Happy Monday Bitcoiners - it’s Bam with another weekly update!

Each week, we condense the most impactful news releases into a concise, easy-to-read update so you’re always in the know!

Notable events this week include 👇

Satoshi Nakamoto statue snatched by vandals in Lugano.

US Gov doubles down on “Project Crypto”.

Coinbase adds 2,500+ BTC to its stash in Q2 comeback.

Let’s dive in⚡

Weekly Live Stream 🚨

Join Rob Wallace this Monday @ 11 ET as he sits down with Jordan Walker, founder of the Bitcoin Collective, to discuss the state of Bitcoin across the Atlantic.

Get Notified When We Go Live?

Latest News 📰

🙌 Adoption

Eight Salvadoran students graduated from the Plan ₿ Summer School in Lugano, Switzerland, an intensive one-week Bitcoin strategy bootcamp for the top 21 candidates selected from over 300 applicants.

The Municipality of Lugano has recovered the stolen Satoshi statue by Satoshigallery, which was taken from a city park and found discarded along the nearby waterfront.

PayPal launches “Pay with Crypto,” letting merchants accept Bitcoin and other crypto with instant conversion to stablecoins or fiat, at just 0.99% per transaction, cutting fees by up to 90% vs international credit cards.

⚖️ Legal

The SEC approves in-kind creation/redemption for all spot bitcoin ETFs, making them more efficient, cheaper, and aligning them with traditional commodity ETFs, such as those backed by gold.

Samourai Wallet developers have pleaded guilty to unlicensed money transmission, a significant reversal and big win for the DOJ. They face fines and up to five years in prison.

SEC Chairman Paul Atkins launches ‘Project Crypto’ to position the U.S. as the “crypto capital of the world” and reaffirms the government’s commitment to protecting self-custody rights.

📈 Markets

Institutional demand now accounts for over 97% of all Bitcoin transactions, more than 600% higher than the daily growth in mining supply.

UK’s Financial Conduct Authority will lift its four-year ban on crypto exchange-traded notes for retail investors starting October 8, 2025. Unlike ETFs, cETNs track crypto prices without direct asset ownership.

Vanguard’s VTSAX quietly acquires 431,101 shares of MicroStrategy (worth $159.2M at ~$369/share), making it the top institutional holder and giving it indirect exposure to 17,000+ BTC.

🏦 Treasury

Strategy reports record Q2 2025 earnings: $14B in operating income, $10B net, and $32.60 EPS. It pledges not to use the ATM below 2.5× MNAV and plans to raise $4.2B via preferred stock to continue stacking.

Coinbase, now listed in the S&P 500, added 2,509 BTC in Q2, bringing its total holdings to 11,776 BTC. Its shareholder letter highlights “weekly BTC purchases.”

Metaplanet files a ¥555B (~$3.7B) shelf registration to issue two classes of perpetual preferred stock, fixed (≤6%) and convertible, as it aims to transform Japan’s bond market and reach 210,000 BTC by 2027.

⛏️ Mining

MARA Holdings raises $950M via 0% convertible notes to buy more Bitcoin, repay $50M in debt, and fund operations, reporting Q2 revenue of $238M, up 64% YoY and above expectations.

Bitmain is establishing manufacturing operations in the U.S., with Florida or Texas as the leading candidates. Setup is expected by the end of this quarter, with initial production beginning in 2026.

A pleb miner sets up a Bitaxe powered by Starlink to mine Bitcoin atop ‘Pen y Fan’, the highest mountain range peak in South Wales (the views are stunning by the way!).

🗳️ Politics

The U.S. Treasury now expects to borrow ~$1T in Q3 and $590B in Q4, totaling $1.597 trillion in new debt for the second half of 2025.

Federal Reserve Governor Adriana Kugler is stepping down, creating an unexpected vacancy that gives President Trump an opportunity to put further pressure on Powell.

El Salvador’s legislature votes to remove presidential term limits, allowing Nayib Bukele to run for indefinite re-election and 6-year terms.

🧠 Bitcoin Trivia 🧠

Answer Correctly 👉 Chance to Win 21,000 Sats

Bam’s 2 Sats 🧢

Strategy Breaks Records

Following Bitcoin’s highest monthly close ever on Thursday evening, the price dropped sharply—ironically timed with MicroStrategy’s blowout earnings.

For context, public companies now hold over 900,000 BTC, representing a 35% increase in just one quarter. Firms are doubling down on Bitcoin Treasury strategies week after week, just like MicroStrategy… or rather, Strategy (still getting used to that).

