Something very significant took place in April 2023, which forever changed the calendars of Australian Bitcoiners. Bitcoin Alive, the first, biggest and best Bitcoin only conference was launched in the land down under, with the 2024 event now just a few weeks away.

The opening panel for the 2023 conference started with a simple, but important question; What is Bitcoin anyway? The discussions throughout the day revolved around this topic, with answers ranging from an idea whose time has come, to the ultimate savings technology, a source of stability for energy grids, and of course, the scarcest asset on earth.

With the 2024 event just a few short weeks away (23 March), it is worth revisiting this critical question, what is Bitcoin anyway? This time, we will help demonstrate just how successful Bitcoin has become across a variety of domains, as it happened within the data.

A Superior Savings Technology

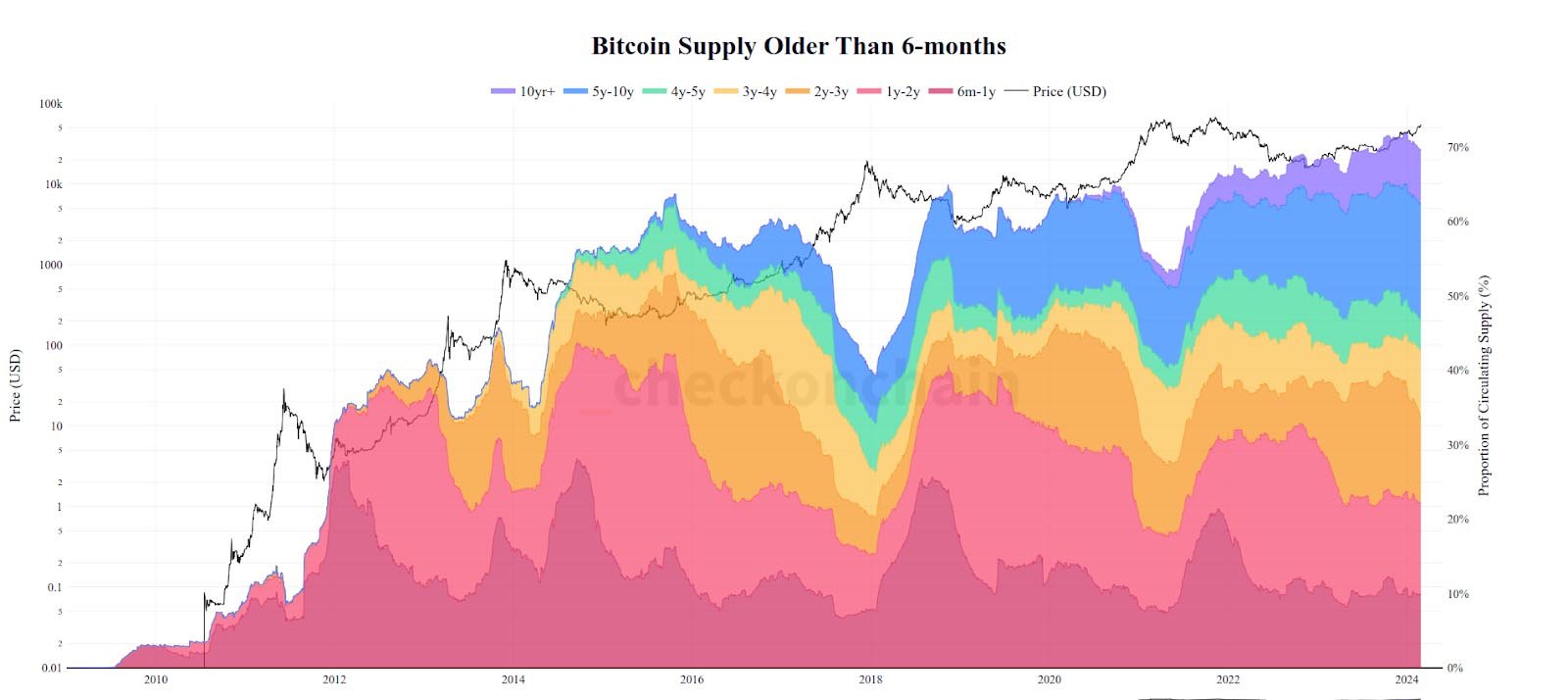

Is Bitcoin really a savings technology? The owners of around 70% of the supply appear to think so, as these coins have not moved on-chain for at least 6-months. Over the last 6-months, Bitcoin prices have rallied from $26k to over $57k. For HODLers to still be sitting tight after a 120% gain tells you they are looking for higher prices.

