Table of Contents

Foreword

At the very start of the first article, the following question was asked:

“As an Island native and local Bitcoin enthusiast, taking local market knowledge into account, the question remains to be answered and justified as to whether this is Bitcoin Island?”

This report seeks to answer that question.

Introduction

Approaching the last set of articles and reports, one can’t help but be engulfed in maxi optimism regarding growing bitcoin usage on the Isle of Man, and why it is pivotal to the Island’s future. The original inspiration for this whole project started from the wonderful experiences and insights taken away from spending three months researching my dissertation in El Salvador.

Visitors to El Salvador will find it hard not to be optimistic about orange pilling in other places, after attending the many Bitcoin events and meet-ups organized by BitcoinBeach, Mi Premier Bitcoin, and many more.

Going back to this project, what started as a simple way to showcase the amazing steps the Island has already taken, after some reflection on my trip, quickly turned into a need to accelerate and be part of the same kind of effort somewhere closer to home.

To summarize the project so far, the first article and report focused on providing an overview of Bitcoin and Lightning in the Isle of Man, while the second article and report examined the current regulatory regime.

Therefore, it is only fitting, and fair in light of criticisms made by myself against the Isle of Man’s existing efforts, to provide recommendations on how the Isle of Man can better shape itself, to leverage the yet largely untapped benefits the Lightning and Bitcoin network can provide.

Throughout the course of reading this report, it is crucial to be aware of the primary challenge confronting the Island’s economic objectives: the significant skills deficit currently observed on the Isle of Man. This deficit epitomizes the systemic issues the Island faces. The report will shed light on these issues in part whilst retaining a focused examination of Bitcoin and Lightning.

However, summarizing the above issue is one key trend that was highlighted in the comments made by Industry members on the Island. These members are featured throughout the report among others:

“…The island grapples with a significant shortage of younger individuals, who constitute the majority of junior to mid-level software developers”

“…The scarcity of younger talent hampers the cross-pollination between companies and industries, a crucial element in fostering a culture of innovation.”

– Sam Dorrer, Chief Executive, Echo

“Prices are high, the general culture isn’t one that appeals to younger people, particularly highly paid devs, and responsiveness to adopt new tech seems very limited.”

– Dan Thomas, Co-founder and Blockchain Solutions Architect, Archit3ct Ltd

The Business Use Case for Bitcoin and Lightning on the Island – Is There One?

Of course, what maxi wouldn’t say that?

The point is, however, that the business case for Bitcoin needs to be executed the correct way. More specifically, a way that reflects the unique characteristics of the Island, as previously discussed at the start of the very first article.

One of the most concrete things taken away from my experience in El Salvador rests upon the power held within communities to drive diffusion and adoption. This is because Bitcoin has emerged as a noticeable social institution within the country. Social institutions can be thought of as informal institutions that shape the behaviors, values, and interactions among members of a society or group.

For instance, the Bitcoin Beach community initiative in El Salvador was already seeing 90% of the families in El Zonte use bitcoin at least within the last six months of 2021, a few months before it became legal tender. Readers who follow the attached Bitcoin Beach report will take away a sense of just how important community and word-of-mouth knowledge dissemination is.

Furthermore, community organizations such as Mi Primer Bitcoin are seeing projections on track to grant over seven thousand Bitcoin Diplomas. In addition, their classes are estimated to have reached an audience of over three hundred thousand Salvadorans in total for 2023. Characterized perhaps better as a subculture in sociology terms, many understate how far Bitcoin adoption represents a culmination of behavioral changes, evident within the new norms that need to be learned for paying, accepting, and dealing in bitcoin.

Summarizing this in the context of the three reports, while the second article and report emphasized the impact of broader legal and regulatory constraints on adoption, it’s crucial to recognize that Bitcoin’s enduring strength lies in the power of its community.

