Part 1 – A Rat Experiment

Today I watched a science YouTube video that showed how rats could be smarter than human beings. It was a Veritasium production on the four things it takes to become a master.

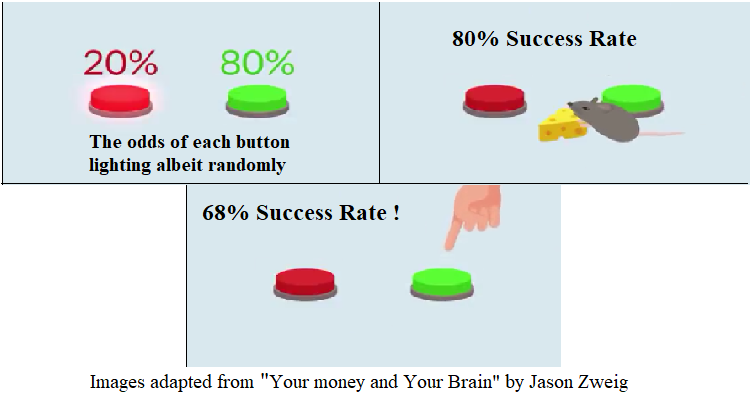

In the video, a red button and a blue button were set up. The red button flashes 20% of the time and the green button flashes 80% of the time but the flashes are purely random. If one presses the green button a second before it flashes, they get a reward of snacks and if one presses the red button a second before it flashes, they forego the punishment of a mild electric shock.

Also, a false prediction of the red button (you press red but then the green button lights) leads to electric shock while you miss the snacks. If you do not press any button, you miss the snacks but still get the shocks on schedule i.e. whenever the red button lights.

So, could there be a strategy in which you can guess when the green button will light, so that you get snacks, but also predict when the red button will light so that you miss being punished with an electric shock?

When the rat is put in the cage, it realizes that predicting when the red button will light is futile. You cannot predict a random sequence. So it maximizes its happiness by continuously pressing the green button. Hence 80% of the time it is happily eating and 20% of the time, buzzz.

When a human subject is put to test, however, something interesting happens. The human tries to predict the red button even after realizing that the button does not follow any pattern. As a result, they waste valuable time they could have spent hitting the green button for snacks, with trying to predict the red button and avoid a shock.

End result: They get shocked 32% of the time while only getting snacks 68% of the time.

They perform worse than the rat!

They just cannot accept that the best result is the statistical averages of 80% for green and 20% for red.

* * *

Part 2 – The Market

The point is, for any field of human endeavour without repeated experience over the same types of problems, claims of mastery in that field are pompous and perhaps come from knowing how to act in that environment, not from predictive power.

For example the best stock traders have access to some sort of insider information, or are good at reading people’s body language (subtle insider information), or are good at making people like them. They are not necessarily good at predicting the best stocks. The same goes for political pundits.

Like in the above experiment, most people cannot accept the fact that trying to beat the market is futile and the best strategy is to simply buy index funds or stocks spread out over as many of the high performing companies as possible and continuously stack your asset portfolio, with bitcoin 100% included because no other asset has performed as well as it has in the 13 years since Bitcoin was released in 2008.

This is because the market performs predictably in the long run as per the well-grounded physics of resource optimization and technological progress. An example is Moore’s law for the doubling of the number of transistors every 10 years, and Swanson’s law for the halving of the price of renewables per watt. But these laws are over the long haul.

Like the gas laws work exceptionally well when you are dealing with an aggregate of millions upon millions of gas particles, the economy works well when you look at the big picture in terms of resources available and how the curves of progress are behaving every five or 10 years.

But try predicting the motion of a single gas molecule and you will know it is impossible. Same as trying to outperform the market on a day-to-day, hour-by-hour basis. Even worse is a minute-by-minute basis.

How about high speed trading algorithms on Wall Street?

They make use of the fact that a lot of people are trying to get a quick buck yet their fingers are not as fast as the signals of the AI bot. So they make profits from human traders’ losses.

And as any seasoned trader dedicated to actually building long-term wealth will tell anyone, you buy hardest when the market has collapsed. Since bitcoin is the greatest asset in the world market as I type this on August 4, 2022, I’ll simply say the same boring words that your grandparents told you about stocks, but applied to bitcoin.

Stay humble, and stack sats.

And if you really can’t help trying to beat the short-term randomness of the market, at least go for the asset that plays with more profits overall. This will yield better in the short term when it does. You know which one.