Bitcoin is perhaps so far the greatest success story of the 21st century. It is also the most controversial and thought-provoking. It is, therefore, not at all similar to conventional success stories like Berkshire Hathaway, a storied American conglomerate. However, SkyBridge Capital founder Anthony Scaramucci, the major institutional investor, believes Bitcoin is the Berkshire Hathaway of the 21st century.

Who is Anthony Scaramucci?

Anthony Scaramucci aka The Mooch is a recognizable name in conventional investing circles. He is also a major Bitcoin proponent, one of the early such examples to come from a major fund manager. Scaramucci’s SkyBridge Capital firm is heavily invested in digital currencies and companies associated with the larger digital asset economy.

He recently tweeted that Bitcoin is a “compounding wealth generation machine” for investors. He drew parallels with the trajectory of Berkshire Hathaway which is one of the biggest success stories of the 20th century.

Scaramucci was also infamously part of former US President Donald Trump’s cabinet for a chaotic couple of weeks and got fired at the end of it. His short stint was comical and didn’t leave a positive lasting impression in the eyes of the public. However, in the investment scene, he is quite successful, even if at times flamboyant and over-the-top.

What is Berkshire Hathaway?

Founded as a textile company back in the 19th century, Berkshire Hathaway started diversifying in the second half of the 20th century under the leadership of Warren Buffet. Buffet, now one of the wealthiest people in the world, is credited with much of the success of the company. He invested in other companies, bonds, investment funds, etc, and made a fortune.

Berkshire Hathaway was unique because instead of encouraging short-term/spot trading, it prioritized investors and investments in the long term. Its confidence in strong companies like Coca-Cola, Dairy Queen, IBM, and Apple resulted in sustained results that resulted in the organization being famed for defining blue-chip companies.

Is the Comparison Realistic?

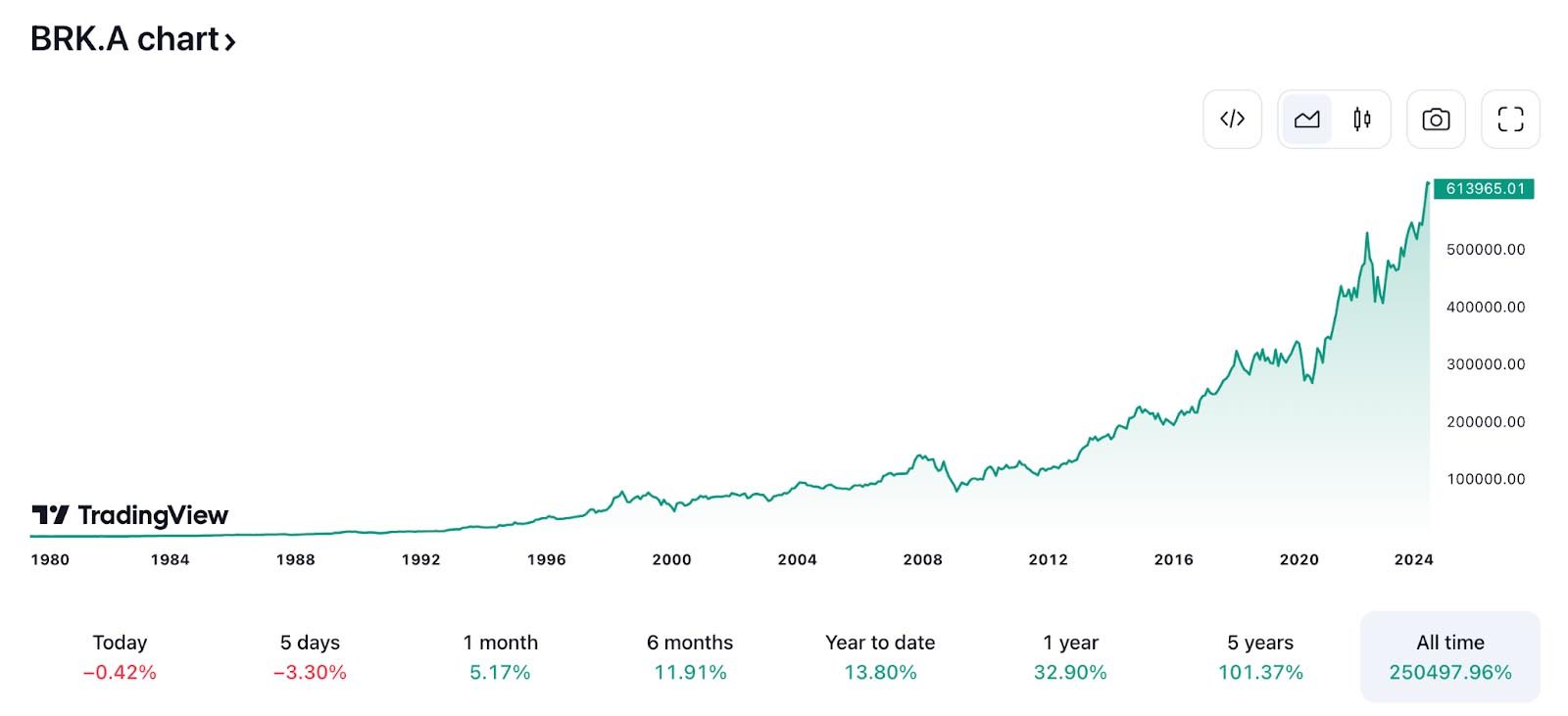

Here is the chart for Berkshire Hathaway to date:

The stock price has appreciated a massive 250,500% during the last 44 years for the company. This makes it one of the biggest success stories of the 20th century. Yes, several other companies like Microsoft, Apple, IBM, etc. had a great 20th century but they all built something. Berkshire Hathaway’s success is down to shrewd investments.

Bitcoin has risen more since its launch but the comparison isn’t fair. Berkshire Hathaway was an established company and therefore its progress was going to be substantial, but steady.

Bitcoin on the other hand is an entirely new digital asset class and had to start from scratch, quite literally. This is why notable investors like Scaramucci are betting heavily on the digital asset market and are ready to go all-in on it. They believe it is an opportunity of a lifetime.

Is Berkshire Hathaway Investing in Bitcoin?

Warren Buffet and his old guard at the company don’t approve of Bitcoin and that hasn’t changed with time. So, the company is not involved in Bitcoin….yet. As a new generation of investment managers comes to the foray at the conglomerate, a change in policy can be expected in the near future.