Key Takeaways

The bill would let Tennessee hold bitcoin in public funds, with strict caps and gradual buying limits.

Only bitcoin is allowed, with detailed rules for secure, offline custody and audits.

The state could accept bitcoin for taxes or fees, while keeping agency payments in U.S. dollars.

Bitcoin as a Long-Term State Asset

Tennessee lawmakers are discussing a new bill that would allow the state to hold bitcoin as part of its public financial reserves. If passed, the bill would make Tennessee one of the U.S. states looking at bitcoin as a long-term financial asset.

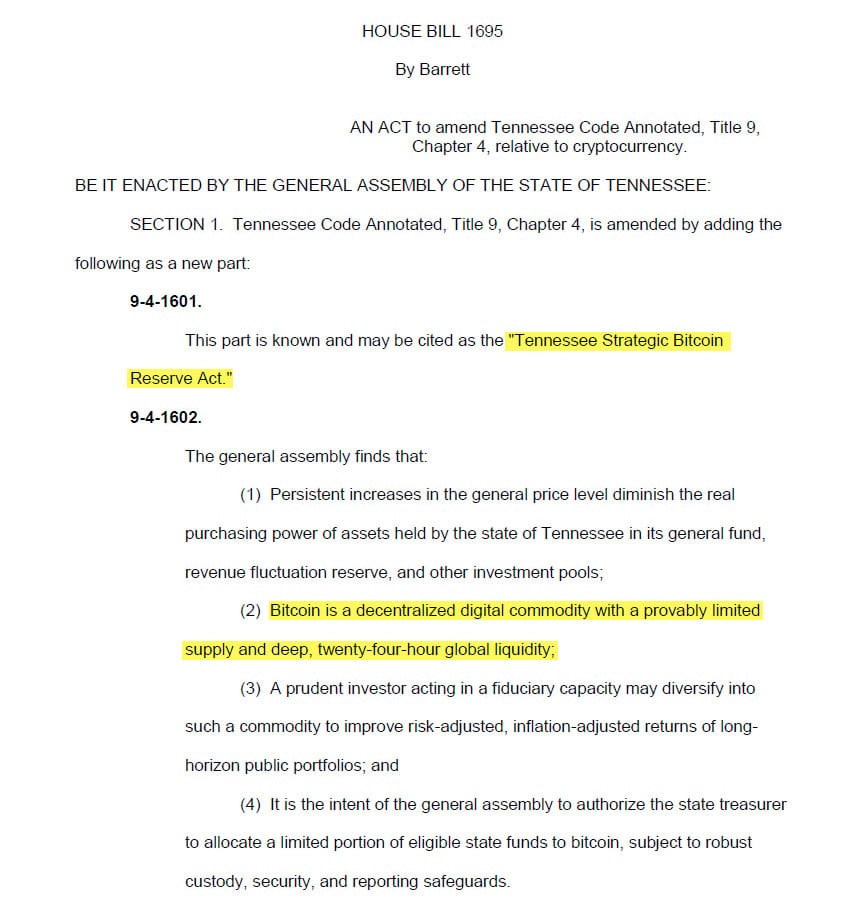

The proposal is called the Tennessee Strategic Bitcoin Reserve Act. It was introduced by State Representative Jody Barrett, a Republican from Dickson. The bill would give the state treasurer limited authority to buy bitcoin using certain public funds.

The bill places clear limits on how much bitcoin the state could buy. At the time of purchase, bitcoin could not exceed 10% of any eligible fund. This cap applies separately to each fund. The bill says the state treasurer may invest money from the following funds into bitcoin:

The general fund

The revenue fluctuation reserve established in § 9-4-211

Any other state fund the general assembly expressly designates

To avoid large or sudden purchases, the bill also limits buying to 5% per fiscal year until the full cap is reached. This means the state would build exposure slowly, over several years.

If bitcoin rises in value after it is purchased, the state would not be required to sell. Lawmakers say this avoids unnecessary trading and lets gains remain untouched.

One key part of the bill is that it allows only bitcoin, not other digital assets. The state would not be allowed to invest in digital asset baskets, alternative coins, or experimental tokens.

Supporters say this reduces risk and keeps the policy simple. The bill describes bitcoin as a decentralized digital commodity with a fixed supply and global liquidity, qualities lawmakers say make it different from other digital assets.

Parts of Tennessee Strategic Bitcoin Reserve Act

By focusing only on Bitcoin, the state would avoid exposure to other digital assets, especially those without any limit in minting or the ones with more centralized control.

The bill includes detailed rules on how bitcoin would be stored. Any custody system would have to keep private keys in encrypted hardware stored offline in at least two locations.

Access would require approval from multiple parties using secure channels.

The system would also need audit logs, annual third-party security reviews, and regular penetration testing. Providers would be required to have disaster recovery plans in place.

Transparency is another major requirement. Every two years, the state treasurer would publish a public report showing how much bitcoin the state holds, how much it cost, and its current value. The report would also include a cryptographic proof so the public can verify the holdings on the blockchain.

The bill would also allow the state to accept bitcoin for taxes, fees, or other payments, if the treasurer chooses to set up such a program. Participation would be voluntary.

Any bitcoin received would be moved into the general fund and recorded at its market value. State agencies would still be paid in U.S. dollars.