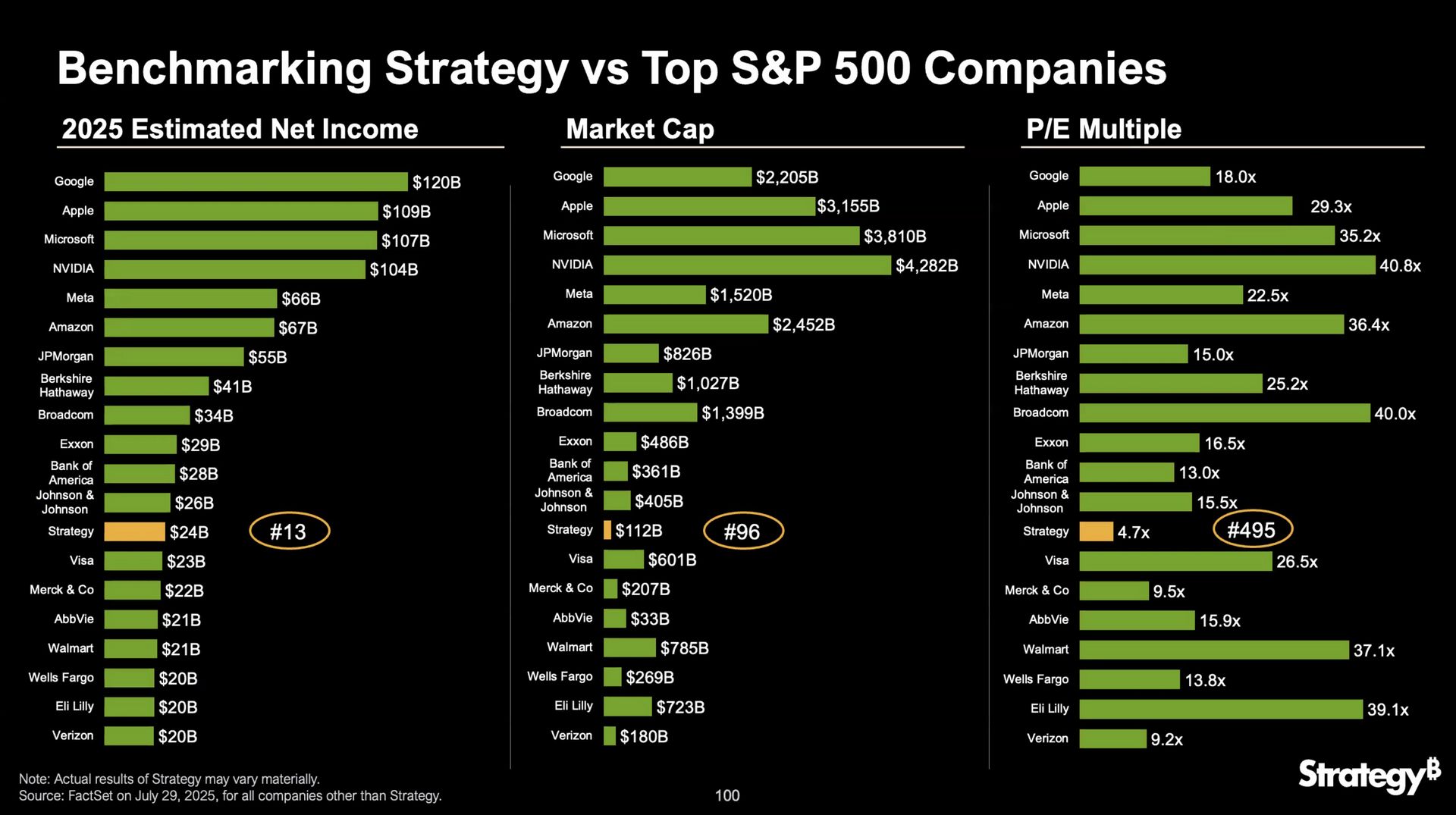

MSTR’s earnings call drew thousands of livestream viewers as the team shared results, growth, and near-term outlook. Most notably: $10 billion in net income last quarter, placing $MSTR among the top 10 most profitable U.S. companies.

During the presentation, Strategy stacked itself up against the S&P 500 and came out swinging. Although not included in the index, it now ranks among the highest estimated net incomes of the top 100 U.S. firms by market capitalization.

And the kicker? Analysts were still projecting negative EPS. Instead, Strategy shattered expectations, beating estimates by over 35,000%. One of the most dramatic accounting-driven turnarounds in Wall Street history… courtesy of FASB.

Shareholder highlight: Strategy has finally set a policy for using the ATM (i.e., issuing new equity). They won’t raise below 2.5× mNAV—only above it.

You’d think that might slow down their Bitcoin acquisition. However, they’re still planning to raise $4.2 billion via a new preferred stock offering: $STRC.

Zooming out: Strategy has added 400,000 BTC in the past year. BlackRock? 740,000 in 18 months. Together, they now hold over 1.3 million bitcoin (6.8% of the total BTC in circulation).

Bitcoin Takes a Breather

Still, despite all the bullish news, Bitcoin dipped to $112,000 over the weekend, and just like that, the top callers are back. Bear market whispers are in the air again.

Let’s be clear: no one’s FOMO’ing yet.

The Accumulation Game Is On

One day, the world will wake up to the fact that Bitcoin is the scarcest asset on Earth. And when it does, every financially self-interested player will have only one move left: start accumulating before it’s too late.

Stay safe and keep on stacking!

-Bam

Trade Bitcoin On Multiple Exchanges

✅Access 20+ exchanges through a single unified experience

📈Advanced technical analysis tools (20,000+ trading instruments)

🏆Execute arbitrage opportunities across various exchanges