Turning the focus back to the Isle of Man, it is argued that the business use case for bitcoin and Lightning acceptance, and the promotion of the industry, is partly embedded in the formalization of a consumer-oriented and managed Bitcoin community on the Island.

To put it differently, for Bitcoin and Lightning to effectively reduce the costs of business activities, there must first be established informal norms of behavior that make people aware of their cost-saving potential.

For example, knowledge of how the Lightning network is optimal for small retail transactions instead of conducting transactions on-chain, due to its application as a second-layer scaling solution, is essential for further usage.

Rick Landman had this to say about the Lightning Network and its ability to reduce transaction costs:

“The Lightning Network’s adoption of channel factories enables the creation of multiple channels within a single on-chain transaction, enhancing efficiency and potentially reducing transaction costs.”

– Rick Landman, Chief Technology Officer, Infinex Partners

In summary, it is claimed that increased usage of the Lightning network for retail payments, and the spreading of knowledge relating to holding bitcoin as a hedge against inflation among other usages, is more successful when community-driven.

Taking this into account with the above point, the business case for adopting bitcoin and Lightning is intrinsically linked to the levels of community support and activity.

Evidence of the Existing Business Use Case

As stated in the first set of articles, there are currently at least 46 businesses that accept bitcoin and Lightning thanks to the push by promising homegrown exchange, CoinCorner. In addition, 2023 saw two car dealerships take note of the potential marketing benefits that accepting bitcoin can provide.

One of these dealerships, SkillianNaylor, had this to say about the business use case for accepting bitcoin on the Isle of Man:

“We have found taking Bitcoin as payment to be really easy and a great way to attract new business from buyers who may not of considered dealing with us had we not had this facility.”

– Simon Skillian, Director at SkillianNaylor Car Company

Furthermore, the Island’s leading physical bullion service company, IMGold, has revealed to the author that they are rolling out the ability to purchase gold and silver bullion with bitcoin.

When asked ‘Do you think focusing on growing the Bitcoin and digital asset industry in the Isle of Man is a good idea and why?’, Mr. Christian simply stated:

“Yes, as it is not going away, so let’s embrace it”

– Illiam Christian, Director, IMGold

This approach is likely correct, especially with the approaching Bitcoin halving. Historical data indicates that when the block rewards for miners are halved, the price of Bitcoin has tended to rise in the months after the event.

This is important to note because the appeal of holding bitcoin as a store of value, is likely to increase for consumers during this period, and for the new U.S.-based institutional spot ETF investors who have yet to experience their first bull run.

Around this period, it is likely that more firms will flock to accepting bitcoin globally for many reasons, including content marketing benefits. However, bringing this back to the Isle of Man’s case, there are still several issues that may deter consumers from willingly creating a Lightning or Bitcoin wallet.

Rick Landman highlighted this following a discussion on the lack of existing consumer protections on the Island for increased network activity post-halving:

“…While the current oversight, which includes imposing policies, procedures, and reporting requirements, offers some level of indirect customer protection, it is largely inadequate.”

“To truly promote industry growth and safeguard consumers, the introduction of a specific license class is essential. This class should be dedicated to regulating the proper operations and management of these businesses, ensuring a higher standard of customer protection.”

– Rick Landman, Chief Technology Officer, Infinex Partners

Insights from First Article

Bitcoin Island? An Overview of Bitcoin in the Isle of Man

- The cause of merchant’s out-of-charge machines often is the result of a low volume of inbound lightning payments.

- Over 45 merchants currently accept bitcoin and/or Lightning, mainly retail and hospitality-oriented.

- Bitcoin, amongst its largest likely core user base in the Isle of Man is viewed as an investment.

- Benefits businesses can take advantage of by being based in the Isle of Man:

- Consistently highlighted was the small, stable, easy, and supportive nature of the Isle of Man’s regulations and business environment.

- Consistently highlighted was the small, stable, easy, and supportive nature of the Isle of Man’s regulations and business environment.

