Building a new financial ecosystem on Bitcoin

Entrepreneurs around the world are building products & protocols on top of Bitcoin’s strong foundation to bring to life a new financial system. The Bitcoin market cap hovers around $323B, however, much of this value is being held and not actively being put to use. This presents an incredible opportunity to build out features such as lending, borrowing and micro-payments in a new monetary system that is not tethered to a single nation state.

The goal of this new class of entrepreneurs is to allow users of the Bitcoin network to benefit from composability, or “money legos”, that allows projects to integrate with Bitcoin. Given the technical characteristics of Bitcoin, new Layer 2 & Side-Chain projects are being launched that aim to harness Bitcoin’s security while adding increased functionality.

RSK (FKA Rootstock) is one such project that has introduced smart-contract functionality to the Bitcoin ecosystem as a side chain.

How It Works

RSK is a Bitcoin side-chain that utilizes merge mining for its consensus mechanism. Merge Mining allows Bitcoin miners to contribute to the RSK network’s security by using the same hash power that mines Bitcoin – meaning a Bitcoin miner can mine RSK without much additional effort or sacrifice from their ability to mine Bitcoin.

Fees & rewards from the RSK network are distributed to these Bitcoin miners for contributing to the RSK network’s security.

For this to work the benefits of using hashpower to mine for the RSK network must outweigh potential risks or costs for these Bitcoin miners. For this to be valid the transaction volume & fees generated on the RSK side-chain need to be lucrative & consistent enough to keep a reliable amount of Bitcoin miners engaged.

The native coin used on RSK is Bitcoin, which can be bridged over to the RSK network (and is a derivative of BTC called RBTC on the RSK network). The mechanism for bridging BTC to & from the RSK network is known as the RSK PowPeg. When BTC is “pegged-in” to the RSK network, BTC is locked in the BTC network and the same amount is released on the RSK network (and to be pegged-out the reverse must occur).

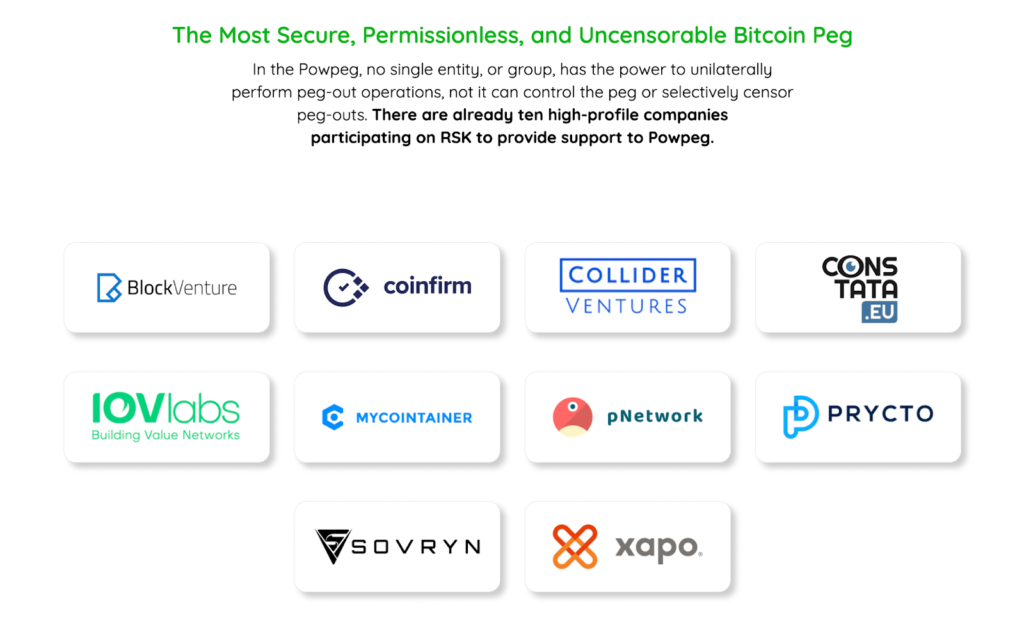

One item to note is that this PowPeg mechanism is facilitated by 10 entities that are key holders to a multsig that facilitates the transfer of Bitcoin to & from the network. Thus the security of the RSK network and its BTC peg relies on these entities not colluding to steal this Bitcoin – or not getting hacked.

There is a centralization risk anytime you rely on ‘trusted’ parties & a risk that multiple parties could be compromised, censor the network, or otherwise act in a malicious manner. As a Bitcoiner this is something you should be aware of & monitor if you use the RSK network.

Applications & Ecosystem

The Total Value Locked (TVL) on the RSK (Rootstock) network is roughly $42M, down from roughly $229M 11 months ago (Source: DeFi Llama).

There are multiple projects building products on RSK including:

MoneyOnChain: A Bitcoin collateralized stablecoin product where “the collateral is not held in a third-party bank account, but, instead, in a smart contract secured by the most liquid and widely used blockchain in the world.”

Sovyrn: A non-custodial and permission-less smart contract-based system for bitcoin lending, borrowing, and margin trading

Tropykus Finance: A platform that allows you to borrow & lend Bitcoin

Kripton Market: A marketplace that allows you to buy/sell products with RBTC directly without the need for a separate fiat on/off-ramp.

Final Thoughts

RSK (Rootstock) is an interesting project that fulfills a need within the broader Bitcoin economy. There are developers building on the network and there seems to be genuine enthusiasm – especially within Latin America. RSK recently held a summit in Buenos Aires on November 10th and a recording of the summit’s live stream is available on twitter for those hoping to learn more about the network.

The merge mining mechanism is novel but does present risks if Bitcoin miners find the cost of supporting the RSK network outweighs the benefits – or if the rewards generated for merge miners are inconsistent / unreliable. Additionally, coordinating upgrades & security patches with miners that do merge mining as a secondary activity will likely present issues as the RSK network grows and matures its software stack

The use of ‘trusted parties’ to facilitate the bridging of BTC to & from the RSK network present multiple risks that come with centralization such as : entities acting maliciously to steal user funds or entities being compelled by local authorities to censor or otherwise restrict certain transactions. The Powpeg mechanism used to bridge BTC to and from the RSK network itself can also go down at times due to network issues, which has occurred recently.

Though there are mitigation measures for the above noted risks, it is something a user should be cognizant of. As the network matures and hopefully grows its user base I imagine there will continue to be improvements to the Powpeg & Merge Mining mechanisms that will improve the overall functionality of the network.

Though the project is down significantly in USD terms from its $229M peak 11 months ago, TVL in BTC terms has remained relatively flat, which seemingly shows that the project is able to keep users on its network – a good sign in these tumultuous times.