With the launch of the spot Bitcoin ETFs in US markets, there is an influx of institutional investors asking the same question. For these guys, they need hard data to justify to their clients why they should have an allocation to BTC over stocks, bonds, or…wait for it…even gold. So let’s bring Bitcoin’s performance into their world.

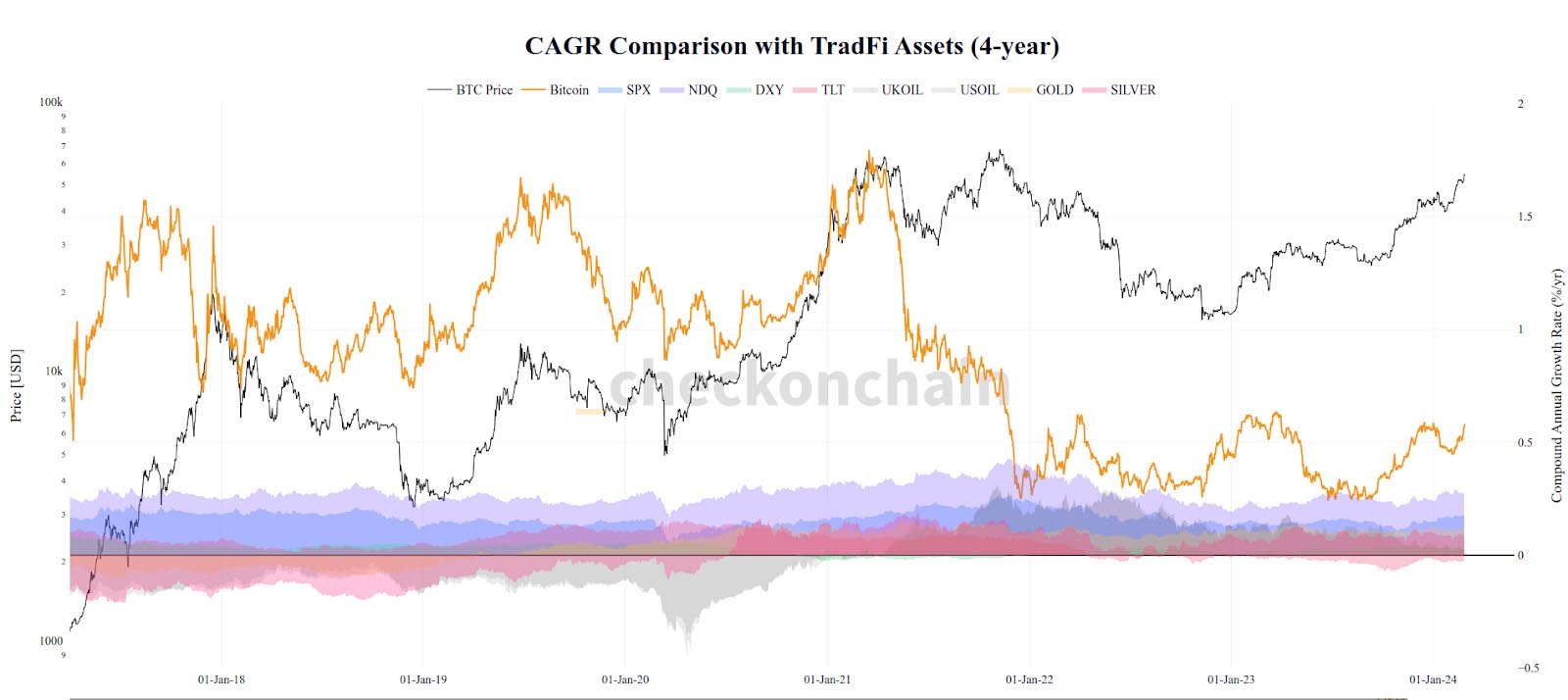

Bitcoin currently boasts a Compound Annual Growth Rate (CAGR) of +58% per year over a typical 4-year halving cycle. In the chart below we can see how BTC (orange) leaves TradFi assets in the dust, compared to +27% for the NASDAQ100, +17% for the S&P500, +7% for Gold, and a pretty nasty -2% loss for long dated US treasury bonds.