- When asked at the Digital Isle of Man conference in November 2023 about Bitcoin being made legal tender:

- Answered by the Chair for Finance Isle of Man initially, a seemingly short-term no for reasons extending to a lack of a central bank was countered by Head of Innovation Kurt Roosen for Digital Isle of Man, who also commented “…those are the types of conversations we have to have going forward”.

- Answered by the Chair for Finance Isle of Man initially, a seemingly short-term no for reasons extending to a lack of a central bank was countered by Head of Innovation Kurt Roosen for Digital Isle of Man, who also commented “…those are the types of conversations we have to have going forward”.

- Presenting a brief conclusion:

- The Isle of Man needs to react quickly to a developing global regulatory environment and institutional demand for bitcoin, with Lightning featuring as a scalability solution to the increased network activity associated.

Insights from Article Two

The Regulation of Bitcoin and Lightning on the Isle of Man

- Consistently highlighted by members of the industry was the need for a more proactive, competitive, and understanding regulatory system in the Isle of Man.

- Authority’s existing stance on bitcoin and other digital assets:

This stance is one of cautiousness, under-commitment, and a strong reversal when compared to the bitcoin Island narrative that developed in 2014/15.

- There remains a lack of knowledge about current regulations on the Isle of Man among residents and business owners.

- However, there remains clear enthusiasm from the population to have the chance to explore what increased retail usage of bitcoin and Lightning may look like.

- Feedback gathered for this article highlights a prevalent sentiment within the industry:

- current regulations, while robust in AML and CFT compliance, are perceived to lack emphasis on safeguarding consumer interests.

- current regulations, while robust in AML and CFT compliance, are perceived to lack emphasis on safeguarding consumer interests.

- Despite the Isle of Man presenting itself as a preferable alternative to the UK in this context, and others discussed through the report, the Island appears to struggle to fully capitalize on this opportunity. This is attributed to the attitudes prevailing within both the regulatory system and public agencies.

Justifying this is the small amount of resources and productive action that has currently been taken towards the several calls to industry.

Recommendations for Advancing Bitcoin and Lightning Usage

Isle of Man Government and Tynwald

The most pressing recommendation for the Island’s Government and Parliament (Tynwald), remains extending business obligations beyond Anti Money Laundering (AML) and Countering the Financing of Terrorism legislation. While this recommendation has a corporate focus, it’s important to note that incentivizing Bitcoin-only and Lightning businesses can yield spillover benefits.

These spillovers could be knowledge dissemination for the local population, meaning the spread of behavioral norms for lowering transaction costs through using bitcoin in a word-of-mouth manner, and tourism-related advantages discussed in the Digital Isle of Man recommendation section below.

Returning to the Government recommendation, the creation of a specific license for Bitcoin and Lightning firms should be approached through a strategic synergy with the community champion recommendation in the consumer section below.

Explaining this further is Sam Dorrer from Echo, a Convertible Virtual Currency Designated Business based in the Isle of Man:

“I advocate for a shift in focus towards attracting crypto and fintech enterprises to the island. Bitcoin adoption could likely follow once a critical mass of industry presence is established on the IoM.”

– Sam Dorrer, Chief Executive Officer, Echo

While the above recommendations may seem hardline to public agencies, one fact ingrained in the above remains crucial to convey to the Government: Be more friendly to Bitcoin and Lightning businesses.

This is a perspective not only derived from the author’s thoughts on the matter but one that is also held by most members of the community on the Island. Specific recommendations made by the industry to the Government on this are as follows:

“The Isle of Man government should prioritize education and training, focusing on specialised programs in Fintech and Blockchain technology.”

“This includes ‘train the trainer’ programs, where industry experts contribute to the curriculum, addressing the shortage of in-depth, subject-specific training in the blockchain field.”

– Rick Landman, Chief Technology Officer, Infinex Partners

“Appoint a small group of professional individuals that are independently commissioned to study Bitcoin, its uses, understand the technology, travel to various fully adopted countries to learn, speak with and engage with other regulators and experts in cryptocurrency.”

