This article discusses the strategic growth of Bitcoin Depot, A leading ATM provider, focusing on its efforts to enhance access to Bitcoin through significant expansion initiatives.

It highlights the company’s approach to integrating bitcoin transactions into mainstream financial systems, aiming to make Bitcoin more accessible to the general public through strategic placements and technological advancements.

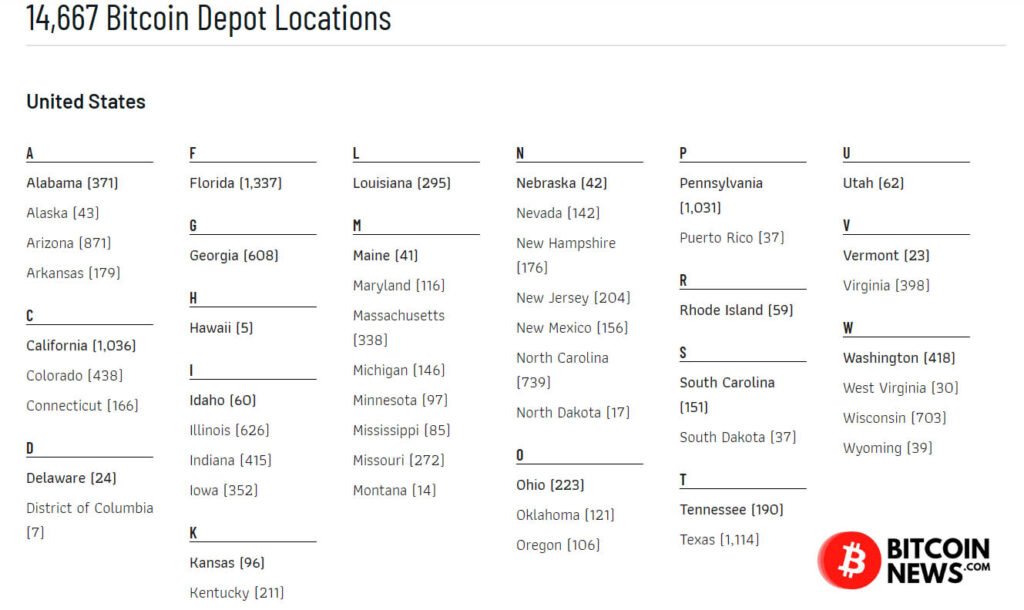

Bitcoin Depot, founded in 2016, has rapidly grown into the largest Bitcoin ATM (BTM) provider in North America.

With a strategic business model that bridges traditional cash transactions with Bitcoin and other digital assets, the company has transformed the financial landscape by making Bitcoin accessible at physical locations across the U.S.

“We are the #1 Bitcoin ATM operator in the United States. We currently operate over 7,000+ Bitcoin ATMs and we have over 6,000+ BDCheckout locations across the US and Canada.

– Source

How Do Bitcoin Depot ATMs Work

1. Create a Digital Wallet: To use one of the BTMs, you’ll need a digital wallet. If you don’t have one, you can create one with the Bitcoin Depot app.

2. Enter Your Information: At the BTM, start by selecting the amount you wish to purchase. You will then be asked to enter your phone number, name, and email address.

3. Verification: A 5-digit verification code will be sent to your phone. Enter the code at the kiosk.

4. Select Your Wallet: You will be asked to provide your digital wallet address.

5. Complete Your Purchase: Insert your cash into the BTM. Once the transaction is complete, choose print or email for your receipt. Your bitcoin will hit your wallet within minutes.

Bitcoin Depot significantly expanded its network by deploying 940 new ATMs in national convenience stores, marking a major stride in making Bitcoin more accessible throughout the U.S.

This expansion aligns with the company’s strategy to increase the number of Bitcoin access points, thereby fostering broader Bitcoin adoption among the general public.

On the technological front, Bitcoin Depot upgraded its ATM software to BitAccess, which helped reduce overhead costs by eliminating expensive licensing fees. This move also improved the overall user experience, making Bitcoin transactions smoother and more efficient.

Financially, the year was remarkable for Bitcoin Depot as it reported a record $689 million in revenue, a 7% increase from the previous year. However, despite these gains, net income saw a significant decrease, reflecting the company’s reinvestment into its expansive growth strategy and operational enhancements.

A major highlight of the year was Bitcoin Depot’s decision to go public, listing on the NASDAQ under the ticker symbols BTM and BTMWW. This public listing is part of a broader strategy to fuel growth opportunities and promote the adoption of Bitcoin in a regulated environment.

Looking ahead to 2024, Bitcoin Depot is well-positioned for continued growth with plans to install another 8,000 ATMs. This expansion will not only solidify Bitcoin Depot’s position as the largest Bitcoin ATM provider in North America but also enhance its influence in the financial markets and among everyday users.

Bitcoin ATMs And Privacy

Bitcoin ATMs offer a certain degree of privacy compared to other methods of buying bitcoin, especially since they can sometimes be used without creating an account with a financial institution. However, the level of privacy they offer is not absolute and varies depending on several factors:

- Identification Requirements: Many Bitcoin ATMs require some form of identification due to regulatory requirements, especially if you’re transacting more than a set amount.

This could include anything from SMS verification to requiring government-issued IDs. The level of identification required typically increases with the amount of money being transacted.

- Transaction Records: Bitcoin ATMs maintain records of transactions, which could include the amount of Bitcoin bought or sold, the time of the transaction, and the wallet address involved.

Depending on the operator and the jurisdiction, these details might have to be shared with regulatory bodies upon request.

- Bitcoin Network Privacy: It’s important to remember that all transactions on the Bitcoin network are recorded on a public ledger.

While addresses are pseudonymous, sophisticated analysis techniques can potentially link your transactions to your real-world identity, especially if the same address is used repeatedly or linked to a known identity at any point.

- ATM Location and Surveillance: The physical location of Bitcoin ATMs could also affect privacy. They are often placed in areas under surveillance, and the footage could potentially be used to identify users.

Related: Address Reuse: Privacy Killer Found In 50% Of All Bitcoin Transactions

“Trade-offs: Bitcoin ATMs offer a quick way to [buy and] sell bitcoin for cash.

They are straightforward to use but may require phone number verification, and the fees can be higher than other methods. Some ATMs might also impose limits on the amount of bitcoin you can sell.”

– How to Sell Bitcoin — BitcoinNews