El Salvador, the small Central American country known for being the first to recognize bitcoin as legal tender, has embarked on an ambitious initiative to train and certify civil servants in Bitcoin.

This bold move underscores the government’s commitment to integrating Bitcoin into the fabric of the nation’s economy and governance.

The National Bitcoin Office (ONBTC) of El Salvador, operating under the Presidential Office, has launched a comprehensive Bitcoin certification program aimed at enhancing the skills of 80,000 public sector employees.

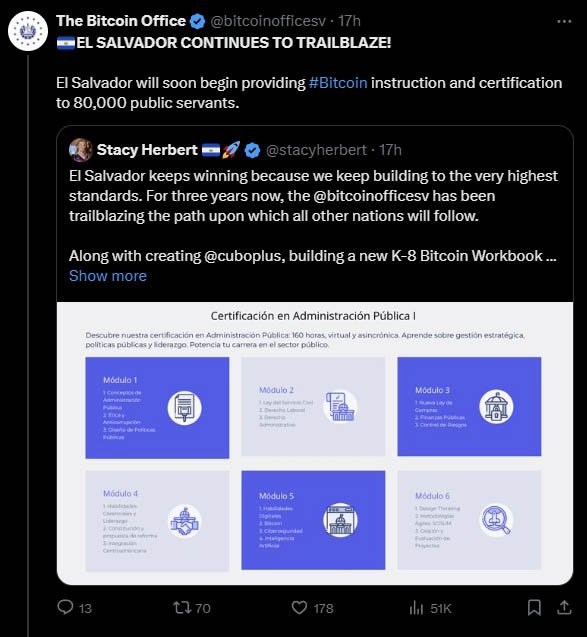

The program, known as “Certification in Public Administration 1,” is a 160-hour virtual course divided into multiple modules, with the goal of equipping civil servants with a deep understanding of Bitcoin, its legal framework, and its strategic management as legal tender.

This initiative represents a significant step forward in President Nayib Bukele’s vision to make Bitcoin a central component of the country’s financial system. Stacy Herbert, the director of ONBTC, expressed optimism about the program’s impact, stating:

“This truly is just the beginning. For we have yet another major announcement to make soon on education that will make you go WOW! These education projects are very low time preference commitments to the long-term success of El Salvador and its Bitcoin (and tech) policy.”

Her words highlight the government’s belief that investing in Bitcoin education will yield long-term benefits for the country’s economy.

The certification program is structured to provide comprehensive education on Bitcoin. It spans 160 hours and is divided into seven to nine modules, depending on the source.

These modules cover a wide range of topics essential for understanding and managing Bitcoin within the public sector. They include the basics of Bitcoin, its legal implications, strategic management, blockchain technology, cybersecurity, and even aspects of artificial intelligence.

The Higher School of Innovation in Public Administration (ESIAP), established by President Bukele in August 2021, is responsible for conducting the training.

This institution was created to elevate the standards of governance in El Salvador, and the Bitcoin certification program is a key component of this mission.

By educating civil servants on Bitcoin, the government aims to create a “Bitcoin-ready” workforce that can effectively manage and implement Bitcoin policies in various aspects of governance.

El Salvador’s commitment to Bitcoin education extends beyond just civil servants. The government has also announced plans to introduce Bitcoin courses in public schools.

Open-source courses like “Mi Primer Bitcoin” (My First Bitcoin) and “Node Nation” will be integrated into the national curriculum, ensuring that the younger generation is well-versed in Bitcoin from an early age.

This move is seen as a strategic effort to familiarize the nation’s youth with digital currencies and prepare them for a future where such knowledge is increasingly relevant.

Related: Mi Primer Bitcoin Launches Initiative to Educate 100,000 Students about Bitcoin

The inclusion of Bitcoin education in schools is part of a broader effort to embed Bitcoin knowledge across all levels of society. The ONBTC’s approach reflects a belief that widespread education will help normalize Bitcoin usage and integrate it more deeply into everyday life in El Salvador.

The Bitcoin certification program and the broader educational initiatives are part of President Bukele’s larger vision to transform El Salvador into a hub for Bitcoin and technology.

Since adopting Bitcoin as legal tender in 2021, the country has been on a mission to position itself as a leader in the digital economy.

The government’s focus on education is seen as a critical component of this strategy. By equipping public officials and citizens with the knowledge and skills to navigate the world of Bitcoin, El Salvador aims to foster a more innovative and dynamic economy.

The ultimate goal is to modernize the country’s financial system, promote digital economy adaptation, and ensure that the benefits of Bitcoin are accessible to all.

Stacy Herbert, in discussing the potential impact of the program, emphasized the “compounding effect” that educating civil servants on Bitcoin could have on the country’s economy.

She believes that as more public officials become knowledgeable about Bitcoin, the more effective and efficient the government will be in implementing and managing Bitcoin-related policies. This, in turn, is expected to drive broader economic growth and innovation.

El Salvador’s success with Bitcoin has not gone unnoticed on the international stage.

Argentina, a country grappling with economic challenges and hyperinflation, has expressed interest in learning from El Salvador’s experience with the scarce digital asset.

In May 2024, Argentina’s National Securities Commission (CNV) initiated discussions with El Salvador’s National Commission of Digital Assets (CNAD) to explore potential collaboration opportunities in Bitcoin regulation and adoption.

Roberto Silva, president of Argentina’s CNV, highlighted the importance of strengthening ties with El Salvador. He indicated that Argentina is eager to leverage El Salvador’s insights into Bitcoin adoption as it considers similar strategies to stabilize its own economy. He stated:

“We want to strengthen ties with the Republic of El Salvador, and therefore, we are going to explore the possibility of signing collaboration agreements with them.”

This potential partnership between El Salvador and Argentina underscores the growing recognition of Bitcoin’s role in addressing economic challenges, particularly in countries facing financial instability.

El Salvador’s leadership in this space has made it a model for other nations considering similar paths.

While El Salvador’s Bitcoin strategy has garnered praise and interest globally, it has also faced skepticism and criticism, particularly from international organizations like the International Monetary Fund (IMF).

Initially, there were concerns about the risks associated with adopting bitcoin as legal tender, including potential impacts on financial stability. However, recent developments suggest that these risks may not have materialized as anticipated.

In fact, the IMF recently acknowledged that some of the predicted risks had not come to pass. Moreover, El Salvador’s bitcoin holdings have proven to be a profitable investment.

As of the latest reports, the country holds approximately 5,848 bitcoin, with an unrealized profit of over $47 million.

This success has bolstered the government’s confidence in its Bitcoin strategy and has provided a financial cushion that could be reinvested into further economic development initiatives.

Despite the positive developments, challenges remain. Public adoption of bitcoin in everyday transactions has been slower than expected. Surveys indicate that while many Salvadorans have tried using Bitcoin, its regular use is not yet widespread.

For example, a significant portion of the population downloaded the Chivo Wallet app when it first launched, but many did not continue using it beyond the initial incentives offered by the government.

Moreover, businesses are not uniformly embracing bitcoin. Although there is a legal requirement for businesses to accept bitcoin, only about 20% of them are reported to be complying, with many opting to convert bitcoin sales back into U.S. dollars immediately.

This indicates that while the government is pushing forward with its Bitcoin agenda, there is still work to be done to ensure that the private sector and the general population fully embrace the digital asset.