Attend Bitcoin conventions, attend Web3 events, understand the culture etc. Then the government needs to take the advice of this group, and be open-minded and realise that the Isle of Man, could be one of the best places in the World for Bitcoin.”

– Martin Aram, Chief Executive Officer, MXT

“Be more bitcoin friendly – Be more welcoming to bitcoin companies, plenty out there we just need more educated government professionals who understand bitcoin and the benefits it could bring to economy growth and island attraction.”

– Danny Howard, Co-founder, NoahPay

Justification for being more Bitcoin-friendly is also partly found in the upcoming Bitcoin halving. Although previously discussed in the above “business use case” section, it is clear to see members of the industry also feel the need for more friendly legislation in time for the halving:

“With the upcoming Bitcoin halving and expected investment surge that follows, the Isle of Man must prepare for an influx of companies seeking credibility through registration or licensing, ensuring a balance in risk appetite to protect its reputation.”

– Rick Landman, Chief Technology Officer, Infinex partners

“… I believe that, even if they are sceptical, that the legal industry needs to adapt to this new technology as its popularity rises – especially when considering where we are in relation to the Bitcoin halving which is due to occur early next year.”

– Jack Igglesden, Advocate specializing in bitcoin, cryptocurrency, and digital assets

Some Isle of Man readers may be wondering, if Bitcoin provides so much opportunity to the Island, why hasn’t the government made it an explicit part of their 10-15-year plan?

Discussing this with the senior manager of a Digital Asset Business on the Island, he stated:

“We think it should be part of the Government’s plan, and we have informed DFE representatives of our views on many occasions.

Sadly, this feedback does not appear to have made much of a difference. It therefore looks like there is little scope for industry to make a change in this area.

The decision appears to be a political one, requiring elected representatives to take the issue to heart.”

– Senior Manager at a Designated Business

The Isle of Man Financial Services Authority

Throughout the project, one consistent answer highlighted by industry members was related to the IOMFSA’s willingness to work with industry. Members of said industry stated:

“Negative and unwilling”

– Dan Thomas, Founder and Blockchain Solutions Architect, Archit3ct LTD

“CVC businesses are actually charged a higher fee by the FSA (DBA CVC) compared to any comparative designated business. That may give an indication of the real attitude they have towards it.”

– Anonymous Digital Asset Business Founder

Following up on his point, Dan Thomas also stated:

“Bitcoin is now 14 years old. It’s not new tech and it needs to stop being thought of as new and ‘scary’ by regulators. There needs to be a wider upskilling in relevant bodies (eg the FSA) around what the technologies are and how they operate, rather than applying regulations in a blanket method across all digital assets that may have some similarities.”

– Dan Thomas, Founder and Blockchain Solutions Architect, Archit3ct LTD

With this in mind, there are a few things the IOMFSA should take action towards.

Firstly, a firmer stance needs to be taken towards the approach to MiCA. The EU-created legislation is essential as an open standard for the Isle of Man to be a part of, given its lack of existing consumer protections in comparison to other jurisdictions. This was also discussed in article two.

Furthermore, the IOMFSA needs to also update the current designated business route for Convertible Virtual Currency businesses, the legal definition on the Isle of Man for Digital Assets.

Three members from the industry also shared their thoughts on this:

“Yes and no. I do believe that the DB route is progressive, however, the scope needs to be refined to ensure that the necessary regulations are in place. Although the DBA has been sufficient in the past, I do believe there needs to be additional regulation to ensure that the Isle of Man’s integrity is upheld and to ensure we do not facilitate an incident such as FTX.”