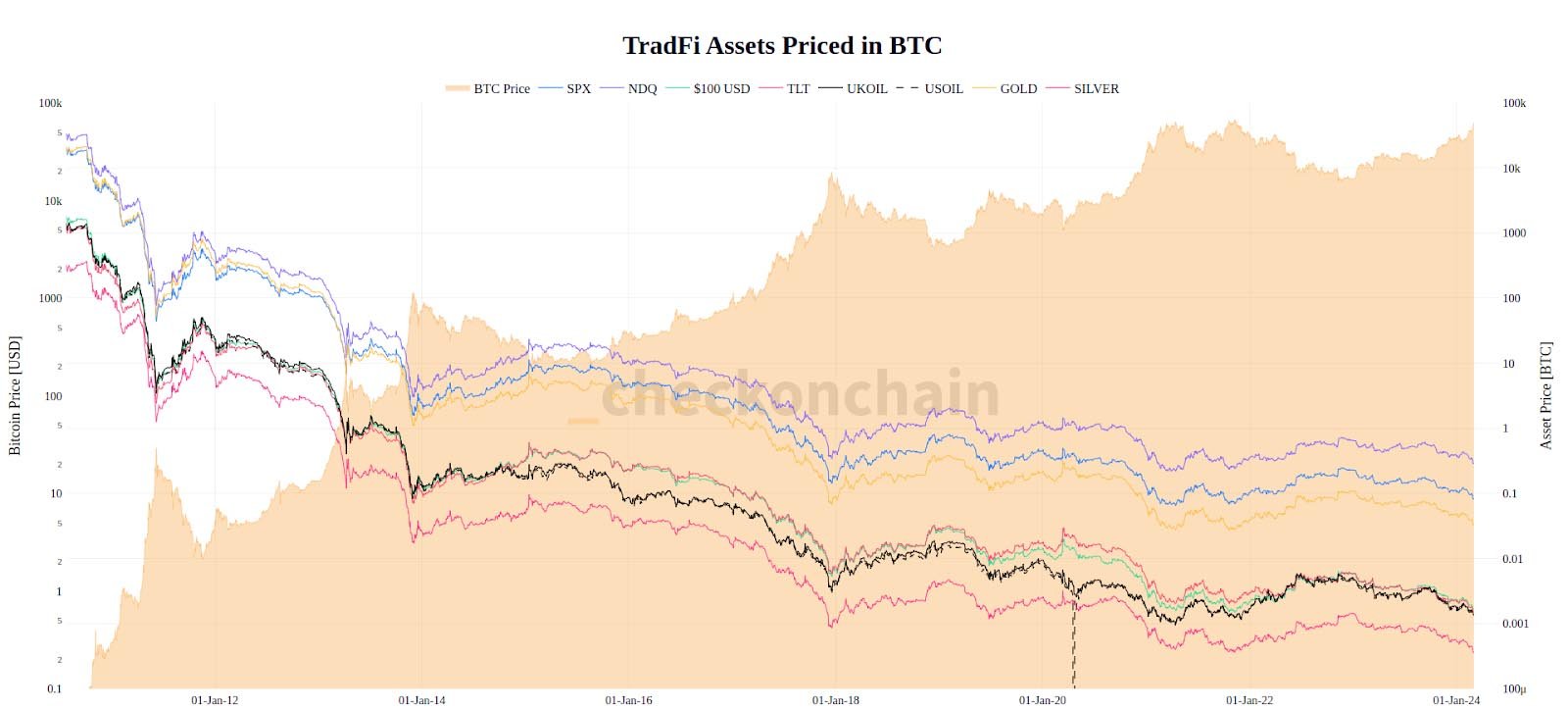

Even on a risk-adjusted basis, Bitcoin continues to outpace TradFi assets, whether we measure it via any one of the Sharpe, Sortino, or Calmar Ratios. If someone was so inclined, they could also value TradFi asset classes in BTC terms to compare relative performance. No doubt it would show that Gold is outperforming Bitcoin massively…right?

So by many metrics, even those commonly used by TradFi analysts, Bitcoin does appear to be emerging as a superior asset for preserving wealth, and saving money for the long term.

