In a move signaling growing institutional acceptance of Bitcoin, BNP Paribas, Europe’s second-largest bank, has made a strategic investment in Bitcoin Exchange-Traded Funds (ETFs).

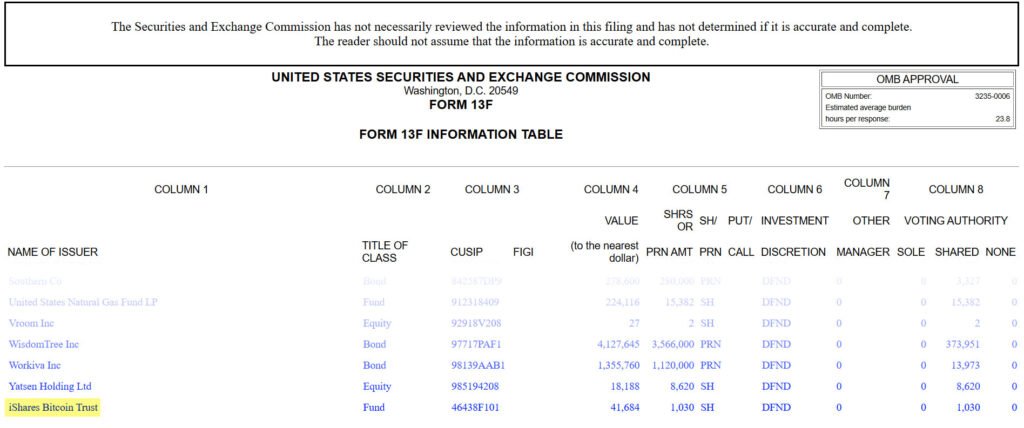

The bank’s recent disclosure, revealed through 13F filings, underscores a broader trend of traditional financial institutions embracing digital assets. This development comes amidst a backdrop of market volatility and shifting investor sentiments towards Bitcoin ETFs.

The filing shows the bank acquired 1,030 shares of BlackRock’s iShares Bitcoin Trust (IBIT), which translates to around $40,000. While this might not be a substantial amount, but it shows continued institutional adoption of Bitcoin ETFs, signaling a significant shift in traditional finance sphere.

BNP Paribas’ Bold Step into the Bitcoin Space

BNP Paribas’ investment in Bitcoin ETFs, particularly BlackRock’s IBIT, marks a notable departure from traditional banking practices.

Despite the relatively modest investment of $41,684 for 1,030 units, the move is significant, given BNP Paribas’ stature within the European banking landscape. BNP Paribas’ decision to invest in BlackRock’s Bitcoin ETF marks a notable milestone in the journey towards wider institutional recognition of Bitcoin.

Institutional Adoption on the Rise

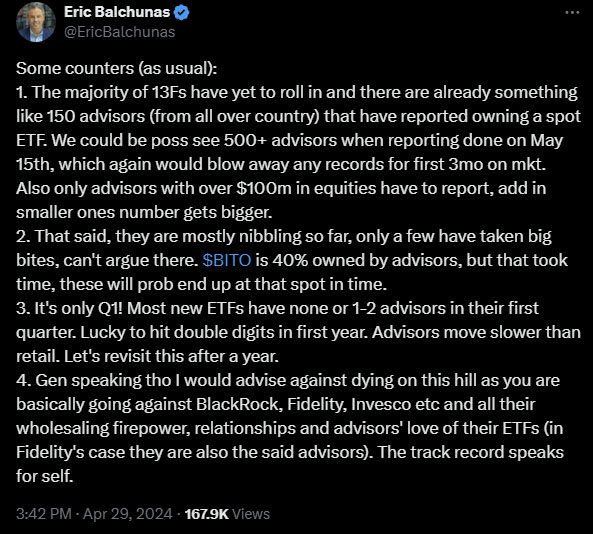

BNP Paribas’ foray into Bitcoin ETFs aligns with predictions made by industry experts, including Bloomberg’s Senior ETF analyst, Eric Balchunas.

Balchunas anticipates a surge in institutional engagement with Bitcoin ETFs, with over 500 investment advisors expected to disclose their holdings by May 15. BNP Paribas’ recent announcement confirms the increasing trend of institutional acceptance and utilization of Bitcoin ETFs.

Market Dynamics and Regulatory Compliance

The move by BNP Paribas reflects a broader shift within the investment community towards Bitcoin. As traditional financial entities navigate through periods of heightened market volatility, the importance of Bitcoin ETFs as viable investment vehicles grows.

Under regulatory requirements, large institutional investors managing over $100 million must disclose their quarterly holdings through 13F filings. BNP Paribas’ investment, alongside previous filings by other financial institutions, underscores a growing acceptance of Bitcoin within traditional finance circles.

Market Volatility and Investor Sentiments

Recent market dynamics, including significant outflows from U.S.-based Bitcoin ETFs, have raised concerns among investors. BlackRock’s IBIT witnessed its first outflow since its inception, totaling $37 million, amidst broader market turbulence.

While the continuous withdrawal of funds from spot Bitcoin ETFs certainly contributed to the decline in the market, BNP Paribas’ investment demonstrates increasing trust in Bitcoin as a viable investment category.

Future Outlook and Implications

Despite short-term market uncertainties, experts remain optimistic about the future prospects of Bitcoin ETFs. Strategic investments from institutions like BNP Paribas, coupled with forecasts of increased institutional engagement, signal a potential stabilization of the market in the long run.

The durability of ETF frameworks, coupled with the keen attention from major asset management firms such as BNP Paribas, may play a significant role in shaping the resurgence of Bitcoin ETFs.

Conclusion: A Paradigm Shift in Traditional Finance

BNP Paribas’ investment in Bitcoin ETFs represents a paradigm shift in traditional finance towards digital assets. As institutional adoption of Bitcoin ETFs gains momentum, it could pave the way for wider mainstream acceptance and additional inflows into regulated Bitcoin investment vehicles.

The participation of traditional giants like BNP Paribas in Bitcoin ETFs signifies a fundamental shift in how traditional financial entities perceive and engage with digital assets.

In conclusion, as market conditions continue to evolve, the role of Bitcoin ETFs in shaping institutional investment in digital assets remains of significant interest.

BNP Paribas’ bold step into the Bitcoin space underscores the growing acceptance of Bitcoin ETFs and sets the stage for further institutional participation in the burgeoning Bitcoin market.