– Jack Igglesden, Advocate specializing in bitcoin, cryptocurrency, and digital assets

“The DFE working with FSA to create an attractive regime which works with the industry, and which embraces completely new ways of doing things with an open mind. Once such a regime is established, marketing such a regime abroad at bitcoin conferences, etc. The DFE needs to send representatives to cryptocurrency-focussed conferences and events, not just those for ‘Fintech’, to get the message up.”

– Anonymous Senior Manager at a Designated Business

“The IOM FSA’s role is pivotal in simplifying the regulatory landscape. It should aim to provide clear regulatory guidelines for Fintech and CVC businesses, reducing compliance complexities. An all-encompassing regulatory framework, incorporating various business classifications, would help regulate operations, ensure customer protection, and maintain the island’s reputation. This regulatory oversight might be more effective under a new commission, possibly comprising industry professionals, rather than under an existing regulatory body. The focus of this framework should include information and internet security, operational procedures, and the status of decentralization/centralization of services.”

– Rick Landman, Chief Technology Officer, Infinex Partners

Consumers in the Isle of Man

Although already touched upon, existing members of the Island’s Bitcoin community must grow and engage community leaders who actively contribute to expanding usage.

This proactive group can initiate more effective communication with the public, reaching to audiences who are on the precipice of understanding how Bitcoin operates. This claim that people are on the precipice is justified through the insights taken from the consumer questionnaire.