Keeping Our Energy Grids Stable

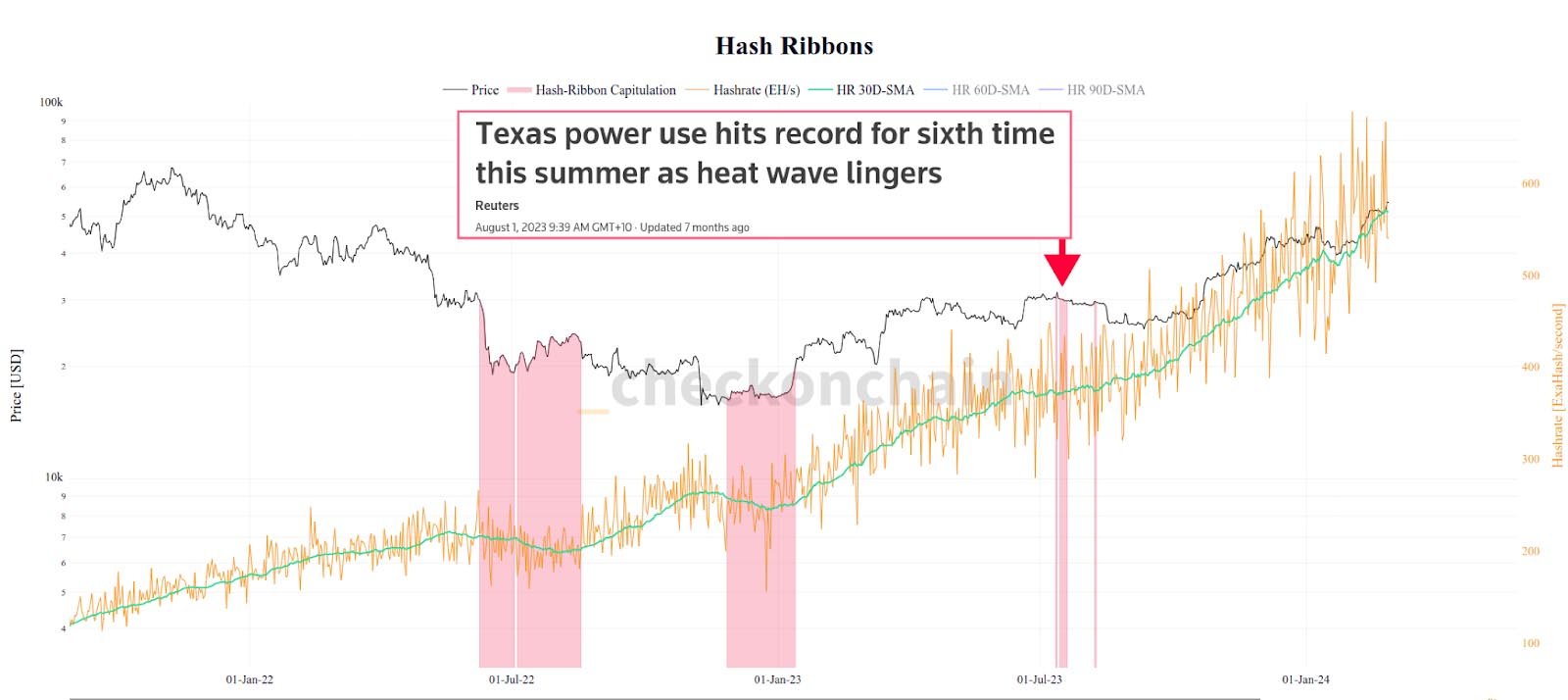

Did you know that the Bitcoin hashrate is now affected meaningfully by the weather in Texas? In July and August last year, an extremely hot summer resulted in a huge uptick in demand on the Texas energy grid.

Not only is Texas a Bitcoin friendly jurisdiction, but the energy grid operator ERCOT oversees a relatively deregulated energy grid, and is open to innovation. The result is that many Bitcoin miners have migrated to Texas, and now participate in load balancing programs. These miners effectively consume any cheap and excess power 99% of the time, but wind down their operations and sell that power back to the grid during periods of extreme demand by the public.

The net result is both a more stable grid overall, more consistent and reliable matching of supply and demand, and ultimately cheaper prices across the board. Bitcoin reducing the average energy bill probably wasn’t on the bingo card just a few years ago.

