In a recent Trump 2024 campaign speech in New Hampshire, Donald Trump, a prominent figure seeking the Republican presidential nomination, made a resolute pledge against the development of a Central Bank Digital Currency (CBDC).

His stance, rooted in concerns over potential government overreach, adds a layer of complexity to the ongoing discourse around CBDCs, especially as the Federal Reserve explores the possibility of issuing one.

Trump 2024: Concerns Over the Fed’s Control

Trump, addressing a crowd on January 17, asserted his commitment to safeguarding Americans from what he perceives as government tyranny facilitated by a CBDC. He stated:

“As your president, I will never allow the creation of a Central Bank Digital Currency. Such a currency would give the federal government, our federal government, absolute control over your money… They could take your money and you wouldn’t even know it was gone.”

This stark opposition aligns with his belief that Central Bank Digital Currencies function as de facto tools for government control, jeopardizing financial autonomy.

Notably, the Federal Reserve clearly states on its website that it has not reached a decision regarding the issuance of a digital currency. The institution emphasizes that any potential issuance would require the enactment of an authorizing law.

Vice Chair Lael Brainard, in his testimony before the House Financial Services Committee in May 2023, examined the benefits and risks of a CBDC. He affirmed that its development is a matter that would unquestionably need Congressional approval.

Trump’s Evolving Views on Digital Assets

Interestingly, Trump does not favor digital assets in general, according to his previous statements.

In 2019, he characterized bitcoin as not being real money and suggested that unregulated digital assets could facilitate illegal activities. Moreover, he had previously expressed skepticism about Bitcoin, stating that it “just seems like a scam,” emphasizing his preference for traditional fiat currency.

However, Trump’s evolving relationship with the blockchain industry is evident in his release of several non-fungible token (NFT) collections, showcasing a nuanced perspective on blockchain technology if its beneficial to him, despite his opposition to Central Bank Digital Currencies and Bitcoin.

Official records from August 2023 revealed that Trump possessed a digital wallet with digital assets valued at $2.8 million.

Broader Global Trend

Trump’s stance echoes previous promises made by candidates for the U.S. presidency, notably Florida Governor Ron DeSantis, who pledged to alleviate regulatory pressure on the digital asset industry. He promised to prevent the issuance of what he considers a potentially dangerous CBDC.

Related reading: Congress Advances Pioneering Anti-CBDC Bill to Curb Surveillance

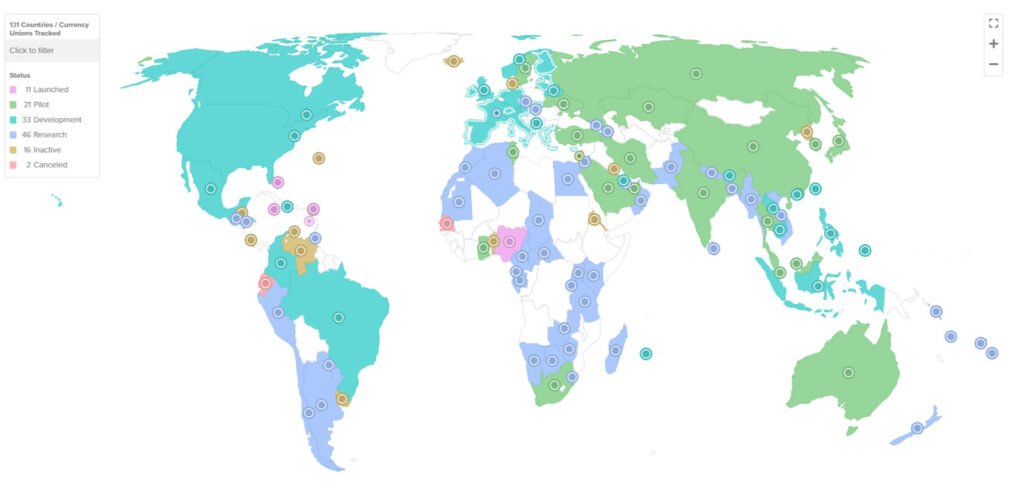

The negative sentiment towards CBDCs emerges as a notable point of contention within the U.S. political landscape. This is in contrast with the broader global trend where numerous countries, accounting for 98% of the world’s GDP, are actively exploring CBDCs.

Notably, the CBDC tracker compiled by the Atlantic Council reveals that 130 countries are actively exploring CBDCs, with 64 countries already in the advanced phase.

In particular, the European Central Bank (ECB) entered the “preparation phase” for a digital euro in October 2023, with China completing its first international crude oil trade using the digital yuan simultaneously.

As the global digital asset community grapples with the implications of CBDCs, it remains to be seen how political, economic, and technological considerations will shape the future of the industry.