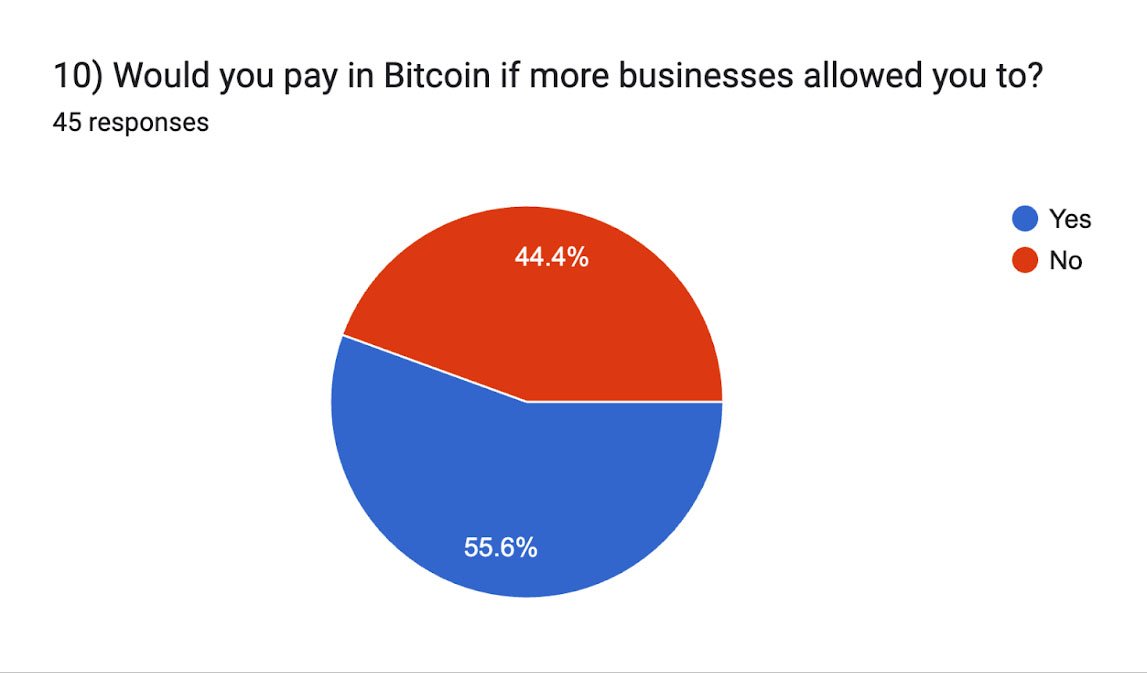

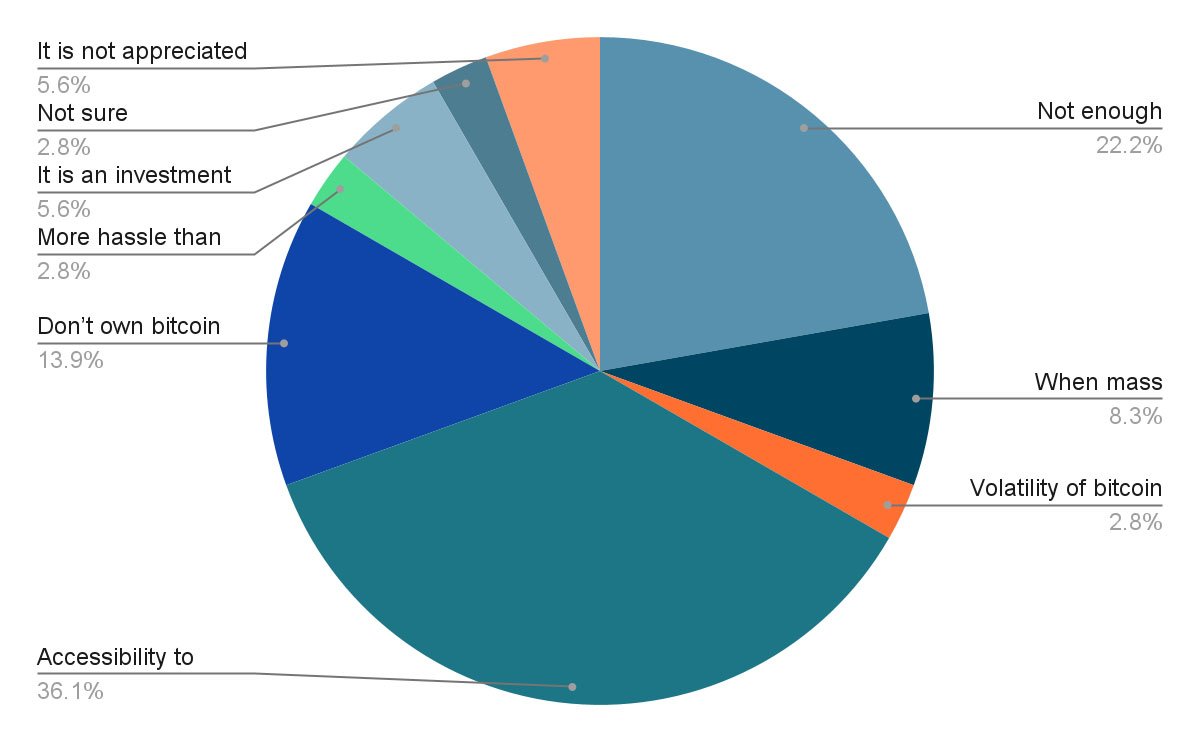

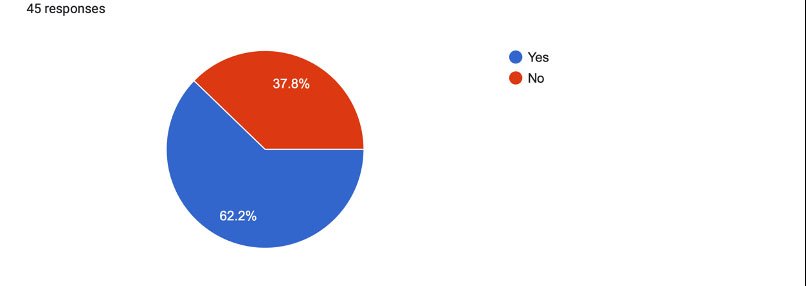

The small-scale self-directed survey, with 45 respondents of which 93% were between the ages of 18-26 (Gen Z), suggests that this demographic is increasingly open to exploring what increased provision of access to the Bitcoin and Lightning network may look like.