The Foundation of Value Settlement

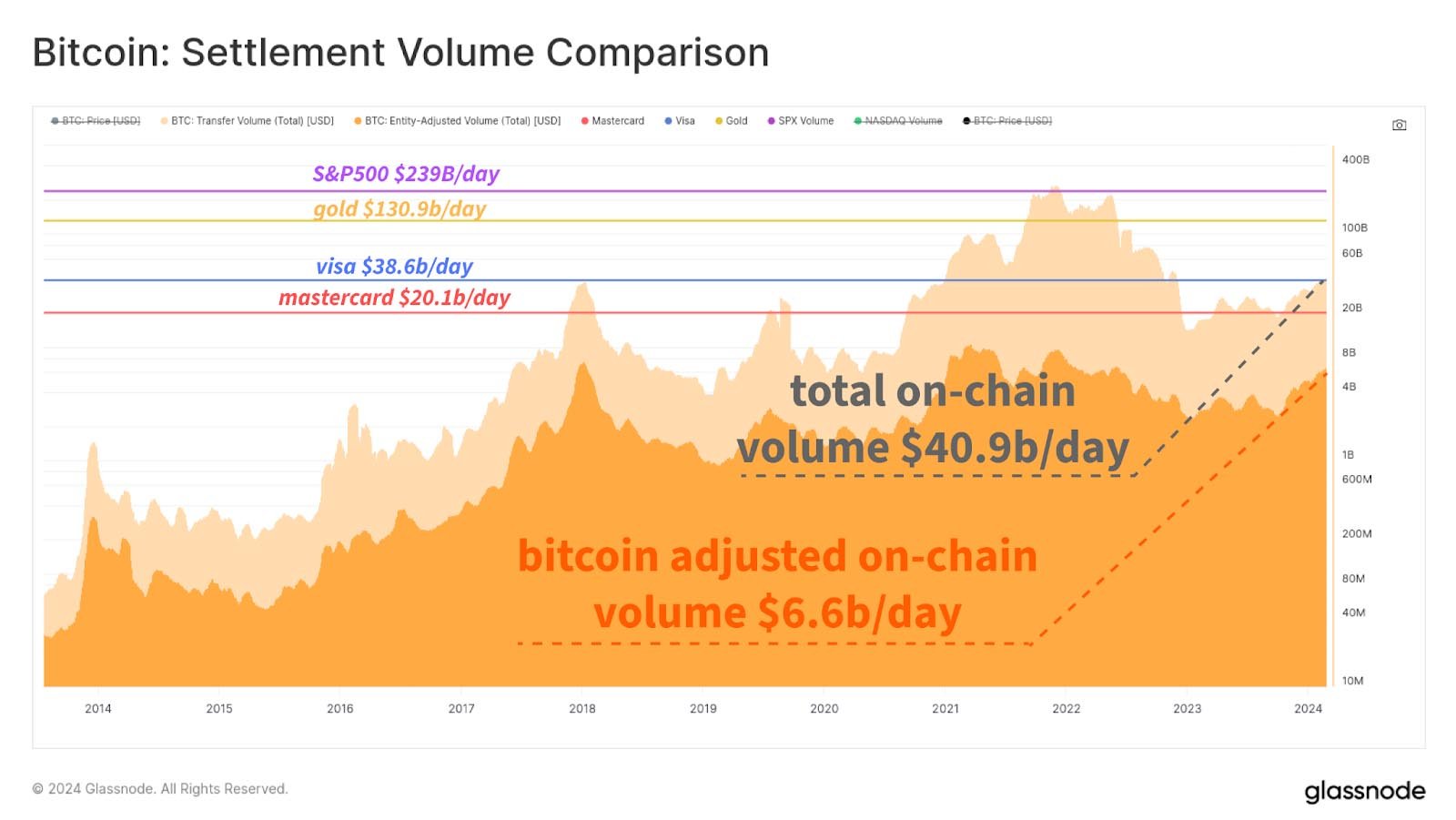

Bitcoin has been designed in a way that maximises security, reliability, and resilience. As a result, the Bitcoin mainchain was never intended to be used for buying your morning coffee. Instead, it is more closely related to the monetary base, with the network being used for ultimate value settlement. One could argue Bitcoin is already well on the way to achieving that goal, even when we compare it to the volume settled by other major TradFi networks (many of which are not even final, but are delayed settlement).

If we measure the raw unfiltered BTC volume moving on-chain, Bitcoin currently settles around $41B in value every day. For a sense of scale, Mastercard does $20.1B and Visa $38.6B in volume processed per day, so Bitcoin is absolutely in the big leagues.

Now as honest Bitcoiners, we must of course filter on-chain data to remove non-economical self-spends, and exchange wallet management transfers. However, even by this filtered metric, the economical value settled on-chain is around $6.6B/day.

This puts 15-year old Bitcoin at 17% of the volume processed by 65-year old Visa. Not half bad really.

