Bitwise Asset Management has filed for a new Exchange-Traded Fund (ETF) to ride the wave of corporate bitcoin adoption.

The proposed ETF is called the “Bitcoin Standard Corporations ETF” and will invest in publicly traded companies that hold bitcoin in their treasuries. The ETF filing with the U.S. Securities and Exchange Commission (SEC) outlines the criteria for the eligible companies:

- Hold at least 1,000 BTC.

- Have a market cap of at least $100 million.

- Have average daily trading liquidity of at least $1 million.

- Less than 10% of their stock is private.

Unlike other ETFs that weight companies by market size, this fund weights companies by their bitcoin holdings. Bitwise has also put a cap to ensure diversification: no single stock can be more than 25% of the ETF.

For example, MicroStrategy, which holds over 444,000 BTC, would get more weight in the ETF than Tesla, despite Tesla’s larger market cap. Tesla has 9,720 BTC, a tiny fraction of MicroStrategy’s holdings.

Hunter Horsley, CEO of Bitwise, said, “It feels like 2025 will be a big year for new corporates adopting the Bitcoin Standard.”

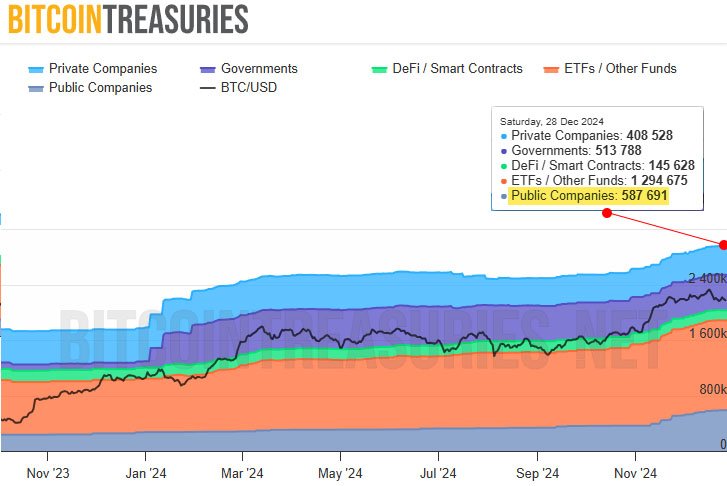

Corporate Bitcoin adoption has been growing rapidly in recent years with publicly traded companies adding BTC to their treasuries. According to BitcoinTreasuries, public companies now hold nearly 20% of all bitcoin held by entities worldwide, with 587,691 BTC.

One prominent example is KULR Technology Group, which bought 217.18 BTC for $21 million and saw its stock price jump 40%. Another one is Matador Technologies, which plans to allocate $4.5 million to bitcoin.

Companies are starting to see bitcoin as an asset for their treasuries. Bitcoin’s price has gone up 117% this year to an all-time high of around $108,000 in December. It has since stabilized at $95,800. Many analysts believe that the digital asset is still undervalued.

“The BTC treasury operations virus is spreading,” said Nate Geraci, President of The ETF Store. He’s referring to the growing number of companies outside the digital asset industry that are diversifying their treasuries with bitcoin.

Bitwise’s proposal isn’t the only one. Strive Asset Management, co-founded by Vivek Ramaswamy, has also filed for a Bitcoin Bond ETF. These are bonds issued by companies heavily involved in bitcoin and the proceeds are used to buy more BTC.

The ETF race highlights the growing appetite among investors for innovative ways to gain exposure to bitcoin and its associated financial instruments.

Corporate Bitcoin adoption and ETFs bring new opportunities, but they are not without risk. Analysts warn of selloffs if demand dries up, especially with bitcoin’s volatility.

Current price of $95,800 is 143% up from this year’s lows. Any big dip below this support could trigger more selling.

Despite the risk, industry leaders are optimistic. With regulatory clarity, a supportive administration, and politics shifting, they think the stage is set for bitcoin to continue to go up.