This article was originally published by Nik Bhatia and Joe Consorti on Substack.com

In such a volatile macro landscape, it’s hard to soar above the clouds at 30,000 feet and view bitcoin as anything other than a high-beta risk asset that is beholden to the everchanging backdrop of Fedspeak, economic data, and the market cycle.

Bitcoin is a macro asset, but it is also the first verifiably scarce commodity and imbues all citizens of Earth with property rights, regardless of whether or not their country of residence honors such basic human freedoms. Let’s take a step back from the macro investor’s chair and observe how bitcoin is advancing in its own right.

Related reading : Freedom Money, God’s Money

Bitcoin 2023: Global Bitcoin Adoption Has Only One Direction

Statistics updated last month indicate bitcoin adoption in global markets is growing at a steady clip, but accelerating in emerging market nations. While the study surveys between 2,000 and 12,000 participants in each country regarding their ownership and use of cryptocurrency, the example provided was bitcoin—given that bitcoin’s market cap continues to trounce that of the total cryptocurrency market, it’s safe to extrapolate that the majority of respondents are referencing bitcoin.

In Nigeria, a country with a dire leadership situation and questionable property rights, ownership and use of bitcoin has nearly doubled in the past three years. Compared to the US, where only 5% of respondents mentioned using bitcoin, one out of every three respondents in Nigeria mentioned ownership and use of bitcoin. Bitcoin is the apex vessel for securing individual property because it is inaccessible to anyone apart from the owner when stored properly. For those outside of developed Western nations, memorizing the keys to your wealth and taking it with you anywhere without fear of encroachment by a state authority is revolutionary—the rapidly growing adoption in Nigeria is indicative of this.

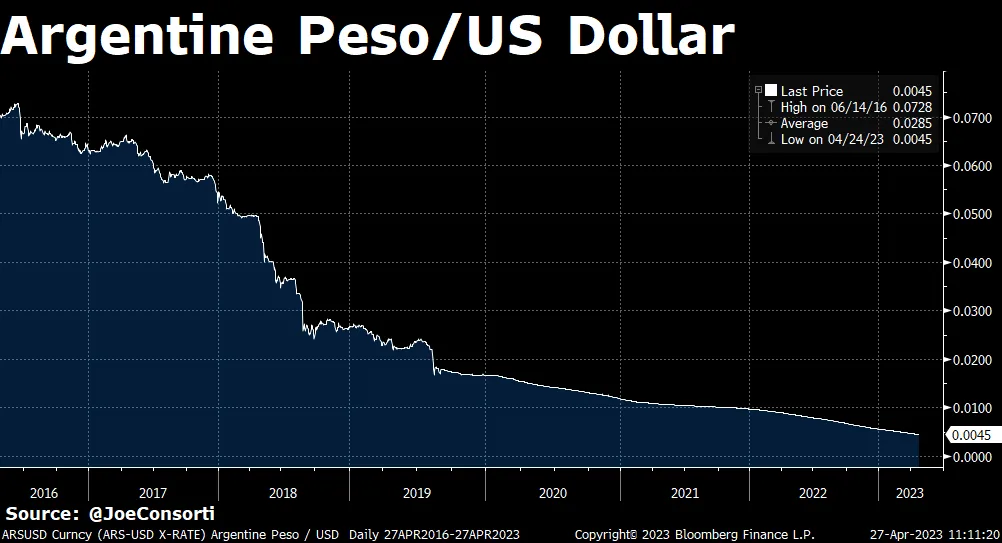

Argentina, a country now laying claim to its third World Cup title, is faced with triple-digit monetary inflation and vice-grip capital controls that prohibit the outflow of dollars. Argentine ownership and use of bitcoin has more than doubled in the past three years—with one in three citizens owning or using bitcoin. Citizens of Argentina are living through persistent double, or even triple-digit monetary debasement:

Trading BTC as if it were the Nasdaq is a luxury reserved for people in countries with stable currencies. Bitcoin’s unique properties, in countries such as Argentina, become apparent when access to dollars is restricted, and there is but one escape hatch. Bitcoin is now worth 6.45 million Argentine pesos, up from ~300,000 just three years ago:

Turkey is faced with the same endlessly-inflationary currency regime. The Turkish lira is down 85% against the US dollar since 2016—bitcoin has appreciated 19 times over to 569,000 Turkish lira. Like in Argentina, ownership and use of bitcoin in Turkey has doubled in three years. When your currency is collapsing, absolute scarcity starts to make a lot more sense.

