARA, America’s largest Bitcoin miner, falls to a 52 week low as risk off sentiment, missed earnings, negative EPS outlook, and recent insider selling by the CEO and CTO weigh on Bitcoin linked equities.

Politics

Michael Selig, a publicly pro bitcoin figure, was sworn in as chairman of the CFTC, placing a bitcoin supportive voice at the helm of US derivatives regulation.

Jason Lowery accepts a role as Special Assistant to the commander of U.S. Indo-Pacific Command, bringing his thesis that Bitcoin is a matter of strategic power into the center of defense planning.

Banks are lobbying Congress to reopen the GENIUS Act to block stablecoin rewards, despite earning 4.4% on reserves while paying savers near zero, drawing criticism from crypto industry leaders.

Bitcoin Trivia

Which publicly listed company holds the 10th largest Bitcoin treasury in the world?

Bam’s 2 Sats

2025 Comes to a Close: The Sideways Year No One Expected

It’s the final week of the year. As grateful as I am for Bitcoin, I think many of us share the sense that 2025 turned out very differently than we expected.

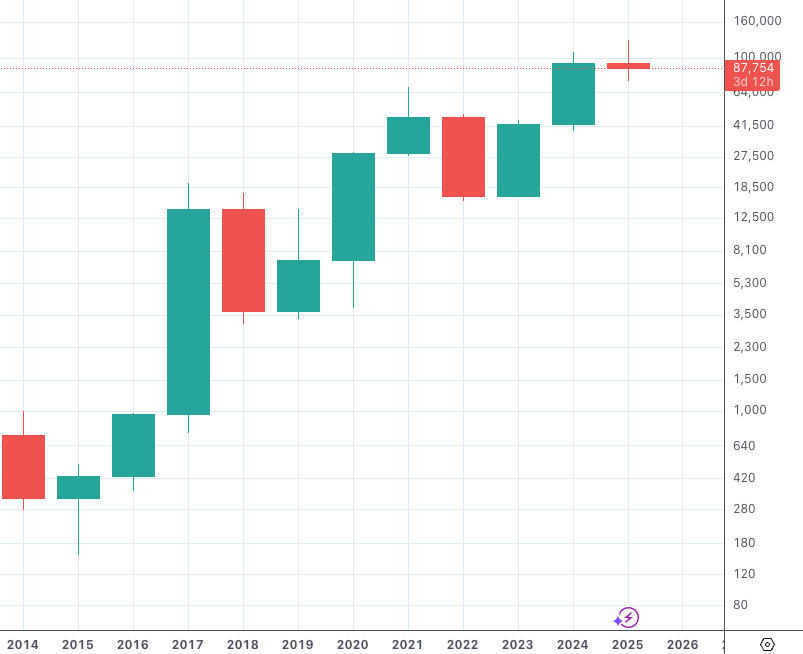

The four year cycle, long treated as Bitcoin’s guiding framework, had many expecting an explosive, green finish to the year. When price surged in early October, the assumption was simple: higher highs, accelerating hype, and history repeating once again.

Likely not a third green year.

But that isn’t how it unfolded.

Some argue the top is in, as it has been in past four year cycles, and that a bear market year should follow. Even if that proves true, this cycle feels different.

If the bull cycle is truly over, there was no exponential third year blow off. What many now label the top of $126,000 sits not far above January’s $109,000 high, especially once dollar depreciation and lived inflation are considered. Prices clearly feel far more than 12% higher as everyday costs continue to climb.

Relative Performance and Sentiment

Layered onto a year of sideways price action set to close in the red, roughly 30% below all time highs, is the sting of watching equities at record levels while gold and even silver dramatically outperform Bitcoin.

One could argue silver delivered the exact chart many Bitcoiners expected from Bitcoin itself.

Silver Short Squeeze

Even with Bitcoin spending much of the year above $100,000, stories continue to surface of wealthy holders selling amid uncertainty about what comes next. At times, morale feels as low as prior bear markets, a sentiment Joe recently captured in an X post.

The Bigger Picture

And yet, zooming out, it is hard to argue that Bitcoin is not winning.

Bitcoin has become increasingly normalized. Companies are accumulating it, governments are debating it, and major moves like Square expanding bitcoin acceptance keep arriving. These are not the signals of an asset fading into irrelevance.

Even if this becomes a bear market, it is worth remembering that bear markets are temporary. Four year cycles exist until they don’t. Gold and silver are reminders that regardless of size, suppression, or perceived manipulation, value eventually asserts itself.

Bitcoin does what it has always done best: absorb capital seeking an escape from central bank inflation and expanding government control.

This year marks a clear step into the mainstream, with Bitcoin entering portfolios through financial instruments. But as adoption grows, education matters. Bitcoin’s defining feature is sovereignty. An absolutely scarce, uncensorable asset.

Freedom Money.

Merry Christmas, Happy New Year, and onward to 2026. Thank you to everyone who read Bitcoin News Weekly in 2025, and welcome to the thousands of new readers who joined us this year.

Stay safe and keep on stacking!

- Bam

This Week on Bitcoin News [Live]

What on earth is happening with silver, and how did it add trillions to its market cap in just a few months?

Join us live today as Rob Wallace is joined by Bitcoin documentary filmmaker Kyle Huber to dive deeper.