The Scarcest Asset Of Them All

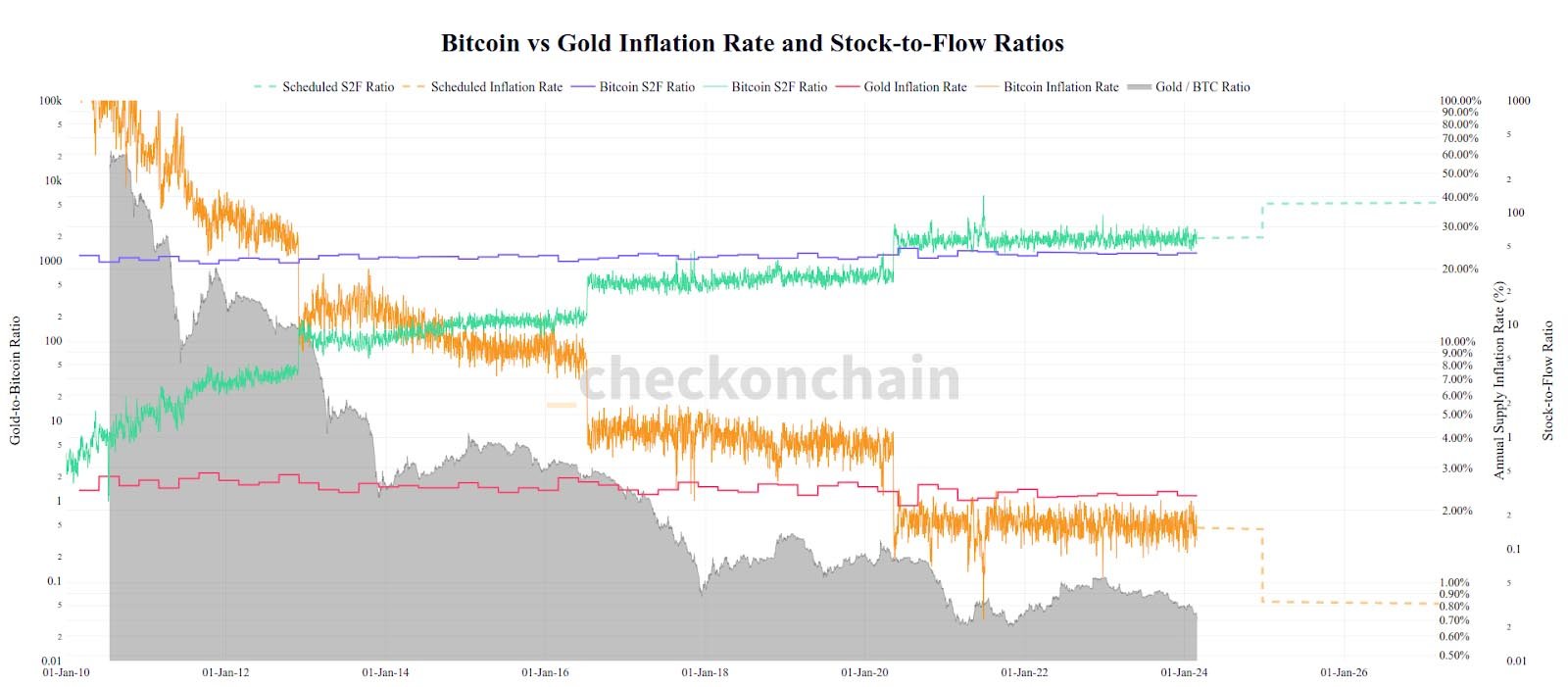

Not only have the new spot ETFs joined the humble sat stackers as a major accumulator for BTC supply, but the fourth halving event is just over the horizon. Over the last four year epoch, Bitcoin and gold have had a relatively comparable annualised inflation rate of 1.75% and 2.25%, respectively.

However, after the April 2024 halving event, the rate at which new BTC are issued to miners will fall to just 0.8%/yr, pushing the Bitcoin’s stock-to-flow ratio to ~120, the highest of any asset. This means at an issuance rate of 3.125 BTC/block, it would take 120 years to reproduce the circulating supply. However, we all know we don’t have 120 years, it halves again in 2028…and again in 2032.

The scarcest asset of them all.

Don’t Miss the Bitcoiners at Bitcoin Alive 2024

Bitcoin, and the Bitcoiners who love it are living through a historical moment in 2024. I can’t think of a better way to celebrate than catching up with the cracking crowd of Bitcoiners at the Bitcoin Alive conference on March 23, 2024. You will catch me (Checkmate) on stage covering the indicators and tools I will be watching to spot when this bull market really enters silly season. We will be exploring the tell-tale signs that things are getting a bit hot near the top.

This conference will be packed full of brilliant minds, from Australia and beyond, on the stage, and in the stands. You really don’t want to miss this one folks, so be sure to grab yourself a ticket, and feel free to say G’day if you see me there!