Related reading : Bitcoin Is Digital Scarcity

There are over 50 countries in which the bitcoin adoption rate is 10% or higher, and 20 countries with an adoption rate of more than 20%. Bitcoin is now undeniable. Amidst a sea of rent-seeking “cryptocurrencies” created by opportunistic venture capitalists, bitcoin stands alone as neutral, immutable money with rules, but no single ruler. Whether you reside in a nation that doesn’t respect human liberties or fleeing a collapsing currency regime, bitcoin is the ubiquitous choice.

Capital and Money Markets

We’ve long said here at The Bitcoin Layer that in order for bitcoin adoption to accelerate globally, we would witness blossoming bitcoin-Lightning-native businesses. Venture capital investment into the bitcoin sphere is gaining serious traction, alongside emergent bitcoin-native active capital allocation methods.

Trammell Venture Partners (TVP) just released a stellar report on The emerging Bitcoin-native venture capital landscape, and it is inundated with key insights about the growth and trajectory of venture capital that is 1) bitcoin-native and 2) leverages its protocol stack such as Lightning Network.

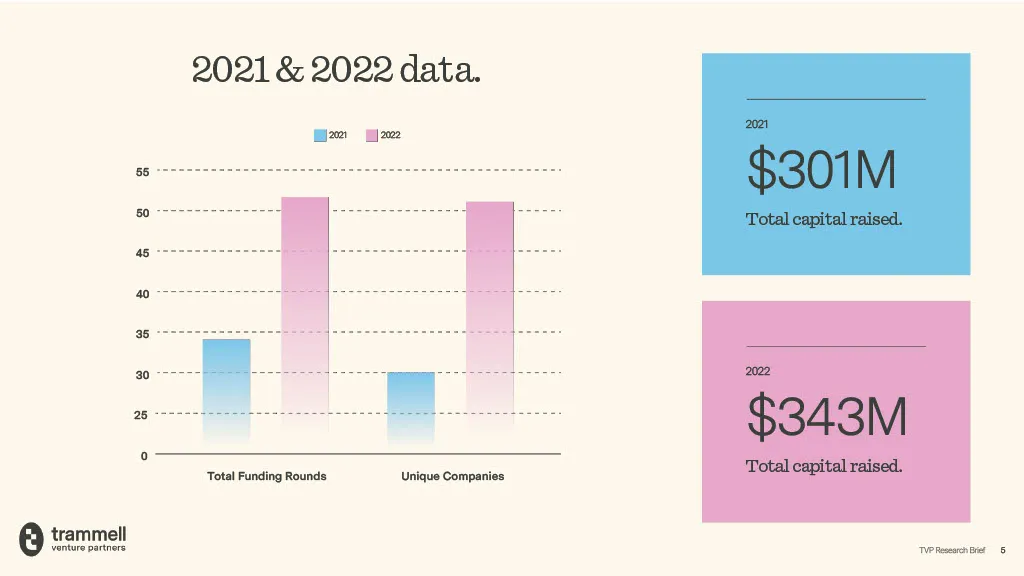

Activity in the bitcoin VC space ramped up in 2022, with total funding rounds increasing from 34 to 52, unique companies increasing from 30 to 51, and total capital raised increasing from $301 million to $343 million. Despite the dismal price action in 2022 compared to 2021, much more new business activity and capital allocation happened in the Bitcoin space than the year prior:

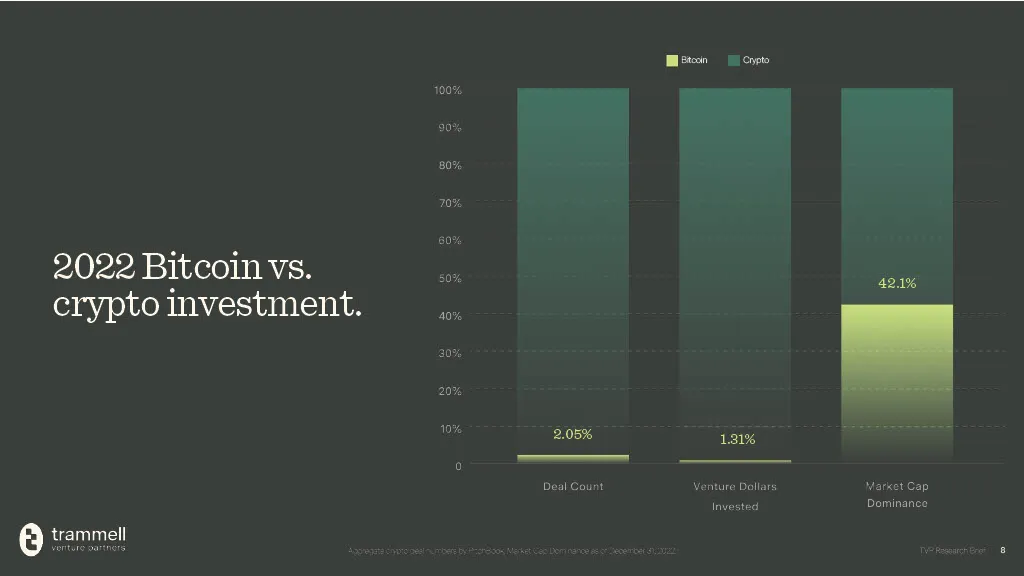

Despite this impressive rise in activity in bitcoin’s own right, venture capital investment in crypto broadly is still head and shoulders above bitcoin. Even though bitcoin makes up 42.1% of the total crypto market cap at the time of writing, it only accounted for 1.31% of venture dollars invested in 2022—that’s a massive disparity, and reflects a severely distorted capital allocation skewed away from bitcoin and towards projects that make up a considerably lower portion of actual market capitalization:

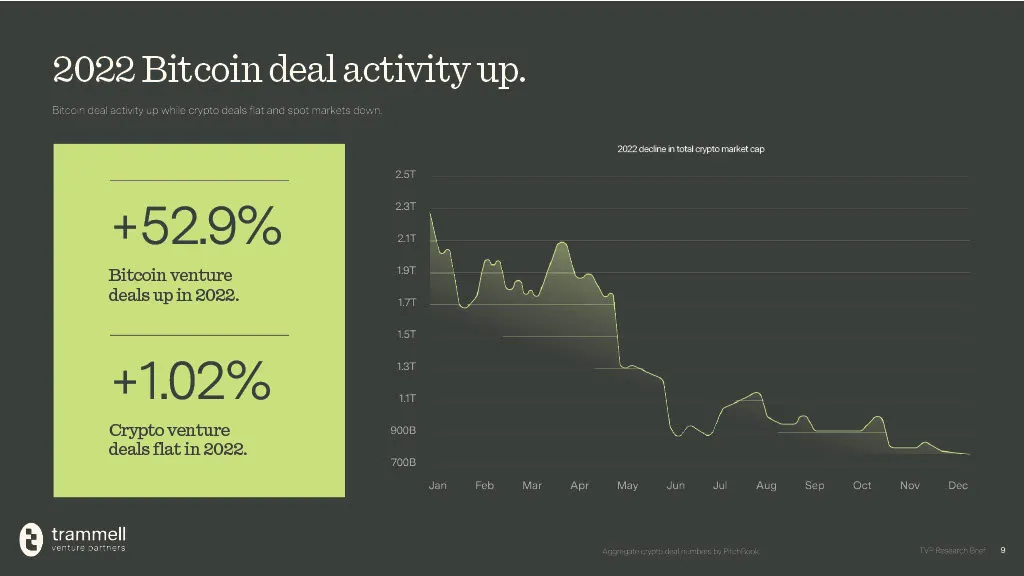

Crypto VC is bloated, with zero interest rates in the wake of the pandemic and excessive fiscal stimulus likely pushing investors out on the risk curve and investing in the highest-yielding projects available. Now that we’re living through a period of creative destruction, wherein positive real yields are destroying companies and projects that can only survive negative real interest rates, far fewer crypto venture deals are being pursued. In 2022, bitcoin venture deal activity was up 52.9%, compared to a very lackluster 1.02% rise in crypto venture deals. Buzzwords like metaverse and web3 and DeFi cannot save you from a 5% cost of capital:

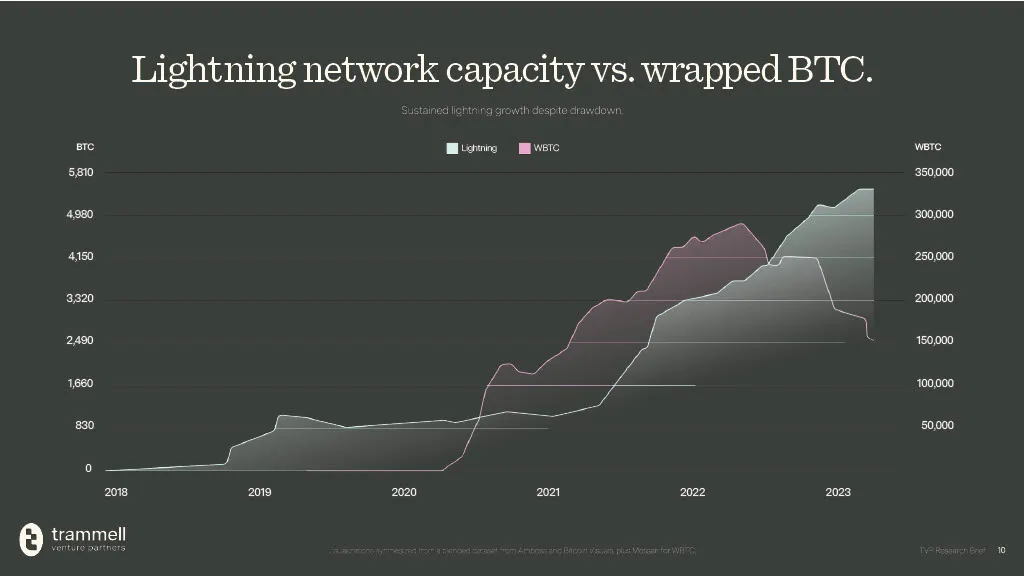

Comparing bitcoin scaling solutions, Lightning Network (LN) is starting to take the lead on a growth basis relative to WBTC (wrapped bitcoin in other blockchains). LN capacity, while still lower than total WBTC across different chains, is persistently growing while WBTC has been in a secular decline. People are shifting their capital toward bitcoin-native scaling solutions and away from altcoin blockchains:

There has been a severe misallocation of capital towards companies building crypto stacked up against companies building on Bitcoin; VC firms like Trammell Venture Partners are on a mission to narrow that gap. Fully-fledged capital market activity is becoming the norm for Bitcoin and Lightning. With an active and highly liquid market of firms building on and adjacent to the bitcoin, its liquidity profile and network activity stand to magnify several times over—if you build it they will come.

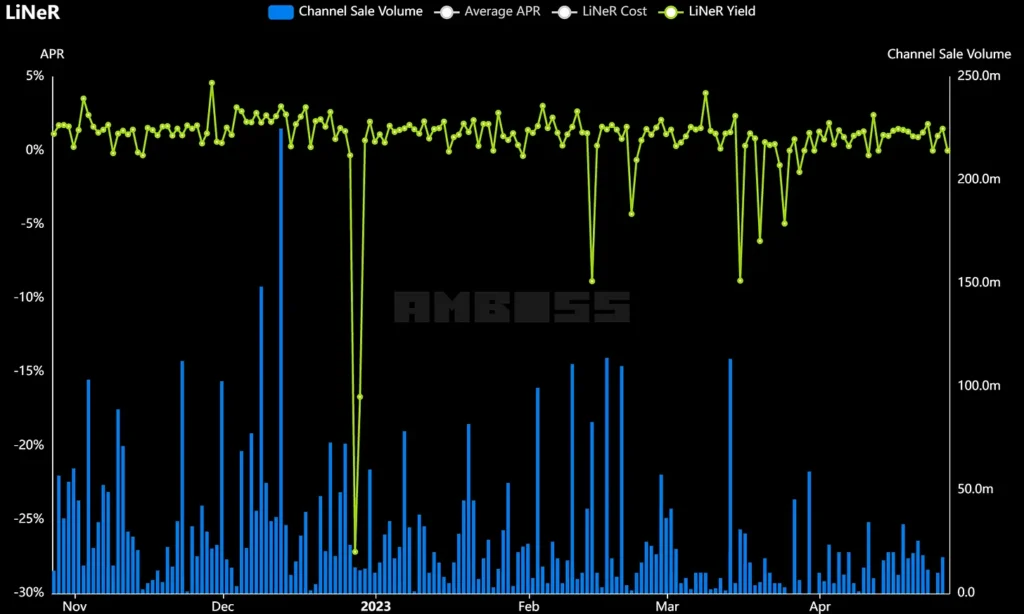

On the side of short-term lending, there are many instruments native to the Lightning Network that allow people to capture a rate of return for allocating capital efficiently. Operating LN channels is one method of capturing yield, but yet another way is lending already-created Lightning channels to other network participants for a specified duration.