Would you pay in bitcoin if more businesses allowed you to?

What would you say is stopping you from paying in Bitcoin on the Isle of Man?

Would you want your bank to start offering digital asset services?

Given the limited scale of the study, conclusions cannot be credibly applied beyond the Gen Z range. Nevertheless, the research underscores the need for a more formalized government and public agency strategy extending beyond mere ‘calls to industry’’.

To bring this vision to fruition, the establishment of a formalized Bitcoin community on the Island is key to bringing the Government to look beyond simply gathering information through ‘calls to industry’, and instead towards a productive outcome delivering clear economic benefits.

Digital Isle of Man

As stated in the first article, it is the author’s opinion that the current Digital Isle of Man agenda insufficiently acknowledges the economic potential of bitcoin and Lightning solutions.

Aside from the transaction costs spilling over to create economic value, meaning lowering the costs of doing business, Digital Isle of Man can also use a more Bitcoin-friendly stance to expand its influence:

“Digital Isle of Man can expand its influence by engaging more actively in global industry-specific conferences, which would be particularly effective if backed by a robust legal framework extending beyond AML/CFT oversight. Investment in digital marketing, such as targeted Google ads and industry periodicals, would also enhance its global presence.”

– Rick Landman, Chief Technology Officer, Infinex Partners

On top of expanding Digital Isle of Man’s influence domestically and globally, the tourism benefits could be notable for the Island. While this is not strictly within Digital Isle of Man’s agenda, and instead more within Visit or Locate Isle of Man’s, there is an argument for all agencies to collaborate on a unified ‘Bitcoin Island Strategy.’

This could have a pivotal role in transforming the appeal of the Isle of Man for consumers and businesses globally. Despite only having 84,000 residents, the Isle of Man currently has over 23% (9000) of the population working within the Government. Furthermore, the Island has eight Government Department’s, including the Department for Enterprise which has four Executive Agencies: Digital Isle of Man, Business Isle of Man, Visit Isle of Man, and Finance Isle of Man.

Within these four government agencies, each agency is bound by a responsibility to incentivize the growth and positioning of the Isle of Man globally, in the respective area of the economy. However, this may lead to a confluence of agendas, meaning tactics and strategies overlap, potentially wasting vital resources that could be better used elsewhere to attract people and businesses to the Island.

This is in contrast to a top-down central government multi-agency strategy for a ‘Bitcoin Island Strategy’, which would have a dearth of resources for positioning itself correctly. This is not enough on its own though. It is the author’s opinion that another element within the Islands economy needs to be reformed simultaneously to gain the maximum benefits of this strategy.

For instance, Nayib Bukele’s Bitcoin strategy wasn’t his whole vision or goal. It was an element within his overall goal of re-branding El Salvador, along with significant development of its existing surf city initiative.

Moreover, the author believes that the lack of global representation for the Isle of Man in the Bitcoin and CVC environment, despite its favorable standing compared to many other locations, as highlighted in a Reuters report, helps substantiate the aforementioned observations. This is important now more than ever, as the Isle of Man could appear less attractive from the development of more comprehensive open standards such as MiCA and ISO, which are now being created for the industry and adopted by the UK and further afield.

Previously, it often seemed that businesses left the UK for a more robust regulatory framework in the Isle of Man. However, with this in mind, the outflow could be from the Isle of Man to the UK if the legislation is deemed more catering in the preceding months and years.

In light of this, the proposed multi-agency strategy should consider:

- Establishing a Bitcoin Development Fund for a circular economy, education, and point of sales integration

- Selecting community leaders for fund allocation

- Create a consumer and tourism-oriented Bitcoin office, paralleling the corporate-focused Blockchain office, with the idea of creating diplomatic relations between the Bitcoin Offices in El Salvador and Lugano, Switzerland

CoinCorner’s push to drive 50 merchants in the Isle of Man to accept on-chain and Lightning payments, the existing narratives regarding ‘Bitcoin Island’ pointed out in article one, changing investor attitudes regarding the US spot bitcoin ETF approval, and many more current context related factors have already contributed to the justification of getting this in motion.

However, this shift requires moving away from a technology-agnostic and risk-free approach, deemed limiting by the author, when trying to harness the overall economic benefits that can be derived from innovation and technology.

Beyond the online engagement advantages that could serve as a content marketing strategy for tourism agencies, this approach could reignite the Isle of Man’s appeal within the industry and as a tourism destination.

Evidence of Bitcoin enabling the re-branding of a nation is best seen in El Salvador. Despite being labeled the ‘most dangerous place in the world outside a warzone’ in 2016 and 2015, the country has witnessed a 35% increase in tourism since 2019. It even secured the 33rd spot on the New York Times ’52 places to go in 2024.’

Many readers could rightly suggest in theory that bitcoin alone did not drive this. However, once you visit and understand the enthusiasm that underpins the nation currently, and talk to other tourists that have decided to visit, it will soon be clear the influence bitcoin adoption has had in tourists’ motivations to visit.

Conclusion

For those who’ve critically engaged with the prior articles and reports, a pivotal question lingers: Why, despite my critique of the Island’s Institutions for their lackluster exploration and acceptance of Bitcoin business and Lightning payments, have I not explicitly delved into why it is important?

The reason is rooted in the overarching conclusion derived from the entire project, meaning only when reflecting on the project in its entirety, is it possible to provide such justification.

After over 3 months of working for free, hours spent researching and coordinating late into the night, 300 email exchanges (many unanswered), one live recorded interview, 75 responses across three questionnaires, 52 outbound comments requests (again, many unanswered), many peers have asked me:

Why bother with all this? The answer I give is the answer I’d give to anyone.

This is important because it touches the Island at nearly every level of change and development the Government and its subsequent public agencies wish to make in the future. Examples of these changes are available within the Islands 10–15 year economic strategy document.

However, to name a few:

- To attract a younger, more economically active population by improving leisure infrastructure, childcare, housing and tax reviews

- Improve the quality and availability of data for policy-making and planning

- Grow to 100,000 Island residents over the next fifteen years

- Create 5,000 new jobs by 2032

- Grow Gross Domestic Product to £10bn

On top of this, the Government has consistently snubbed the chance to expand the reach of its Bitcoin and CVC industry. This is despite constant claims to be a ‘fast follower’ in the face of new technologies. However, this approach will not work for the industry in this case on the Island.

Speaking anonymously, a senior manager at a designated business stated:

“Cryptocurrency price increases lead to increased government interest in the area, and a desire to make the island crypto-friendly again.”

“Unfortunately, by the time any changes are implemented, it is likely that another bear market is beginning, meaning that change was embraced too late. The groundwork needs to be set during the bear market cycle first, in order to bear fruit during the bull market.”

“If a bull market materialises in 2024, the island will not have positioned itself to derive maximum benefit from the rise. More planning is needed, and a recognition of the bull/bear cycles which the industry are familiar with. Again, this feedback has been provided to the DFE previously”

– Anonymous Senior Manager at a Designated Business

Providing a conclusive statement on this that captures the insights from the 19,000 words written across six documents, the Island needs to support the changes its young population wishes to see.

Those making the decisions currently are not those who will reap the negative externalities that failing to act now will bring. With public spending set to increase dramatically over the next decade, failing to bring in new revenues to bolster its reserves, will see the young generation of the Island pay the prices and continue to leave if personal taxes increase.

Continual ignorance to the many that advocate for the changes dispelled within this report will further send the brightest and best of the Island elsewhere, in hopes of somewhere that will act effectively, swiftly, and more reasonably in the face of a shifting global environment and attitudes towards Bitcoin.

Lastly, to answer the question posed right at the start of this article and the first set, the Island of Man is not currently Bitcoin Island. However, it can and should be.