Enter LINER, which stands for the Lightning Network Rate, and which harkens to traditional money market reference rates such as LIBOR. LINER is the annualized rate of return on leasing LN channel liquidity. There are several marketplaces where this can happen, but LINER is calculated using channel sale data from the Magma Marketplace by Amboss. Allocating liquidity in the form of leasable LN channels to one another is a valuable service that network participants are willing to pay for, and such transactions bring the first widely-published instance of a risk-free reference rate to BTC/LN. Currently, LINER is at ~2.5%, but fluctuates in a wide range due to relative illiquidity compared to other money markets:

This is a monumental step towards attracting sufficient capital for Bitcoin to become a deep and liquid collateral market. A standardized and regularly published rate of return on capital attracts capital allocators who seek a positive real return. With this publicly available time value of bitcoin comes competition, driving rates lower and driving even more liquidity onto Bitcoin and the Lightning Network. We believe this market will one day be deep and liquid enough to exist as a viable collateral market on the world stage alongside corporate bonds and US Treasuries. This could play out over decades, but we view the rise as being one that rivals, challenges, and even defeats anything in the non-dollar sphere.

While US Treasuries are the universally agreed-upon benchmark rate, the Lightning Network is arguably closer to the proverbial “risk-free” moniker that USTs currently have. While LN incurs its own unique risks like inactive peer risk, hot wallet risk, and forced closure risk, it does not have the (albeit minimal) credit risk and default risk, both implicit in the form of debasement and explicit in the form of actual default. Also, all reference rates native to bitcoin and Lightning are unmanipulated by a central authority and set entirely by the free market’s demand for efficiently allocated capital, unlike with US Treasuries which can be influenced by the Federal Reserve’s suite of policy rates. We are several trillion dollars away from Bitcoin rivaling US Treasuries, but the properties of the bitcoin protocol stack offer a potentially superior set of characteristics for banks and fixed-income investors looking to park their idle capital.

With Magma Marketplace’s standardized lease durations that act like a traditional fixed-income duration, it’s possible to construct a Lightning Network-derived, bitcoin-denominated yield curve with different tenors. A regularly-published yield curve attracts human and physical capital to innovate, participate, and compete to generate a positive return on capital—a bitcoin-native yield curve for the world to see will drive innovation, efficiency, and liquidity into the asset.

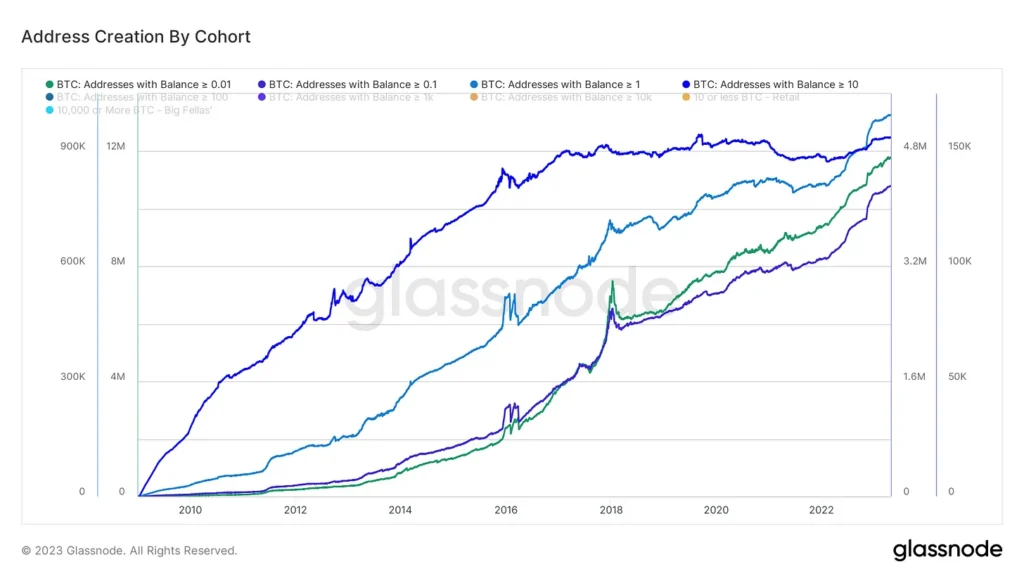

Stripping away the macro environment and staring down from 30,000 feet, bitcoin is proliferating across the globe. Whether purchasers and participants are capital allocators leveraging bitcoin-native financial instruments to generate proverbially risk-free yield, or residents within an inflationary or tyrannical nation seeking asylum in the form of digital property, they are coming to the network regardless of price, in every shape and size:

Related reading: